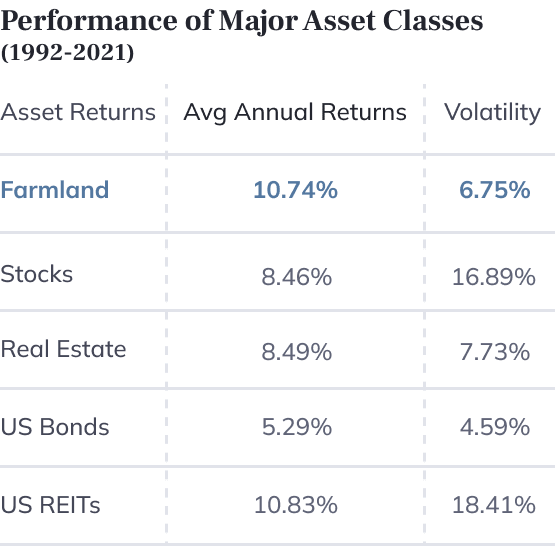

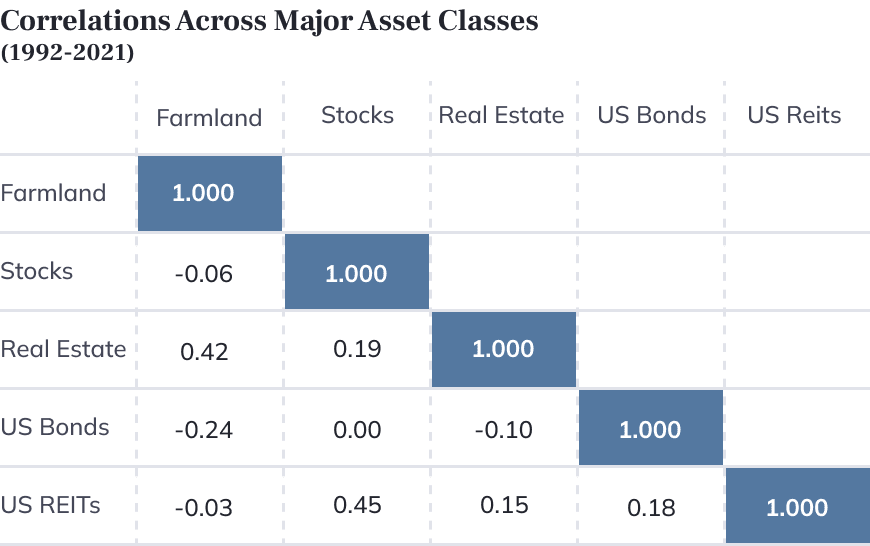

FarmTogether is a farmland investment manager that enables accredited investors to invest in US farmland. That may sound like an odd investment choice, but farmland has been a popular alternative investment for the ultra-wealthy for years. The reason? It has historically slow, steady, and stable returns, and its performance is historically uncorrelated to any other index.

As such, many people have found farmland to be an attractive investment. But, until recently, it's been extremely difficult to invest in due to many factors, including knowledge of the market, locations (rural areas), price, and more.

FarmTogether seeks to change that. They enable investors to add farmland to their portfolio via three products: crowdfunded offerings (fractional shares of farmland), bespoke offerings (sole ownership), and their sustainable farmland fund (diversified portfolio via a single allocation).

See how FarmTogether works, and learn more in our FarmTogether review.

FarmTogether Details | |

|---|---|

Product Name | FarmTogether |

Min Invesment | $15,000 |

Annual Fee | Varies By Investment |

Account Type | Taxable, IRA, Trust |

Promotions | None |

Who Is FarmTogether

FarmTogether is a farmland investment manager (agricultural real estate). However, instead of traditional residential and commercial real estate opportunities, it focuses on farmland. The Founder is Artem Milinchuk, and the CEO is Jared Hine.

Alex Shevchenko is a board director of FarmTogether. Alex and Max Lytvyn co-founded Grammarly and are investors in FarmTogether.

“We think farmland as an investment is something that in 10-20 years will be a must in any professionally managed diversified portfolio. We are excited to be at the forefront of the rapid change in this exciting new market,” said Milinchuk in an interview with Valuewalk.

As an aside, there’s a game called Farm Together (with a space), which can make it a little difficult to find info on FarmTogether (the investment manager). In fact, there’s far more info on the game than their investment platform.

What Do They Offer?

FarmTogether gives investors the opportunity to add institutional-quality to their portfolios through three products. However, their flagship crowdfunding platform has been around the longest and is the most well known; it enables you to invest in shares of entities that hold farmland. These entities are generally LLCs, managed by FarmTogether. If you are familiar with real estate crowdfunding platforms, FarmTogether works the same way. Just like real estate, it is illiquid and has a long hold period (i.e., years).

Investors make money through cash distributions and land appreciation. Cash distributions occur quarterly or annually, depending on the investment’s harvest sales schedule or lease agreement for the given year. Cash distributions are based on your percentage ownership in the LLC. As an example, if you own $50,000 in a $5 million investment, your percentage ownership is 1%. Land appreciation is realized only at the time of sale.

What can you expect from an investment in FarmTogether? The two charts below show the performance of U.S. farmland compared to other publicly traded assets and real assets. Market indexes are from 1992-2021.

Farmland is a passive investment. And, when investing through FarmTogether, you won’t have to deal with tenants or any management of property. Of course, a passive investment usually means someone else is managing the investment for you and those people expect a fee. FarmTogether has a team of experts who manage each offering. Part of the fee you pay covers management, closing of the deal, and other administration costs.

The minimum investment is consistent for each offering at $15,000.

FarmTogether Performance

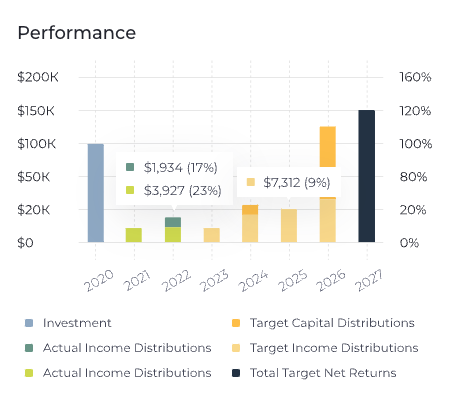

Unlike other real estate investing platforms, FarmTogether does not share much of it's historical performance. While each deal is different, many platforms aggregate together all their returns and highlight it. Here's the only performance reporting for FarmTogether we could find (and notice, most of it is forward-looking):

Are There Any Fees?

Yes. You’ll have to be a registered user to see the exact fees associated with each opportunity as they vary based on your investment amount and the structure of the deal, but you can see the general fee structure for each product on their product overview page.

There is an origination fee and an annual fee. Most fees will be below 2%.

Crowdfunded Farmland Offerings:

- 1 - 2% one-time admin fee

- 1 - 2% annual management fee

- 5% net operating income fee or 20% of the gross rent (typically 0.75%-1.0% annual management fee).

Sustainable Farmland Fund:

- 1.25% annual management fee

- 2% acquisition fee

- 15% incentive fee over a 6% cumulative hurdle rate. If you have $5,000,000 invested, the incentive fee drops to 10%

Sole Ownership:

- 2% one-time admin fee

- 1-2% annual management fee

How Does FarmTogether Compare?

FarmTogether is not the only platform that allows you to invest in farmland or real estate. AcreTrader is the largest competitor to FarmTogether in the agriculture space. If you're thinking about investing in real estate in general, you might consider something like Fundrise.

Here's a quick comparison:

Header |  |  | |

|---|---|---|---|

Rating | |||

AUM Fees | 1.00% - 2.00% | 0.75% | 1.00% |

Min Investment | $15,000 | $8,000 to $20,000 | $500 |

Open To Non-Accredited Investors? | |||

Cell |

How Do I Open An Account?

You can open an account at farmtogether.com. You must be an accredited investor, which means anyone who:

- Earned income that exceeded $200,000 (or $300,000 together with a spouse) in each of the prior two years, and reasonably expects the same for the current year, OR

- Has a net worth over $1 million, either alone or together with a spouse (excluding the value of the person’s primary residence).

- More recently, you can also qualify as an Investment Professional, meaning you have the professional knowledge, experience, or certifications in addition to the existing tests for income or net worth.

Non-accredited investors are not currently eligible to invest with FarmTogether, although FarmTogether is looking into ways to open up the platform to more investors.

Is My Money Safe?

As with any investment, there is a level of risk that you can lose money. Additionally, you have to consider if FarmTogether will be around in a few years when it comes time to sell your shares. If not, you may not be able to sell your shares or have a difficult time trying to find a buyer and complete the transaction.

Those risks are really no different than what you’ll find with most real estate crowdfunding platforms. It’s also worth taking into consideration that FarmTogether, at the time of this writing, has only one opportunity listed, which brings its future viability as a business into question.

Crowdfunded investments are fairly new. Most sprung up between 2012 and 2014, which is not nearly enough time to judge the performance of investments requiring several years of hold time. Also, don’t forget that RealtyShares shut down at the end of 2018 when their funding ran out. So what happened to investors who bought shares of real estate through RealtyShares? They were handed over to IIRR Management Services, LLC. What ultimately happened to all of those investments isn’t known.

Why Should You Trust Us

I have been writing about and reviewing investment firms and covering real estate investments for 10 years. I have personally owned single family, multi-family, real estate syndications, private partnerships, and more - including farmland. I'm well versed in both the investment aspect and tax aspect of these products and services.

Furthermore, we have our compliance team that regularly checks and updates the facts on our reviews.

Who Is This For And Is It Worth It?

FarmTogether offers a unique real estate investment opportunity for those who qualify. Like all real estate crowdfunding platforms, there are risks and investments are illiquid.

If you're comparing investments, there is only one other major alternative in the space - AcreTrader. We encourage you to shop deals on both platforms.

If you are willing to try a passive real estate investment in something a little difficult and understand all the various risks, you might want to give FarmTogether serious consideration.

Farm Together Review

-

Pricing and Fees

-

Ease of Use

-

Customer Service

-

Products and Services

-

Risk Mitigation

Overall

Summary

Farm Together is an alternative investment platform that allows you to invest in US Farmland.

Pros

- Multiple ways to invest in farmland

- One of the only farmland offerings with a fund

Cons

- Higher minimum than other options

- Variable fees can make understanding costs challenging

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Ashley Barnett