Everyone wants to live a long and fulfilling life. But when you look at retirement calculators, it’s easy to see that planning to live a long time is expensive. When it comes to figuring out how to fund your retirement, guaranteed sources of income (such as annuities) make a lot of sense when you see that you might outlive your nest egg.

Of course, buying annuities is expensive, and the annuities are often loaded with excess fees. If you want to avoid the excess fees, it makes sense to shop for annuities using Blueprint Income.

Here’s what you need to know about the platform and how you can use it to your advantage.

What Is Blueprint Income?

Blueprint Income is an online marketplace for personal annuities. It works to help anybody buy an annuity that will provide a guaranteed stream of income during that person’s retirement years.

Blueprint Income is dedicated to simplifying the complex world of annuities, and helping its customers find the lowest cost options for guaranteed retirement income planning.

What Makes Blueprint Income Different From Other Annuity Providers?

Annuity salespeople have a reputation for being shady and underhanded. Because annuities are extremely complex products, it’s easy to be trapped into a high fee, low quality product without even knowing it.

What makes Blueprint different than a traditional annuity salesperson is that Blueprint Income is an annuity marketplace that has a fiduciary promise. That means Blueprint will work in your best interest to find the right annuity for you.

The company aims to match you with the right annuity based on your expected ability to fund the annuity, your retirement timeline and more. It will also explain the details of your annuity contract with you. What will happen if you have to withdraw funds early? What will happen if you can’t fund your annuity as expected? The team at Blueprint will explain all of these details for you.

Should I Create A Personal Pension?

If you’re less than five years away from retirement, you can simply buy an annuity right through Blueprint Income. These typically cost at least $100,000.

However, if you’re decades away from retirement, you’re probably not in a position to buy an annuity. Instead, you’ll have to fund an annuity using Blueprint’s “Personal Pension” plan.

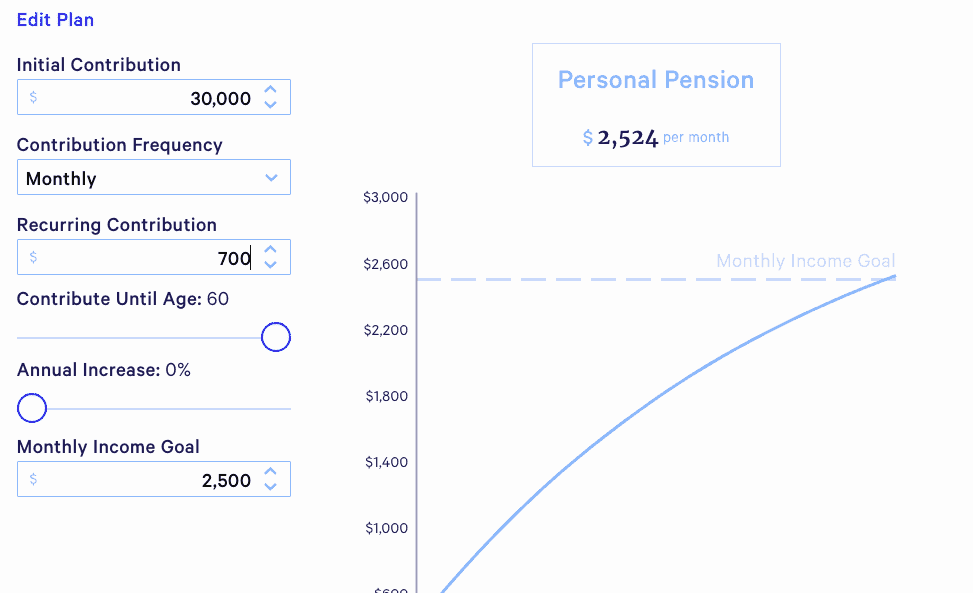

These personal pension plans offer a way for you to buy a guaranteed income stream in the future. Using the Blueprint Income tool, I found that I needed a $30,000 initial investment plus $700 per month to fund a $2500 pension in 30 years (for me and my spouse). This more or less translates to a 4% guaranteed investment return.

Since annuities are guaranteed and other forms of investment are not, it’s tough to compare annuities to other types of investments. However, most people with 30+ year time horizons will likely see better returns if they invest in more aggressive investments.

Final Thoughts

In most cases, younger investors should work on funding their 401ks and IRAs before even thinking about funding an annuity. If you’ve still got cash after maxing out those accounts, it could be worthwhile to look into annuities.

Just beware, annuities are extremely conservative. Investing in real estate, your personal business, or the stock market are much more volatile, but also likely to yield better returns in the long run. It may make sense to speak to a fiduciary financial planner before locking yourself into a personal pension plan through Blueprint Income.

Blueprint Income

-

Pricing and Fees

-

Ease of Use

-

Customer Service

-

Products and Services

Overall

Summary

Blueprint Income is an online annuities platform that offers fixed income annuities.

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Chris Muller