HSA Bank offers a robust health savings account, as well as FSAs and more.

A Health Savings Account (HSA) offers triple tax benefits. It allows you to contribute pre-tax dollars and spend them tax-free on qualified medical expenses.

Then, after you reach age 65, your HSA funds can be withdrawn and spent just like retirement money! Learn more about how the HSA is like a secret IRA.

For these reasons, opening an HSA can be a great way to prepare for your near-term healthcare expenses and your retirement down the road. But to use an HSA, you’ll need to be in a high deductible health plan (HDHP).

There are a lot of expenses that qualify for use with an HSA. To get started, you’ll need an HSA provider to hold your HSA funds. In this article, we’ll review HSA Bank, which is one such HSA provider.

See how HSA Bank compares on our list of the Best HSA Providers.

HSA Bank Details | |

|---|---|

Product Name | HSA Bank |

Monthly Fee | $0 |

Account Minimum | $0 |

Investment Options | Extensive Through Schwab |

Promotions | None |

Who Is HSA Bank?

HSA Bank is a leader in the consumer-directed healthcare industry. It provides HSA, FSA, and HRA accounts to individuals, employers, and partners.

HSA Bank began offering Medical Savings Accounts (MSAs) in 1997, but slowly began transitioning to HSAs. By 2004, it was only offering HSA accounts. In 2005, it became a division of Webster Bank, N.A. which is a subsidiary of Webster Financial Corporation. HSA Bank currently administers three million HSA accounts and has $10.7 billion in assets.

Currently, HSA Bank is not accredited by the Better Business Bureau (BBB). However, they have been actively responding to each complaint.

What Do They Offer?

HSA Bank offers medical-related savings accounts directly to consumers. These include:

- HSA (Health Savings Account)

- FSA (Flexible Spending Account)

- HRA (Health Arrangement Account)

In this article, we’ll focus on their HSA product for members, which are individuals who buy an HSA directly from HSA Bank. Anyone who wants an HSA will need a High Deductible Health Plan (HDHP). Because of this restriction, not all health insurance plans qualify for an HSA. Health sharing plans are not insurance and do not qualify for an HSA.

In many cases, if you switch employers, your HSA can go with you. Unlike an FSA, an HSA isn’t a use-it-or-lose type of plan. Your funds will keep rolling over each year and be available for use with qualified medical expenses.

Related: HSA vs. FSA: Which Healthcare Savings Account Is Best?

Qualified Medical Expenses

To take advantage of an HSA, any spending must be on qualified medical expenses (QME). These include deductibles, co-insurance, prescriptions, dental and vision care, and a lot more.

To pay for QMEs, you can use your HSA debit card or pay out-of-pocket and later reimburse yourself from the HSA account. You can also withdraw funds from an ATM using your HSA debit card.

There are spending limits on the HSA debit card. You can spend $5,000 per day at merchants dedicated to healthcare, such as a doctor’s office or hospital. And $3,500 per day can be spent at merchants that are not healthcare-specific, such as grocery stores or retail stores.

HSA funds spent on non-QMEs are taxable and will incur a tax penalty. This penalty goes away after age 65. If at some point, you lose your HDHP, your HSA funds will remain with HSA Bank and can be used on QMEs. You just can’t contribute to the HSA anymore.

Contribution Limits

All HSAs have various contribution limits and these are the same across HSA providers. The following limits are for 2024.

Cell | Individuals | Family |

Maximum Contribution Limit | $4,150 | $8,300 |

Minimum Deductible | $1,600 | $3,200 |

Maximum Out-Of-Pocket | $8,050 | $16,010 |

Catch-up Contribution (55+) | $1,000 | $1,000 |

HSA Investing

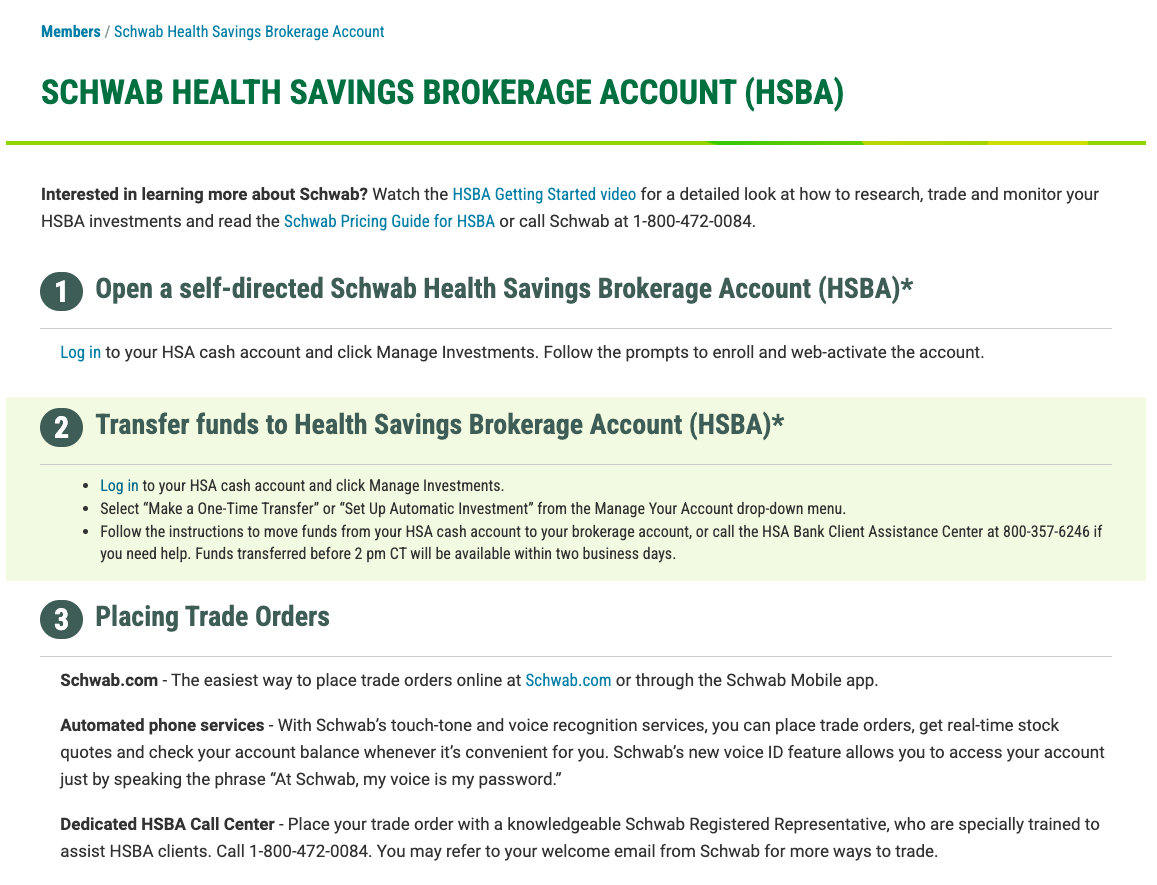

An HSA account is more than just a savings account. You can also invest your HSA funds once you have at least $1,000 in your account. With HSA Bank, if you want to invest in stocks, ETFs, mutual funds, and bonds, you can do so by using the Schwab Self-Directed Brokerage option.

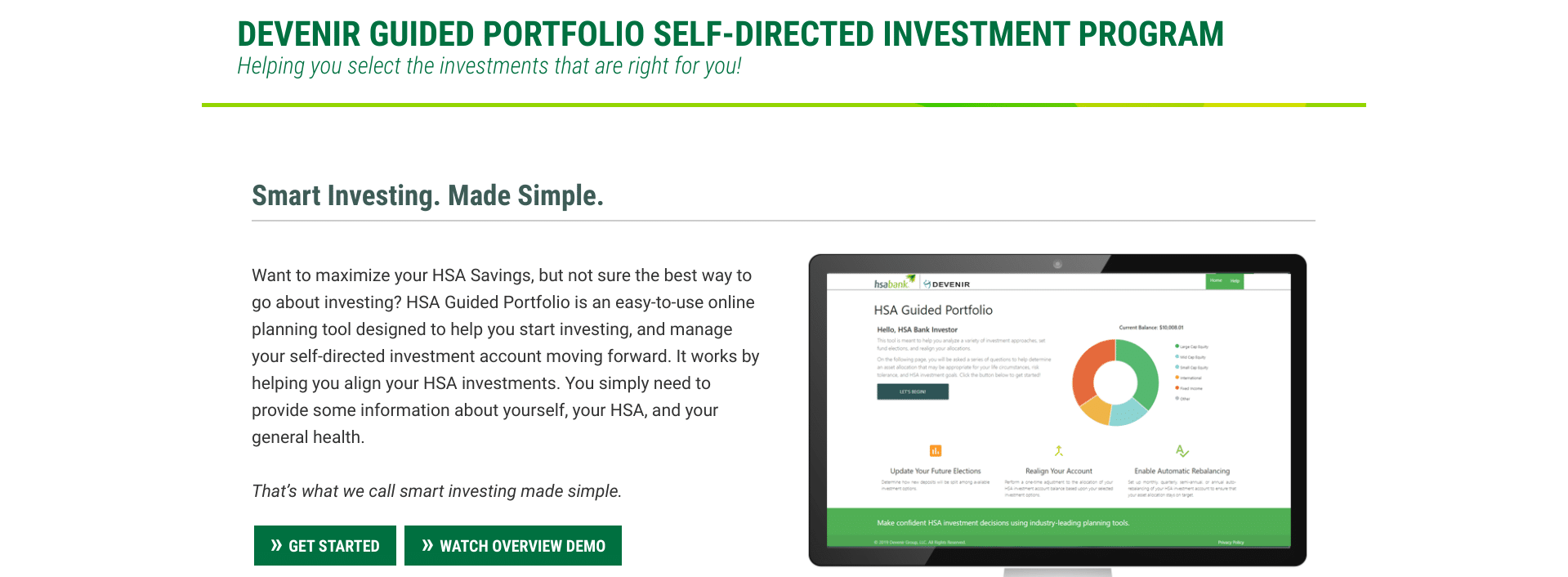

Or you can go with the Devenir Guided Portfolio Self-Directed Investment Program which offers guided portfolios and automatic rebalancing.

If you choose not to invest your HSA funds, you’ll earn the following APYs:

$25,000 or more | 0.20% |

$5,000.00 - $24,999.99 | 0.10% |

Less Than $5,000.00 | 0.02% |

Are There Any Fees?

HSA Bank no longer charges a monthly service fee on any of its accounts, which is a huge plus. Customers could potentially incur two fees (although both can avoided):

- Printed HSA Account Summary Fee — $1.50 (can be waived by choosing e-statements)

- HSA Closure Fee — $25.00

Also, the annual fee for the Devenir Guided Portfolio Self-Directed Investment Program is 0.30% of assets under management, invoiced quarterly, with a minimum fee of $1.50 per quarter. Note: The advisory fee is only assessed on the first $50,000 in your investment account.

How Does HSA Bank Compare?

HSA Bank makes it easy to open an HSA account and invest your funds once you've saved up at least $1,000. And it's one of the few HSA providers that charges no service fees regardless of account balance. If you want to see how HSA Bank compares, check out this quick chart:

Header |  |  | |

|---|---|---|---|

Rating | |||

Monthly Fees | $0 | $2.75 (until min balance met) | $0 |

Min Deposit | $0 | $0 | $0 |

Min For Investing | $1,000 | $1,000 | $0 |

APY | Up to 0.20% | Not disclosed | 0.01% |

FDIC Insured | |||

Cell |

How Do I Open An Account?

You can visit the HSA Bank website to open an account. It only takes about 10 minutes to fill out the online application and there are no application fees.

Is My Money Safe?

Yes — HSA funds are on deposit with Webster Bank, which is an FDIC member. Your funds are protected up to $250,000. Additionally, the HSA Bank website uses encryption.

How Do I Contact HSA Bank?

We were impressed to find that HSA Bank offers 24/7 customer service. And there are a variety of ways to get in touch with a support representative. These include:

- Phone (English): 800-357-6246 | 414-978-5294

- Phone (Spanish): (866) 357-6232

- Email: askus@hsabank.com

You can also start a live chat with a support person after you've logged into your member account. HSA Bank has an A- rating on the Better Business Bureau (BBB) and has been promptly answering and/or resolving complaints after they're filed.

Why Should You Trust Us

We have been covering HSAs and reviewing HSA products for almost 10 years. We were one of the earliest media outlets to highlight using an HSA as an IRA. The HSA has also been a tool I've used personally across multiple providers.

Our team has tested, tried, and used almost every HSA service available to consumers, so we're very confident in our recommendations to you.

Who Is This For And Is It Worth It?

Yes, opening an HSA account can be a great decision. They provide a great tax-advantaged way to cover medical expenses when you have an HDHP. And you don’t lose any contributed funds if you don’t spend them.

Further, HSA Bank is one of the top HSA providers available today. Their fees are reasonable. And account holders can access a vast variety of DIY investment options through Charles Schwab or get auto-investment service through Devenir.

If you’re paying too much in fees or would like more investing options, you may want to consider switching to HSA Bank. For step-by-step instructions on how to change your HSA provider, check out this guide.

However, for most, we believe they will be happier using Fidelity HSA or Lively - especially if you want to invest your HSA. Both Fidelity and Lively require no minimums to invest, and they have no monthly fees either.

HSA Bank FAQs

Let's answer a few of the most common questions we hear in regard to HSA Bank.

Is HSA Bank legit?

Yes, HSA Bank has a track record of 100+ years, has over 3 million members, and manages over $10 billion in assets.

Can you withdraw from HSA Bank?

Yes, you can withdraw your HSA funds to reimburse out-of-pocket expenses at any time (including cash withdrawals). However, if you decide to close your account, you'll be charged a $25 fee.

Can I open an HSA without an employer?

Yes, as long as you have a High Deductible Health Plan (HDHP), you'll most likely be eligible to open an HSA account with HSA Bank.

What is the daily limit for HSA Bank's debit card?

The daily spending limit is $5,000 at healthcare providers and $3,500 at non-healthcare-specific retailers such as grocery stores and department stores.

HSA Bank Features

Monthly Fee | $0 |

Paper Account Summary Fee | $1.50 (waived if customer chooses e-statements) |

Account Closure Fee | $25 |

Account Minimum | $0 |

Minimum Balance For Investing | $1,000 |

Investment Options |

|

Guided Portfolio Annual Fee | 0.30% (invoiced quarterly)

|

Debit Card Issued | Yes |

Debit Card Daily Spending Limits |

|

APY |

|

ATM Cash Reimbursements | Allowed |

Customer Service Number | 1-800-357-6246 |

Customer Service Hours | 24/7 availability |

Mobile App Availability | iOS and Android |

Bill Pay | Yes |

FDIC Certificate | 18221 |

Promotions | None |

HSA Bank Review

-

Commissions and Fees

-

Customer Service

-

Ease of Use

-

Tools and Resources

-

Investment Options

Overall

Summary

HSA Bank is a health accounts provider that offers HSAs, FSAs, and HRAs with low fees and flexible investing options. Read our full review!

Pros

- Access to Charles Schwab’s investing platform

- Earn interest on non-invested cash

- 24/7 customer service

- Available in all 50 states

Cons

- A $1,000 minimum balance is required to start investing

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Ashley Barnett