Webull is another app-based online broker that focuses on commission free trading. But unlike some of their competitors, Webull is really targeting technical traders.

Their desktop and mobile platforms have a large amount of technical research for individuals looking to trade stocks.

Check out our full Webull review and see how it compares to our picks for the top online stock brokers.

If you open a Webull account, you'll get up to two free gifts of stock. One free stock valued from $3 to $300 if they open Webull brokerage account and another valued from $8 to $2,000 if you direct deposit at least $5. Check it out here >>

Who Is Webull?

Webull is a mobile app that offers free stock trading. The company’s legal name is Webull Financial LLC. They are a registered broker-dealer with the SEC and a member of FINRA and SIPC. The company was founded in 2016 and is a privately held, venture capital-backed company.

Webull announced its app on May 30, 2018, in a press release. Its CEO is Anthony Denier. Webull’s clearing firm is Apex Clearing Corporation.

“Webull believes that everyone should have an equal opportunity to control their own financial future,” said Denier, in a press release. “This is why we have created a professional-level informational and trading platform that previously was only available to professionals or the super wealthy. Webull strives to keep its vast depth of news, real-time market data, analysis tools, and trading commissions completely free. We pride ourselves on continually improving our platform and bringing exciting and useful tools to help everyone make smarter financial decisions.”

Setting up a new account with Webull is done through their app, which you can download at Webull.com or on your phone's app store. Most account applications are approved within one hour. It can take longer if your application needs further verification. You must open an account on the app.

From there, you can fund your account with an ACH bank transfer. There’s no minimum deposit required. As is standard at all brokerages, there is a $2,000 minimum to use leverage/short in margin accounts or if you have a cash account and wish to switch to margin. Let’s take a look at Webull’s feature set.

What Does It Offer?

Webull offers news, real-time market data, analysis tools, and trading commissions all for free. There are some features that come with a fee, however, which we'll discuss further below.

For beginners and anyone who wants to see how the platform works, you can open up a paper trading account, which doesn’t require real money. The following are all included in the app.

Advanced Trading Tools And Resources

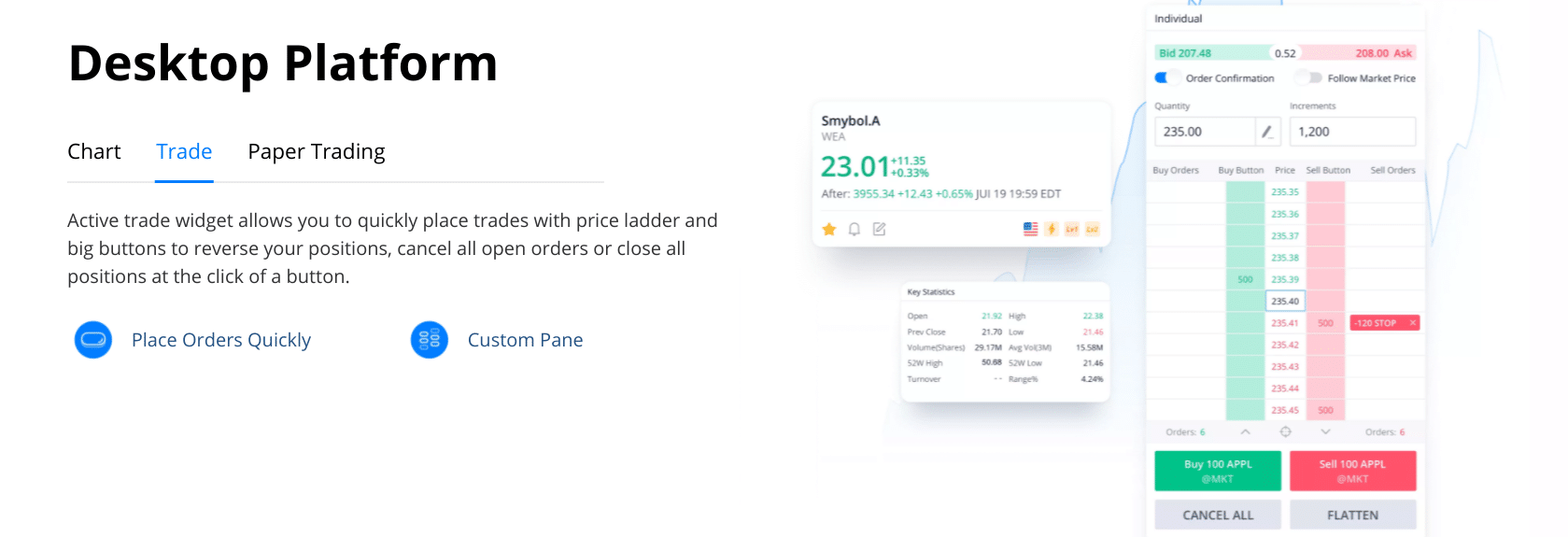

Webull's trading platforms comes chocked full of goodies for technical traders. You'll find 50 technical indicators at your disposal and 20 charting tools. A few examples include:

- Exponential moving averages

- Bollinger Bands

- Money Flow Index

- MACD

- RSI

Everyone gets access to Level 2 market data. Plus, it's easy to quickly place trading using a price ladder or quickly tap one button to reverse your position.

You'll also get access to a ton of financial data and news including:

- Press releases

- Analyst recommendations

- Historical EPS

- Revenue data

- Insider holdings and transactions

- Financial calendars

- Stock screeners

- Watchlist and alerts

Webull also support full extended hours trading. That means you can trade in the pre-market sessions from 4:00 AM - 9:30 AM (ET) and after hours from 4:00 PM - 8:00 PM (ET).

Fractional Shares

Until recently, fractional share investing was one of the few features that were still missing from Webull's platform. But that's no longer the case of as of July 13th, 2021.

Now Webull customers can trade fractional shares of stocks and ETFs. The minimum amount is $5 or 1/100000 of a share. And just like with full shares, you'll pay $0 in fractional share trade commissions.

Free Options Trading

While nearly all brokers no longer commissions on options trades, most still do charge a per contract fee. But that's not the case with Webull. That makes it one of the few options trading platforms available today that are truly free.

Currently, Webull fully supports up to Level 3 multi-leg strategies. And it says that support for Level 4 and Level 5 options trades will be coming soon.

Related: Best Options Trading Platforms

Margin Trading

If you want to short stocks, you’ll need margin account approval and a $2,000 deposit. Webull allows 4X margin intraday and 2X overnight. Keep a watchful eye on the account’s balance. If it falls below $2,000, the account may be forced to liquidate its holdings in order to cover position drawdowns.

Like other brokers, Webull uses a tiered system for its margin rates based on the amount of money that you borrow. These rates range from 5.74% to 9.74%.

Related: Best Margin Account Rates

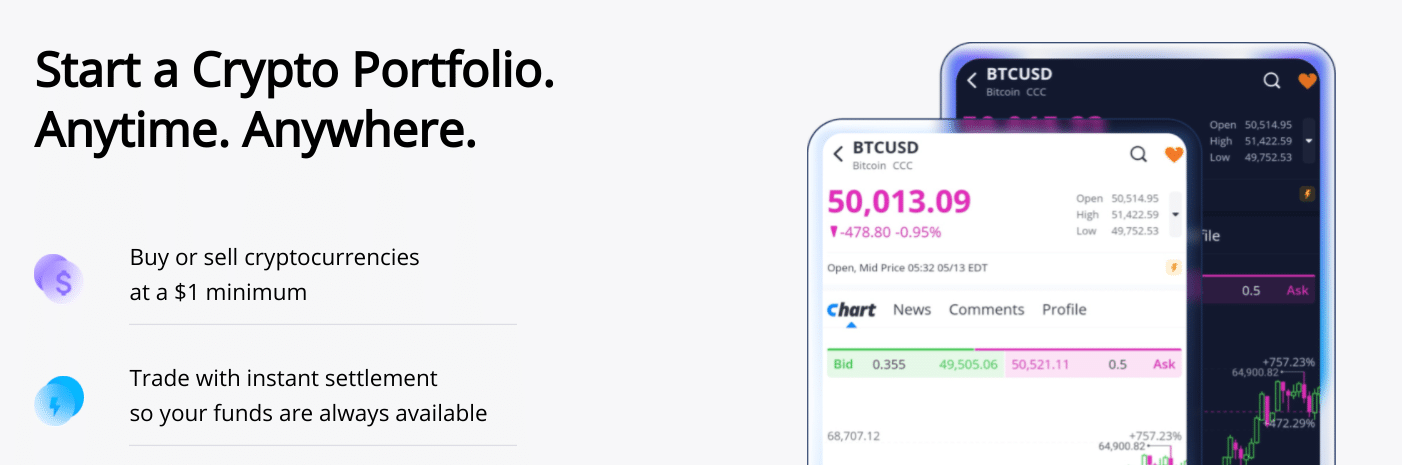

Webull Crypto

Webull is one of the few stock brokers (along with Robinhood and SoFi) that also supports crypto trading. While it markets the product as "commission-free," you will have indirect costs that are charged through the spread.

Webull says that its price markup is 100 basis points or 1%. That's less than you'll pay with a Gemini or Coinbase basic account. But it's more than you'll pay if you have a Coinbase Pro or Gemini Active Trader account or use another trader-centric platform like Crypto.com or Binance.

Cryptocurrency trading on Webull is also fairly limited. Right now, they only offer the following coins:

- Algorand (ALGO)

- ApeCoin (APECOIN)

- Avalanche (AVAX)

- Aave (AAVE)

- Basic Attention Token (BAT)

- Bitcoin (BTC)

- Dogecoin (DOGE)

- Bitcoin Cash (BCH)

- Cardano (ADA)

- Chainlink (LINK)

- Ethereum (ETH)

- Ethereum Class (ETC)

- Litecoin (LTC)

- Polygon (MATIC)

- Uniswap (UNI)

- Ren (REN)

- Shiba Inu (SHIB)

- Solana (SOL)

- Sushi (SUSHI)

- Stellar Lumens (XLM)

- Terra (LUNA)

- Tezos (XTZ)

- US Dollar (USDC)

- Zcash (ZEC)

Finally, it should be noted that Webull doesn't currently allow cryptocurrency assets to be transferred on or off its platform. So if you later to decide that you'd like to move to a different exchange, you'll have to convert your crypto to fiat first.

If you're looking for robust crypto trading with fewer limitations, check out our recommended list of cryptocurrency platforms and exchanges.

Are There Any Fees?

While commissions are free in Webull, there are some activities you’ll be charged for. On trades, the SEC and FINRA charge fees, which are small. There are also margin fees which range from rates of 3.99% to 6.99%. And you'll pay a 1% point spread on either side of a crypto trade.

Charging for transfers is standard on brokerage platforms. Webull is no exception. The normal ACH bank transfer doesn’t cost anything on Webull’s side, although your bank may charge a fee. Wire transfers will cost $25 for domestic and $45 for international.

Webull Bonus Offer

Webull is currently giving new users the gift of up to two free stocks.

First, you can get one free stock valued from $3 to $300 if you open Webull brokerage account. Second, you can get another free stock valued from $8 to $2,000 if you direct deposit at least $5.

Also, between February 27th and April 30th, 2024 Webull will match your IRA contributions up to 4.5%. This includes contributions into an existing IRA and rollovers. So if you have an IRA at a different brokerage you can move it to Webull and get the match on the full amount (up to a $1,000,000 balance).

You'll get a 3.5% match of contributions (or rollovers) and an extra 1% match if you also refer a friend to Webull. You and your friend will both get the 4.5% match.

How Does Webull Compare?

Webull isn't the only investment and trading app to commission-free pricing, but it's one of the best, especially for options traders. It's a runner-up on our list of the best free investing apps.

With that said, here's a quick comparison of Webull:

Header |  |  | |

|---|---|---|---|

Rating | |||

Commissions | $0 | $0 | $0 |

Min Investment | $0 | $0 | $0 |

Banking? | |||

Cell |

Is My Money Safe?

Webull is a member of the Securities Investor Protection Corporation (SIPC), which protects the securities of its members’ customers up to $500,000 (including $250,000 for claims for cash).

Apex Clearing Corporation provides an additional insurance policy. From Webull’s website, “The coverage limits provide protection for securities and cash up to an aggregate of $150 million, subject to maximum limits of $37.5 million for any one customer’s securities and $900,000 for any one customer’s cash. Similar to SIPC protection, this additional insurance does not protect against a loss in the market value of securities.”

While Webull’s charting features are powerful, some might find charting a little difficult to use on a mobile app. On the other hand, if you find yourself always on the go but need access to in-depth stock market research and charting capabilities, Webull is definitely for you.

How Do I Contact Webull?

Webull's customer service representatives are available 24/7. That's a high level of support that we typically only expect to see from a full-service broker. To get in touch with someone from Webull's team, simply call 888-828-0618 or email them at customerservices@webull.us.

What's Missing?

The free investing space is crowded. Top competitors include Charles Schwab, Fidelity, Robinhood, and Public. The big differentiator is that only Webull and Robinhood also support crypto trading.

However, Webull is missing some key features that would really make it powerful. They currently don't support mutual funds, bonds, OTC Bulletin Board or Pink Sheets stocks. Stocks that are under $1 and/or have a market cap of $10 million or less are restricted as well.

Why Should You Trust Us?

I have been writing about and reviewing investment firms and brokerages since 2009, and have reviewed almost every US-based investment firm open to individual investors. I have tested and tried the Webull app personally, and out team has also used and tried it when reviewing the product.

Furthermore, we have been polling our audience for years to find out which investment firms they trust and use, and that's how we put together our annual rankings of the best investment companies.

Finally, we have our compliance team that regularly checks and updates the facts on our reviews.

Who Is Webull For And Is It Worth It?

If you're looking to get started trading securities, Webull has a compelling offer. It provides truly free trading of stocks, ETFs, and options combined with top trading tools and support for cryptocurrencies.

However, if you're a long term buy and hold investor, we think that there are better options elsewhere. Also, if you need access to other investments - like mutual funds - this isn't the platform for you.

Webull FAQs

Let's answer a few common questions about Webull:

Is Webull owned by China?

Although Webull is headquartered in New York, it's owned by by Fumi Technology, which is a holding company in China.

Is Webull legitimate?

Yes, Webull is a FINRA-registered broker. It's also a member of the SIPC which means that its clients' assets are insured up to $500,000 against losses due to brokerage failure.

Is Webull good for beginners?

No, Webull's tools are targeted at more experienced traders. It also doesn't offer mutual funds which are often recommended as a good place to start for new investors.

Does Webull offer any bonuses or incentives for new clients?

Yes, new clients can earn up to two free stocks. You'll get one free stock (valued from $3 to $300) automatically after you open a new Webull account. And you'll get the second free stock (valued from $8 to $2,000) after you ACH deposit at least $5.

Webull Features

Account Types |

|

Tradable Assets |

|

Account Minimum | $0 |

Stock Commissions | $0 |

ETF Commissions | $0 |

No-Transaction-Fee (NTF) Mutual Funds | N/A |

Options Costs |

|

Basic Account Fee | $0 |

Miscellaneous Fees |

|

Margin Rates | 5.49% to 9.49% |

Banking Services | No |

Fractional Shares | Yes |

Customer Service Number | 888-828-0618 |

Customer Service Hours | 24/7 |

Customer Service Email | customerservices@webull.us |

Web/Desktop Access | Yes |

Mobile App Availability | iOS and Android |

Promotions | Two free stocks - up to $2,300 value |

WeBull Review

-

Commission and Fees

-

Ease of Use

-

Customer Service

-

Tools & Resources

-

Investment Options

-

Specialty Services

Overall

Summary

Webull is a commission-free trading and investing platform. Unlike other platforms, Webull focuses on technical trading and has improved tools and charting.

Pros

- Commission-free trading for stocks, options, crypto, and ETFs

- No minimum balance requirements

- Solid technical research information geared towards trading

Cons

- Online and app-based only

- Limited account types

- Limited investment options

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Ashley Barnett