Lively is a fintech company that is focused on making the health savings account (HSA) easy and accessible for millions of Americans.

As a twenty- or thirty-something, you’re probably enjoying some of the best health of your life. Consequently, your healthcare spending is likely to be much lower now than it will be when you’re in your 40s, 50s, 60s and retirement years.

If you’re experiencing lower healthcare costs now, it probably makes sense to choose a high-deductible health insurance plan and to save and invest as much as you can into a health savings account.

But which HSA should you choose? You could choose an HSA through your company, but if you’re self-employed (or you have an HSA with high fees or poor investment options), you may be on the lookout for another HSA provider.

As an individual, one of the best HSA options to consider is Lively. Lively provides a fee-free HSA that offers investment options through Charles Schwab Health Savings Brokerage Account and a guided portfolio option through Devenir. Here’s what you need to know about Lively.

See how Lively compares on our list of the Best HSA Providers.

Lively Details | |

|---|---|

Product Name | Lively HSA |

Monthly Fee | $0 |

Account Minimum | $0 |

Investment Options | Robust Through Schwab And Devenir |

Promotions | None |

Who Is Lively?

Lively is a fintech HSA provider that leverage technology to reduce fees and simplify the user experience. Founded in 2016, the company recently surpassed $500 million in assets under management.

With traditional banks and brokers, HSAs are just one of their many account options. But Lively is hyper-focused on health savings accounts (HSAs). It doesn't currently offer any checking or savings account products. However, for employers, it does offer flexible savings accounts (FSAs).

Lively was named one of our best HSA providers in 2024.

What Does It Offer?

As an account holder, you may be able contribute tax-free money to your Lively HSA. To contribute to the account, you must have an eligible, high-deductible health insurance plan. Not sure you have that?

You can either check your health insurance plan statements or talk with an HR representative at your company. If you’re eligible to contribute, you won’t pay payroll taxes, income taxes, or any other taxes on the money you contribute to the account. You are subject to certain annual HSA contribution limits.

Once you have money in your HSA, you can either hold the money in cash (see interest rates below) or invest the money. Here's a closer look at Lively's key features and benefits.

Low Costs

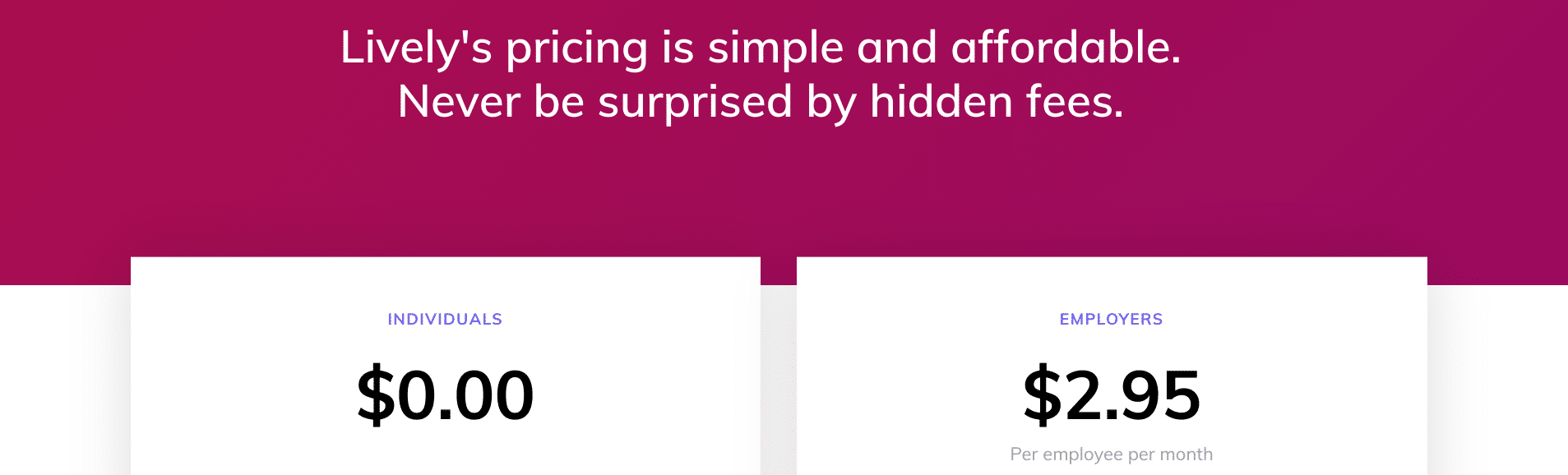

If you’re an individual (including a self-employed person), you can open a no-fee HSA through Lively regardless of the size of your initial deposit. That's a big deal as many HSA providers won't remove their monthly fees until you reach a certain minimum balance requirement.

Here are a few more fees that Lively has eliminated:

- Account closing fee

- Funds transfer (in or out) fee

- Debit card fee (up to three cards)

- Excess contribution fee

If you’re an employer, Lively HSA isn’t free. Instead, you’ll pay $2.95 per participating employee per month.

Great Investment Options

One of the key reasons we've been a fan of Lively is due to their ability to invest 100% of your HSA dollars. There's no cash minimum that you're required to reach before you can begin investing, however, there may be fees if you don't maintain a balance at Lively.

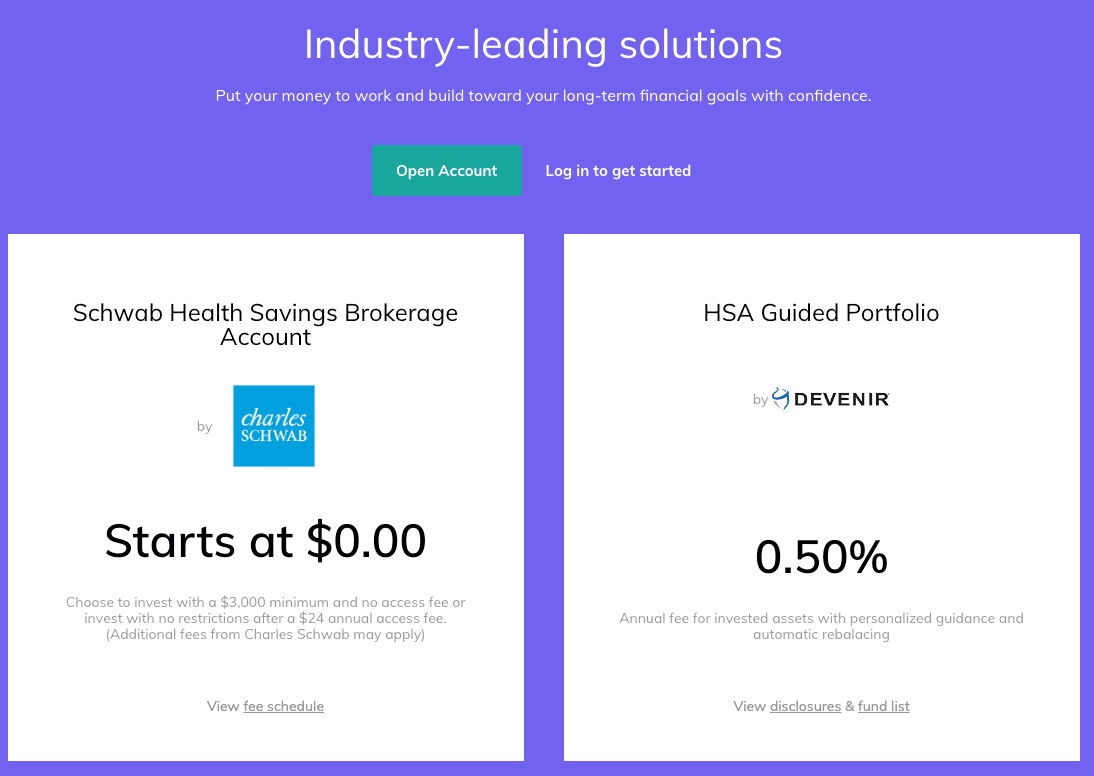

You can invest your HSA through Schwab Health Savings Brokerage Account (where you can pick pretty much anything to invest in) or by creating a Guided Portfolio in partnership with Devenir.

If you want to invest at Schwab, there is a $24 annual fee assessed by Lively, unless you maintain above $3,000 in their cash account.

If choose the Guided Portfolio option through Devenir, there is a 0.50% annual fee.

Important Note For Existing Lively Customers At TD Ameritrade: All Lively accounts at TD Ameritrade are being converted to Charles Schwab accounts.

Simple Spending And Reimbursements

All Lively account holders are issued a Lively HSA debit card that can be used at medical offices, pharmacies, and other qualified providers. The card comes with no one-time, monthly, or transaction fees.

Up to three cards can be issued per account which means that two family members can have their own cards too. Any medical expenses that aren't paid for with your Lively HSA debit card can also be easily reimbursed by simply uploading your receipts.

It's also easy to track your deductible spending and out-of-pocket costs by logging into your account online or inside the mobile app.

Low Interest Rate On Cash

This is one of the few areas where it could be argued that Lively falls short. It currently pays a dismal 0.01% to 0.525% APY on non-invested cash balances. In order to get the relatively low 0.525% APY, you need to have over $10,001+ saved in their HSA boost account. You're better off simply moving the funds to Charles Schwab and investing it in a money market at this point.

With HSA Bank, meanwhile, you can earn up to 0.20%.

But it should be noted that HSA Bank won't let you start investing you until you reach a $1,000 balance. With Lively, on the other hand, you can begin investing with your first dollar.

How Does Lively Compare?

We currently rank Lively #2 on our list of best HSA providers. Their blend of low costs and ample features makes them hard to beat. But if you want to use them for investing purposes, Fidelity might be a better choice.

However, there are several other providers nipping at Lively's heels that may suit certain people better. Check out this quick table if you're wanting to compare your options:

Header |  |  | |

|---|---|---|---|

Rating | |||

Monthly Fees (For Individuals) | $0 | $0 | $2.50 (until min balance met) |

Min Deposit | $0 | $0 | $0 |

Min For Investing | $0 | $0 | $1,000 |

APY | 0.01% | 0.01% | Up to 0.20% |

FDIC Insured | |||

Cell |

Who Is Eligible To Open A Lively HSA?

To open a Lively HSA, you must either currently have an HSA with funds in it, or you must have an HSA-compatible, high-deductible health insurance plan that will allow you to contribute funds to an HSA.

If you currently have an HSA, you can roll over your funds to the Lively HSA during the enrollment period. You can transfer funds to a Lively HSA even if you aren’t currently eligible to contribute to an HSA.

People who don’t have an HSA, but do have a HSA-compatible health insurance plan, may open an HSA through Lively.

Is It Safe And Secure?

Yes, cash deposits with Lively are FDIC-insured up to $250,000 through its partner bank Choice Financial. And investments receive up to $500,000 of SIPC insurance protection through its brokerage partners (Charles Schwab and Devenir).

Lively also takes data security seriously and is HIPAA compliant. Its website servers are encrypted with TLS 1.2+ and AES-256 encryption. And it supports two-factor authentication to ensure that your account is only accessible by you.

How Do I Contact Lively?

Lively offers phone, email, and live chat support from 6 AM to 6 PM (PT), Monday through Friday. Their customer service number is 888-576-4837 and you can contact them by email at hello@livelyme.com.

Why Should You Trust Us

We have been covering HSAs and reviewing HSA products for almost 10 years. We were one of the earliest media outlets to highlight using an HSA as an IRA. The HSA has also been a tool I've used personally across multiple providers, including Lively.

Our team has tested, tried, and used almost every HSA service available to consumers, so we're very confident in our recommendations to you.

Who Is This For And Is It Worth It?

Right now, Lively is one of the best HSA providers in the marketplace. The investment options are top-notch (Charles Schwab is consistently a high-quality and low-cost broker), and the fees are near impossible to beat. If you’re self-employed and looking for an HSA provider, Lively should be near the top of your list.

The only drawback is the minimum to invest without fees. If you're primarily using your HSA for investing, you might be better served by other options.

As an employee, you might have an easier time contributing to your employer-provided HSA rather than a Lively HSA. However, it’s worth checking your HSA’s fees and investment options.

If you’re overpaying or cannot invest how you like, consider opening up a Lively HSA — you’ll still enjoy all the tax benefits. Check out this guide on how to change your HSA provider.

Lively HSA FAQs

Here are a few common questions that readers ask about Lively.

Is Lively HSA legit?

Yes, Lively has been serving customers since 2016, manages over $500 million in assets, and has received over $40 million in funding from venture capital firms such as Costanoa Ventures, Ally Ventures, Liquid 2 Ventures, and Y Combinator.

Who owns Lively HSA?

Lively is a privately-owned company. Its co-founders are Alex Cyriac and Shobin Uralil.

Can I transfer my HSA to Lively?

Yes, you can transfer a portion all of your account with no fees. However, you may be charged an account closure fee from your existing HSA provider.

Can I use my Lively debit card at an ATM?

No, Lively does not allow its members to make ATM cash withdrawals from their accounts.

Lively HSA Features

Monthly Fee | $0 |

Excess Contribution Fee | $0 |

Account Closure Fee | $0 |

Account Minimum | $0 |

Minimum Balance For Investing | $0 |

Investment Options |

|

Guided Portfolio Annual Fee | 0.50% |

Debit Card Issued | Yes |

Debit Card Daily Spending Limits | $5,000 |

APY | Up to 0.525% |

ATM Cash Reimbursements | No |

Customer Service Number | 1-888-576-4837 |

Customer Service Email | support@livelyme.com |

Customer Service Hours | Mon-Fri, 6 AM to 6 PM (PT) |

Mobile App Availability | iOS and Android |

Bill Pay | Yes |

FDIC Certificate | 9423 (through Choice Financial) |

Promotions | None |

Lively HSA Review

-

Commissions and Fees

-

Customer Service

-

Ease of Use

-

Tools and Resources

-

Investment Options

Overall

Summary

Lively is a Health Savings Account (HSA) provider that allows for individual HSA accounts. It also is one of the few HSA providers that allows you to invest your entire HSA balance.

Pros

- No fees for individual and family HSAs

- Invest 100% of the balance of your HSA

- Investing can be self-directed or guided

- Easy to spend and track expenses

Cons

- Investing requires opening a separate account (with Charles Schwab or Devenir)

- Low APY on cash balances

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Chris Muller