Student loan consolidation is a specific federal government program for your student loans. The word "consolidation" is different than the English meaning of many to one. So separate that in your mind as we discuss student loan consolidation.

Getting rid of student debt is high on the radars of everyone who has it. Especially so when you have your loans scattered between different student loan servicers. That's where many people think student loan consolidation comes into play.

It's not unheard of for graduates to end up with 5-6 different student loans, sometimes at different loan companies. If you take out a different loan each year of college, maybe a couple summer sessions - you could have a variety of loans at different places. Plus, consolidation could make sense in certain specific circumstances - like having old FFEL loans.

In such instances, it may be worth it to consider a student loan debt consolidation loan (a mouthful isn’t it?)

It seems like a roundabout way to go about paying your debt: I mean, you are taking out a new loan to pay off another loan. Where is the sense in that?

The reality is that, if you are currently having trouble keeping up with payments or digging yourself out of debt quicker, a debt consolidation loan may be just the solution for you. Furthermore, there are other potential benefits to taking out a consolidation loan as well (such as being able to take advantage of student loan forgiveness programs). But it's not without problems.

Let's learn more here.

How Does Student Loan Consolidation Work?

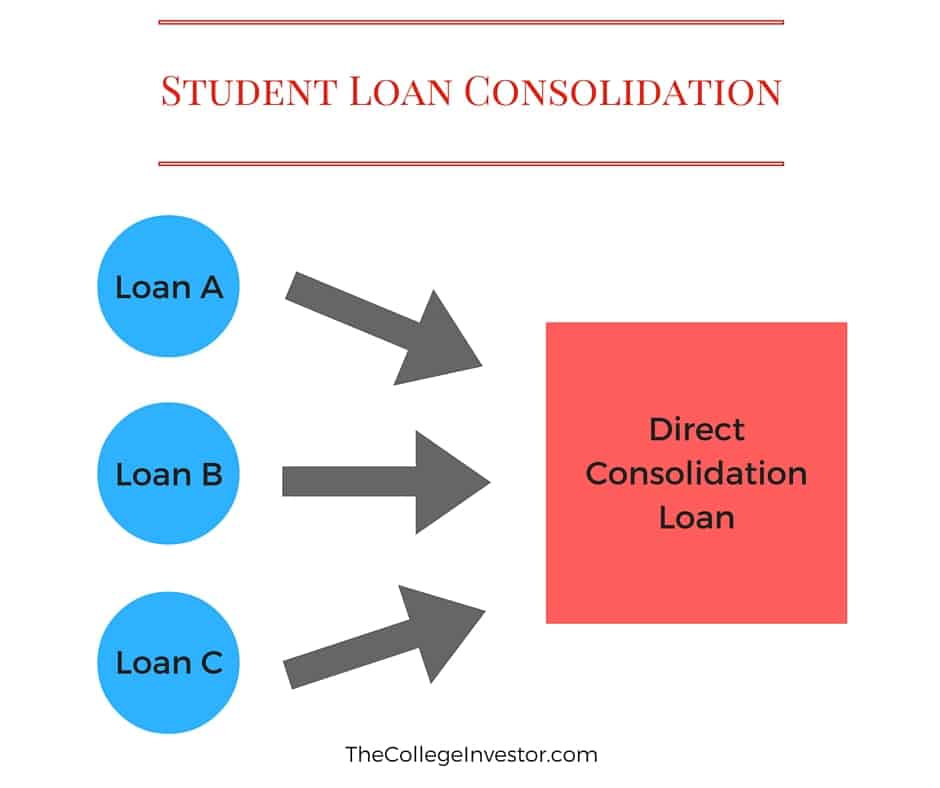

Student loan consolidation is the process of combining your Federal student loans into one single loan.

For example, you might have 3 or 4 different student loans by the time you graduate college (one for every year you went to school). This can be hard to manage because you could have 3 different payments to make each month. And if you miss one, you could end up harming your credit score.

Student loan consolidation makes this easier on you by making those 3 different loans into a single loan to make payments on. This new loan is called a Consolidation Loan.

Note: You can also simply consolidate one loan to one loan. This is helpful for Parent PLUS Loans.

Although, a debt consolidation loan helps to simplify and streamline your payments, a downside to getting it is that your new lower monthly payments could also lengthen the amount of time you will have to pay off your loans by.

Tip: You could easily offset this by paying a little more each month.

Here’s an example:

If your payments currently come to a total of $250 across multiple accounts and you apply for a debt consolidation loan, that payment could come down to say $120.

Now you are paying just one payment of $120 per month (plus any applicable tax) instead of twice the amount like you were paying before.

If you can manage to add, say, an extra $30 and pay $150 each month, you could in fact offset the time disadvantage that is introduced by paying less money towards your student loans.

Note: This doesn't apply to Spousal consolidation loans. Read all about Spousal Student Loan Consolidation Loans here.

What Loans Qualify For Student Loan Forgiveness

You can consolidate just about every Federal student loan into a new consolidation loan. These include:

- Direct Subsidized Loans

- Direct Unsubsidized Loans

- Subsidized Federal Stafford Loans

- Unsubsidized Federal Stafford Loans

- Direct PLUS Loans

- PLUS loans from the Federal Family Education Loan (FFEL) Program

- Supplemental Loans for Students (SLS)

- Federal Perkins Loans

- Federal Nursing Loans

- Health Education Assistance Loans

To qualify, you must have at least one loan in that is in the grace period of in repayment. Additionally you need to be current on your payments.

If your loan payments are in default, you will be required to make at least 3 consecutive monthly payments before you can apply for the Federal student loan debt consolidation loan.

If you have old FFELP loans, it's recommend you consolidate them ASAP so that you can potentially qualify for updated student loan forgiveness options like Public Service Loan Forgiveness. You have until April 30, 2024 to consolidate old FFEL loans and qualify for the recount waiver.

Student Loan Consolidation, Repayment Plans, Special Exceptions

The first big problem that can happen with student loan consolidation is that, since you can consolidate just about every type of Federal student loan, you can accidentally put a loan type in your new consolidate loan that prevents you from having certain repayment plans.

FFEL Loans - Access To SAVE

If you have old FFEL loans, you want to consolidate them as soon as possible. The big mistake here is waiting. If you consolidate your old FFEL Loans by April 30, 2024, you'll be able to qualify for the payment recount. If you've been paying your old FFEL for 20 years for undergraduate, or 25 years for graduate school, you'll qualify for loan forgiveness.

Second, even if you haven't hit the timeline yet, you can qualify for the new SAVE repayment plan, which could significantly lower your student loan payment.

Parent PLUS Loans - Access To ICR and PSLF

This used to be a problem with Parent PLUS Loans, where parents would accidentally consolidate some loans with their Parent PLUS Loan. This could eliminate the other loans from qualifying.

However, if you have a Parent PLUS Loan, you know that you're limited on your loan repayment plans. One option to get access to more repayment plans is to consolidate your Parent PLUS Loan. This single consolidate will allow you to have access to the Income-Contingent Repayment Plan, and also in-turn allow you to be eligible for PSLF.

Parent PLUS Loans - Double Consolidation

Double consolidation is a loophole that's set to expire on July 1, 2025. If you have multiple Parent PLUS Loans, or multiple loans (including a Parent PLUS Loan), you can double consolidate and gain access to all the repayment plans, include SAVE.

This is a process that you must follow to make it work. First, divide your loans into two groups. It doesn't really matter the groups, just make sure there is a PLUS Loan in one of the groups. Let's call it Group 1 and Group 2.

You consolidate Group 1 with one loan servicer. Consolidate Group 2 with a different loan servicer. Use the paper consolidation application, and make sure you include and exclude the correct loans in each group.

Note: It doesn't matter which loan servicer you pick as long as they are different. It also doesn't matter which repayment plan you choose because you'll never enter repayment on these loans.

Finally, once the two individual consolidations for Group 1 and Group 2 have processed, you now consolidate these two groups into a new loan - let's call it Consolidation Loan 3. You can select whichever servicer you want (might as well pick MOHELA if you're going for PSLF). You can also select SAVE as the repayment plan if you want.

Can Loan Consolidation Make You Pay More Interest?

There are a lot of variables that go into student loan consolidation, but it could cost you more if you're not careful.

Consolidating your student loans could end up costing you more over the life of the loan if you forget a couple of things. Immediately at consolidation, your new consolidation loan will be essentially equal to the sum of all your existing loans. Your interest rate will be the weighted average of all the loans you consolidated (rounded up to the nearest 1/8 percent), and your payment should also equal the sum of all your individual payments.

Because remember, student loan consolidation is about convenience in paying multiple loans – nothing else.

Your new consolidation loan gives you choices in repayment plans – you could switch to an income-based repayment plan, or the extended plan.

If you switch to any other repayment plan, you will end up paying more over the life of the loan. However, that could be worthwhile if you simply can't afford your payment today and don't have a choice.

Also, when you consolidate, you'll need to re-apply for any interest rate deduction programs you were on. For example, if you were saving 0.25% for using Direct Debit, you would need to re-setup that plan to save again.

These small factors are what people forget when consolidating their student loans, and it could end up costing them more.

Student Loan Consolidation vs. Refinancing

Student loan consolidation is different from student loan refinancing, but many people use the terms interchangeably.

Student Loan Consolidation: This is a free program to combine your Federal student loans into a new Federal student loan.

Student Loan Refinancing: This involves getting a private loan to replace some (or all) of your existing student loans.

You can consolidate Federal loans, but you cannot consolidate private loans.

You can refinance both Federal and private student loans - but it doesn't usually make sense to refinance Federal loans.

When Student Loan Refinancing Makes Sense

It can make a lot of sense to refinance your private student loans. When you refinance your loans, you have the potential to lower your interest rate and lower your payments.

When you do refinance, it's important to look at both the interest rate, and the loan term. You can get refinancing loan terms from 2 years to 20 years, and the term length you decide on has a big impact on both your payment and the interest you'll pay.

Recommendation: Try to refinance your loan for no more than 7 years to get the best interest rate.

Here's an example of how this can make sense financially (from a real life example):

Loan Amount | Monthly Payment | Interest Rate | Years Remaining | Total Interest | |

|---|---|---|---|---|---|

Loan 1 | $19,415 | $115.00 | 5.06% | 12 | $8,581 |

Loan 2 | $12,789 | $136.85 | 9.74% | 12 | $13,568 |

Loan 3 | $10,995 | $115.60 | 9.49% | 9 | $8,145 |

Loan 4 | $15,170 | $242.24 | 12.50% | 12 | $16,832 |

Loan 5 | $8,051 | $152.09 | 8.25% | 8 | $4,482 |

Total | $66,421 | $761.78 | $51,607 |

By refinancing all his student loans into one new loan for $66,421, he was able to get the following:

Loan Amount | Monthly Payment | Interest Rate | Years Remaining | Total Interest | |

|---|---|---|---|---|---|

New Loan | $66,421 | $496.65 | 4.16% | 15 | $22,976 |

This refinancing loan was for NO cosigner, and was based on him having excellent (780) credit. As you can see, even though the loan term is a little longer than we recommend, but because of the much lower interest rate, he's able to BOTH lower his monthly payment by 35% and pay over 50% less interest over the life of the loan.

If you're looking at refinancing, we recommend Credible - they are a student loan refinancing comparison tool that shops a bunch of different lenders for you to find the best rate.

We highly recommend Credible because you can see if it's worth it in about 2 minutes with no credit check. Plus, College Investor readers get up to a $1,000 gift card bonus for refinancing with them. Check out Credible. Or, check out this list of places that offer student loan refinance.

Why You Shouldn't Normally Refinance Federal Student Loans

When it comes to Federal loans, however, the story is different. The reason is, beyond the interest rate and payment, Federal student loans have a ton of perks and options to help borrowers.

First, if you're payment is too high, you could qualify for income based repayment. This will lower your student loan debt to less than 15% of your discretionary income (or 10% for PAYE and RePAYE plans). That means, regardless of what your loan amount or credit score is, you'll get a lower payment.

Second, these income-based repayment plans also include student loan forgiveness at the end of 20 or 25 years. That means, not only can you get a lower payment, but your loan could be forgiven after a period of time.

Finally, Federal student loans qualify for Public Service Loan Forgiveness, or PSLF. If you work for a non-profit or the government, you can get loan forgiveness after just 10 years. That's a huge perk.

If you were to refinance your Federal loans into a new private loan, remember: your new private loan replaces all of your Federal loans. As such, your new loan will have ZERO of these perks.

You might be thinking, well, I don't need an income based repayment option today. And that's fine, but can you say so with certainty tomorrow? Are you secure in your job and income level? Will you never work in public service in the next 10 years?

These are all important questions to ask.

The Only Scenario When Refinancing Federal Student Loans Makes Sense

When you answer those questions, you'll quickly see that there is only one scenario where it makes sense to refinance your Federal student loans into private ones.

The ONLY scenarios when it could potentially make sense to refinance a Federal student loan is if you meet all of the following requirements:

- You are currently paying under the Standard 10-Year repayment plan

- You are easily able to afford your monthly payments, and they do not exceed 10% of your take-home income

- You do not work in any qualifying public service or government job

- You don't plan to need income-based repayment within the next 10 years

- You are looking at paying your student loan off early or could possibly pay your loan off early

- You have excellent credit (over 760). We recommend Credit Karma as a free way to check your credit.

Also, if you have Parent PLUS Loans, it can make sense to refinance your Federal loans into private loans.

If you meet all of the above requirements, then refinancing your Federal student loan could potentially make sense as a way to save money over the life of the loan. The reason is that you'll likely never qualify for income based repayment since you can afford the standard repayment plan. Also, you'll never have an ability to apply for Public Service Loan Forgiveness.

To get the best interest rate and terms for a refinancing loan, you'll also need to have great income and a great credit score. If you have both of those, you'll likely be able to find a refinancing student loan with a lower interest rate and better terms than your Federal loans (but not always).

It never hurts to shop around if you fit into this scenario. Check out Credible and see if there's a better deal out there. It's free to compare loans, and you never know, you could save thousands of dollars over the life of the loan.

How To Consolidate Federal Student Loans

Consolidating your Federal student loans is relatively easy. The Department of Education estimates that it will take you about 20 minutes on StudentAid.gov.

There is no cost to consolidate Federal Student Loans. You don't need to pay a third-party company a huge fee to do this. You can do this yourself.

You have to go through here: Federal Direct Loan Consolidation

When you consolidate your loans, your interest rate will be an weighted average of all the loans being consolidated. You also can qualify for a 0.25% interest rate reduction if you sign up for automatic payments.

So, if you have $10,000 at 6.8%, and $20,000 at 3.4%, you would end up paying 4.5% on your new $30,000 loan. However, realize that the underlying cost structure doesn't change, and you will still end up paying the same amount of interest over the life of this new consolidated loan compared to the underlying loans.

Once again, there is no getting out of the loan. A Federal Consolidation Loan simply streamlines your payments.

If you're not quite sure where to start or what to do, consider hiring a CFA to help you with your student loans. We recommend The Student Loan Planner to help you put together a solid financial plan for your student loan debt. Check out The Student Loan Planner here.

How To Consolidate Private Student Loans

Private student loans are a bit of a different game. They are much more like car loans or home loans. There are different interest rates and fees offered by different banks to student loan borrowers.

If you have private loans, it can really pay off to shop around and find a great rate for a consolidation loan. As mentioned above, Use Credible to find a great student loan consolidation and refinancing rate. Credible is a marketplace for student loans where you can receive offers from multiple lenders after filling out a simple form. Credible vets everyone they work with so they only work with quality lenders. Don't forget to take advantage of your gift card bonus offer for refinancing with Credible.

You can start the process right here: Credible Refinancing.

Avoiding Scams

As a reminder, you don't have to pay for student loan consolidation. There are a lot of student loan scams out there targeting people looking to consolidate their student loans. There are also a lot of so-called “aid” companies that want to charge you to consolidate your student loans.

The bottom line is that you can simply consolidate your student loan for free at StudentAid.gov, or by simply calling your lender. Once you login to StudentLoans.gov, you can easily complete your student loan consolidation application. If you know your name, address, and Social Security number, you're capable to do this yourself without paying anyone else.

Let's break down what you need to know about third-party companies, and how to avoid student loan consolidation scams.

What These Companies Are Charging You For

I want to make clear that these companies aren't necessarily fraudulent. Rather, they are charging you for a service that you really don't need to pay for. They use marketing tactics to make you think that you have to pay for their services to get student loan consolidation, but you don't.

If you read on these companies' websites, they will be doing the following for you:

- Determine the best student loan consolidation programs for you

- File all the paperwork

- Working with you if you're in default

- Answer your questions

When you sign up with them, one of the first forms you fill out will be a Power of Attorney form. This gives the company legal rights to act on your behalf with your student loan companies. That's scary that you're letting these people act on your behalf! Just do it yourself.

The trouble is, you don't need to be paying someone for this! You can fill out the paperwork yourself. As for the best student loan consolidation program? You have one option for Federal student loans – just one.

Should You Pay For Help With Your Student Loan Debt?

Now, don't get me wrong - I know that dealing with your student loans can take time and be confusing. You don't have to pay anyone for help - but I also know that I can't be your mom.

I've been doing this a long time, and regardless of how easy I say it is - there's still a good 30% of you that don't want to deal with this and would rather pay a third party company to help. That's fine.

There's a cool app called Chipper that can help you manage your student loan repayment, see if it makes sense to consolidate, and even help you find loan forgiveness. It's free to start. Check out Chipper here >>

If you're not quite sure where to start or what to do, consider hiring a CFA to help you with your student loans. We recommend The Student Loan Planner to help you put together a solid financial plan for your student loan debt. Check out The Student Loan Planner here.

Final Thoughts

The bottom line is that student loan consolidation can be a great way to help organize your loans, potentially qualify you for loan forgiveness programs, and make repayment easier. But you need to understand that potential problems it could cause as well.

First, if you have Federal student loans, you only have one way to consolidate these loans: a Direct Consolidation Loan. This loan is available for free through the U.S. Department of Education. You can learn more and apply for it here: StudentAid.gov.

Second, if you have private student loans, you do have more options to consolidate, but even then, I really only want you to look at one option – Credible. This site gives you a free saving estimate of what you could save by consolidating and refinancing your student loans in 30 seconds. Then, if you go forward with your private consolidation, you can receive and compare offers from many lenders after completing a single short form. As a bonus, College Investor readers can get up to a $1,000 giftcard if they refinance with Credible!

Finally, make sure that you don't consolidate Federal and private loans into a single private loan. Keep them separate. You get a lot of benefits from your Federal student loans, and you lose them if you merge them into a private student loan.

And don't fall for any student loan consolidation scams!

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Ashley Barnett