As getting a college degree gets more expensive by the year, more and more students are relying on federal student loans to keep the dream alive. And when you get your award letter you might see listings for both subsidized and unsubsidized student loans.

However, all the language that is used to describe the different types of loans available to you can sound like coded jargon, yes?

In this post, we are going create a dent in that cloud of confusion.

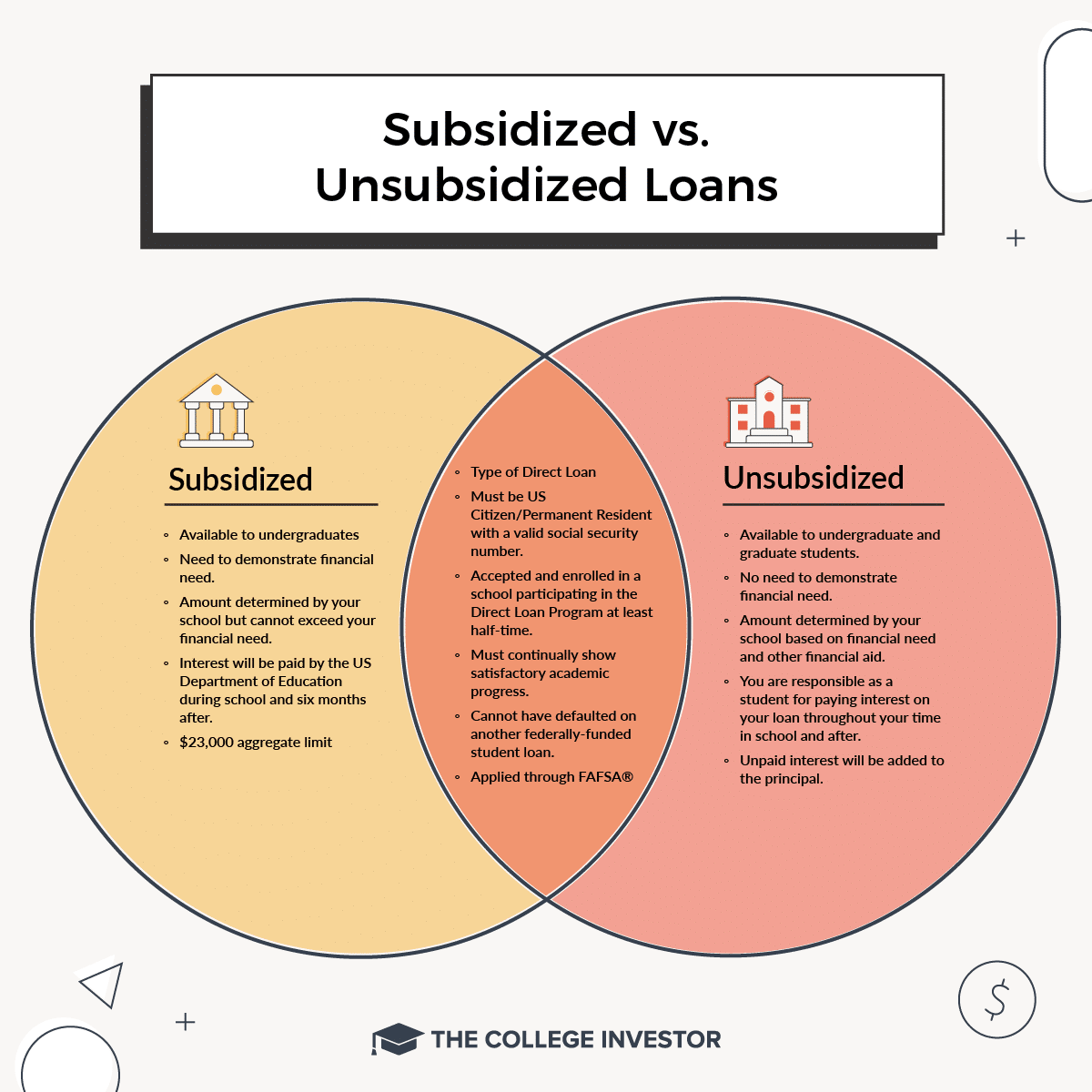

Today we’ll talk about the differences between the terms “Subsidized” and “Unsubsidized student loans” when it comes to the Federal Direct Student Loan Program.

The William D. Ford Direct Loan Program is the largest loan program offered by the United States Department of Education. It's basically the "law" that defines what can and can't be done with student loans.

The Subsidized and Unsubsidized loans are two of the four types of Direct Loans. These are the most common types of loans that undergraduates will get. Let's break down what they mean, what you need to know, and options if you need to borrow more.

Subsidized Student Loans

If you qualify for Federal Direct Subsidized Student Loans, you should definitely take advantage, as they are one of the best student loans you can get.

Unsubsidized Student Loans

Who Is Eligible For Direct Loans?

There are several factors to be aware of when it comes to qualifying for direct loans. There are also limits to how much you can borrow with Direct student loans.

Something to note: Most males students need to be registered with the Selective Service in order to receive Federal Aid.

How Much Can You Borrow?

There are different borrowing limits depending on if you're a dependent student or independent student. The limits also change based on what year of school you're in.

If the amount your school determines is more than you actually need, you can also borrow less money - something that will come in handy if it is your goal to pay off your student loans faster.

When your loan is awarded, it will be sent directly to your school who will then apply the money to your school account to pay tuition and fees.

Here's the current student loan borrowing limits:

Year Of School | Dependent Student | Independent Student |

|---|---|---|

First Year Undergraduate | $5,500 - No More Than $3,500 Subsidized | $9,500 - No More Than $3,500 Subsidized |

Second Year Undergraduate | $6,500 - No More Than $4,500 Subsidized | $10,500 - No More Than $4,500 Subsidized |

Third Year Undergraduate And Beyond | $7,500 - No More Than $5,500 Subsidized | $12,500 - No More Than $5,500 Subsidized |

Professional And Graduate | N/A | $20,500 - No unsubsizied |

Note: All graduate and professional students are considered independent students. Also, graduate and professional students aren't eligible for subsidized loans.

There is also a total loan limit you have to follow:

Dependent Students: $31,000, with no more than $23,000 subsidized

Independent Students: $57,500 for undergraduates, with no more than $23,000 subsidized

Professional and Graduate Students: $138,500 for professional and graduate students, with no more than $65,500 subsidized. These loan limits include any aggregate loans taken out during undergraduate study.

How Much Time Do You Have To Pay Off Your Direct Loans?

With the Unsubsidized student loan, once you have graduated from school, you have a six-month “grace period” where you don’t necessarily have to make payments on your loan although you will have to pay any interest you accrued on the amount you borrowed.

In most cases, Subsidized student loan borrowers will not have to worry about payments until the grace period is over.

Your repayment period begins a day after the grace period ends - this holds both for Subsidized and Unsubsidized student loan borrowers.

Because you absolutely do not want to miss when your repayment begins, it is important that you communicate clearly with your loan servicer to get details the specific date your repayment period starts, how much you need to be paying and the methods of payments.

If for some reason, you are unable to pay the interest during the six-month grace period (under the Unsubsidized program) , the interest amount will be capitalized. This means that the interest amount will be added to the principal which can potentially increase the amount you have to pay each month.

Generally you will have between 10-25 years to pay off your student loans.

If you decide to consolidate your loans using the Direct Consolidation Program this time period is extended up to 30 years.

For both the Subsidized and Unsubsidized loans, you have the opportunity to use income-based repayment programs like PAYE and REPAYE.

What If You Need To Borrow More?

Many people see those subsidized and unsubsidized student loan limits for undergraduates and don't know how they will afford to pay for college. And that's a rational fear if you were planning to borrow the full cost of college. But remember, paying for college is a pie - and there are a lot of different slices to choose from.

For the full breakdown of the "best" way to pay for college, check out this article: The Best Way To Pay For College.

If you're already exhausted other options, and know your ROI on education, then you can look at private loans.

We recommend students shop and compare private loan options before taking them out. Credible is an excellent choice because you can compare about 10 different lenders in 2 minutes and see what you qualify for. Check out Credible here.

We also have a full comparison tool on the Best Private Loans To Pay For College here.

Key Takeaways

We would love to hear your thoughts in the comments!

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Chris Muller