A great rental real estate portfolio will spin-off positive cash flow and allow investors to benefit from easy financial leverage. Historically, this asset class beats inflation and provides exposure to an asset with underlying value.

But, depending on where you live, finding houses that make financial sense in your local market may be next to impossible. Soaring home prices and moderate rents can lock some investors out of the market. With so many real estate markets “on fire”, would-be real estate investors may want to look outside of their city or state to find their first or next investment property.

Buying a rental house from a distance can pose difficulties. Rental properties may come equipped with leaky toilets, difficult tenants, and unexpected vacancies--and addressing these problems from out of town can be tricky without the right support.

With help from our partners at Roofstock, we’re going to break down what you should know before you buy a rental property across state lines. If you want to look at investment real estate that’s for sale right now, sign up for Roofstock here and start browsing.

When To Consider Long Distance Real Estate Investing

Rental property ownership can provide stable income, but it’s not an asset for everyone. Layering in long-distance real estate ownership adds to the complexity. But investing in a long-distance investment property may make sense, especially if:

- Your local market has a low rental income to property value ratio. (The ratio of the monthly rent to the property value is well below 1%).

- You don’t have a specific advantage (home repair skills, ability to “drive for dollars”, etc.) that would allow you to find excellent deals locally.

- Despite unfavorable local conditions, you want to own and maintain physical rental real estate as a part of your portfolio.

- You’re willing to put in the work to find a team of people who can help you manage your property from afar.

Rental properties are houses (or apartments). They are big, unwieldy assets that need to be physically maintained. As the owner of that asset, it is up to you to keep the asset in shape. That means you need to know who to call when the HVAC breaks in July, or when the caulk around the tub starts to leak. On top of that, you’ll need to find tenants and make sure they pay their monthly rent.

Over time, rental properties may yield income with less time investment. But it takes a lot of work to find and buy a property. Then it takes more work to find tenants. It takes more work to find a team of people who can provide services to the property to keep it in shape. And even if you outsource it to a property manager, it takes work to find a property manager you trust.

With all the upfront work, the investor’s reward is steady cash flow.

Rental properties rarely provide massive returns except when investors use leverage and invest in many, many properties. It’s not a bad asset class (in fact, it is my favorite). But buying real estate and selling it after a few major repairs is a recipe for lost money.

Think carefully before you leap in to real estate investing, especially if you plan to buy at a distance. Remember, even in expensive markets, you may be able to “house hack” to gain exposure to rental real estate.

How To Buy An Investment Property Long Distance

If you feel like long distance real estate investing is right for you, the process will involve several steps. Here's what you'll need to do to find the right property, purchase it, and fill it with tenants to begin receiving rental income.

1. Research, Research, Research

Most people who want to own rental real estate want to own more than one property. Multiple doors mean more cash flow. Often, real estate investors who invest from a distance choose one metro area to focus their investments.

Focusing on one market offers many practical advantages. It allows investors to understand the market dynamics in the area. Focused investors can develop a local network of excellent real estate agents, property management companies, service people, and general contractors.

Figuring out where you want to invest may be the most important first step in buying real estate from a distance. When studying regions for investment, real estate investors will want to understand the general real estate climate. They can study things like:

- What are the major draws to the area? (universities, specific Industries, hospitals, schools, etc.)

- Who rents in this area? (students, retirees, families with children, etc.)

- What is the ratio between expected monthly rent and typical property values in the area?

- Is the area stable, growing, or shrinking?

- What are the employment prospects for most people in the area?

- How do property taxes compare to property values?

By studying market dynamics, you can feel more confident that you can find profitable deals that will stand the test of time. Understanding the market can also prevent you from snapping up a $72,000 house only to find out that it is highly overvalued for the area.

If you want a great guide to get started, check out Roofstock Academy. You can learn how to master turnkey rental properties online, and this course goes well with actually using their platform for purchasing property.

I also like this guide from Bigger Pockets that explains how to do market analysis. You can also look at listing sites like LoopNet (for Multi-family properties), Apartments.com, and Zillow to get a feel for pricing in the market.

2. Start To Build Your Network

When you own property from a distance, you’ll need a team of people who can help you find, finance, and maintain your real estate.

Finding quality connections from a distance can be a real challenge. Companies like Roofstock make it easy. But you can always find your own network as well. Here are a few groups of people that you’ll want to find.

Other Small Real Estate Investors In The Area

They may seem like your competition, but I’ve found that fellow investors offer the best connections to service people such as plumbers, electricians, cleaning crews, pest control, HVAC repair people, insurance providers, and other service providers.

Good Inspectors

A good inspector can help you understand how long it will be until critical systems need to be replaced. They will dramatically reduce the risk associated with a house long distance.

Real Estate Agents Or Local Turnkey Providers

As a distance real estate investor, you’ll want to work with local real estate agents or turnkey companies to find properties. Don’t just use a Zillow real estate agent. Instead, seek out agents who specialize in rental property acquisitions.

If you use a turnkey company, look for reviews or ask to speak to former customers. One national turnkey company is Roofstock and they have a great selection of inventory to choose from.

Lenders

Mortgage lenders for long distance investment properties don’t necessary need to be local. But you’ll want to look for lenders that understand rental real estate and steer clear of loan companies that only issue mortgages for owner-occupied housing.

Insurance Brokers That Deal With Landlords

Buying insurance for rental properties is not as easy as calling a broker and asking them to compare rates. Many insurance companies only insure landlords under certain conditions. It’s taken me a few years to find an insurer that will consistently offer a reasonable rate for my long-distance rental property.

Service Providers

Rental property owners need to know plumbers, pest control, and HVAC providers at a minimum. Issues with plumbing, pests, or heating and air conditioning can quickly lead to dissatisfied tenants and property problems. You may be able to find local providers through the Next Door app or through online communities like the Bigger Pockets Forums.

Property Managers

A good property management company will field tenant calls and dispatch service providers as needed. They may handle aspects of the vacancy process such as giving tours. Unfortunately, many property managers want clients with large portfolios. They may specialize in apartment management. A person with one or two houses may find it difficult to locate a property manager to serve their needs.

Roofstock, however can refer you to a preferred property manager that is vetted and monitored.

3. Line Up Funding

You’ll need to save money for a down payment (typically 20-25% minimum) and a repair fund for a rental property. You’ll also want to figure out your preferred lending scenario. Many real estate investors use a HELOC on their residence to buy the rental property and then mortgage it later to pay the loan back. This works well if you live in an expensive real estate market, but it can backfire if you’re unable to secure a fixed-rate mortgage on the new property.

Other investors try to buy and rehab with cash and take out a mortgage after the repairs are complete. Still, others prefer to use traditional mortgages to buy. You may see some real estate investors talk about “hard money” loans. These are typically private loans with fairly high-interest rates. They tend to be appropriate for people looking to fix and flip, but are not typically a good long-term choice for rental property buyers.

The great thing about using a platform like Roofstock is that they have lending partners on the platform that they can refer you to (and they’re familiar with what you’re doing). This can make a transaction seamless.

4. Look For Properties

Once you know your market, have a team, and have your funding, you can finally start looking for deals. Most of your searching will be done online, and you may never see a house in person. You’ll likely rely on online images and video to “see” the property.

Some prospective landlords will make a trip to look for properties. This makes a lot of sense, especially if you’ve never been to an area. By seeing properties in person, you can get a better sense of what $100,000 will get you in the market. The trip may cause you to reevaluate what you want to find.

Roofstock makes it really easy to look for properties. You can search their website by area, type of property, price, and so much more. Check it out yourself here >>>

5. Make An Offer

When you find a property that seems to meet your criteria, you can make an offer on the property. Many investors like to have an “inspection contingency” clause allowing them to back out for any or no reason following an inspection.

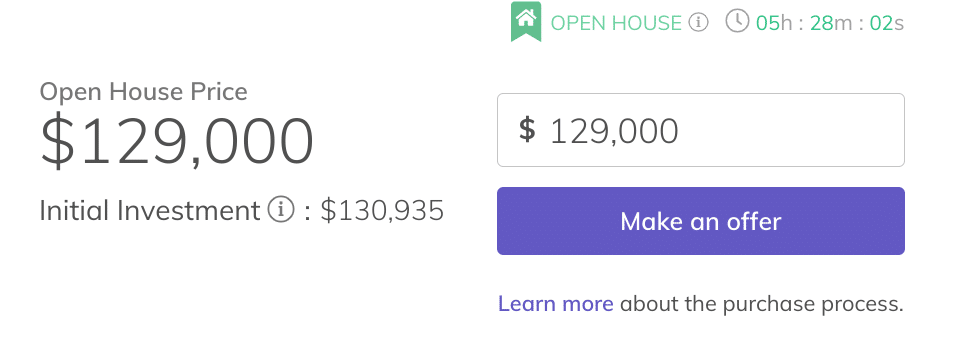

On the Roofstock platform, it’s incredibly easy to make an offer - just click a button!

6. Buy The Property

Thanks to Covid-19, buying properties digitally is no longer a major problem. Most documents can be e-signed or signed in front of a notary.

Be sure to call your title company or real estate attorney before wiring any money. Wire transfer fraud can be a major source of lost money, so take precautions.

7. Find Tenants And Maintain The Property

Once the property is yours, you can fill it up with tenants and start collecting rental income. Of course, you also become responsible for paying the loan and maintaining the property.

Keep careful tabs on your profit and loss, since it can be easy to overspend on capital investments or to underspend on regular maintenance activities. Careful tracking can help you become a better real estate investor as you refine your approach.

Is Long Distance Real Estate Investing For You?

Buying real estate takes a ton of upfront work to build a network and to procure a property. But the work can pay off, even if you have to leave your market to find a property that works. If you’re willing to put in the effort, you may be able to build up a modest portfolio of rental properties that provide income to fund your lifestyle.

Just remember, an out of state property is still a house. It requires upkeep, and you won’t easily be able to DIY a repair when you’re 18 hours away.

If you’re ready to start browsing properties, check out Roofstock here >>>

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.