Vanguard is the third largest investment firm in the United States, and has been highly popularized by low-cost index fund investors.

The single most important trend in investing today is the trend towards passive, low-cost index fund investing.

Legendary investor, John Bogle founded the first index fund in 1975 with $11 million dollars. Today, that Vanguard 500 Index Fund (VFINX) has nearly $235 billion dollars under management for retail investors.

The Vanguard Group, John Bogle’s investment company, is now one of the largest investment companies in the world. They have over $7.6 trillion in assets under management (as of March 2024). Two-thirds of that is in funds or ETFs that track an index.

How has Vanguard become so popular over the last 45 years? They keep your investing costs low, so you stick with them. If you're interested in opening a brokerage account at Vanguard, here's what you need to know in our Vanguard review.

The above rating is based on our opinion of Vanguard as rated in various categories, including commissions and fees, customer service, product offerings, and more, as of February 9, 2024, based on a review of services offered. Please see the Vanguard review section below for a full breakdown.

Vanguard Details | |

|---|---|

Provider Name | Vanguard Brokerage Services |

Min Investment | $0 |

Commissions | $0 for Stocks, Options, and ETFs |

Account Type | Taxable, IRA, Trust, and More |

Promotions | None |

What Does Vanguard Offer?

Vanguard's platform usually appeals most to long-term, buy-and-hold passive investors who take a passive investing approach. If that sounds like you, here are a few key Vanguard features that you should know about.

Plus, in 2024, Vanguard was named a top pick as one of the best places to invest in our annual readers poll. Our readers love Vanguard because of their low costs and fees. Best of Award for 2024 was given on February 9, 2024, based on a poll of 1,000 Americans who identify as investors.

Full Service, But Outdated Digital Tools

Vanguard Brokerage Services is a full-service self-directed discount brokerage firm. But the company specializes in no-load, low-cost mutual funds and ETFs. You can trade also stocks, options and more, but the Vanguard website doesn’t make it easy. Active traders will want to put a hard pass on Vanguard Brokerage Services.

I’ve personally had an account at Vanguard for several years. Still, I have to be honest that I hate the Vanguard website. And the user reviews for its updated Android mobile app (released mid-2021) have been absolutely brutal.

Every time I log into the website I’m tempted to move my money to Fidelity or Charles Schwab. However, I stick around because Vanguard makes it cheap and easy to invest. And I don’t need to do tax loss harvesting in my retirement accounts.

Investment Minimums

Vanguard does not have any account minimum requirements. However, to start investing in mutual funds, you’ll usually need at least $3,000 for most index funds. In some cases (typically target date funds), Vanguard has lowered the barrier of entry down to $1,000. I

If you’re just getting started, you don’t need to despair about these minimums. Vanguard allows account holders to buy just one share of a Vanguard ETF. As a result, you can start investing in a well-diversified portfolio for just a few hundred dollars.

Research Tools

Unlike other full-service brokerages, Vanguard has clunky research and analysis tools. You can see a few portfolio insights from Vanguard’s portfolio watch feature. However, you can’t track your portfolio against an ideal asset allocation.

Vanguard’s best research is in PDF files that are tough to search. In keeping with the company’s commitment to passive investing, most of the research falls into the category of “timeless.” That means that the information you find won’t necessarily influence your portfolio today or any time soon.

Limited Investment Options

I never thought I'd say this for one of the largest brokerage firms in the United States, but Vanguard made the decision to limit their own customer's ability to buy cryptocurrency index funds, like the new Bitcoin ETFs.

You can read their own press release on the topic, but this is something I disagree with. Vanguard doesn't have to launch their own Bitcoin or crypto ETF, but they shouldn't stop their own investors from buying one. Furthermore, this action has prompted many smaller investors to leave Vanguard.

What About Small Business Plans?

In 2024, Vanguard sold it's small business plans - their Solo 401k, SIMPLE IRA, and multi-member SEP IRA to Ascensus. As a result, Vanguard now only focuses on individual accounts.

They will continue to offer a single member SEP IRA as part of their normal retirement plans.

If you're looking for a solid Solo 401k option, check out our guide here: Best Solo 401k Plans.

Vanguard Digital Advisor®

Vanguard Digital Advisor is an advisory product from Vanguard Advisers Inc., an affiliate of Vanguard's brokerage company, Vanguard Marketing Corporation and is Vanguard's response to the robo-advisor trend. And it does this by helping you focus on retirement planning, investment management, and debt payoff strategies, not just your portfolio.

The Digital Advisor platform has a variety of tools that can help you understand how to best pay down debt, free up money faster, and set goals for retirement.

Once you have your retirement goal set, the robo-advisor will automatically invest your investment funds into a combination of Vanguard ETFs® that's aligned to your risk tolerance. Digital Advisor then manages those investments and adjusts them automatically to keep them aligned with your goal as it evolves over time.

The minimum investment to enroll in Digital Advisor is $3,000. The annual net advisory fee is approximately 0.15% AUM (or roughly $1.50 for every $1,000 you invest), although it could vary depending on your specific holdings.

This is lower than what you’ll see from other robo-advisors. Betterment and Wealthfront, for example, both currently start at 0.25% per year. However, it should be noted that both of those platforms have $0 minimums.

Vanguard Personal Advisor

If you're looking for a little more "hand-holding" and want to speak to a financial expert that can help you manage your portfolio, set goals, and help you invest, you might consider Vanguard Personal Advisor.

With Vanguard Personal Advisor, you'll connect with a financial advisor to understand your goals, and they'll help you put a plan in place.

Once you have your plan, Vanguard Personal Advisor will review your portfolio quarterly and rebalance as needed. You can also connect with your advisor by phone, email, or video chat if you have questions.

The annual cost starts at 0.30% of assets under management. That's a very low price relative to what other companies charge for similar services. However, Vanguard Personal Advisor has a $50,000 account minimum, which will be unattainable for many investors.

Benefits For Large Accounts And Service Levels

Vanguard does offer some benefits for large accounts, which in general are better than most other brokerage firms.

Vanguard has four main service levels: Voyager, Voyager Select, Flagship, and Flagship Select.

Note: For Vanguard, your benefit level is calculated on how much you have invested in Vanguard mutual funds and ETFs. If you have other funds or even stocks, that doesn't count towards your service level. This is different than Fidelity, which is based on account value.

Voyager

At $50,000 invested in Vanguard funds you get access to Voyager level benefits. This is the level needed to access Vanguard Personal Advisor Services (PAS) mentioned above.

You also get access to a Voyager level customer service number, which should queue you ahead of "regular" level customers.

Voyager Select

At $500,000 invest in Vanguard funds you become a Voyager Select customer. The main benefit of this level is that you can get help from Vanguard's financial planners and legal without needing to enroll in PAS. However, they will NOT implement any plan for you - this is just advice.

You also get a dedicated customer service phone number, which should offer more experienced customer service representatives.

Flagship

At $1,000,000 invested in Vanguard funds you become a Flagship member. With Flagship service, you get a dedicated customer service account representative, and you'll see their contact information. This is NOT a financial advisor, simply a dedicated rep (who is usually assigned to hundreds of accounts). However, this representative can streamline paperwork, setup meetings with a financial advisor, and more.

At this level, you can also invest in some Vanguard mutual funds that are closed to the public. Depending on your goals, this could be a good perk.

Flagship Select

At $10,000,000 invested in Vanguard funds you become a Flagship Select member. Not much is known about this level, other than the fact that you get much more personalized attention from Vanguard, you likely have a financial advisor and customer service rep assigned to your account, and you can access a variety of Vanguard services, funds, and more.

Are There Any Fees?

Vanguard offers nearly 130 of its own mutual funds and over 75 ETFs. You can buy and sell Vanguard funds at no cost. On average, the expense ratios on Vanguard funds are among the lowest. These days, Vanguard (through Vanguard Brokerage Services), Charles Schwab, Fidelity, and the iShares from BlackRock fight for the lowest expense ratios on common indexes.

No matter what, you can feel confident that you’ll pay very low fees on your mutual funds or ETFs. Even Vanguard’s actively managed funds have low fees relative to their counterparts.

Vanguard recently announced they are moving to commission-free investing like most of the other major brokers. They currently charge $0 for stock and options. Nearly all ETFs and over 3,000 mutual funds also have $0 commissions.

How Does Vanguard Compare?

Vanguard consistently makes it onto our list of the best places to invest. DIY investors will love that its investment options have some of the lowest costs in the industry and its advisory options may appeal to those would like a little more hand-holding.

But Vanguard has a lot of competition in the online brokerage space. Check out this quick comparison here:

Header |  |  | |

|---|---|---|---|

Rating | |||

Commissions | $0 | $0 | $0 |

Min Investment | $0 | $0 | $0 |

Banking | |||

Cell |

The above ratings are based on our opinion of Vanguard, Fidelity, and Charles Schwab as rated in various categories, including commissions and fees, customer service, product offerings, and more. Please see the Vanguard review section below for a full breakdown, or the respective review sections on the other providers.

How Do I Open An Account?

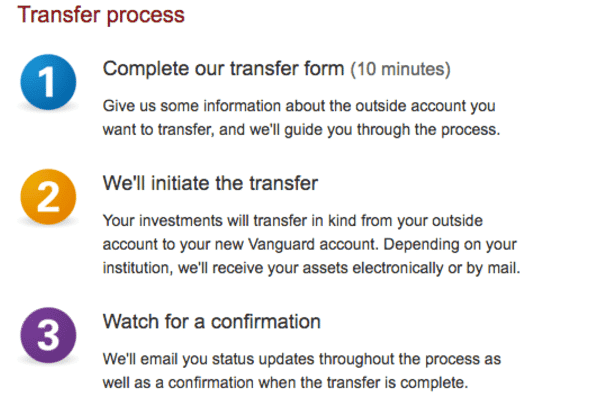

Vanguard excels in helping people open new accounts. In particular, rolling over a retirement or after tax brokerage account is a pain-free process.

The whole account opening/rollover process involves a series of questions written in plain English. Once Vanguard figures out what you need to do, they give you the appropriate forms, and complete the account rollover for you.

If you’re opening an account with funds from your bank account, you can log in to Vanguard’s personal investor page, and choose the type of account you want to open.

From there, you’ll connect to your bank account, and transfer funds. The whole process takes about 10-15 minutes. After that, it takes 2-3 business days for your funds to settle.

Vanguard makes it easy to open any type of investing account you can imagine. This feature came in handy when I decided to open a SEP-IRA at the last minute one year. I managed to open the account the day before taxes were due. Here's a video walkthrough of how you can open an account:

Is It Safe And Secure?

Yes, Vanguard is a member of the SIPC which offers up to $500,000 of asset protection in the (highly unlikely) event it was to go bankrupt. Vanguard has also secured additional insurance through Syndicates at Lloyd's of London that provides per-client coverage of up to $49.5 million for securities and $1.9 million for cash.

Vanguard also seems to take data privacy and security very seriously. In addition to securing its site with SSL encryption, it offers two-factor authentication, voice verification, and account activity alerts.

How Do I Contact Vanguard?

There are several ways to get in touch with Vanguard's support team. Here are their customer service phone numbers and hours:

- Personal investing: 877-662-7447 (Monday–Friday 8 AM to 8 PM, EST)

- Retirement plans: 800-523-1188 (Monday–Friday 8:30 AM to 9 PM, EST)

- Institutional investing: Monday–Friday 8:30 AM to 9 PM

- For Profit: 800-523-1036

- Nonprofit:888-888-7064

- Financial advisors: 800-997-2798 (Monday–Friday 8:30 AM to 7 PM)

You can also contact Vanguard by visiting its support page, reaching out through its mobile apps, or connecting via social media.

Why Should You Trust Us?

I have been writing about and reviewing investment firms and brokerages since 2009, and have reviewed almost every US-based investment firm open to individual investors. I have seen this space evolve from high cost to low cost options, and have seen the amount of investment tools grow for individuals.

Furthermore, we have been polling our audience for years to find out which investment firms they trust and use, and that's how we put together our annual rankings of the best investment companies.

Finally, we have our compliance team that regularly checks and updates the facts on our reviews.

Who Is This For And Is It Worth It?

As Vanguard continues to grow, we’re hard pressed to say it’s best days are behind it. Vanguard’s low cost promise means that investor dollars will continue to pour in for the foreseeable future. However, savvy investors can get the tools they want and the expense ratios they want too.

Vanguard offers great features for cost-conscious investors who want to use Vanguard’s inexpensive funds. However, you can find these same features at other low-cost brokerages like Fidelity or Charles Schwab.

If you already have an account at Vanguard, I wouldn’t bother changing it. On the other hand, if you’re looking for a new account, consider some of the other options that I’ve mentioned or check out our full list of top online brokers.

Vanguard FAQs

Here are a few of the most common questions we see asked online about Vanguard:

Is Vanguard good for beginners?

Yes, with an industry-leading menu of index funds, Vanguard makes it easy for new investors to get instant diversification with rock-bottom costs.

Is Vanguard good for active traders?

No, unlike many of its competitors, Vanguard doesn't offer a separate trader-centric platform. So if you're looking for lots of charting tools and technical studies along with fast trade execution, Vanguard won't be the right broker for you.

How much money do you need to open a Vanguard account?

Vanguard has a $0 account minimum; however many of its mutual funds have minimum investment requirements that typically range from $1,000 to 10,000

Does Vanguard have any bonus offers or incentives?

No, Vanguard isn't currently offering cash bonuses or any other benefits that are exclusive to new clients.

Vanguard Features

Account Types |

|

Tradable Assets |

|

Account Minimum |

|

Account Fee | $20 for accounts under $10,000 but can be eliminated by signing up for e-delivery service. |

Fund Minimum | $1,000 to $10,000 |

Stock Commissions | $0 |

ETF Commissions | $0 |

No-Transaction-Fee (NTF) Mutual Funds | 3,000+ |

Options Costs | Commissions: $0 Per contract fee:

|

Management Fees |

|

Banking Services | No |

Customer Service Number |

|

Customer Service Hours |

|

Mobile App Availability | iOS and Android |

Promotions | None |

Advertiser Disclosure

This content was reviewed by Vanguard but the opinion is the authors alone.

Vanguard Personal Advisor is provided by Vanguard Advisers, Inc., a registered investment advisor, or by Vanguard National Trust Company, a federally chartered, limited-purpose trust company. The services provided to clients who elect to receive ongoing advice will vary based upon the amount of assets in a portfolio.

Please review the Form CRS and Vanguard Personal Advisor Brochure for important details about the service, including its asset based service levels and fee breakpoints.

Vanguard Digital Advisor's services are provided by Vanguard Advisers, Inc. ("VAI"), a federally registered investment advisor. VAI is a subsidiary of VGI and an affiliate of VMC. Neither VAI nor its affiliates guarantee profits or protection from losses.

Vanguard Digital Advisor is an all-digital service that targets an annual net advisory fee of 0.15% across your enrolled accounts, although your actual fee will vary depending on the specific holdings in each enrolled account. To reach this target, Vanguard Digital Advisor starts with a 0.20% annual gross advisory fee to manage Vanguard Brokerage Accounts. However, we'll credit you for the revenues that The Vanguard Group, Inc. ("VGI"), or its affiliates receive from the securities in your managed portfolio by Digital Advisor (i.e., at least that portion of the expense ratios of the Vanguard funds held in your portfolio that VGI or its affiliates receive). Your net advisory fee can also vary by enrolled account type. The combined annual cost of Vanguard Digital Advisor's annual net advisory fee plus the expense ratios charged by the Vanguard funds in your managed portfolio will be 0.20% for Vanguard Brokerage Accounts. For more information, please review Form CRS and the Vanguard Digital Advisor brochure.

For more information about Vanguard funds, visit vanguard.com to obtain a prospectus or, if available, a summary prospectus. Investment objectives, risks, charges, expenses, and other important information about a fund are contained in the prospectus; read and consider it carefully before investing.

Vanguard Marketing Corporation, Distributor of the Vanguard Funds.

Vanguard Review

-

Commission & Fees

-

Customer Service

-

Ease Of Use

-

Investment Options

-

Tools & Resources

-

Account Types

Overall

Summary

Vanguard is a leader in low cost investing, and they have a lot of options available to help investors achieve that. The only thing lacking is that their website and app aren’t the easiest to use.

Pros

- Commission-free trading of stock, options, and ETFs

- A leader in low-cost mutual funds and ETFs

- Access to every account type and many services available

Cons

- Outdated platform and user-interface is hard to navigate

- Lacking some tools that investors may want access to

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Ashley Barnett