Over 5 years ago I went on the hunt for the best solo 401k providers, did my research, and learned a whole lot. I've shared in the past the best options for saving for retirement with a side income, and I've leveraged a SEP IRA in the past.

However, as my business income has grown, a solo 401k is a better option for sheltering more money for retirement tax free today. One of the big reasons I've opted for a SEP IRA in the past is that it's very easy to setup and my income wasn't really high enough to justify a solo 401k.

Today, however, I'm willing to accept a little more paperwork to save a lot more in taxes. Even after contributing for a few years, I've actually found that there isn't that much extra paperwork - it's very similar and when you open the account at your brokerage, you can't really even tell the difference.

So, let's get started and look at the Solo 401k. I also share my comparisons of different solo 401k providers, including what you should consider for options (Roth, loans, mega-backdoor, and more).

Promo: MySolo401k. MySolo401k is one of our top picks for non-prototype solo 401k plan providers. Their plans offer all the 401k options - traditional, Roth, after-tax, and you can hold your investments at Fidelity or Schwab. Plus, you can invest in alternatives, real estate, and more. Check out MySolo401k here >>

Why A Solo 401k

You might be asking why I'm considering a solo 401k versus a SEP IRA or other self employed retirement savings options. Well, it all comes down to circumstance and how much you can save.

Let's look at two scenarios that are similar to mine. First, in the past, I only saved in a SEP IRA because my income was lower and I was still maxing out my 401k at work, so I didn't need any additional employee contributions.

With both a SEP and Solo 401k, on $30,000 of income, the employer contribution is $5,576.11. Since I was already doing the $20,500 at my primary employer, that amount didn't make a difference.

However, fast forward to today, the business makes much more income, and my wife is now working for the business. As such, it can make a huge difference in savings and lowering our taxes. Let's assume that the business is going to make $100,000 this year. That means that the business can contribute $18,587.05 to both my 401k and my wife's 401k. Plus, my wife can contribute $20,500 of her salary to the 401k as well (since I still make my $20,500 at work).

As such, the solo 401k provides much more savings options, and lower taxes today as a result. The reason: when you are self-employed, you can make both the employer and employee contribution - up to the limits!

Side Note: My personal scenario is a couple years old now. Limits have increased.

Related: 401k Contribution Limits

What To Look For In A Solo 401k

Going through the process of shopping around for a solo 401k provider, I've learned a lot about what to look for. There are a lot of options and nuances that you should look for when shopping for a 401k. Many of the "free" providers offer simple generic plans (these are called prototype plans), and if those don't work for you, you can have a third party provider create a custom 401k plan for your business, which you can then take to a brokerage (these are called non-prototype plans).

Whoa, that sounds confusing, and it can be. So let's look at the major options that you need to consider when selecting a solo 401k provider.

- Does the 401k provider offer both Roth and Traditional contributions?

- Does the 401k provider offer after-tax contributions to do a mega backdoor Roth IRA.

- Does the 401k provider offer loans from the plan?

- What types of investment options are allowed in the plan (i.e. can you invest in alternative assets like real estate, startups, or even cryptocurrency)?

- Does the provider allow rollovers into the plan and rollovers out of the plan?

- The costs to maintain the plan

- The costs to invest within the plan

Based on your wants and needs, there are a lot of things to compare when shopping for a solo 401k provider. Let's compare some of the main firms that offer solo 401ks.

Prototype "Free" Solo 401k Plan Providers

We're going to start with the 5 major firms that provide Prototype Plans. These are the "free" plans that the companies advertise.

Note: Over the last few years, many of the prototype plan providers have been limiting what you can do with your Solo 401k. For example, NOT allowing Roth contributions or NOT allowing after-tax 401k contributions to do a mega backdoor Roth.

As such, I've personally moved to a non-prototype plan provider, and I actually recommend most people do the same.

Right now, the best free solo 401k is being offered by E*TRADE, due to the fact that they offer the most options with their plan.

E*TRADE by Morgan Stanley Solo 401k

When I started looking for solo 401k options, E*TRADE wasn't really on my mind. I think of them as a trading brokerage, as their fees on many products are higher than I would want. However, a friend of mine said good things about their solo 401k option, so I checked them out.

And honestly, I was impressed. E*TRADE offers both Traditional and Roth contributions to their solo 401k. They also allow loans under their plan.

They accept rollovers of any kind into the plan.

There are no setup fees involved with setting up a solo 401k at E*TRADE. Inside the 401k, you're subject to the regular commissions at E*TRADE, which is currently $0 per trade. However, they do also offer a large amount of no-fee mutual funds.

Learn more about E*TRADE in our E*TRADE Review.

Fidelity Solo 401k

Fidelity has been my go-to investment brokerage for years because they offer a wide variety of products and services at very low prices. In fact, it's where I manage all of my investments today.

So I was disappointed to learn that Fidelity doesn't offer a full service solo 401k option. Their current "free" solo 401k doesn't offer a Roth contribution option, and it doesn't offer 401k loans. Speaking to their representative, they told me this was to save costs on maintaining the plan since they don't charge to setup a solo 401k.

However, because it is Fidelity, they do offer a full range of investment options, from commission free ETFs, to mutual funds, stocks, bonds, and more.

Fidelity also offers rollovers into the plan, which can be a great strategy for doing a backdoor Roth IRA. However, they don't allow in-service distributions from the plan. Only E*Trade potentially offers this.

The Fidelity solo 401k is cheap. There are no setup fees or annual maintenance fees. And trading within the Fidelity solo 401k is the standard $0 commission for stocks, ETFs, and options. That's why we believe Fidelity is one of the best free investing brokers for long term investors.

Note: Fidelity recently updated their plan to allow EFT direct deposit and mobile check deposit to fund your solo 401k. This makes depositing money much easier!

Learn more about Fidelity in our Fidelity Brokerage Review.

Ascensus/Vanguard Solo 401k

Vanguard sold it's self-employed business accounts, including the Solo 401k, to Ascensus in 2024. As of today, not much has changed with the plan, other than the branding is now "Ascensus featuring Vanguard Investments".

Vanguard was one of the most popular solo 401k options because Vanguard has always been synonymous with low fees. As such, I expected them to be a very low cost provider, but their 401k plan was generally lacking. With Ascensus, maybe this will change? We will keep this updated.

Ascensus does offer Traditional and Roth options for their solo 401k, and they just started allowing rollovers of existing IRAs into the Solo 401k plan. However, they still don't allow loans from their plan.

Ascensus only allows participants in their solo 401k to invest in Vanguard mutual funds (not even Vanguard ETFs). This limits investment options quite a bit. This might also change moving forward.

The fees on Ascensus's solo 401k were also surprising. They charge a $20 annual fee for custodial services, and they charge a $20 per fund per year fee for each fund you hold inside your 401k plan. That means if you hold 5 funds inside your solo 401k, you could be paying $120 per year.

Read our Ascensus review here.

Charles Schwab Solo 401k

Schwab is another discount brokerage that offers a prototype solo 401k plan for free. Since Schwab is continually working to improve their image in the low-cost brokerage space, I was interested to see what they offered.

As of 2024, it appears that Schwab finally offers both Roth and Traditional 401k contributions - that's a big win.

However, they do not offer loans under their plan. And they don't offer elective after-tax contributions to their plan.

It appears that you can rollover a 401k into your Schwab solo 401k, but you cannot do an IRA rollover.

Schwab does offer a lot of investing options, including Vanguard mutual funds and commission free ETFs.

There are no fees to open the solo 401k, and there are no yearly maintenance fees. Inside the 401k, traditional Schwab pricing applies - $0 per stock trade, with $0 on Schwab funds and ETFs.

Note: Schwab acquired TD Ameritrade and has been rolling over all their assets into Schwab directly. If you had a TD Ameritrade 401k, you'll now have a Schwab 401k.

Learn more about Charles Schwab in our Charles Schwab Review.

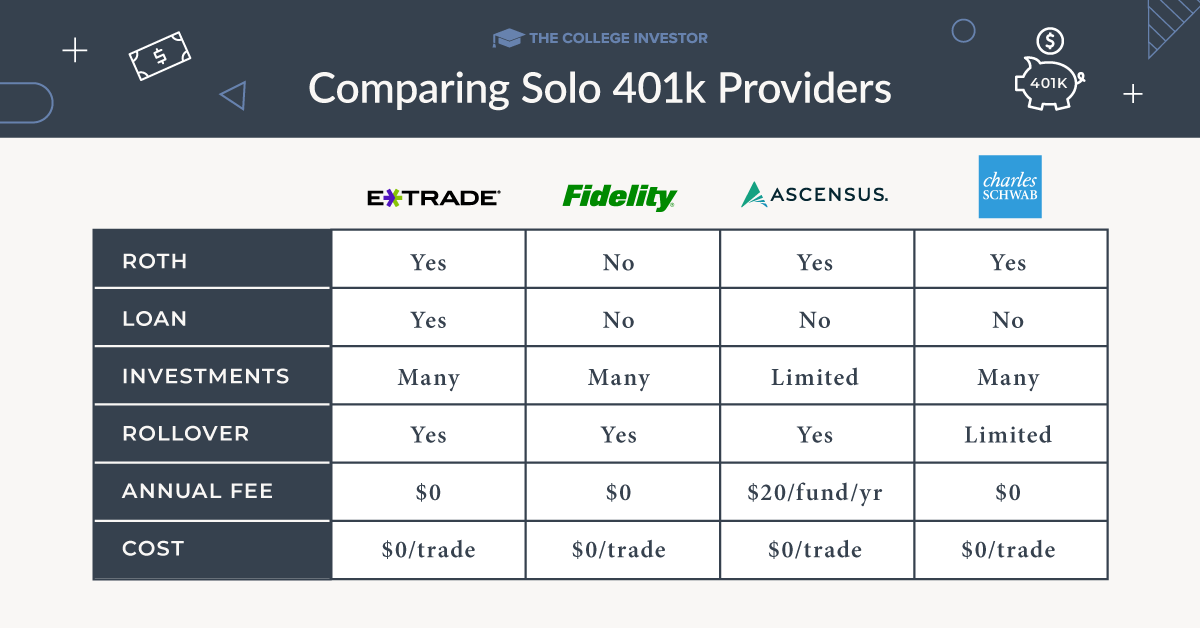

Comparing The Most Popular Solo 401k Providers

Now that we've covered the major "free" solo 401k providers, let's compare them in a chart side-by-side to see how their offerings compare to each other.

Now you can see why the choice of solo 401k providers is so difficult. Each firm has strengths and weaknesses, and the selection depends really on what matters to you. However, E*TRADE does stand out as having the most robust options.

And if none of these really excite you, you can always create your own solo 401k with a third party provider.

Third Party Solo 401k Providers (Non-Prototype)

If you need or want a solo 401k that is a little more robust that the free prototype plans these five brokerage firms offer, then you need to find a third party service that will create the plan documentation for you.

Some of the common reasons why you'd consider using a third-party service to create your solo 401k documentation:

- You want a choice in brokerage

- You want to invest in alternative assets such as real estate, startups, cryptocurrency, promissory notes, tax liens, precious metals, and more.

- You want checkbook control over your 401k

- None of the prototype providers matches exactly what you're looking for with options

Remember, just because you go with a third party provider also doesn't mean you can't invest at your favorite firm. For example, you can create a third party solo 401k and then have that 401k held at Fidelity. This gives you access to all of Fidelity's investment choices, but your options are created by the plan, and NOT Fidelity.

How is this possible? Your plan provider simply creates your plan documents that govern your 401k plan. You can then take those documents to your favorite broker (most choose Fidelity or Schwab), and you open a non-prototype account. These are equity-holding accounts that simply manage your equity investments. What they don't do is any of the paperwork associated with your plan. Did you withdraw from your plan? You're responsible for creating the 1099-R.

You typically work with your plan provider each year to prepare the documents for your plan, including any 1099-Rs or the 5500-EZ.

Also, you can use these plans to execute a Mega Backdoor Roth IRA. In fact, several of these companies specifically advertise that they offer it.

This isn't an exhaustive list. There are also local firms in most areas that can create 401k plan documentation as well.

Comparing Non-Prototype Solo 401k Providers | ||||

|---|---|---|---|---|

MySolo401k | Nabers | RocketDollar | Ubiquity | |

Roth | Yes | Yes | Yes | Yes |

Loan | Yes | Yes | Yes | Yes |

Investments | All Types | All Types | Many | Many |

Setup Fee | $525 | $499 | $600 | $285 |

Annual Fee | $125 | $99 | $360 | $228 |

Equity Location | Fidelity or Schwab | Fidelity or Schwab | Not Advised | Your Choice |

Some of the most popular online providers include:

My Solo 401k

My Solo 401k is my personal pick for the best non-prototype solo 401k provider. The reason is that you are able to fully customize your solo 401k to include any (and all) options available - Roth and traditional contributions, mega backdoor after-tax contributions, loans, and more.

Plus, they help you setup your accounts at Fidelity or Schwab, which is very helpful!

Finally, every year they will ensure that your plan documents are up-to-date, and they will help you file any required forms - including the 5500-EZ. This part of the reason you pay an annual fee for your plan.

Setup Fee: $525

Annual Fee: $125

Read our full My Solo 401k Review here.

Solo 401k by Nabers Group

Solo 401k by Nabers Group touts itself as the largest non-prototype Solo 401k plan administrator when looking at the amount of sign ups and assets that are managed.

One area that Nabers has been focused on for the last several years is technology. They have been working on instant document prep, a secure online portal to access your documents, automated record keeping, and more.

Because so much is automated, you are stuck with some limits (such as on loans), but that's very minor compared to the rest of their service. They are also slightly lower priced that most options on this list.

Setup Fee: $499

Annual Fee: $99

Read our full Nabers Group Solo 401k Review here.

RocketDollar

RocketDollar is another solo 401k provider that is highly recommended. If you want to compare apples-to-apples, they are slightly more expensive than MySolo401k. However, they also offer a lower tier that doesn't include some of the key features you might want.

The lower level is Silver, and while it's cheaper, you'll have to take care of any tax filing each year. The comparable level (and one we would recommend) is Gold.

Setup Fee: $600

Annual Fee: $360 (paid monthly at $30/mo)

Read our full RocketDollar Review here.

Ubiquity

Ubiquity is one of the lesser known Solo 401k providers, since they typically focus on small to mid-size business 401ks. However, they also offer one for self-employed people called the Single(k) Solo 401k.

This plan offers a lot of the same options as the others, including checkbook control, the ability to do both traditional and Roth options, and the ability to do after-tax mega backdoor Roth contributions.

The only downside is that you need a brokerage to accept their plan documents, and with their base plan they don't help you with that setup or record-keeping.

Setup Fee: $285

Annual Fee: $228 (paid as $19/mo)

For slightly more, you can get their Single(k)+, which includes plan record-keeping, custody, and administration. The cost of this is:

Setup Fee: $350

Annual Fee: $450 (paid as $37.50/mo)

Read our full Ubiquity Review here.

Conclusion

If you're considering a solo 401k for your small business or side business, really consider the benefits that are important for you.

For me, having a Roth option was very important because I want to be able to get tax diversification when I retire (I'm looking to have a lot of pre-tax money, and having post-tax money will be nice). I also want to have low costs but a lot of investment options.

Remember, you also need to keep track of your own solo 401k information. I maintain a Google spreadsheet with info on my plan - pretax, aftertax, etc so that I can track it should the need arise.

With everything said above, I originally went with E*TRADE for my solo 401k. The service has been top-notch, and I've been very happy with them. However, I wanted to start doing more with my 401k, including crypto, startup investing, and the mega backdoor. With that in mind, I went with My Solo 401k, and decided to hold my equity investments at Fidelity within the My Solo 401k Plan.

Note, if you're going the self-direct route, you might also consider a Self-Directed IRA as well.

If you have a solo 401k, where did you choose to have it? Why? What features are most important to you?

Methodology

The College Investor is dedicated to helping you make informed decisions around complex financial topics like finding the best individual 401k. We do this by providing unbiased reviews of the top brokerages and retirement accounts for our readers, and then we aggregate those choices into this list.

We have picked solo 401k accounts based on our opinions of how easy they are to use, their costs and fees, any interest rates and bonuses provided, and a variety of other factors. We believe that our list accurately reflects the best solo 401k accounts in the marketplace for consumers.

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Chris Muller