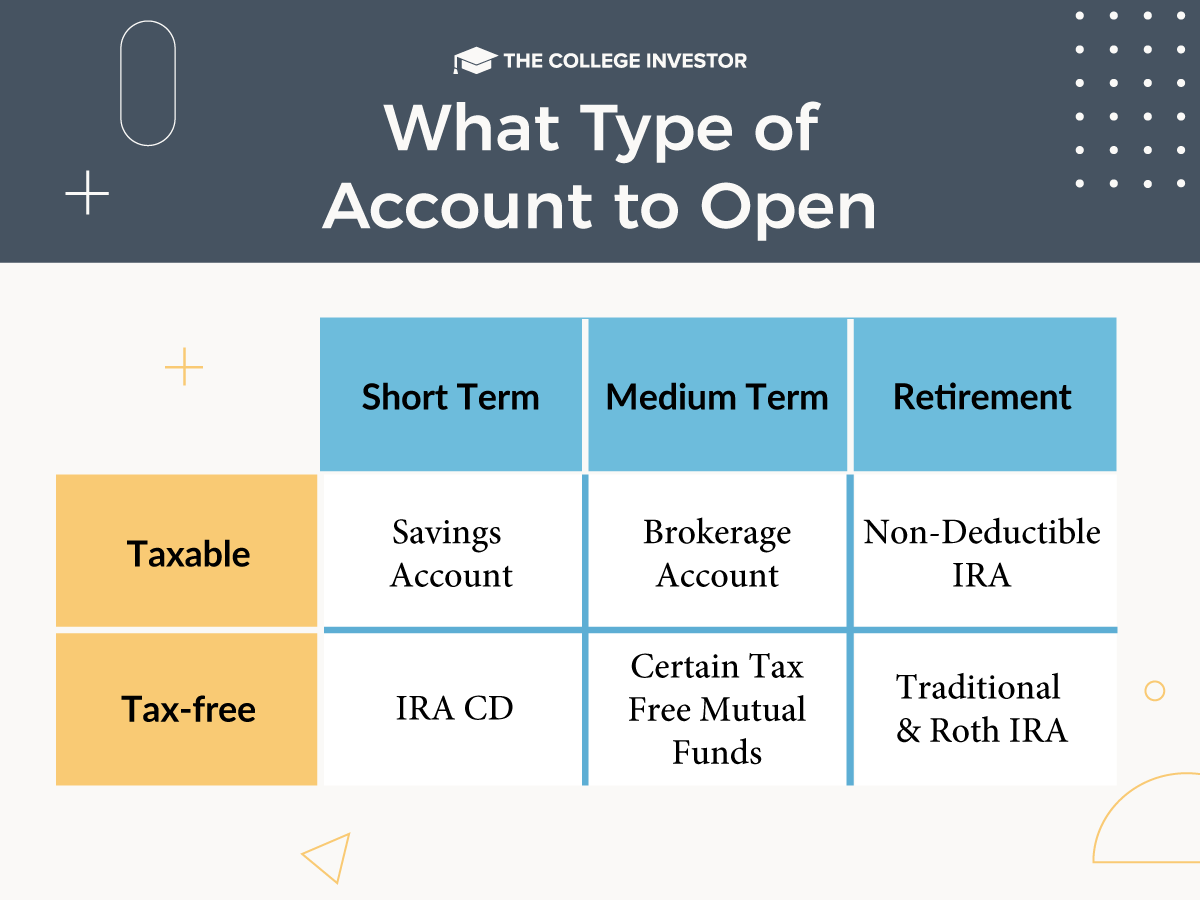

If you are just considering getting started investing, you may be overwhelmed by the first choice on the investment account application: what type of investment account do you open?

The truth is that there are a lot of different accounts for different purposes, so I will try to shed a little light on the more common ones that are offered at most discount brokerages.

Remember, an investment account is like a vehicle, while your actual investments are the passengers. Depending on the vehicle you own, it can only hold certain numbers and types of passengers. Plus, certain other rules will apply. That is how accounts work. Inside the account, you hold your stocks, bonds, mutual funds, etc. Some accounts have limits on how much you can put in, and there are rules about what types of investments you can hold in certain types of accounts.

First, there are two main distinctions in accounts: brokerage and retirement. There are also some specialty accounts. Brokerage accounts can be accessed at any time to deposit and withdraw funds. Retirement accounts have restrictions on how much can be invested annually, and can usually only be withdrawn upon in retirement.

Both types also have their benefits. Brokerage accounts can invest in any investment product, and can also take on leverage and short positions. Retirement accounts are somewhat limited in what they can invest in, but they usually offer some type of tax advantage.

Brokerage Investment Accounts

Cash - A cash brokerage account is the most basic form of investment account. It's also known as a standard brokerage account. This account type is funded by your cash, and you can only invest with the cash in the account. This account is limited in what you can do because you can only use your cash. For example, you can't engage in certain options trading, and you can short sell either. If you're interested in that type of trading, you should look for a margin account. You should note that everything you do in a cash account is taxable, so make sure you pick your investments wisely.

Look at our guide that compares the best brokerage accounts here.

Margin - A margin account is very similar to a cash account except you have the ability to trade on margin. This means that you're able to borrow from the brokerage when you place a trade. It still requires a certain amount of capital, and you can usually borrow up to 50% of what you have. A margin account gives you the ability to place every trade possible - including options trades and short selling. This is all due to the fact that you're able to borrow from the broker to conduct the trade. Just like a cash account, a margin account is fully taxable.

Retirement Investing Accounts

When it comes to saving for retirement, there are a lot of different investment vehicles. IRAs are the main type that you can go an open. You may be familiar with a 401k or 403b, but those are employer sponsored plans and individuals don't open those accounts.

Traditional IRA - A Traditional IRA (individual retirement account) is a savings vehicle that allows you to save and invest for retirement up to the IRA contribution limits. The benefit of using a Traditional IRA is that, in many cases, the amount you contribute is tax deductible. Once you put money inside the account, everything you do or trade is tax deferred. You only pay taxes once you withdraw the money in retirement, but you will do so at ordinary income tax rates.

Check out our picks for the best places to open an IRA account.

Roth IRA - A Roth IRA is similar to a Traditional IRA, except that you invest using after-tax money. Inside the account, both the Roth and Traditional IRA act the same. However, with the Roth IRA, when you withdraw your money in retirement, you don't pay any taxes on it.

For these accounts, the gamble is this: do you think you're going to be in a higher tax bracket now or later. If you are paying higher taxes now, and think you'll pay less in retirement, a Traditional IRA makes sense because you get the tax breaks today. However, if you are in a low tax bracket now and plan to be in a higher tax bracket in retirement, a Roth IRA is the better choice.

SEP IRA - A SEP IRA is designed for the self-employed. In fact, it stands for Self-Employed Pension. Anyone who is self-employed can start a SEP IRA, and they're really quick and easy to open. In fact, if you're a freelancer or side hustler, this is a great account to open. The limits on these accounts are very high, and you can contribute upward of 25% of your income to this account.

401k - A 401k is a workplace sponsored retirement investing account. It can be sponsored by your employer, or by yourself if you're self-employed (hence the Solo 401k). The great thing about a 401k is that the amount you can contribute is significantly higher than what you can contribute in an IRA. The 401k has employer and employee contributions - and some employers even offer matching contributions!

403b - A 403b is similar to a 401k in that it's a workplace sponsored retirement plan, but this is for non-profit or tax exempt organizations. The contribution limits for a 403b are the same as a 401k, and many employers also offer matching contributions here as well.

Education Savings Accounts

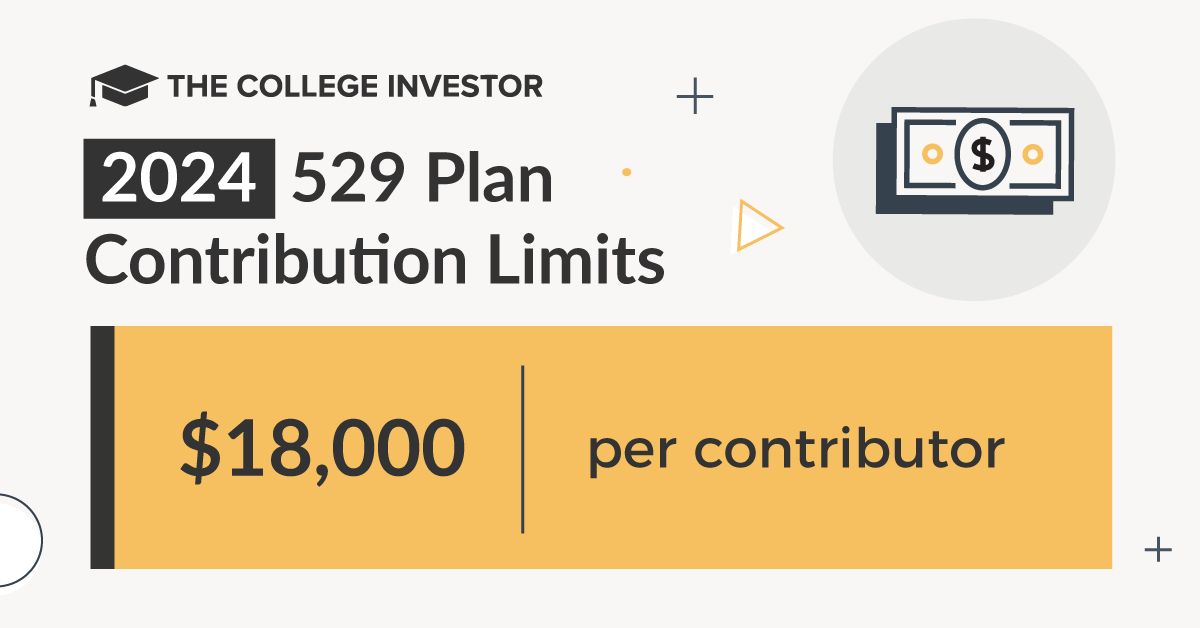

529 Plan - A 529 plan is an education savings account that used to be primarily used for college, but now can be used for K-12 expenses, student loans, and more qualifying expenses. This account has an account owner (usually a parent or grandparent), and an account beneficiary (usually a child). It's a great tool that allows money to grow inside of it tax-deferred, and when the money is used for qualifying expenses, it's tax free. Plus, most states provide a tax deduction for contributions as well.

Read our full guide on where to open a 529 plan in your state.

Coverdell Education Savings Account - A Coverdell Education Savings Account, previously known as an Education IRA, is another account that allows families to save for K-12 expenses and college. These accounts are less popular than a 529 plan, specifically because of the low contribution limits, but they do have some advantages, especially when it comes to qualifying expenses.

Health Savings Accounts

Health Savings Account - A Health Savings Account, or HSA, is a popular way to save for health expenses, but also retirement. This account comes with a triple tax benefit that has a lot of people leveraging this account as an IRA rather than for healthcare.

You also can open an HSA for yourself outside your employer, as long as you qualify. You can also rollover old HSAs into a new account. See our list of the best HSA providers here.

Which Type of Investment Account Should I Open?

If you are just getting started investing, and don't plan on accessing your investments until retirement, you should consider a retirement account. These accounts have lots of tax benefits and are designed for long term investment strategies.

If you are looking to "play" or speculate in the stock market, I would recommend a margin account. It is very similar to a cash account, but as you want to take on more advanced investment strategies, this account will provide the flexibility you will inevitability want.

And if you're looking to save and invest for the future, always take advantage of "free money". Meaning, if you get a 401k match, HSA match, or other free money - start investing there!

What type of investment account do you have? Are you planning on opening other investment accounts?

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Colin Graves Reviewed by: Chris Muller