There are many passive crowdfunding platforms that allow regular folks (i.e. who aren’t millionaires) to diversify their investments into real estate without having to manage anything. But what if you want to invest in a business?

You could buy stock in a publicly-traded company. But that won’t get you in at the ground floor when the business is just getting started or taking off. This area has generally been reserved for accredited investors or venture capitalists with billions of dollars to invest.

Mainvest is looking to change that dynamic. They let anyone invest in local startups and early-stage small businesses for as little as $100. This article will detail how Mainvest works and who might be a good fit to invest with them.

Editors Note: Mainvest has made the decision to cease operations.

Mainvest investors were hit with a double-whammy of bad news in recent days. First, Mainvest surprised members with a decision to cease operations effective June 14th, 2024. However, on May 20th, the company announced that their payment processing systems had been impacted by problems with its banking partners, Synapse and Evolve. While this appears to be a separate issue from the earlier decision to close operations, its causing disruptions for customers who are looking to withdraw funds.

Mainvest Details | |

|---|---|

Product Name | Mainvest |

Min Invesment | $100 |

Investor Fee | $0 |

Issuer Fee | 6% |

Open To Non-Accredited Investors | Yes |

Promotions | None |

What Is Mainvest?

Mainvest is a business investment platform open to non-accredited investors. It was founded in 2018 and is based in Salem, MA. Its CEO and co-founder is Nick Mathews. Mainvest has raised $3 million through a seed round.

Being around since only 2019, there isn’t any track record for Mainvest. Mainvest vets each business before listing them and not all businesses will pass the vetting process. Even so, there’s no way to tell how successful Mainvest has been.

What Does It Offer?

Mainvest allows anyone to invest (you must be 18 and have a U.S. bank account) in local small business. The minimums to invest are just $100.

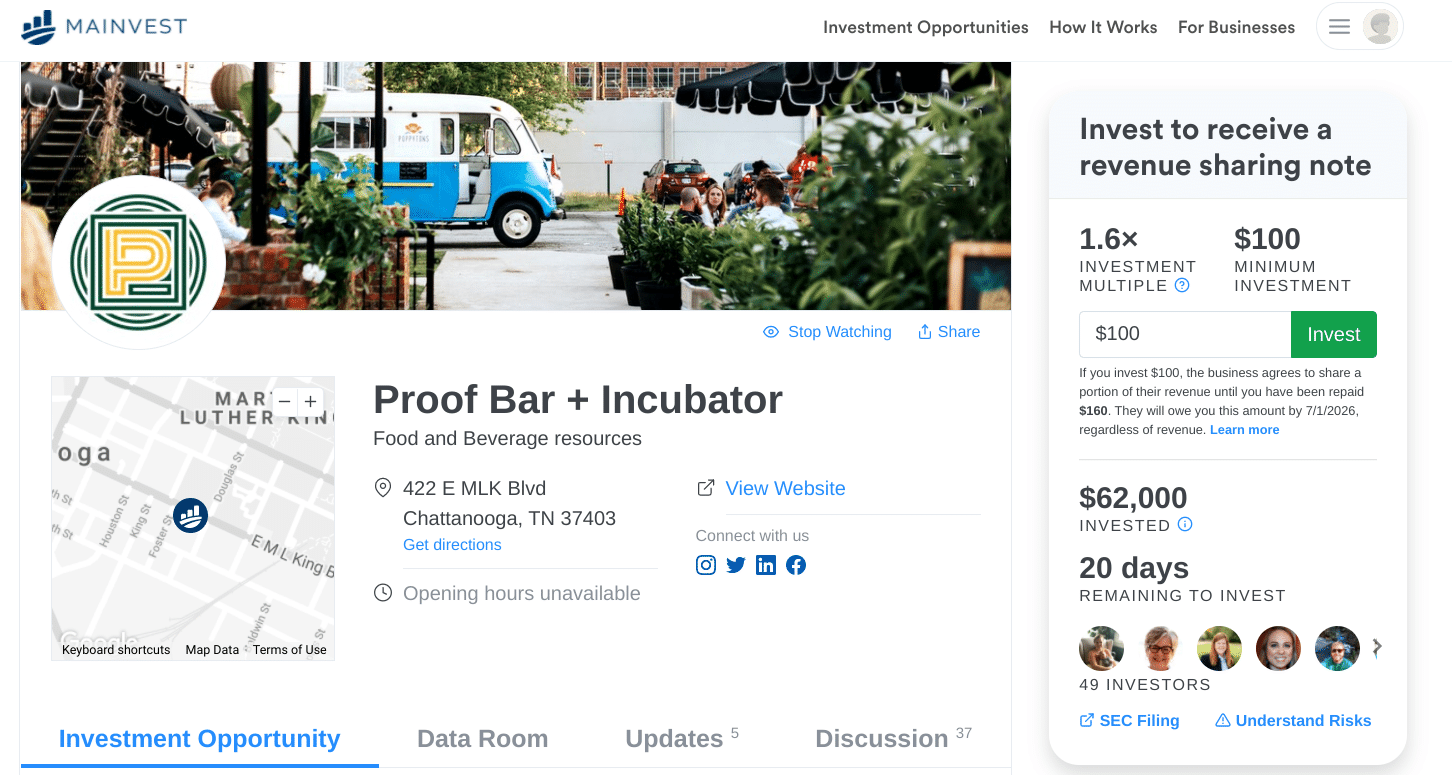

Mainvest says that you can invest in debt or equity opportunities. However, nearly all listed opportunities are revenue shares, which implies equity investments.

When you make an equity investment on Mainvest, the company will agree to pay you a percentage of its revenue each quarter until you receive a certain investment multiple. It will also pledge to pay the entire investment multiple by a certain date regardless of its revenue.

IRR Vs. Annualized Return

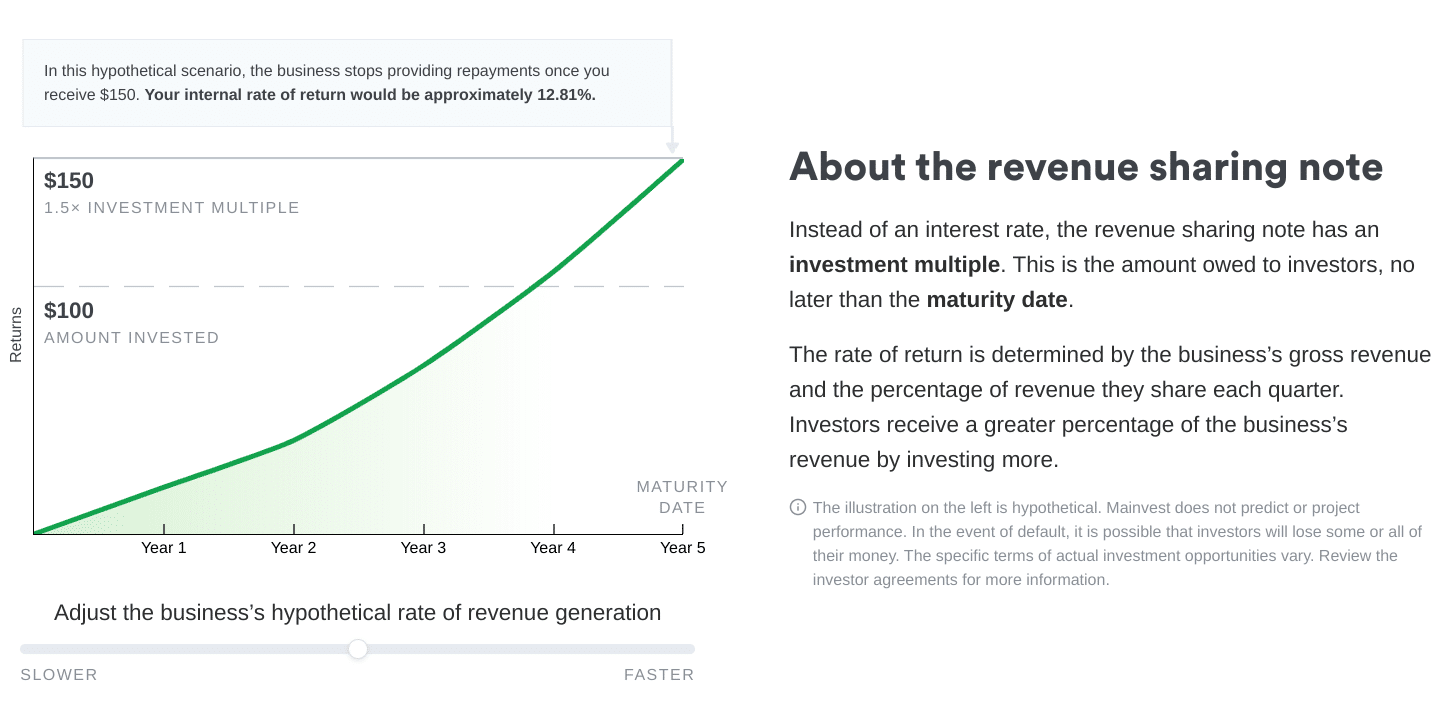

Mainvest quotes its investment returns in the form of a multiple. For example, 1.4X, 1.5X, etc. This means if you invest $100 at 1.4X, you should expect a return of $140 by the investment maturity date.

Stock investment returns are generally quoted on an annualized basis. This allows for easy comparisons across different investments. However, Mainvest does not use annualized returns. Instead, as mentioned above, they use a multiple and IRR.

What is IRR? IRR is the internal rate of return. Mainvest investments are held for multiple years. While you could quote the return for each year, an IRR takes the annual returns for each year and lumps them into one number. IRR isn’t an average annual return but gives you an idea of what the investment returned each year.

There is an IRR calculator on Mainvest's website, so you can see the IRR for different amounts. The calculator, for example, shows an IRR of 12.81% on a $100 investment, with a 1.5X multiple, and a 5-year maturity date.

Open To Individuals

That’s right, you don't have to be a venture fund to invest in any opportunity listed on Mainvest. At one time, startups and early-stage business investments were reserved for billion-dollar funds or for those who knew someone starting a business. Mainvest is now allowing anyone to get involved in small business investments.

Lots Of Data Available To Analyze Businesses

There’s a ton of data available for each business. Because each opportunity is an investment in a security, all businesses on Mainvest must file with the SEC. You can view each of their SEC filings along with balance sheets, income statements, and financial projections.

Analyzing the data is probably one of the most important parts of determining if an opportunity has potential. Once you’ve read all of the data posted by Mainvest, you might want to contact the business to get some additional questions answered and vet them even further. You can contact any business through Mainvest’s platform.

Easy To Get Started

There’s no barrier to entry with Mainvest. If you're comfortable typing in your checking account information, the rest is fairly simple. You can transfer money through the Mainvest website and get paid there as well. You also get a dashboard to monitor your investments.

Are There Any Fees?

Mainvest doesn’t charge any fees to its investors but it does charge a significant fee of 6% to the businesses that receive funding through the platform. If the project doesn't reach its funding goal, however, Mainvest will return 100% of your investment back to you.

How Do I Contact Mainvest?

Mainvest can be contacted at info@Mainvest.com or (978) 414-5989. You can also mail their headquarters at 81 Washington St. Suite 201, Salem, MA 01970. Chat is available on their website too.

Customer Service Ratings

Better Business Bureau — No rating or reviews. Member since 2019.

Facebook — 5 stars from 9 people

How Does Mainvest Compare?

Outside of being an accredited investor and potentially a venture capitalist, there aren’t too many ways to invest in a private business. Even if you are accredited, you need a network of people who are aware of deals, access to data about the business and, of course, a lot of capital.

There are a few other websites that can bring deals to you though. SeedInvest and EquityZen are two prominent examples. Here's a quick look at how Mainvest compares to these two competitors.

Header |  | ||

|---|---|---|---|

Rating | Cell | ||

Min Investment | $100 | $500 | $10,000 |

Fees | 0% for investors (Businesses pay 6%) | 2% (up to $3,000) | 3% to 5% |

Open To Non-Accredited Investors? | |||

Cell | Cell |

How Do I Open An Account?

You can open an account by visiting Mainvest and clicking sign up. You can create a new account using your email or sign in with Google. You’ll need to fill in your contact and banking information. The process should take less than 5 minutes.

Is It Safe And Secure?

The Mainvest website uses encryption and money transfers are done through Plaid, a financial industry standard. However, funds are not FDIC, or SIPC protected. Therefore, your funds are completely at risk due to investment losses.

Once your funds are transferred from your bank into Mainvest and before they are invested, they sit in an escrow account. Once the funds are ready to be distributed to an investment, they are moved out of the escrow account.

Is It Worth It?

If you've been wanting to invest in a private business but weren't sure how, Mainvest could be for you. If you're close to one of Mainvest’s investment opportunities, you can even drop by and check out the business yourself. Mainvest has a map filter so that you can view opportunities that are nearby.

But investing in small businesses is always risky because of their limited resources and governance compared to larger firms and Mainvest is no different. There is no secondary market with Mainvest, so it's highly unlikely that you'll be able to resell your securities. Plus, it only funds brick & mortar businesses. So if you want to invest in the next Amazon, Mainvest probably isn’t for you.

If you're looking to invest in larger companies, whether physical or online, you can already do that with thousands of publicly-traded companies on the stock market. No accreditation is required and it's easy to diversify even with small amounts of capital by investing in funds or fractional shares. Check out our favorite stock brokers here >>>

Mainvest Features

Account Types |

|

Minimum Investment | $100 |

Investor Fees | None |

Issuer Fee | 6% |

Target IRR | 10% to 20% |

Investor Requirements | None |

Investment Options | Brick and mortar small businesses |

Fund Transparency | Moderate -- fund financials are filed publicly with the SEC |

Investment Term | Varies by project, typically 5-10 years |

Share Redemption Program | None |

Secondary Market | None |

Revenue-Sharing Payout Schedule | Quarterly |

Customer Service Options | Phone, email, and chat |

Customer Service Phone Number | 978-414-5989 |

Customer Service Email Address | info@Mainvest.com |

Mobile App Availability | None |

Promotions | None |

Mainvest Review

-

Pricing & Fees

-

Ease of Use

-

Customer Service

-

Passive Income

-

Diversification

-

Liquidity

Overall

Summary

Mainvest is a crowdfunding platform that helps local small businesses raise capital and is open to non-accredited investors.

Pros

- Open to non-accredited investors

- Most investments have $100 minimums

- Lots of data to analyze each business

- Pays passive quarterly income

Cons

- Very short track record

- Illiquid (no secondary market)

- Investing in small businesses is risky

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Chris Muller