One of my goals for this year was to max out as many different retirement vehicles as possible. We've talked about the strategies to maxing out the traditional retirement accounts, but have you heard of the Health Savings Account or HSA? The HSA is now one of my top strategies for saving for retirement, and it should be a high priority for you too.

The HSA is a custodial account that is designed to help people save for healthcare expenses. However, it can also work as a "secret" IRA and allows you to save even more for retirement tax-free. It's important to remember that HSAs aren't technically retirement accounts like an IRA, but the rules associated with the account make it an awesome tool for savers who qualify for it.

Let me show you why I think the HSA is your secret retirement weapon and how I'm using it as a "secret" IRA.

Don't forget to check out the best HSA account providers here >>

How Do HSAs Work?

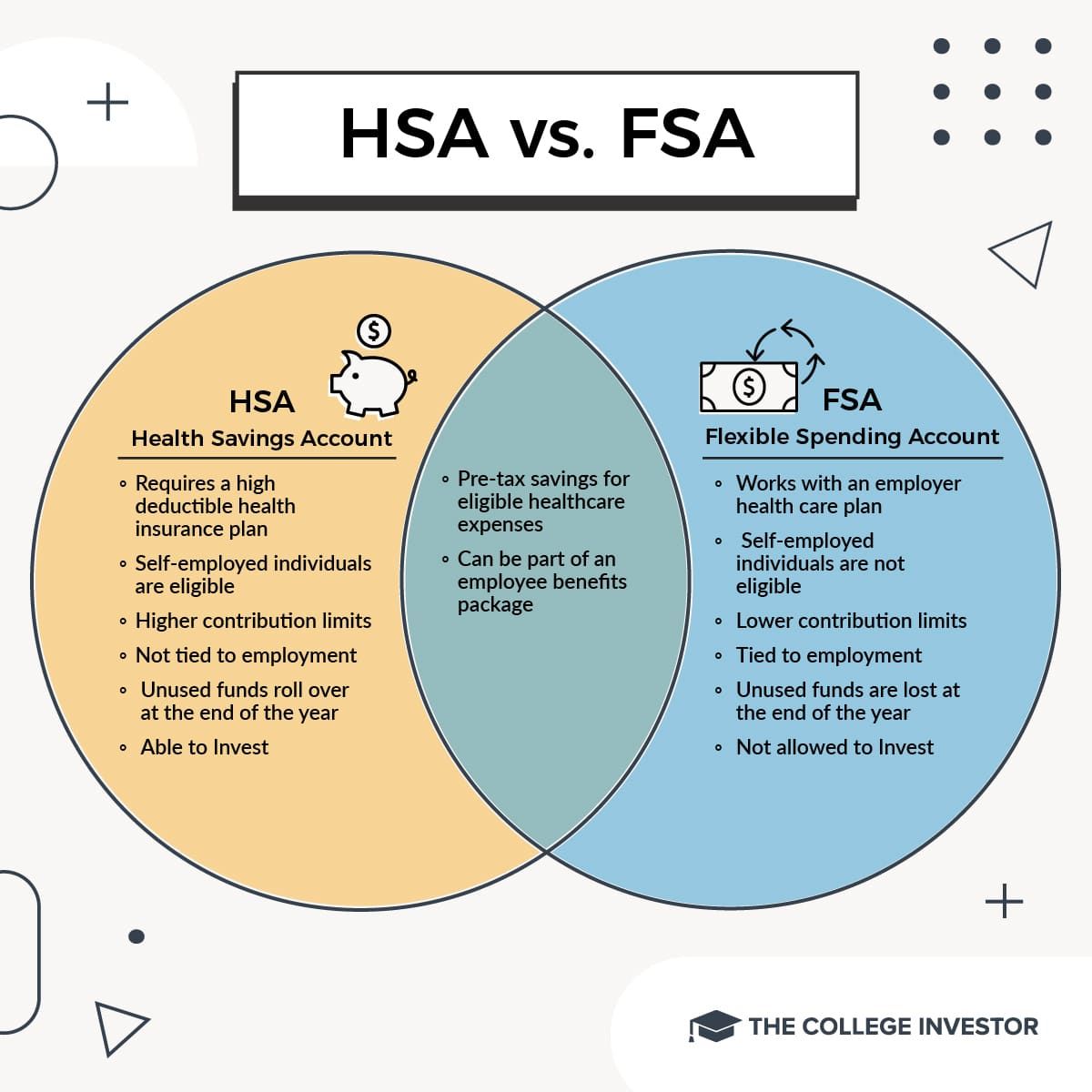

Health Savings Accounts came into existence in today's form in the early 2000s when President Bush expanded Medicare. A big premise of HSAs are that they are tied to having a high deductible health care plan, but they allow a lot of benefits that Flexible Spending Accounts didn't have.

In order to be able to contribute to an HSA, your healthcare plan must meet certain High Deductible Health Plan (HDHP) deductible limits. In 2022, those limits are:

Minimum - Maximum Deductibles:

Individual: $1,400 - $6,900

Family: $2,800 - $13,800

If your plan meets these deductible limits (which your employer will likely confirm with you during open enrollment), you can contribute pre-tax money to your HSA.

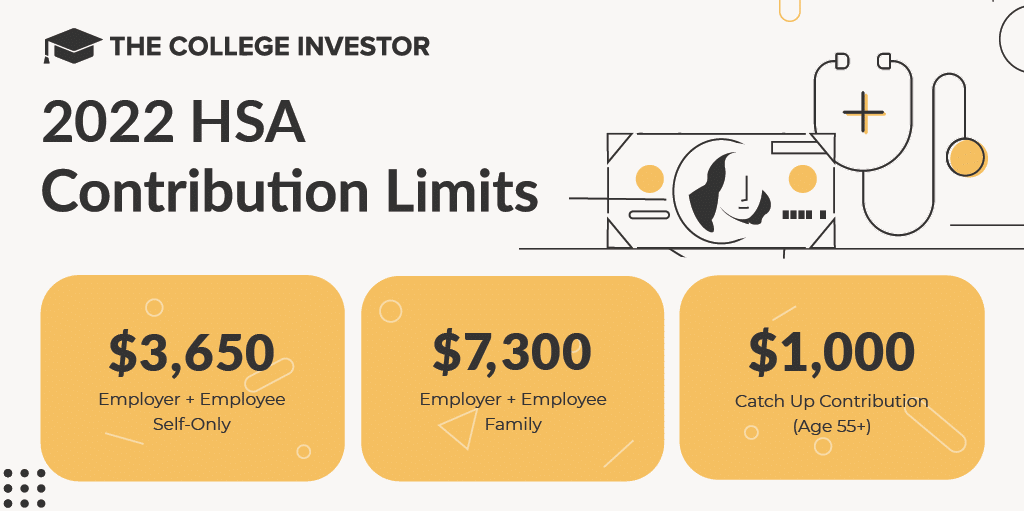

For 2022, the HSA contribution limit is:

Individual: $3,650

Family: $7,300

You can check out next year's HSA contribution limits here.

It's important to note that this contribution limit includes both employer AND employee contributions. So, if your employer is going to contribute on your behalf, you need to adjust your paycheck withholding appropriately.

So, now that your money is in this account, what now? Here's where the real fun begins. Just like a flexible spending account, you can withdraw the money at any time for medical expenses. The money in your HSA carries over from year to year, and if you leave your employer, you can take your money with you. Remember, it's your HSA, just like an IRA or 401k would be your money too.

The awesome advantage of the HSA is that you can invest the money inside the account. However, it's important that you check with your plan administrator. Each plan varies widely (which is a bummer), but in general you can select funds similar to a 401k inside your HSA. Some HSAs require you always maintain a cash minimum (like $2,000) before you can invest, but once you reach that limit, you can invest in the funds offered.

The Triple Tax Benefits Of HSAs (And More)

What makes HSAs an awesome "secret" IRA is that you get a triple tax benefit by saving in an HSA. Wait, what? Yes, HSAs offer a triple tax benefit that is unheard of in other retirement accounts. It's these benefits that make the HSA the best retirement vehicle (seriously, I just said that).

So, what are these amazing benefits?

1. Contributions Are Pre-Tax

All of your contributions to the HSA are pre-tax. This is done via payroll deduction, but you can also opt to do this manually if you're self-employed (it's just more tedious). That means that you get a tax savings up front simply by contributing, just like you would get with a traditional 401k.

For example, if you're in the 25% tax bracket, and you contribute the maximum of $6,750 for a family, you could potentially see a tax savings of around $1,687 dollar in year one. If you are able to have the contributions done via payroll deduction, you can also save on FICA taxes (Social Security and Medicare). That will save you another $506 per year.

So, by contributing the maximum, you'll realize a tax savings immediately of $2,193.

2. Growth Is Tax-Free

Just like an IRA, all the money inside your HSA grows tax free. So, if you invest and see massive gains - those are tax free. If you have a bunch of dividend paying funds, the dividends are tax free. Simply sit back and watch your money grow over time.

3. Withdraw Is Tax Free For Qualified Medical Expenses

With an HSA, qualified medical expenses are able to be taken out tax free at any time. We're going to talk about this more in a second, but I want you to remember that phrase: withdrawn at any time. Unlike a flexible spending account where there are timelines for reimbursement, that doesn't apply to your HSA account. For reference, the IRS has a pretty comprehensive list of qualified medical expenses.

Beyond those three, there are two more awesome benefits to consider:

4. After Age 65, Withdraws Are Taxed Just Like An IRA (No Penalty)

If you still have money in your HSA at age 65 that you haven't been able to get reimbursed with qualified medical expenses (because maybe you're a rockstar and have millions saved in your HSA), don't fret! After age 65, your HSA now works just like a traditional IRA. There are no penalties for withdrawing the money in your account - you will just pay ordinary income tax on the money. As such, you can leverage your HSA, along with other retirement accounts, to achieve tax diversification in retirement.

5. You Can Use HSA Money For Your Medicare Premiums

Finally, another unspoken benefit of the HSA is that you can use your HSA money after age 65 for your Medicare Premiums - tax free. No other medical savings account has ever allowed for the use of tax free money to be used for Medicare or insurance premiums, so this is huge. You may not realize it, but you could be spending $400 per month on Medicare premiums. If you have an HSA, you could use pre-tax money for that, instead of other accounts or Social Security.

Don't Confuse An HSA With An FSA

When talking about using an HSA as an IRA, it's essential that you don't confuse the HSA with the more common FSA, or Flexible Spending Account. These accounts also let you save pre-tax money for medical expenses, but the limits are lower, and you cannot invest the money. Even worse, FSAs only allow a tiny rollover every year.

See the full difference between an HSA and FSA here, or this quick comparison chart:

How To Leverage Your HSA Like A Secret IRA

So, all of those tax benefits are charming and all, but seriously, how can you really leverage the HSA like a "secret" IRA? Well, let me tell you the secret HSA hack that really sets the HSA over the top.

Remember that phrase earlier: you can withdraw money from the HSA anytime? That is what makes the HSA so powerful and why I recommend that you use the HSA as a primary retirement savings vehicle.

Basically, if you can afford to pay for your medical bills today, you should be maximizing your contribution to your HSA between your money and your employer. Most employers who offer HSAs typically contribute anywhere from $600 to $1,250 to your account. That's a free match, just like a 401k, and you never want to leave money on the table. So, it's then on you to make up the different to contribute to the maximum.

When you get billed from your health providers, simply pay the bill out of pocket, AND SAVE THE RECEIPT. I simply created a file that is called "Medical Bills - To Be Reimbursed". Here's what it looks like:

Next, leave the money in your HSA to grow for as long as possible. Contribute the maximum to your HSA every year. Rinse and repeat. Over time, the added contributions and compounding of money will allow your HSA to grow and grow and grow! As you get new medical receipts, simply add them to your file.

My personal goal is to let this money grow for years. Maybe 65, but maybe sooner. I don't have a set deadline, but I do know that I want the power of compounding to take over and really maximize the tax free gains.

Finally, when you're ready to withdraw, simply submit your big file of "Medical Bills To Be Reimbursed" and you'll get a big stack of tax free money. You could even do a little bit at a time. It's not like you have to take it all out at once.

That's how you leverage your HSA as a "secret" IRA.

Concerns About Having A High Deductible Health Plan (HDHP)

One of the biggest concerns with an HSA is having a high deductible health plan (HDHP). It can be a scary change from traditional HMO health plans, and honestly, a lot of the language in most employer open enrollment packages makes it super hard to understand what you will really pay.

After having a HDHP for a while, and having a few medical bills to go along with it, I wanted to alleviate some concerns about having a HDHP, because I've found it to not be scary at all, and in many cases, it's been cheaper than my old insurance coverage AT MY SAME EMPLOYER.

It's important to remember that a HDHP is still insurance. And with insurance, you get a lot of coverage already. For example, most HDHPs include 100% coverage for wellness visits, vaccinations, and more. And many services are covered at 80% - sick visits, x-rays, surgery, etc. And many plans still offer decent prescription drug coverage, with $4 generics, etc.

If you want to compare your options that include an HSA, check out Policy Genius for a quick and easy quote.

My Story

You may think that 80% coverage number is scary, but you also have to realize that you're going to pay 80% of the insurance negotiated price with the hospital - which is usually pretty cheap. For example, I recently had to get a CT scan. The hospital billed my insurance $2,100. But I only had to pay $370.16 - or 17%. And when the time comes, I can always submit that $370 bill to get reimbursed from my HSA.

Under my old PPO plan, I was surprised that vaccinations and wellness visits weren't covered. With a baby, that added up to a lot of medical expenses. Now, under the HSA with HDHP, wellness visits and vaccinations are 100% covered - so I'm seeing a savings in medical expenses immediately.

Of course, every plan is different, and you should read the fine print on any potential health insurance plan. But remember:

- HDHPs are still insurance, so you get a lot of coverage automatically

- You will only pay a portion of any bills, and that's on the negotiated amount by the insurance company

- The maximum you'll ever pay each year is your Out of Pocket Maximum

Conclusion

If you qualify for a Health Savings Account or HSA, you need to be maxing it out each year and leveraging it like an Individual Retirement Account. The HSA plays a critical role in the order of operations for saving for retirement.

Remember, the key benefits with HSAs and the reason to use the HSA as an IRA are:

- Triple Tax Savings

- Carry over annually and rollover from employers

- Ability to reimburse expenses anytime

- Acts like a traditional IRA after age 65

If that doesn't excite you, and make you think that the HSA is the best retirement account ever, I don't know what to tell you. I'm putting it out there that the HSA is the best retirement account, even though it technically isn't a retirement account. Now go get this setup.

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Chris Muller