TreasuryDirect is the U.S. government’s website that allows you to buy treasuries directly from the government. If you can buy treasuries from the government, is there any reason to use a broker?

In this article, you’ll find out the differences between going direct vs. with a broker.

Plus, we'll share some other options (like Fidelity or Schwab) where you can invest for free.

Buying from TreasuryDirect

The TreasuryDirect website can be found at https://www.treasurydirect.gov. As you can see from the .gov domain, the website is owned by the government. You can buy treasuries directly from this website. Although, you can’t sell them on the same website. More on that a little later.

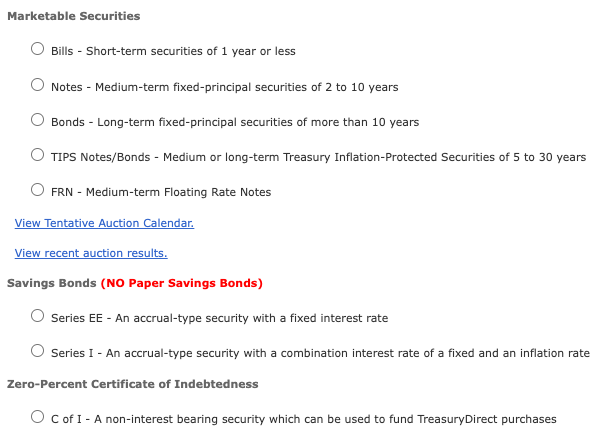

TreasuryDirect allows you to purchase any of the following marketable securities:

- Treasury bills

- Notes

- Bonds

- TIPS

- Savings bonds

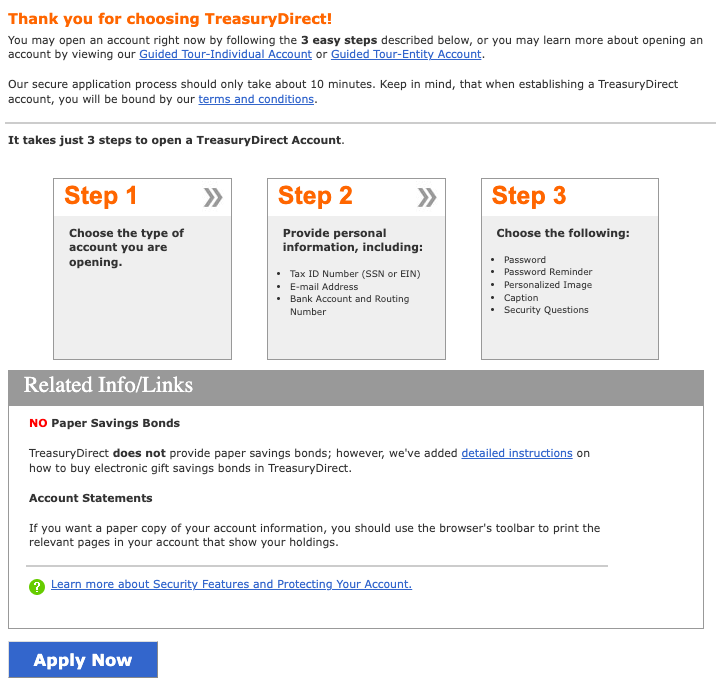

The first step in buying marketable securities on TreasuryDirect is to open an account. You’ll need the following:

- Social Security number or taxpayer identification number for entities

- Driver license number

- Checking or savings account number and routing number

- Email address

- To have a U.S. address

- To be over the age of 18

With that information in hand, you can go here https://www.treasurydirect.gov/indiv/indiv_open.htm to open an account as an individual. The process is fairly lengthy.

Once you’ve created an account, you’re ready to buy treasuries. This part isn’t much different from how you purchase treasuries on brokerage sites. Unlike brokerages though, there isn’t a fee for purchasing treasuries. To purchase, you’ll need to wait until an auction is available, since treasuries are sold at auction.

Auction frequency depends on the specific type of security but can occur each week or a specific time during the month. The Federal Reserve does regularly change auction dates so you’ll need to check the auction calendar to find out when the next auction is available for your specific security.

Besides no fees, TreasuryDirect also removes any third-party risk. The government is less likely to go out of business than a brokerage firm. Additionally, you own your treasuries and have full control over them.

Also, there is no minimum amount to purchase. Some brokerages will require a certain number or amount of bonds to be purchased per transaction.

How To Place A Trade

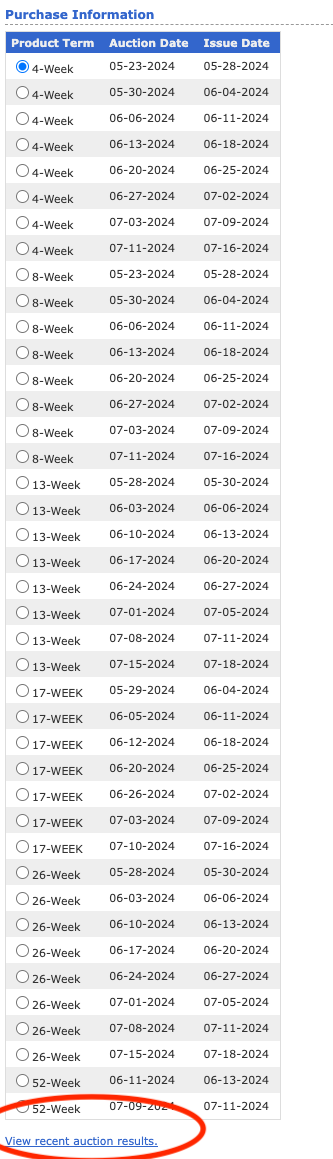

Honestly, it's easy, yet not easy, to place a trade on TreasuryDirect. When you want to place a trade, you simply select the bond you want to buy. But this isn't for beginners - you have to know exactly what you want... it's kind of overwhelming the first time.

Here's what that looks like:

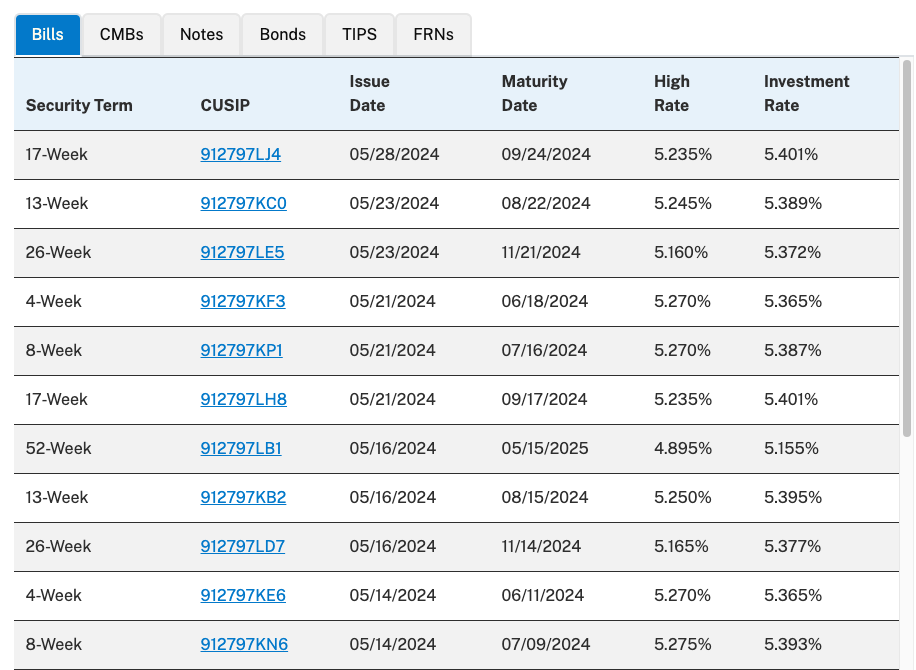

The only way to know what the rate of the bond you are buying is to click the "View Recent Auction Results", which then opens a new tab and shows you the rates.

With this data combined, you can make a decision and buy. It's a little tedious.

Selling Marketable Securities Purchased on TreasuryDirect

While buying treasuries from TreasuryDirect is similar to that of a brokerage, what is different is the fact that you can’t sell your treasuries on TreasuryDirect. In other words, they can’t be redeemed before maturity. This doesn’t mean you can’t sell treasuries purchased from TreasuryDirect. You can. But you’ll need to go into the secondary market to do it.

To sell securities purchased on TreasuryDirect in the secondary market, you first transfer them to a broker, bank, or dealer — an entity capable of selling treasuries. There will likely be a commission fee on the sale.

TreasuryDirect works really well if you intend to buy and hold until maturity since there is no way to sell your treasuries through them.

Something else to be aware of is the TreasuryDirect website: it’s security is a little overkill. This can make the site difficult and cumbersome to use since security is usually always in the way. For example, you may be prompted for answers to your authentication questions more often than you’d like. Clicking the back button will usually result in your session being killed. This means, you’ll have to log back into the site.

TreasuryDirect Alternatives: Buying At Your Own Broker

Many brokerages allow buying and selling of treasuries. The process is a little more involved than the buying and selling of stocks but this isn’t anything specific to brokerages. Treasuries and bonds require purchasing at an auction, selecting specific types, maturities, or even discount rates. It’s important to understand the lingo so you know exactly what you’re buying.

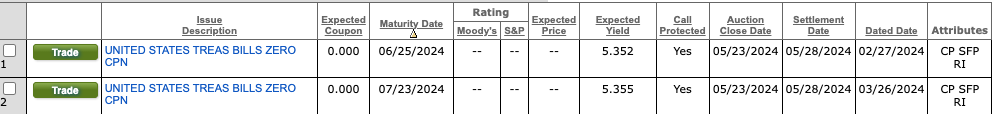

Here's what it looks like on Fidelity, where you can actually see the yield and other important info all on one screen.

In addition to new issues, brokers have access to the secondary market. This means a higher availability of treasuries from others who are trying to sell their treasuries before maturity.

Also, since you are likely to already have a brokerage account, you can save yourself time by not having to set up a TreasuryDirect account.

Who Is TreasuryDirect For?

If you don’t have a brokerage account and looking to hold treasuries until maturity, you are probably the perfect candidate for TreasuryDirect. If you already have a brokerage account and want to buy and sell treasuries, TreasuryDirect doesn’t offer much advantage.

For those buying lots of treasuries, there may be a savings advantage on commissions. Selling before maturity means transferring any securities out of TreasuryDirect and paying a sell-side commission to a broker; but depending on volume, it may be worth it to first buy your treasuries at TreasuryDirect.

Treasury Direct Review

-

Commissions and Fees

-

Customer Service

-

Ease of Use

-

Tools and Resources

-

Investment Options

-

Specialty Services

Overall

Summary

Treasury Direct is a platform where you can directly invest in US treasury bonds.

Pros

- Directly buy treasury bonds commission-free

- Ideal platform for those looking to hold treasuries for the long term

Cons

- You cannot sell on the platform – you must transfer to your own broker

- The website can be difficult to use due to security measures

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Colin Graves