When it comes to building an investment portfolio, there is a wide range of assets to consider. Farmland is one of the newest available investment opportunities that is climbing the ranks in terms of popularity.

Often overlooked by the average investor, some of the “best” investors in the world like Warren Buffett and Bill Gates have been buying up farmland like crazy over the last few years. What do they know that we don’t?

In partnership with FarmTogether, let’s take a closer look at what makes farmland such a valuable asset class. Plus, we’ll dive into how you can add this asset class to your investment portfolio easily and with a small allocation. If you’re serious about getting started with farmland, FarmTogether makes it easy. Check out FarmTogether here >>

Farmland As An Investment

Farmland is a type of alternative investment. Historically, farmland was only available if you wanted to buy an entire farm outright and actively manage the property yourself. Luckily, that’s no longer the only option for investors today.

Investors can earn money by investing via crowdfunding platforms, where you own the land without having to get your hands dirty. For as low as $15,000, you can purchase a stake and lease the land to farmers. In other words, they’ll take care of the physical work, while you reap the rewards financially. They’ll pay you to lease the land, and you’ll also make income from the harvest of the crops. What could be easier?

A second way farmland can pay off as an investment is in the value of the land itself. The population continues to increase while the amount of arable land continues to decrease; as a result farmland values are surging. As a result, we’re having to produce more with less… and people need to eat. As a farmland owner, you’ll benefit from the appreciation of this land over time. And if you decide to sell the property, that could lead to a big payday down the road.

Farmland Investment Returns

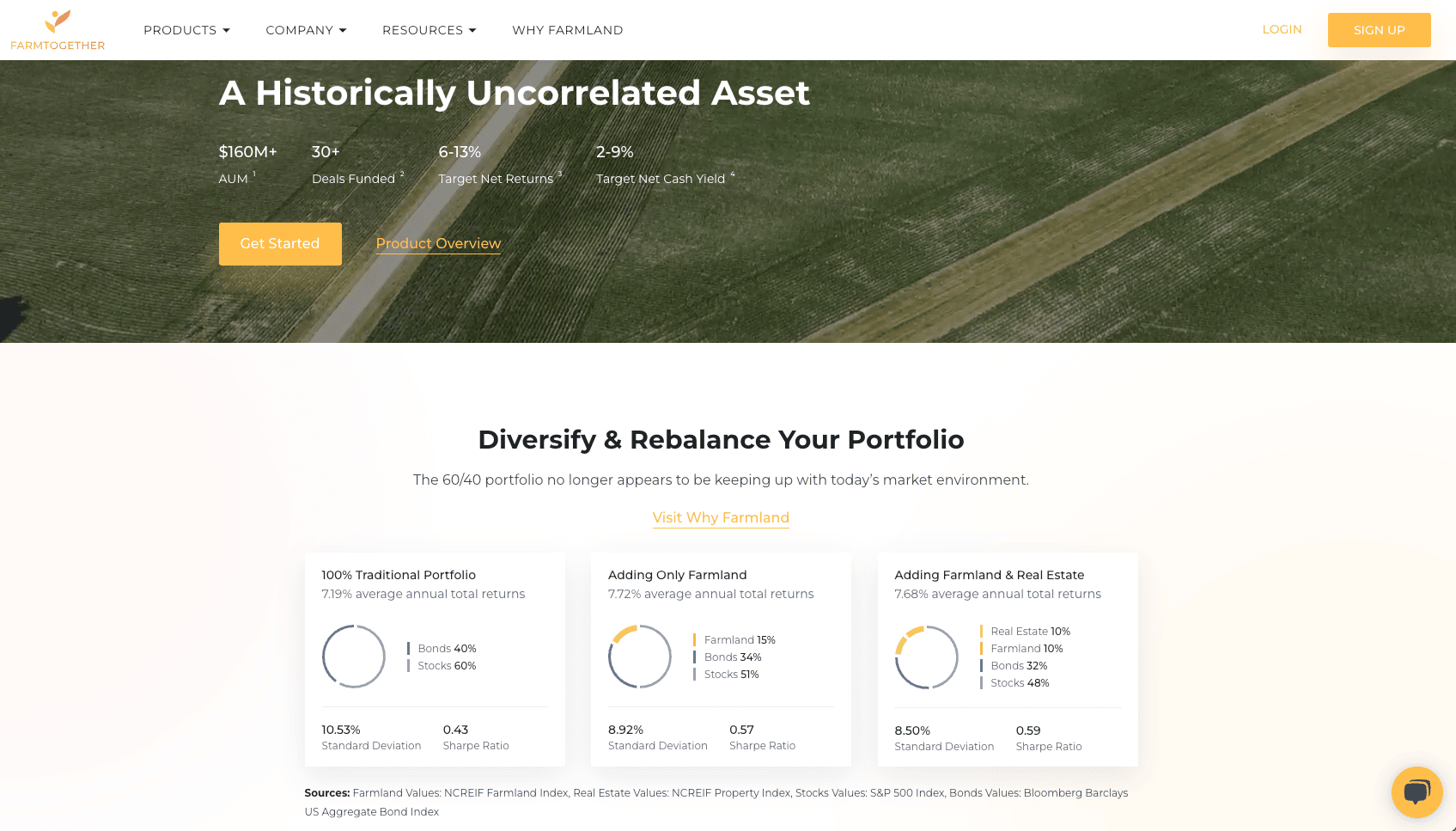

You might not immediately think of farmland as a good fit for your investment portfolio. But, at a time when stock prices are slumping and inflation is soaring, this real asset may be just the thing to diversify your portfolio and preserve your capital.

Here’s a look at how the performance of U.S. farmland stacked up against other asset classes:

- Farmland: Average annual returns for farmland were 10.74% between 1992 and 2021.

- Stocks: Average annual returns for stocks were 8.46% between 1992 and 2021.

- Real estate: Average annual returns for traditional real estate were 8.49% between 1992 and 2021.

- U.S. Bonds: Average annual returns for US bonds were 5.29% between 1992 and 2021.

- U.S. REITs: Average annual returns for REITs were 10.83% between 1992 and 2021.

Based on this sampling, farmland may be a worthwhile asset for many investment portfolios. Learn more at FarmTogether here >>

Why Farmland Is So Valuable

Farmland is a type of real estate investment opportunity. But the reasons behind farmland’s rising value are a bit different than your traditional real estate investment.

Here’s a closer look at why farmland is so valuable.

Stability

Farmland returns have been historically uncorrelated to conventional assets, such as stocks, bonds, real estate, and other alternative investments. Looking to diversify and stabilize your portfolio? Look no further.

Investors are increasingly looking at this historically low-volatility asset to combat the volatility we're seeing in the economy & across the markets.

Inflation

Inflation is putting pressure on players at every level of the economy. Of course, household budgets are feeling the pinch. But inflation is impacting the market in other ways, like encouraging the Federal Reserve to raise interest rates.

Farmland is considered to be one of the best historical hedges against inflation. As inflation remains high, farmland has held its real value well. How? Both the cash yield and land value of this real asset is linked to inflation measures, such as the Consumer Price Index (CPI). Thus, when inflation rises, commodity prices also tend to increase, which can lead to a higher cash yield from the farm. Rising commodity prices in turn lends to an increase in the value of the land, providing a long-term hedge.

Soaring Farmland Values

The Seventh Federal Reserve District tracks agricultural land values in its district on a quarterly basis. The district includes Illinois, Indiana, Michigan, Wisconsin, and Iowa. In the 2022 third-quarter report, farmland values in the district increased.

The rising value of farmland isn’t a minor uptick. According to the Chicago Federal Reserve, farmland values in the district saw a 20% increase from last year. Some states saw their farmland value increase more than others. For example, farmland values in Indiana were up almost 30% from the same time last year. Nationwide, the New York Times recently reported an increase by about 12.4% and reaching $3,800 an acre, the highest on record since 1970.

And, something tells me these numbers are only going to continue to climb.

Food

Humans simply cannot survive without food. Since the purpose of farmland is to grow food for the population, farmland is a cornerstone of our society. After all, the reality is that people will always need to eat the food that farmland produces. With that, it seems unlikely that farmland as an asset is going to disappear anytime soon.

If you are looking for something tangible to invest in, farmland is one opportunity.

Rising Prices

You’ve likely noticed that food is getting more expensive at the grocery store. While this puts pressure on our wallets, farmland investors see higher revenue from crops.

For example, the Chicago Federal Reserve indicated that corn and soybean revenues are both up from a year ago. However, the crop yields, or the amount of crops per acre, have fallen slightly from this time last year.

How To Invest In Farmland

The traditional way of investing in farmland required most investors to have substantial knowledge about farming practices. Luckily, not every farmland investor needs to get familiar with the Farmers Almanac. Instead, you can opt to invest through a platform that handles the legwork of this investment for you.

FarmTogether presents a straightforward way for accredited investors to add farmland to their investment portfolio. The platform offers several different investment opportunities:

- Crowdfunded Farmland Offerings: With a minimum investment of $15,000, you can invest in a wide range of farmland opportunities through fractional ownership. Expect to hold onto this investment for eight to 12 years.

- Sustainable Farmland Fund: Access a diversified portfolio via a single allocation. This private evergreen fund requires a minimum investment of $100,000.

- Sole ownership bespoke program: If you are seeking a fully customizable investment structure, this sole ownership option might be the right fit. But you’ll need a minimum investment of $3 million.

As an investor, the right farmland investment opportunity will vary based on your goals. However, the appeal of hands-off farmland ownership is very appealing. You won’t have to commit the time to farm the land yourself or find a farmer to lease the land. Instead, FarmTogether handles those details as a part of their fee.

FarmTogether is only available to accredited investors. In order to be an accredited investor, you must have a net worth of over $1 million when your primary residence isn’t included or have made $200,000 for the past two years.

Summary

Farmland might be the right fit for your investment portfolio. That’s especially true if you are looking for an alternative asset to round out your portfolio with an asset that’s not as correlated to the stock market and has the potential to provide income.

If you want to invest in farmland without getting dirt on your hands, then consider investing through FarmTogether.

Sarah Sharkey is a personal finance writer covering banking, insurance, credit cards, mortgages and student loans. She has written for numerous finance publications, including MagnifyMoney, Business Insider and ChooseFI. Her blog, Adventurous Adulting, helps young adults get a handle on their finances.

Editor: Claire Tak