Seeking Alpha is an investment research platform that has some premium services.

As an investor, research is a critical part of finding winning investments. But if you have a day job, finding time to analyze companies and vet stocks you’re considering can be a challenge.

Stock market research services like Seeking Alpha can help solve this problem by providing you with the hot stock ideas and market news. You can even track your own portfolio and set up custom stock alerts so you don’t miss a trade.

But Seeking Alpha Premium charges a membership fee if you want unlimited access to investing ideas. To decide if Seeking Alpha is worth it or not, it’s important to know what features it offers and if they justify the price.

Promo: Get a $25 off coupon! Seeking Alpha Premium is currently available for $214 for the first year! Check out Seeking Alpha here >>

Seeking Alpha Details | |

|---|---|

Product Name | Seeking Alpha |

Product Type | Investing Research |

Investing Newsletters | 12+ |

Membership Types | Basic (Free), Premium, and Pro |

Premium Pricing | Monthly: $29.99 |

Pro Pricing | Monthly: $299.99 |

Promotions | 7-Day Free Trial |

What Is Seeking Alpha?

Seeking Alpha began in 2004 and has its headquarters in New York. The platform uses crowdsourced ideas from a global pool of investors. In other words, people from around the world create content on Seeking Alpha to share their investing ideas with others.

Seeking Alpha focuses on stock investing. However, you can also find research and analysis for ETFs, commodities, mutual funds, and cryptocurrency.

According to its website, 20 million users visit the platform each month. Additionally, over 7,000 contributors publish 10,000 investing ideas each month that Seeking Alpha edits before publishing.

What Free Features Does Seeking Alpha Offer?

The main downside to staying free versus using Seeking Alpha Premium is that you can only read five articles per month. However, a free membership still comes with several features that can help to inform and educate you as an investor.

Stock Ideas

Seeking Alpha organizes the latest investing ideas from contributors under different ideas in the Stock Ideas tab. These sections include:

- Long ideas

- Short ideas

- IPO analysis

- Bonds

- Closed-end funds

- Financial advisors

- Editor’s picks

Some ideas, like shorts, are exclusive to Seeking Alpha Pro members. But for free and Premium members, this tab is useful for reading the latest analysis on a particular sector investment strategy.

Education

If you’re new to investing, Seeking Alpha’s education tab has resources to help you learn the fundamentals and become a better investor. This section is also useful for learning some of the terminology you encounter on the site.

Education categories include:

- Dividends

- ETFs and mutual funds

- Investing

- Portfolio management

This isn’t groundbreaking content, and you can find the same information with a Google search. However, it’s another free feature that’s useful for beginners.

Seeking Alpha Newsletter

Seeking Alpha lets users subscribe to over a dozen free email newsletters. Newsletter categories include:

- Dividend Ideas

- Energy Investing

- ETF Ideas

- Global Investing

- IPO Daily

- Mergers and Acquisitions

- Must Reads

- Tech Daily

- Wall Street Breakfast

Must Reads is the most popular category with over 3 million subscribers. Wall Street Breakfast is also a useful newsletter since it’s a one-page summary of the top finance and business stories for the day.

Alpha Picks

Alpha Picks is the newest offering from Seeking Alpha. This offering is almost a direct competitor to The Motley Fool's Stock Advisor service.

Alpha Picks gives you two new picks per month, with the goal of building a long-term buy and hold portfolio. When you first sign up, you'll get access to all 20 Alpha Picks on Day 1, so you can see what the existing portfolio is.

If there is a change, you'll get a sell alert immediately.

Alpha Picks is $99 for the first year. Check out Alpha Picks here >>

Marketplace Services

One of Seeking Alpha’s more unique features is its marketplace service. The marketplace offers additional paid subscriptions you can purchase to receive ideas and research from investing experts.

Marketplace services usually tackle a specific sector or investing philosophy. As a subscriber, you get private research, a community chatroom, and can contact the investing leader of the service. Some popular Seeking Alpha marketplace services include:

- The Data Driven Investor ($41 per month): Focuses on high-growth stocks and quant analysis.

- Potential Multibaggers ($59 per month): Focuses on growth, value, and tech with the goal of multiplying your investment several times.

- High Dividend Opportunities ($72 per month): Creates a model portfolio aiming for 9% yield or more for dividend enthusiasts.

- High Yield Landlord ($67 per month): Focuses on becoming a “passive landlord” and earning 8% yield through a real estate portfolio.

- Crypto Waves ($125 per month): Utilizes technical analysis to help cryptocurrency investors maximize gains.

The marketplace is extremely diverse which is a perk. These services are also closer to actual stock picking services since you get buy recommendations or model portfolios from investing experts.

However, these services are pricey. Crypto Waves costs $1,500 per year or $999 when paid annually. Ultimately, it’s good that Seeking Alpha has more tailored stock recommendation services on its platform. Just ensure the annual cost of a service is worth it and suits your investing style.

What Does Seeking Alpha Premium Offer?

Seeking Alpha's basic version offers a few handy tools and features for free. But if you want to unlock all that the platform has to offer, you'll need to upgrade to a paid tier. Here's what Seeking Alpha Premium and Pro have to offer.

Unlimited Premium Content

The main reason to pay for Seeking Alpha premium is to access more content. The free plan only lets you read five articles per month and some content is still gated. Additionally, most free content is only available for 10 days before becoming gated for free readers.

With Premium, you can read as much content as you want, and article age doesn’t matter. Pro users get a few more perks like a short portal that highlights the best short selling ideas.

Pro readers also get exclusive interviews and early-access to Top Ideas, which are Seeking Alpha’s hand-picked, high-conviction stock ideas. However, Premium users can read Top Ideas seven days after publishing, so you still get the best content eventually.

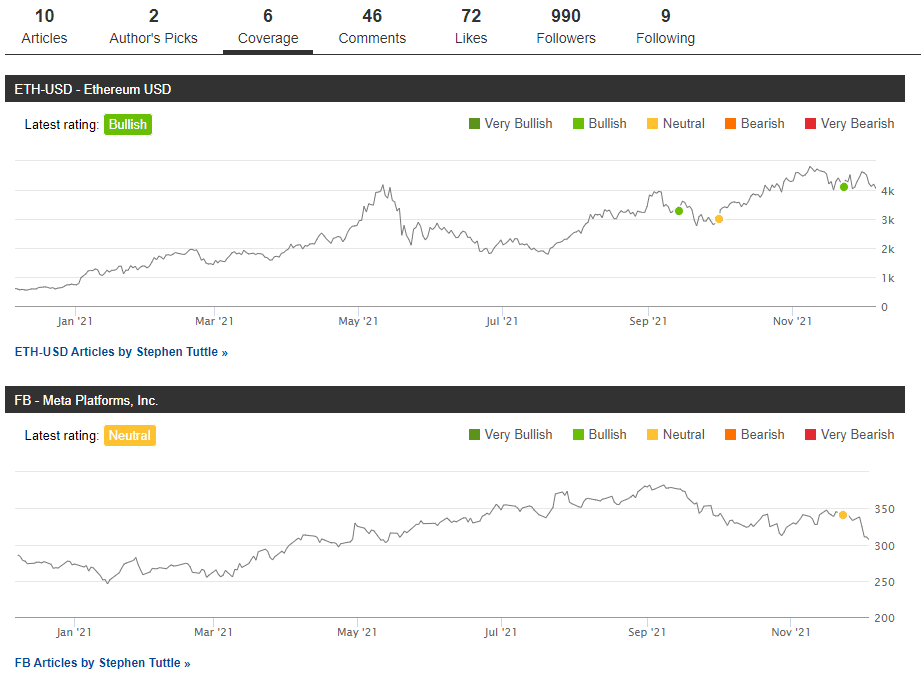

Author Ratings And Performance

Free Seeking Alpha members can read articles from authors to get an idea of where they stand on a particular investment idea. But free members don’t get to see an author’s latest rating or historical ratings.

In contrast, Premium Seeking Alpha members can dig into an author’s historical calls on a particular company or sector. This helps you understand an author’s long-term investing view and also helps you spot if an author is simply hopping on bandwagons or if they produce more original research.

Some Seeking Alpha contributors work as research analysts for their day job or even manage investment funds or their own research firms. So digging into their historical thinking and current ratings can help inform your own investing decisions.

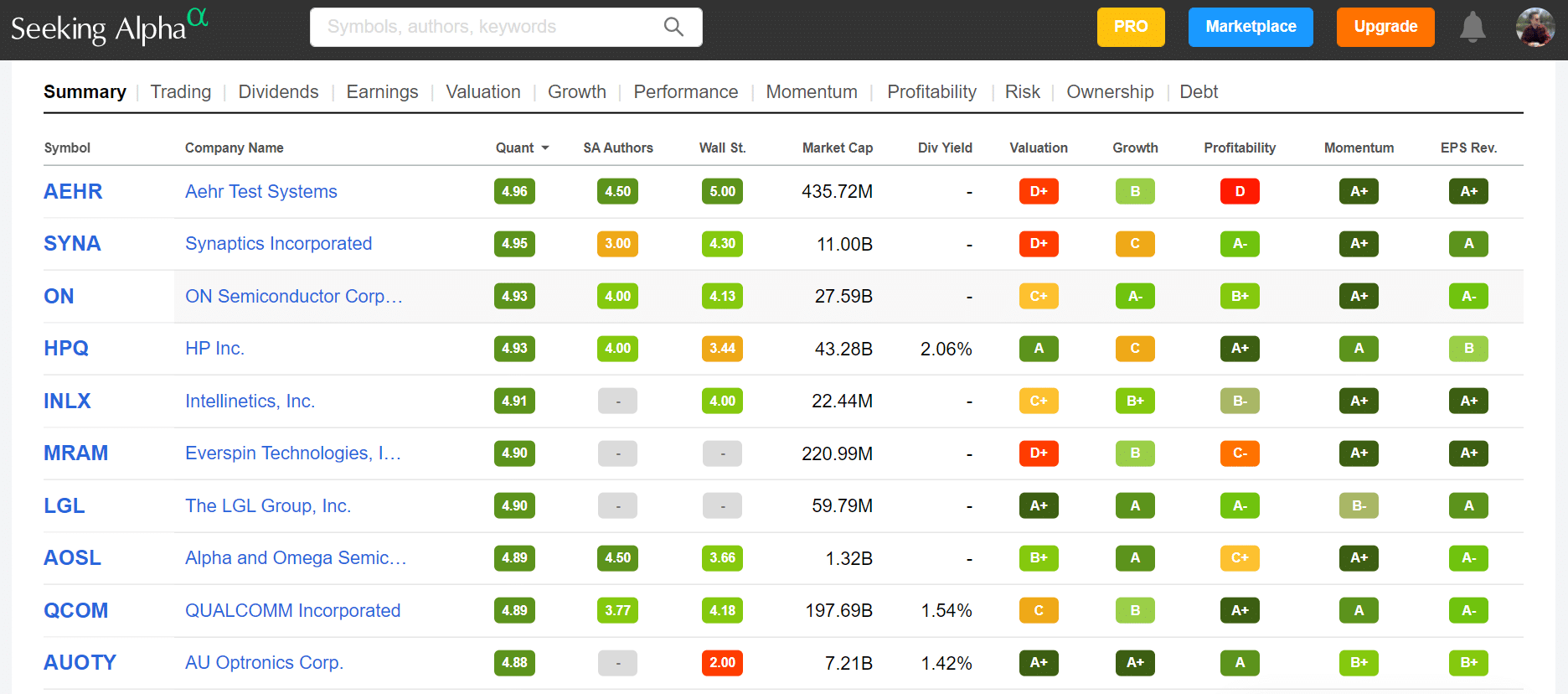

Stocks Screener

One of Seeking Alpha’s best features is its stocks screener tool. You can set up pre-made screeners or create your own to view a list of top stock ideas in a particular sector side-by-side.

Pre-made stock screeners include the top:

- Rated stocks

- Dividend stocks

- Growth stocks

- REITs

- Small cap stocks

- Tech stocks

- Yield monsters

- Value stocks

Your screener dashboard contains a wealth of information for you to start your research. Off the bat, stocks display a Quant rating, Seeking Alpha author rating, Wall Street rating, and company market cap.

Seeking Alpha also assigns ratings for valuation, growth, profitability, momentum, and earnings per share (EPS) revenue.

This is just the summary tab. You can take deeper dives into how stocks are trading, dividend payouts, and revenue estimates. The “Valuation” tab also contains data on:

- Enterprise value (EV)

- Trailing twelve months (TTM) price-to-earnings (P/E) ratio

- TTM price/earnings to growth ratio (PEG)

- EV/EBITA (earnings before interest, taxes, and amortization)

- Price/cash flow

Seeking Alpha consolidates data on historical performance, profitability, and the debt companies have. You can also apply filters to your stock screener. For example, you can edit market cap, countries, or the level of bullish or bearish ratings stocks have.

Overall, the stock screener tool is an excellent way to get a snapshot of a particular sector or to set up your own screener for stocks you’re considering

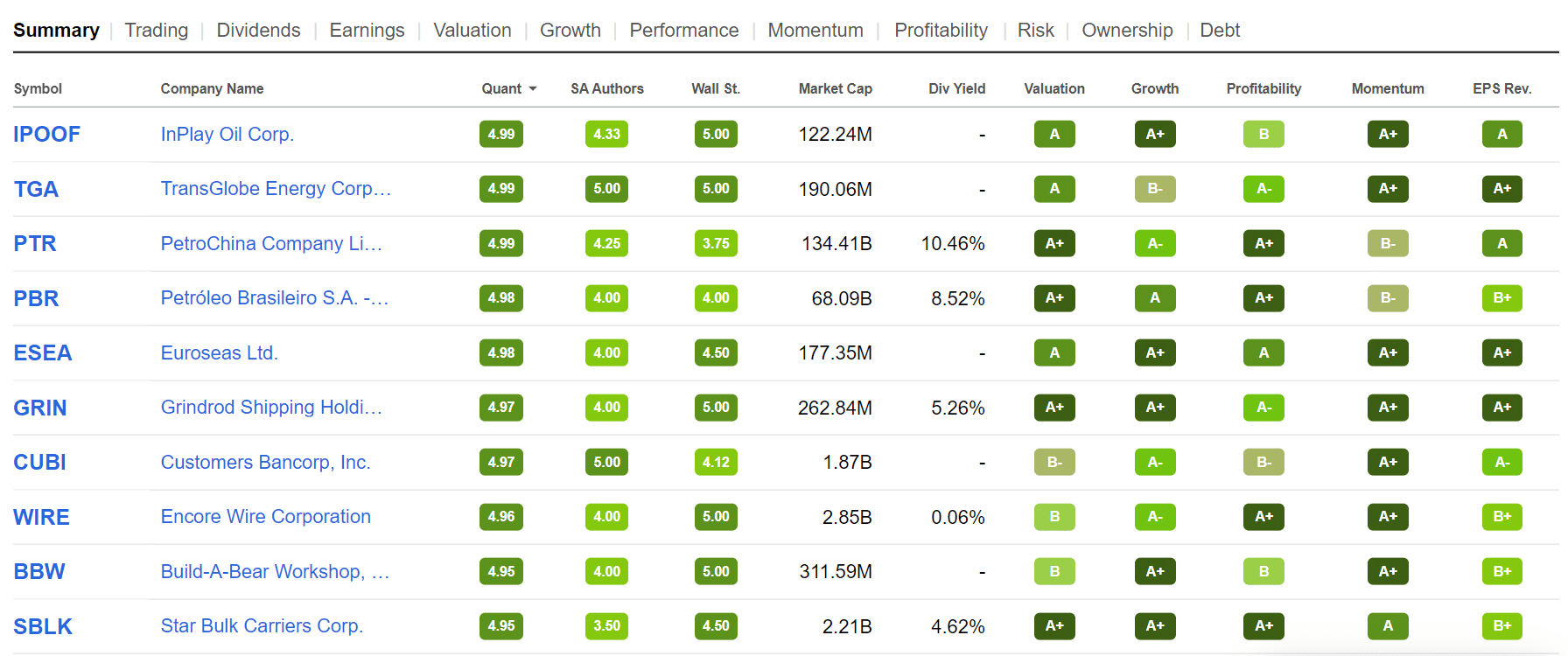

Top Rated Stocks And Quant Ratings

Seeking Alpha’s Top Rated Stocks screener is a preset screener that includes the platform’s best stock recommendations. Seeking Alpha uses three research datasets to rate these stocks:

- Seeking Alpha contributors

- Wall Street analysis

- Seeking Alpha’s Quant Model

According to Seeking Alpha, stocks that make this list are vetted by quantitative and fundamental analysis. Data also refreshes daily, so you’re left with a current, diversified list of some high-conviction investing ideas.

Seeking Alpha’s Quant ratings are a major part of how this works and a feature the company references often as a selling point.

In short, the quant ratings measure a stock against other stocks in that sector based on factors like:

- Growth

- Earnings revisions

- Momentum

- Profitability

- Value

Stocks get scores based on these factors, with highest-scoring stocks getting a very bullish recommendation. All of this is done algorithmically, and stocks are also backtested, which uses historical stock performance to see how well an investing strategy would work.

This might seem like a lot of jargon. But Seeking Alpha actually acquired CressCap Investment Research. CressCap specializes in quantitative analysi. And its CEO, Steven Cress, manages Seeking Alpha’s Quant Strategy department.

Top ratings don’t mean a stock is going to make you money. However, this section is a useful feature of Seeking Alpha Premium if you’re looking for investment ideas that are backed by data.

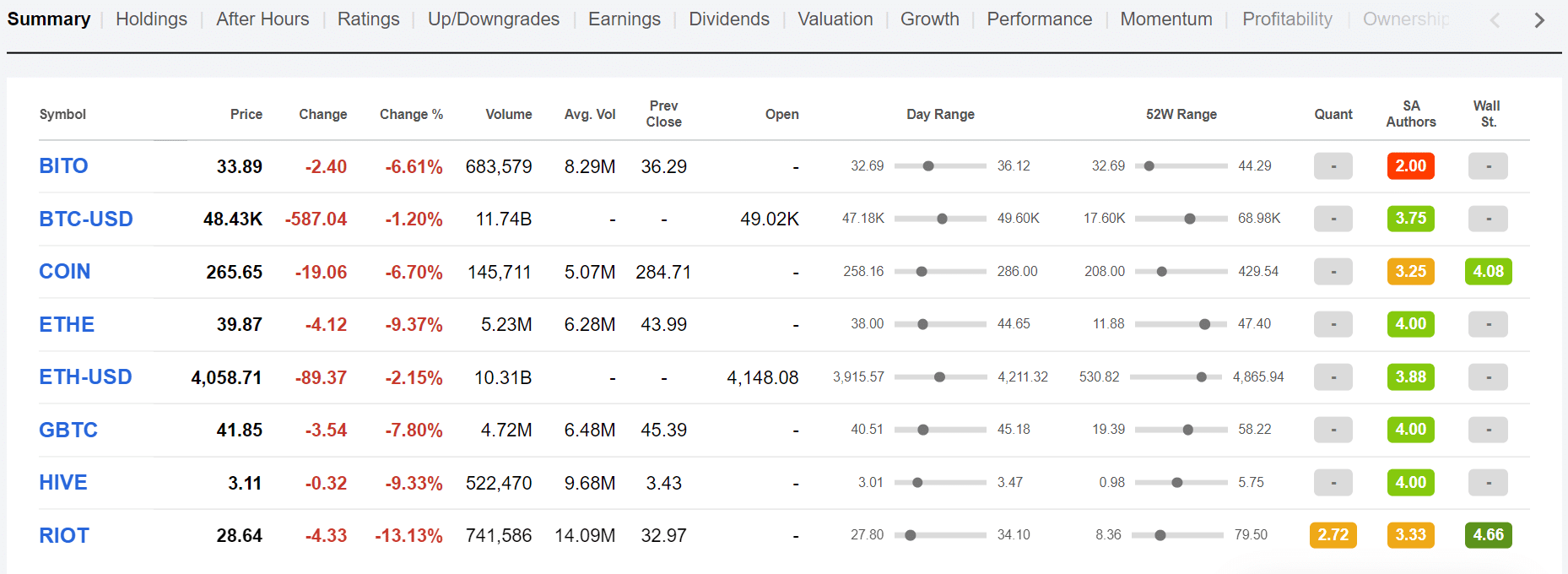

Portfolio Monitoring

Seeking Alpha lets you track your portfolio’s performance, helping you keep your research and actual investments under one roof.

You connect your brokerage account through Plaid to sync your investments with your Seeking Alpha account. Alternatively, you can manually add your positions.

Once you add your holdings, Seeking Alpha displays a summary of each security, including:

- Share price

- Dollar and percent change

- Previous close

- Volume

- Scores from Seeking Alpha authors, Quant Ratings, and Wall Street

Seeking Alpha also highlights the latest news, research articles, press releases, and transcripts for companies in your portfolio. Much of this content comes from Seeking Alpha contributors, but the SA News service also pulls in relevant articles and press releases from the web.

You also get stock upgrade or downgrade alerts for your portfolio. Most of these ratings come from Seeking Alpha author data, but it’s a quick way to gauge if stock sentiment is bearish, neutral, or bullish. You can even enable stock alerts to receive breaking news or articles about specific companies.

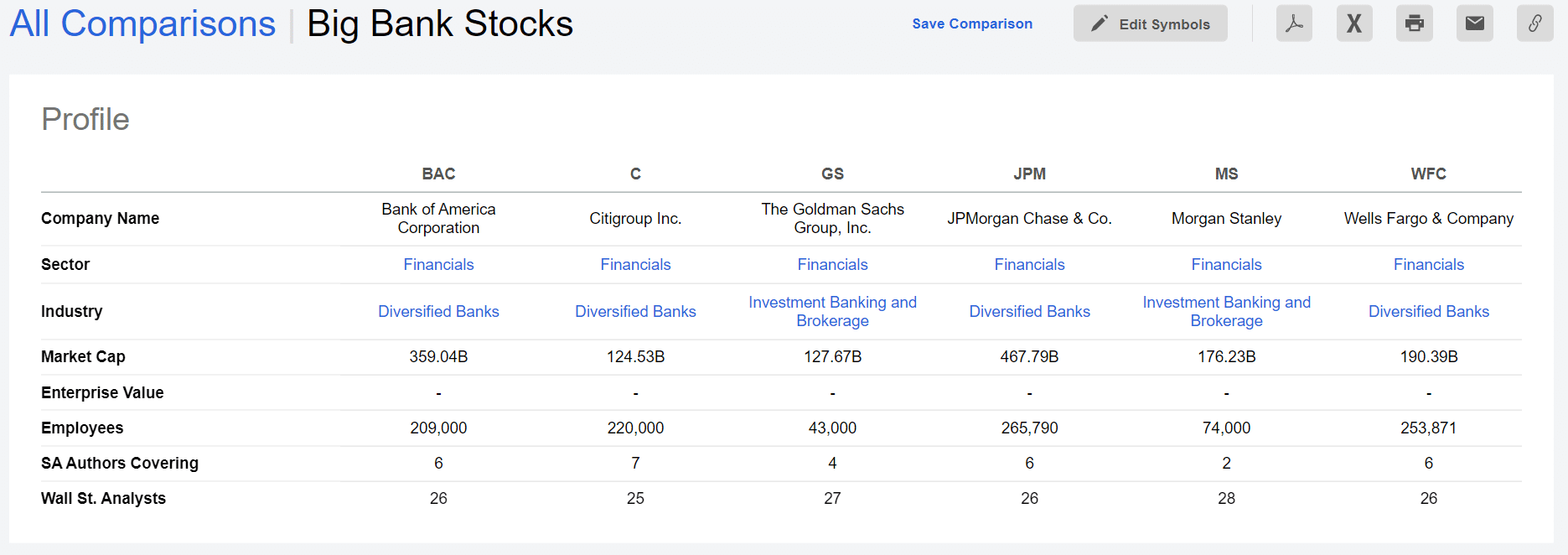

Comparison Tool

Seeking Alpha’s comparison tool lets you compare up to six tickers side-by-side. If you want to compare industry leaders against one another or more speculative plays, this tool is useful.

You create your own comparisons by entering in companies manually. Seeking Alpha also has premade comparisons for:

- Big bank stocks

- Big pharma stocks

- Cash equivalents

- FAANG stocks (Facebook, Amazon, Apple, Netflix, Google)

- Gold ETFs

- Retail stocks

You get a snappy company overview as well as quant ratings, trading data, dividend and performance data, and various valuation metrics.

Overall, the comparison tool is a nice addition, especially if you use it to compare your own holdings or several stocks you’re considering adding.

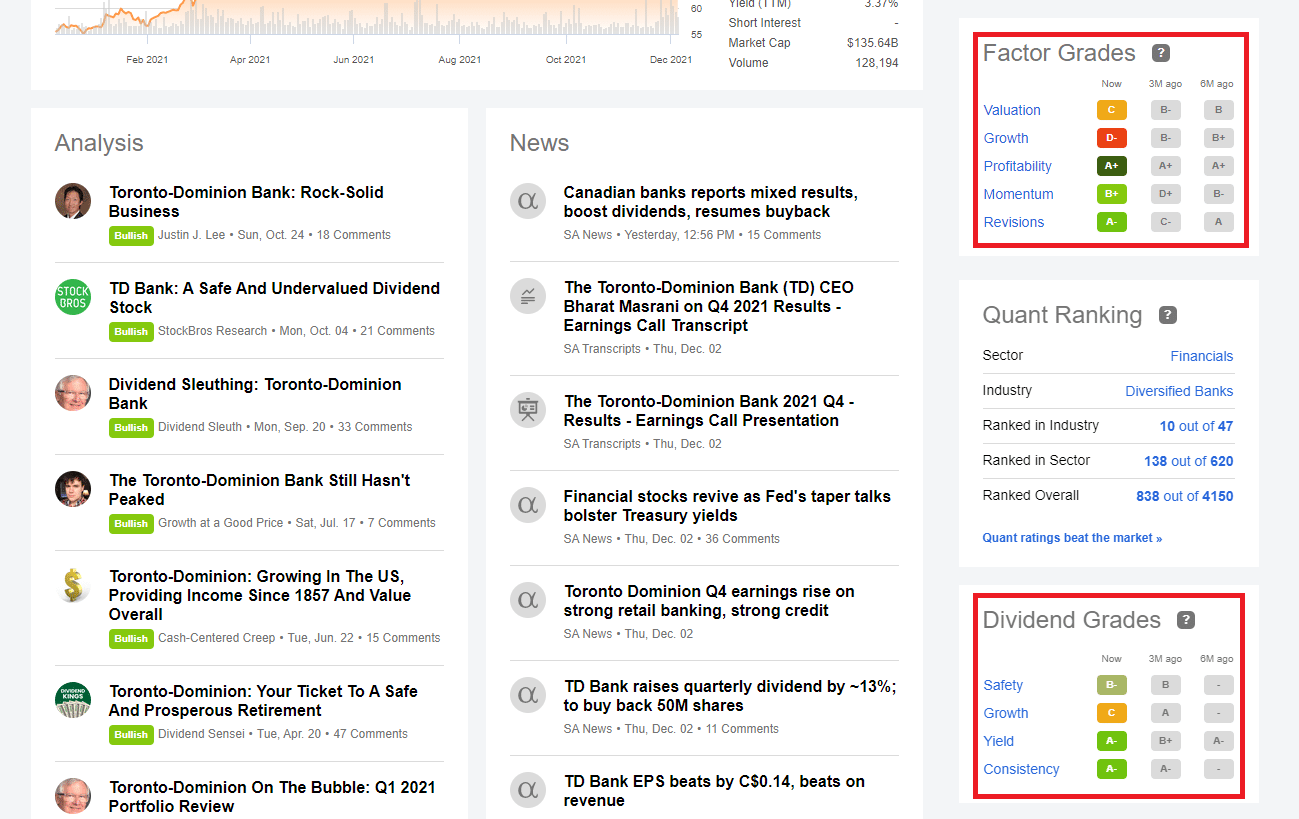

Dividend And Factor Grades

Two more data points Seeking Alpha uses to help you make informed decisions are its dividend and factor grades.

On your stock screener, companies get scores from A to F for metrics like profitability and growth. Here’s what each rating type highlights:

- Factor Grades: Ranks value, growth, profitability, momentum, and revisions with letter grades.

- Dividend Grades: Ranks dividend safety, growth, yield, and consistency with letter grades.

This isn’t game-changing data for investors, but it’s another way to quickly evaluate a security for overall performance and dividend performance.

Earnings And Conference Calls

Free Seeking Alpha members can read earnings and conference call transcripts. But with Seeking Alpha Premium, you get to listen to call recordings and download transcripts and available investor presentations. This feature helps you stay informed on your holdings or companies you’re considering investing in.

Notable Calls

Another feature of Seeking Alpha Premium is the Notable Calls section. This is a special news section where investing professionals share their ideas. According to Seeking Alpha, this ranges from analyst buy calls to contrarian calls from well-known investors.

In other words, this is where you can access some of the latest and more exciting investment ideas. Notable Calls is just one section of the Market News tab. Other sections include:

- All headlines

- Buybacks

- Cryptocurrency

- Energy

- Healthcare

- IPOs

- Politics

- REITs

- SPACs

- Tech

If you invest in a particular sector, the corresponding market news tab is a great place to start your Seeking Alpha reading each day.

What's The Cost?

This means most investors need to pay for Seeking Alpha to get the value they’re looking for. Here’s how Seeking Alpha’s pricing works:

- Basic: Free

- Premium: $29.99/mo, $239 when billed annually, or $540 if you pay for three years up front.

- Pro: $299.99 per month or $2,400 when billed annually

You can try Seeking Alpha Premium for free with a 7-day trial. Because of the expensive monthly cost, Seeking Alpha Premium is a popular choice that unlocks most of the platform.

How Does Seeking Alpha Compare?

There are numerous stock recommendation services out there and websites where you can learn more about investing. Two of the more common Seeking Alpha alternatives people search for are The Motley Fool and Barron's.

The Motley Fool is your best option if you want monthly stock picks and unlimited educational content from its website Fool.com. Like Seeking Alpha, The Motley Fool also has an active forum where you can discuss investment ideas.

Barron's, meanwhile, could be worth considering if you'd like to have the option to receive paper copies of your newsletters through the mail. Here’s how these three services stack up:

Header | |||

|---|---|---|---|

Rating | |||

Pricing For | Premium | $89/yr (Save $100) | Digital |

Stock Screening | Up to 2% | N/A | 0.01% |

Fund Screening | Yes | No | Yes |

Community | Yes | Yes | No |

Free Trial | Yes, 7 days | Yes, 30 days | No |

Platform | Web, iOS, Android | Web | Web, iOS, |

Cell |

Promotions

Right now, you can get a $25 off coupon for your first year when you're a new subscriber. That means that you can get Seeking Alpha Premium from just $214 for the first year.

How Do I Subscribe?

You can get started with Seeking Alpha by visiting its website here and starting your free trial of Premium. Know that you will be required to provide a payment method to create your account.

If you don't like what you see with Seeking Alpha Premium, you'll need to cancel before the end of your 7-day trial to avoid being charged a subscription fee. If you decide to remain a member, your subscription will auto-renew indefinitely at the current price for your selected plan.

Thankfully, Seeking Alpha doesn't make it difficult to cancel your subscriptions. You'll just navigate to the "Subscription Settings" page under your profile and you'll find a "Cancel Subscription" button under each product that you've subscribed to.

How Do I Contact Seeking Alpha?

Since Seeking Alpha is an informational tool rather than a management service, it's unlikely that you'll run into may problems that require personal assistance. But if, for example, you have a billing issue that needs resolved, there are few ways to get the help you need.

Seeking Alpha has a customer support page and FAQ helpdesk. You can also email support at subscriptions@seekingalpha.com or call 1-347-509-6837. Their team currently has an "Excellent" customer service rating on Trustpilot of 4.4/5 from 70+ reviews.

Why Should You Trust Us?

I have been investing and analyzing individual stocks for over a decade. However, as many people realize, in-depth analysis takes a lot of time and effort - and life (work, kids, family) can make that challenging. That's what led us originally to look at stock research services like Seeking Alpha.

We've been analyzing their services and tools since 2019, and have seen both their successes and struggles. And while you should never take any advice without doing your research, in general we've found they offer great tools for you to make your own informed decision.

Today, we regularly update this review with new product updates as they announce them.

Who Is This For And Is It Worth It?

Since Seeking Alpha introduced its five free monthly article restriction, you pretty much have to pay for the Premium plan to use the service. So is Seeking Alpha Premium worth the cost?

Seeking Alpha has contributors from hedge funds, world-renowned research firms, and financial experts. This doesn’t mean advice you read is a guarantee to make money or that contributors are infallible. However, you’re getting a variety of investing ideas from quality contributors to help you make investing decisions.

Paying $29.99 per month, or $239 to $540 upfront for the discounted pricing, isn’t cheap. But if you actually spend time reading content and furthering your education, Seeking Alpha Premium could be worth it.

In contrast, if you’re a less active investor, Seeking Alpha’s stock ideas will be less relevant. In this case, investing with a robo-advisor or in several ETFs might be better fits.

If you're just looking for stock picks and are comparing your options between services like The Motley Fool, then Alpha Picks could be the best option for you.

Seeking Alpha Features

Memberships |

|

Premium Pricing |

|

Pro Pricing |

|

Newsletters | 12+ |

Stock Analysis | Yes |

Mutual Fund Analysis | Yes |

ETF Analysis | Yes |

Portfolio Analysis | Yes |

Forex Analysis | Yes |

Options Advice | Yes |

Fee Analysis | Yes |

ESG Ratings | No |

Customer Service Number | 1-347-509-6837 |

Customer Service Email | subscriptions@seekingalpha.com |

Mobile App Availability | iOS and Android |

Web/Desktop Access | Yes |

Promotions | $25 off coupon |

Seeking Alpha Premium Review

-

Pricing & Fees

-

Ease of Use

-

Tools & Features

-

Customer Service

Overall

Summary

With a free Seeking Alpha membership, investors can read up to five articles per month. But Seeking Alpha Premium subscribers get unlimited access to Premium content and can also view Author Ratings, Author Performance, Quant Ratings, and Dividend Grades.

Pros

- Over a dozen free email newsletters

- Useful stock screener tool

- Link your brokerage account to monitor your portfolio

- Get stock buy and downgrade alerts

Cons

- Only five free articles per month

- Marketplace subscriptions cost extra

- A lot of data for completely new investors to handle

Tom Blake is a personal finance writer with a passion for making money online, cryptocurrency and NFTs, investing, and the gig economy.

Editor: Ashley Barnett Reviewed by: Robert Farrington