At the onset, real estate investing sounds like an expensive venture costing thousands of dollars in initial investment. And in the past, it used to be!

Fortunately, you don’t need six figures in the bank to be a real estate investor today. It really starts with a solid financial plan.

Many people who have reached financial independence have done so investing in real estate (in fact, it's one of the most common ways to become a millionaire). This might seem like an impossible achievement if you’re only looking at the end result, but by starting out with small steps and making continued forward progress, you can make your way to “real estate mogul” even if you only have a smaller dollar amount to start investing with.

Today we will discuss how you can get started in real estate investing without breaking the bank, even if you don’t have hundreds of thousands of dollars.

Why You Should Consider Real Estate Investing

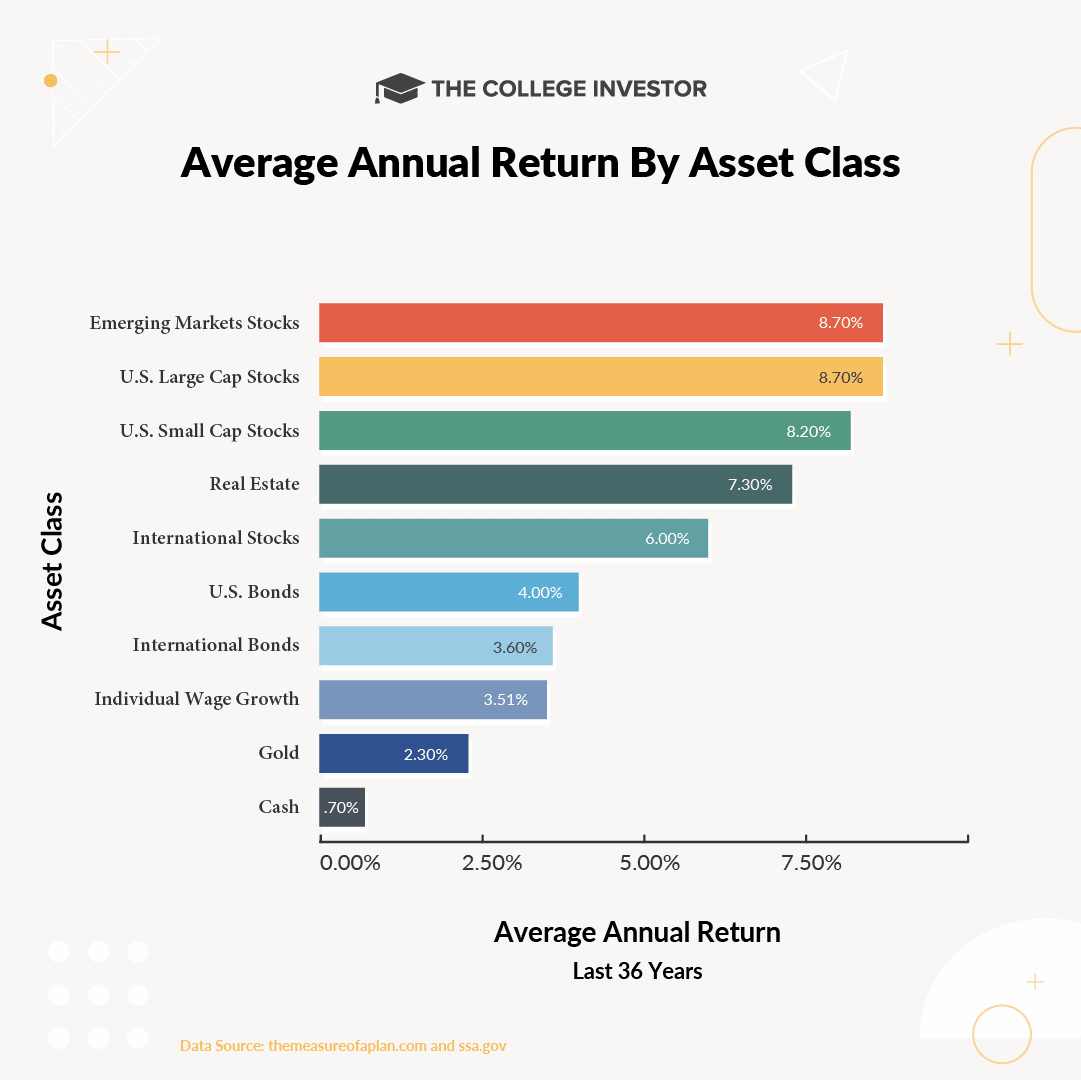

The biggest reason you should consider real estate investing is because of the potential for high returns compared to other asset classes (such as investing in the stock market) - but also uncorrelated returns. In fact, real estate has had an average annual return of 7.30% since 1970.

To compare, the S&P500 had an average annual return of 10.31%.

Real estate investing offers leverage over assets, control over the assets, and a substantial profit, if done correctly. You can even invest in real estate while you are still in college! Regardless of when you start, real estate investing is one of the many ways to grow your financial portfolio.

But it's important to remember that comparing real estate to stocks is comparing apples to oranges. While there are some similarities, there are many differences that investors need to realize and understand as well.

Here's what you need to do to get started.

1. Get Educated

The best approach is to learn all that you can with the free resources available for your immediate consumption. You need to learn the basics, but you also have to ask the right questions when presented with information.

While you may be bombarded with images of expensive real estate investment seminars, that is not a requirement to be successful in real estate investing. You can learn the basics from useful free guides online to get a jump start on the basics. There are plenty of real estate books, podcasts, and free information online as a good place to start. You can also speak with other real estate investors.

Here are the main types of properties and investments available for real estate investment. Each type of investment has its own nuances that you should understand before you invest.

- Vacant Land

- Single Family Homes

- Small Multifamily Properties

- Large Multifamily Properties

- Commercial Real Estate

- Mobile Homes

- Notes/Paper/Mortgages

Once you learn about the different types of options for the real estate listed above, you will want to think about the one that fits your budget, time, and requirements.

You will also want to learn how to properly evaluate a neighborhood in order to make the best investment. You may not be familiar with the city or locality where you are investing, so you will definitely want to check out how to evaluate the locality or neighborhood you are investing in to make an informed decision.

2. Set Your Goals

After doing your homework, you will have a range of the initial investment you can expect to make in getting started. It's possible to get started with just $1,000 (or even less in some circumstances). But you should also have a goal and know yourself.

How much risk do you want? How much work do you want to put in?

Write down your goal. Next, reverse-engineer what you need to do to get to that point - what is the initial investment amount required to get started?

3. Find The Cash For Your Down Payment Or Investment

At some point, you are going to come to the realization that you have to put away your disposable income so that you can fund your real estate investing dreams. You can do so even if you earn a meager salary, or even if you are a starving college student. You can do this, and the important thing is to begin with the end goal in mind.

You can raise funds quickly by working on your side hustle or following your new budget.

4. Explore Your Real Estate Investment Options

It is important to understand your options, as some have higher risks and higher investment requirements.

Traditional Real Estate Investing

The first option is in traditional real estate investing, which involves buying rental properties and renting them out to tenants.

Traditional real estate investing is a popular way to grow your wealth, but it also comes with some cons that you should look at before you make the leap.

Traditional real estate investing requires searching dozens of listings and visiting several properties before you decide on the right property suitable for rental purposes.

Aside from that, you will also spend a considerable amount of time searching for tenants, showing the property to tenants, and staging the home when showing the properties to tenants. Maintenance and property management are often overlooked duties that are vital to successful rental real estate investments.

If you decide to purchase the home as an owner occupied home, there is an additional risk where you are responsible for a large mortgage loan on the property with a substantial risk in the event of a decline in the housing market.

While these risks are not enough to turn someone off entirely from traditional real estate investments, you have to know what you are getting yourself into before you make the decision.

A newer option to get started down the traditional real estate path is Roofstock. Roofstock allows you to buy cash-flowing single family homes across the United States. You can fully purchase your rental properties online, and they have tools to help you manage them as well.

Read our Roofstock review here, and get started with Roofstock here >>

Crowdfunded Real Estate

If owning and managing your own rental property is not appealing to you, but you still want to grow your portfolio through real estate investing, crowdfunded real estate investing may be a better option for you.

When you participate in crowdfunded real estate investing, you are part of a group of people who pool their money with other investors, and then lend or invest that money with experienced rental real estate investment property owners.

You stand to profit from the experienced investor’s skills with a minimal investment of time with minimal risk, depending on the investment.

One of the benefits of this option is that you can track statistics online to review an investment’s earnings history information. You can also manage your investment online, and you will get a summary with year-end tax information as well.

Crowdfunded real estate investing is a very popular option because you do not have to search for property, get a mortgage loan, screen or manage tenants or manage the property. More importantly, someone else is responsible for the property loans. Your risk and workload are minimized, yet the potential for profit still exists.

Prior to crowd funding, private securities could not be marketed publicly under the Securities Act of 1933. As a result, it was difficult to get information about private securities investments unless you associated with wealthy real estate investors who invested in six-figure deals.

Today, crowdfunding gives investors access to a variety of investing deals, despite your background, resources, or level of experience.

While crowdfunding is an attractive option, you need to research the company and the options to make sure that the company is legitimate and also a good fit. You need to know the minimum investment amount to make sure that the deal will work for you. You will want to know how long they have been in business, as well as their guidelines for borrowers and investors. Lastly, you need to know the fees being charged for their service.

Here are two of our favorites:

Fundrise

Fundrise is one of the largest Real Estate Investment Trusts (REIT). You invest with others in a basket of real properties. The great thing about Fundrise is that you get some diversification of deals, versus simply having all of your money tied up in one deal.

Check out Fundrise here.

RealtyMogul

RealtyMogul is one of the largest crowdfunding companies with some attractive features:

- Well-vetted properties (only 1 out of 1000 deals meet their criteria)

- Residential and commercial real estate offerings

- $1,000 minimum investment

- REIT offerings designed for passive income and growth

- Residential and commercial real estate offerings

- 1031 Exchange Opportunities

Check RealtyMogul out – they're getting a lot of attention in this space.

Understand The Risks Of Real Estate Investing

You have to understand the risks before making the investment. One of the key risks involved is buying a property and having to sell it at a significantly lower price due to market conditions or other conditions outside of your control.

Another common mistake includes the timing of purchases and sales may result in substantial losses or losing out in a deal or the market picking up ahead of your prediction forcing you to buy the same product that was available for a bargain at a premium.

If you're owning the rental, maintenance and other large expenses can also be a challenge.

Be Aware of The Tax Implications

From the onset, you will want to be aware of tax implications of the real estate investment properties. One of the key determining factors is how the property is classified, and how it is used.

You do not want to part with a major chunk of the returns you earn from an investment as taxes. The one and the only way to ensure this is by understanding the tax implications of any property investment well in advance. An important part of how the property is classified is how the property is treated under rental real estate activities.

Go through the existing tax schedules and also get a clear picture about the varying rates that apply. Always speak to a tax professional if you have questions or concerns.

Your Real Estate Investment Plan In a Nutshell

Real estate can be a lucrative option, but you need to make informed decisions and take consistent action. Use the action guides linked above to fast track your real estate investment education, but remember to do your research based on your own unique financial situation to reach your maximum potential in real estate investing.

Have you ever thought about investing in real estate? Does knowing that you can invest in real estate without a lot of money motivate you to get started? Why or why not?DISCLAIMER

The information contained herein neither constitutes an offer for nor a solicitation of interest in any securities offering; however, if an indication of interest is provided, it may be withdrawn or revoked, without obligation or commitment of any kind prior to being accepted following the qualification or effectiveness of the applicable offering document, and any offer, solicitation or sale of any securities will be made only by means of an offering circular, private placement memorandum, or prospectus. No money or other consideration is hereby being solicited, and will not be accepted without such potential investor having been provided the applicable offering document. Joining the Fundrise Platform neither constitutes an indication of interest in any offering nor involves any obligation or commitment of any kind.

The publicly filed offering circulars of the issuers sponsored by Rise Companies Corp., not all of which may be currently qualified by the Securities and Exchange Commission, may be found at www.fundrise.com/oc.

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Chris Muller