Following the closures of the Covid-19 pandemic, life has slowly started to return to normal, and parties are now part of our lives again. While people celebrate, not every industry is celebrating along with US consumers. According to the State of the US Wine Industry 2022 report, “It turned out that a celebration did take place, but the wine category wasn’t invited to the party!”

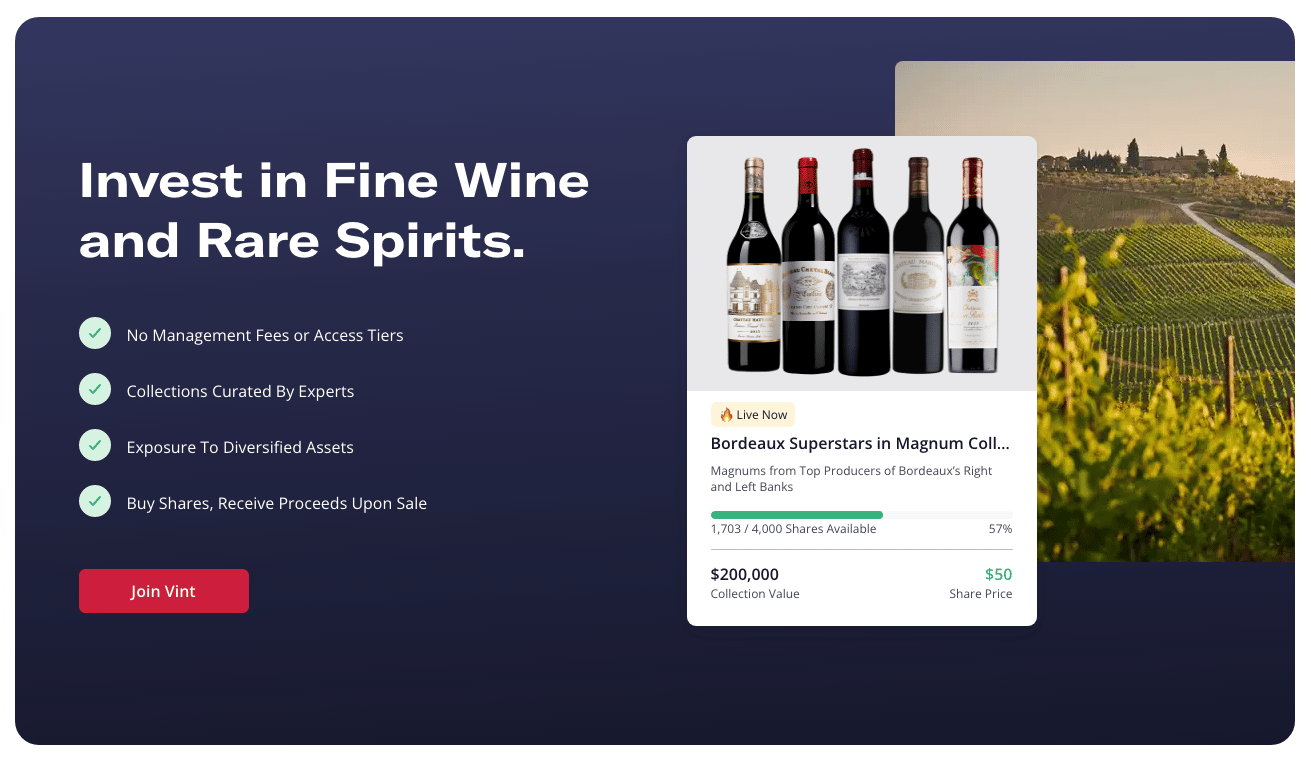

While average consumers may prefer spirits to wine, fine wines may remain a viable long-term investment. And Vint, a digital platform, is making it easy for everyday people to invest in shares of wines. We explain how the platform works, and how investors can use the wine investment platform to diversify their investment holdings.Vint Details | |

|---|---|

Product Name | Vint |

Min Investment | Depends on the wine collection |

Sourcing Fee | 8 to 10% |

Account Type | Taxable |

Promotions | None |

What Is Vint?

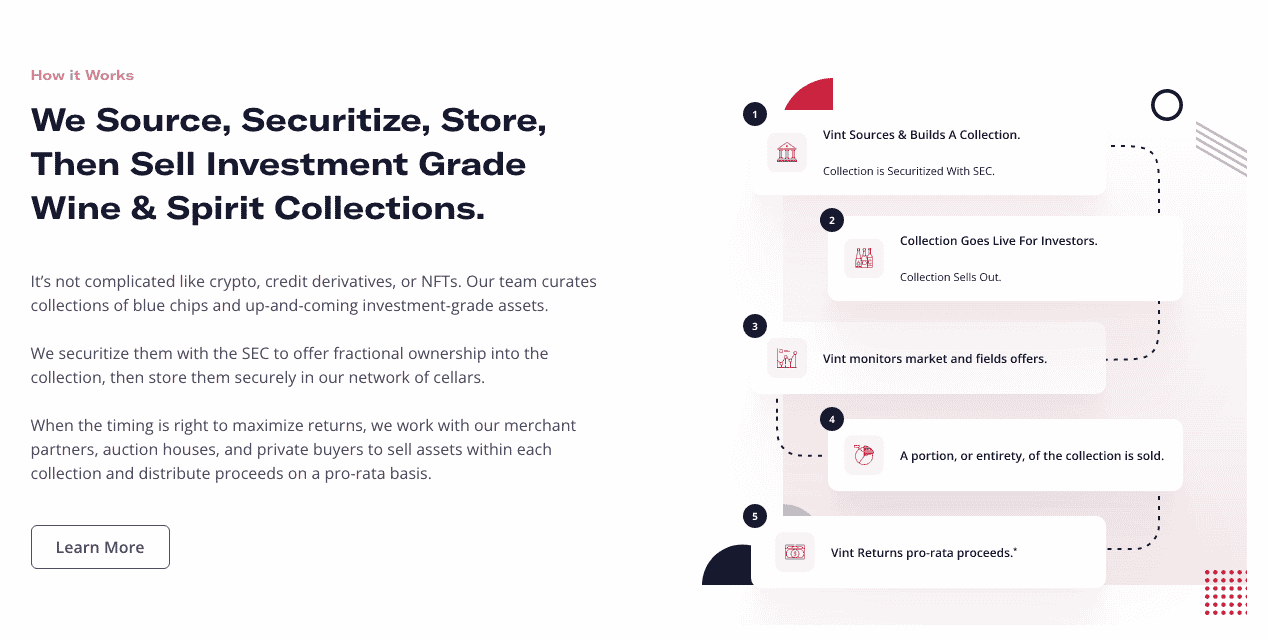

Founded in 2019, Vint is a platform that allows you to invest in wine, whisky, and other spirits. The company buys, stores, insures, and sells high-end wines. Through Vint, you can buy a share of a wine collection. You may earn a profit when the company sells a collection (or a few bottles from a collection) and distributes the initial investment and the profits. Vint handles the logistics, so you don’t have to decide exactly what to buy or when to sell.

What Does It Offer?

Vint allows you to buy shares of wine collections and over time, sells the collections—then you receive your initial investment, plus profits. Here are some of its primary features.

New Collections Every Two Weeks

You can buy shares of a new collection as frequently as every two weeks. The collections can range from a single obscenely expensive bottle of whiskey to a few hundred bottles of relatively affordable wine.

You can learn about the alcohol inside the collection and the financial investment side of the collection. You can buy as little as a single share of a collection. Shares typically range from $20 to $100 but vary depending on the value of the collection.

Receive Distributions as Vint Sells Wine

Each time Vint sells a portion of a collection, you will receive a distribution. Vint doesn’t sell entire collections at one time, so you may receive multiple distributions as Vint sells off the assets in the collection. The investment thesis explains the likely maturity dates of the collection, but assets could be sold sooner or later depending on market conditions.

If a collection loses money, the disbursement will be smaller than the initial investment.

No Need To Be Accredited

Anyone 18 or older can invest in shares of wine on the Vint site. Non-accredited investors have certain limits placed on their investment activity. For example, a person earning $60,000 per year can invest no more than $6,000, or 10% of their income, in a single offering. Nonetheless, the structure makes it easy to invest.

Vint Handles The Wine

Even if you’ve taken a wine-tasting course or visited places like Napa or Sonoma, you’re probably not an expert in wine handling logistics. Vint has a full range of wine experts including individuals who select investment options, buy and sell the wines, and manage the investment side.

You have to pay a modest sourcing fee to Vint, but Vint keeps the wine safe and your investment on track. If nothing else, Vint keeps you from drinking your investment when you want to celebrate your recent promotion at work.

Learn About Wines And Investing

Each collection includes an investment thesis that explains the “why” behind a certain collection and how the investment could be profitable. Vint’s investment materials may appeal to the novice wine connoisseur since they include details about the wine’s provenance and other interesting nuggets.

Invest In a Self-Directed IRA

If you have a self-directed IRA, you can place shares of your wine collections inside your IRA. This could be a reasonable investment to help you maintain a lot of diversification as you work towards your retirement date.

Are There Any Fees?

Investors pay a sourcing fee each time they buy shares through Vint. The exact sourcing fee varies by investment and is disclosed in the final investment documents.

If a collection doesn’t receive full funding, Vint refunds the full amount you paid including the fee.

How Do I Contact Vint?

Vint has several contact methods including a website chat function which is monitored regularly. You can access it through the Vint website. Alternatively, you can reach out to Vint by emailing support@vint.co.

How Does Vint Compare?

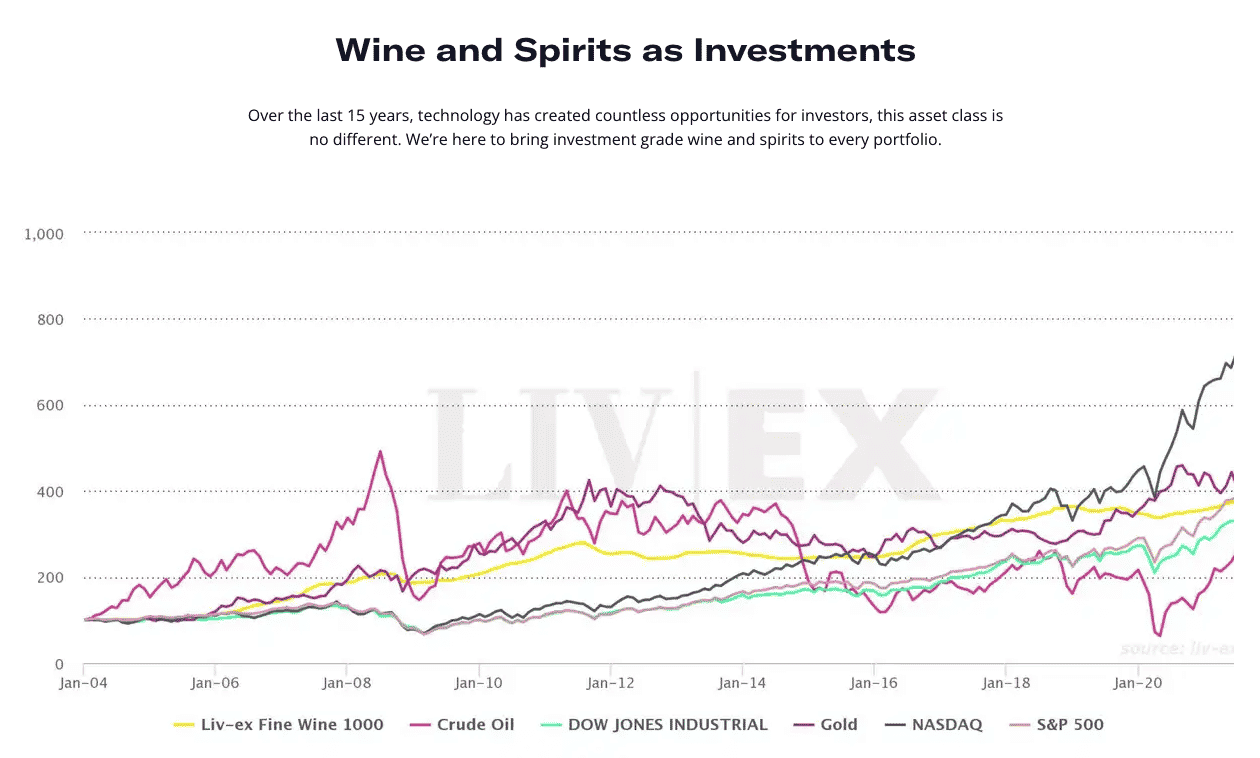

Wine investing was once the purview of the ultra-wealthy, but today, technology has disrupted this space. Vint is just one platform of several with a similar model.

Vinovest is Vint’s closest direct competitor. While Vint’s entry price point is as low as $20, Vinovest requires a $1,000 minimum investment. Additionally, Vinovest investors buy individual bottles of wine, and they can choose to drink them or sell them. Vint’s investors never own physical wine. They only own shares of an investment.

Vinovest Review

This platform hires sommeliers (wine experts) who recommend the best vintages for your personal pallet and your investment portfolio.

VINODOME and ALTI Wine Exchange are blockchain-based wine investment companies. These companies have higher fees than Vint, but they offer an interesting way in which NFTs can represent real-world assets.

Wine Investing Falls Into The Alternative Investments Category

Wine investing is just one type of alternative investing model. It’s similar to investing in fine art through a platform like Masterworks or memorabilia through Collectable. Whether you own art, NFTs, baseball cards, or wine, the investment doesn’t produce a stream of income.

Instead, you can only make money if other people want to buy your asset at a price higher than you paid.

With these types of investments, you’ll typically hold for several years, but not forever. Vint takes this guesswork out of the buying and selling by doing it for you.

How Do I Open An Account?

To open an account, you provide your name and email address, and you certify that you’re at least 18 years old and live in the United States. You can sign up through Vint’s website.

To invest, you have to provide additional details including a social security number, your physical address, a phone number, and more. You must also certify that the investment doesn’t exceed 10% of your income or net worth each time you invest.

Is It Safe And Secure?

Vint is an SEC-regulated platform. Investors can feel confident that Vint’s business model is up-to-par with bank-level security. It buys and sells wines and allows investors to buy shares of collections. All interactions with Vint are done electronically, so Vint keeps high standards for holding and encrypting data. This extremely high level of security is necessary because Vint requests social security numbers and bank account information from users.

Despite digital security, it’s always a gamble, as you may lose money when investing through Vint. The wines may not increase in value, which means you lose money.

Additionally, the investments are highly illiquid. You can’t easily sell your shares to a secondary market, so you’re stuck waiting until the disbursements come through.

Is It Worth It?

Vint is a fun site with a large number of impressive wine investment collections. The company has a few remarkable disbursements, but these have been over a relatively short time.

It’s tough to say whether investors will make money through the site. It’s not even clear whether fine wine investing will continue to produce returns. Despite wine sales being up 17%, the wine industry as a whole is shrinking which makes it difficult to predict whether this kind of investing makes sense.

However, if you have an interest in wine, you could start with a small amount. Even if your investment isn’t huge, remember that this is an alternative investment with an unproven company.

For solid returns in the long term, opt for mainstream investments like stocks, bonds, and real estate.

Wine Is Great, But Are You Invested for the Long Haul? Don't Fall Behind

Read our guide on everything you need to know to get started in making investments for your future.

Vint Features

Account Types | Investing account |

Minimum Investment | Depends on the specific collection |

Ability to Invest Through Your IRA | Yes, you can use a self-directed IRA to invest in any of Vint's offerings. Vint uses Alto. |

Sourcing Fee | Typically 8 to 10% |

Management Fees | None |

Average Time to Sell Your Wine | Vint says these investments are "medium to long-term" |

Fractional Shares | Yes |

Customer Service | website chat |

Customer Service Email | support@vint.co |

Mobile App Availability | None |

Web/Desktop Account Access | Yes |

Promotions | None |

Vint Review | Invest In Wines

-

Pricing and Fees

-

Ease of Use

-

Customer Service

-

Diversification and Risk Management

-

Products and Services

Overall

Summary

If you’ve considered making an investment in wine, take a look at Vint, which makes it easy to invest in shares of wines.

Pros

- Buy shares for as little as $20-$100

- Vint manages the sale of assets

- Receive disbursements as Vint sells assets

Cons

- Somewhat unpredictable window for returns

- No option to buy the wine and drink it

- It’s an illiquid investment option

Hannah is a wife, mom, and described personal finance geek. She excels with spreadsheets (and puns)! She regularly explores in-depth financial topics and enjoys looking at the latest tools and trends with money.

Editor: Claire Tak