Solo 401k by Nabers Group offers a robust individual 401k option for investors looking to do more with their retirement funds.

Self-employment doesn’t necessarily mean you can’t reap similar benefits of an employee-sponsored 401k plan you’d get from working full time at a company. For those who choose to be their own boss, there’s something called a solo 401k, which is specifically designed for self-employed people who don’t have any employees.

The individual 401k offers a huge tax shelter for business owners and is an excellent option to save and invest for retirement. Most discount brokerages offer fee-free individual 401k plans, but these brokerages limit the types of investments.

Self-employed people who want to invest in alternatives like crypto, real estate, or gold and silver need to look to specialty companies to open self-directed individual 401k accounts.

Today we’re reviewing The Nabers Group, which offers a fixed fee, self-directed 401k account that allows you to have access to all sorts of alternative investments. We explain how it works and whether it makes sense to open one.

Quick Summary

- Self-directed individual 401k which allows self-employed people to invest in almost anything.

- Traditional and Roth contributions are allowed.

- Loan yourself up to $50,000.

- Flat monthly fee for all account holders.

- Debit cards are designed with kids in mind

- Parents can set store-specific spending limits

- Rewards on savings plus the option to add parent-paid interest

Solo 401k by Nabers Group Details | |

|---|---|

Product Name | Solo 401k by Nabers Group |

Account Type | Solo 401k |

Employer Fees | $99 Annually $499 Setup Fee |

Promotions | None |

What Is the Solo 401k by Nabers Group?

The Solo 401k by the Nabers Group is a self-directed 401k for self-employed people and their spouses. A solo 401k account allows account holders to invest in nearly any asset class including gold and silver, mortgage notes, real estate, and other asset classes that most people can’t access through their retirement accounts.

The Nabers Group has been offering self-directed 401k products since 2006, just a few years after individual 401ks became more popular due to legislative changes. The fixed fee for the product includes access to all sorts of legal templates to ensure that your investments stay legally compliant.

Plus, they appear to have the largest market share of non-prototype solo 401k plans on the market.

What Does It Offer?

The Nabers Group offers a Solo 401k designed for self-employed people who don’t have any employees. Investors can opt for conventional investments like stocks and bonds, but the Nabers Group also enables alternative investments.

Invest In Almost Any Kind Of Asset

The Solo 401k by Nabers Group is a self-directed 401k plan for self-employed people. It allows investors to have tax-advantaged investments in alternative asset classes such as:

- Loans

- Syndicated real estate

- Real estate

- Hedge funds

- Cryptocurrency

- Bullion

- Private businesses

- Other passive investments

Fixed Fee For Administration

People who opt to open a Solo 401k through Nabers Group will pay a $499 setup fee and $99 annual fee. The fee doesn’t change depending on the complexity of your investments or the size of your account balance.

Regular Educational Webinars

The Nabers Group offers weekly educational webinars to give investors more clarity on how they can best use their self-directed 401k account. These webinars are in addition to one-on-one support for those who need it.

Investment Advice

Nabers Solo 401k operates as an SEC registered investment advisory firm. As such, they can act as competent advisors to help you with your alternative investment choices and setup.

Up To $50,000 Portfolio Loan

Plan participants who have cash in their portfolio can use up to half of it as a 401k loan. The maximum loan amount is $50,000. The interest payment on this loan is the Prime Rate + 1%. So, as an example, a person with $80,000 in cash can lend themselves $40,000. The remaining $40,000 can be invested after the loan has been issued.

Plus, these loan documents can be setup instantly.

Nabers Group Handles Annual Paperwork

The Nabers Group creates IRS-approved 401k setup documents, and it generates IRS Form 5500-EZ for account holders. The company also gives account holders templates for 401k loans and other common transactions.

Unlike other companies, 5500-EZ prep is near instant, and documents are delivered via an encrypted vault.

Roth Option Available

The account offers the option for Roth contributions and in-plan Roth conversions. In-plan Roth conversions allow account holders to convert some or all of their pre-tax contributions into Roth contributions that won’t be taxed again. Account holders must pay the tax on the converted funds the year the money is converted to a Roth holding. This can be advantageous for self-employed people who have a low income year.

Are There Any Fees?

This fee covers the cost of:

- Account administration including ongoing plan maintenance and support

- Unlimited fee rollovers

- Bank, brokerage, and crypto account access

- Form 5500-EZ preparation

- One-click annual IRS maintenance

How Do I Contact the Nabers Group?

The Nabers Group is based out of Scottsdale Arizona, but it serves self-employed people across the United States. The best way to contact the Nabers Group is through its customer service number (877) 765-6401. The company also has a chatbot on its web page.

How Does Nabers Group Compare?

Major brokerages like Fidelity and Charles Schwab offer fee-free solo 401k plans for qualified people. However, the investments in these accounts are limited to stocks, bonds, ETFs, and mutual funds. For most people, these free accounts are just fine. But those who want to self-direct, their investments will need to pay for that option. Self-direct simply means investors want access to alternative investments and complete control over the buy and sell decisions.

Comparing The Most Popular Solo 401k Providers | ||||

|---|---|---|---|---|

Fidelity | Ascensus | Schwab | E-Trade | |

Roth | No | Yes | No | Yes |

Loan | No | No | No | Yes |

Investments | Many | Limited | Many | Many |

Rollover | Yes | Yes | Limited | Yes |

Annual Fee | $0 | $20/fund/yr | $0 | $0 |

Cost | $0/Trade | $0/Trade | $0/trade | $0/trade |

People who opt for the Nabers Group pay a higher fee for the option to direct their investments as they see fit. However, they will have virtually unlimited investment options at their disposal. The fees charged by the Nabers Group are slightly higher than fees charged by direct competitors like Rocket Dollar and Alto.

These companies sometimes charge one-time set-up fees but otherwise offer similar services as the Nabers Group. Based on the price differential, investors may be better off choosing one of the less expensive alternatives.

Header |  | ||

|---|---|---|---|

Rating | |||

Setup Fee | $499 | $360 | $525 |

Annual Fee | $99 | $180 | $125 |

Plan Types | Roth & 401k | IRA & 401k | IRA & 401k |

Checkbook? | |||

Cell |

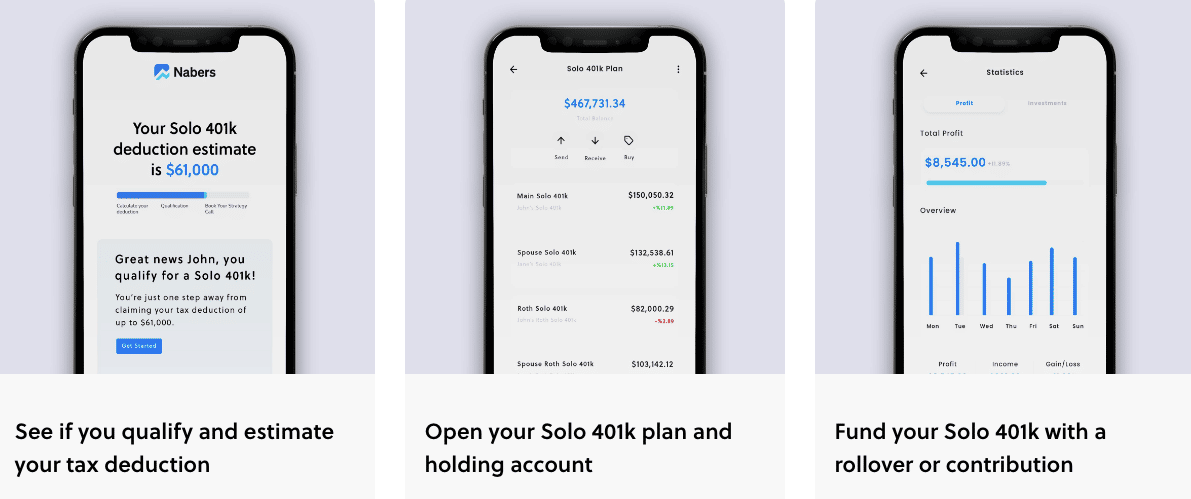

How Do I Open An Account?

To open a Solo 401k through the Nabers Group, complete a quick online application. The application ensures that you’re qualified to open up a Solo 401k plan. If you are, Nabers Group creates plan documents for the person. Once that is done, investors need to set up a deposit account for their investments.

The Nabers Group has “preferred” banks that help investors set up IRS compliant checking accounts. Once that is done, investors can start transferring funds or assets into the account, and investing can begin.

Is It Safe And Secure?

The Nabers Group has a robust security and privacy policy designed to keep information and assets safe. Investors pay for their accounts using Stripe, a secure payment portal. All of a person’s account and personal information are encrypted in transit and at rest.

Investments and cash for investments are not held by the Nabers Group, so these assets are theoretically quite safe (especially those held at banks or brokerages).

Overall, the security protocols seem robust, and investors can invest with confidence.

Why Should You Trust Us?

I have been advocating and discussing the Solo 401k for at least 7 years now - creating one of the first (and most robust) comparisons of the major solo 401k providers. I created this guide (and all of the other reviews) because of my own needs to find a solo 401k that allowed me to not only invest in stocks and bonds, but also startups and real estate.

Beyond my own experience and research in the space, our compliance and editorial team thoroughly checks the content for accuracy and updates pricing and features as needed.

Is It Worth It?

Typically, self-employed people don’t need a fancy self-directed 401k. Their retirement investments likely include run-of-the-mill ETFs and mutual funds. Few people want to put their retirement money into speculative investments.

However, some people have the specific knowledge to be able to invest in alternative assets like gold, silver, real estate, or promissory notes. These investors may want to combine an alternative investing strategy with the tax advantages of a solo 401k.

The product makes sense for self-employed people seeking alternative investments. However, it is not a low-cost leader. Investors should look at less expensive alternatives before choosing to go with Nabers Group for their self-directed Solo 401k.

Solo 401k by Nabers Group Features

Account Types |

|

Solo 401k Pricing | Setup Fee: $499 Annual Fee: $99 |

401k Employee Pricing | N/A |

Self-Directed Investing | Yes, fully self-directed |

Managed (Robo-Advisor) Portfolios | No |

Supported Assets |

|

Payroll Sync | None mentioned |

Local Offices | None (online-only) |

Customer Service Number | 877-765-6401 |

Customer Service Number | 888-483-2645 |

Customer Service Hours | Monday-Saturday, 8 AM-11 PM (MT) Sunday by appointment |

Mobile App Availability | iOS and Android |

Web/Desktop Account Access | Yes |

Promotions | None |

Solo 401k by Nabers Group Review

-

Pricing and Fees

-

Investment Options

-

Account Types

-

Customer Service

Overall

Summary

The Nabers Group offers a self-directed 401k account that allows self-employed people access to alternative investments such as crypto.

Pros

- Invest in almost any asset class.

- Instant document prep (for 5500-EZ and loan docs)

- Nabers Group handles document prep for account holders.

Cons

- The setup fee is $499 and the annual fee is $99/yr

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Claire Tak Reviewed by: Chris Muller