Credible is a marketplace that allows borrowers to shop around for both student loan refinancing, private student loans, personal loans, and mortgages.

We have been fans of Credible for a long time, because we're fans of being able to shop and compare actual prequalified loan rates at once. And Credible makes that easy.

If you're looking to get a better interest rate on your loan, or maybe lower your payment for your student loan debt, one of the best options (especially for private loans) is to refinance your student loan. However, finding the best interest rate and terms for your loan can be tough.

There are dozens of student loan lenders and refinancing companies out there. Where do you even start? And will applying at each place hurt your credit? That's where Credible comes into play.

Credible consistently comes in at the top of our list of best places to refinance student loans and places to find the best student loans. The reason is simple - they make comparison shopping for student loans easy, so you get the best deal quickly.

Let's dive into Credible and see what it's all about. Hopefully you'll see why we love them too. Plus, if you get a loan via Credible, you'll get up to a $1,000 gift card bonus for using our link (see terms)*.

Here's our Credible Review:

Credible Details | |

|---|---|

Product Name | Credible Student Loan Refinancing |

Min Loan Amount | Varies By Lender |

Max Loan Amount | Varies By Lender |

APR | 5.24% - 12.43% APR |

Rate Type | Variable and Fixed |

Loan Terms | 5, 7, 10, 15, 20 years |

Promotions | $1,000 Gift Card Bonus |

Hate To Read? Watch The Video Review

Note: This video was created 6 years ago, and the layout and flow may be different than today. For illustrative purposes only, actual results may vary.

What Is Credible Student Loan Refinancing?

If you have a private student loan, and want to lower your interest rate or change your payment terms, one of the best ways to do that is by refinancing your student loan. You can also refinance Federal student loans, but it's typically not advised. Read our full guide on student loan consolidation to learn why.

When you refinance your student loan, you're taking out a brand new loan, that pays off your old loan. This new loan hopefully has a lower interest rate, or maybe a longer repayment period, which will lower your monthly payment.

The hard part is finding this "magical" loan. That's where Credible comes into play. On Credible, you can fill out a single form, and it will compare multiple lenders at once for you.

You can even fill out the entire application on their site (including for cosigners), and they walk you through the entire process from start to finish. Their goal is to make getting a student loan easy, and we think that they do it well.

It compares options from many of the top lenders: College Ave, RISLA, Citizens Bank, and more.

How Does Credible Work?

Credible is one of the easiest platforms we've used. It's very straightforward and it takes about 2 minutes to find your rate.

1. Find My Rate

The first thing you do is click "Find My Rate" and fill out the short form. It takes about 2 minutes to enter your information.

You need to provide information about your education and finances, as well as how much student loan debt you're looking to refinance.

The great thing about this is this doesn't impact your credit score. Credible starts the entire process with a soft credit check, so you don't have to worry about this impacting your credit score. That means that you can see if it's even worth it to refinance worry free.

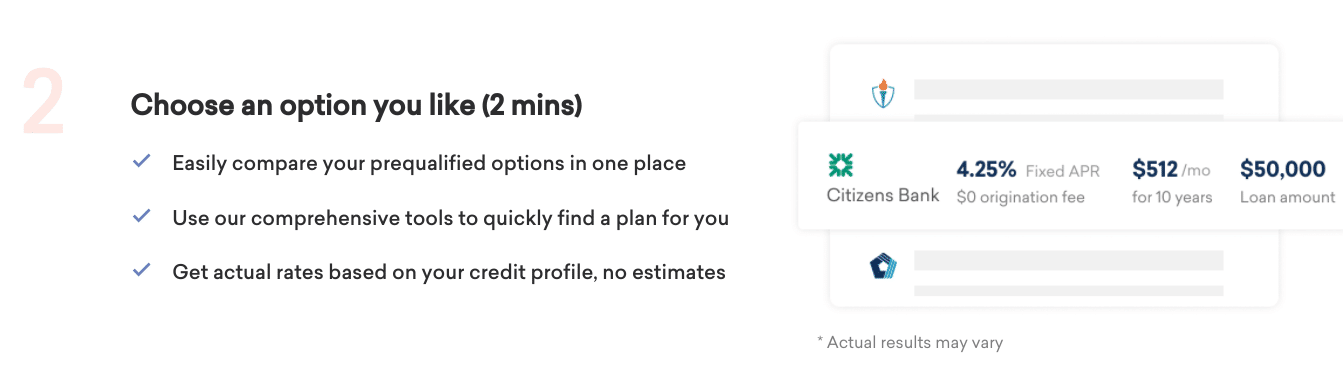

2. Compare Your Options

After you enter your information, you'll see a dashboard of the various offers you might qualify for: including interest rate, terms, and loan amount. I say "might" because none of these are 100% guaranteed. Note: While it's not guaranteed, these are your actual pre-qualified rates².

Assuming nothing changes in your credit profile, market rates have not changed and you can verify the information you provided in your profile, these rates are typically accurate.

However, if you were accurate during the process, and your information can be verified, you can potentially get some great rates. The awesome thing is you can see your options up front and know if it makes sense to refinance your student loan or not.

3. Apply For Your Student Loan

Once you decide on a lender, it's time to apply. During the application process, you'll be asked more in-depth questions about your loans, your financial history, and the lender will run a real credit check.

After you complete this process, the lender will work with you directly to finalize all the details.If you need a cosigner for your student loan, they can start an application on Credible's site as well and it can all be streamlined together.

4. Collect Your Bonus

When you refinance your student loan through our link, you'll get up to a $1,000 gift card bonus*! We're affiliates for Credible and we're proud to pass this bonus offer on to you. See our full list of the best student loan bonus offers here.

When Does Student Loan Refinancing Make Sense?

There are a few situations when student loan refinancing makes sense. And when it does, it can save you a lot of money!

Using a service like Credible can make sense when:

- You have private student loans at a higher interest rate than you can get when you refinance

- You have federal student loans, you're making payments on the standard repayment plan, and you want to pay off your student loans faster

Most people don't realize that they can refinance their student loans multiple times. So, if you already have private loans and you can save on interest, you can refinance. If you find a lower rate, you can do it again.

If you have Federal loans, you can lose some protections. But if you're looking to pay off your loans faster, and can afford it, refinancing can save you a lot of money!

Credible Private Student Loans

Credible also works with its lending partners to offer private student loans for students who are still in school (or planning to go to school). They offer both fixed rate and variable rate private student loans. We consistently rank Credible as one of the best private student loan marketplaces.

Just like for student loan refinancing, you can fill out a simple form and compare offers from multiple private student loan lenders all at once (without a hard credit check)¹. Credible makes it easy to invite a co-signer to your application and even compare multiple co-signers to see which one gets you a better offer without affecting incurring any hard credit inquiries.

They have most of the major lenders for private loans on their platform, including Sallie Mae, Citizens Bank, College Ave, and more.

With private student loans, it's important to make sure you fully understand what you're getting. We typically don't advise people to take out private student loans if at all possible. If you think it's necessary, though, using a service like Credible makes a lot of sense. You need to shop around.

Remember, always follow the proper order of operations when it comes to paying for college.

Credible Personal Loans

Credible also provides personal loans on its platform using the same system that they have for student loans - where they will connect you with lending partners. They allow you to enter your information and compare multiple personal loan lenders in just 2 minutes. See why we recommend them to find personal loans.

Personal loans don't make sense for everyone (especially for people paying for college), but they can make sense for individuals looking to consolidate credit card debt and more. They are also a great alternative to tax advance loans because you borrow more, for longer.

Credible offers personal loans from $600 to $100,000.

Other Products

Credible also provides mortgages comparisons on its platform.

Who Qualifies To Apply?

It's important to note that Credible itself does not lend any money. Instead, they are a comparison platform for various direct lenders. But they advertise on their platform that there are NO minimum qualifications to use Credible.

However, you must be 18 years or older and have at least $5,000 in student loan debt you're looking to refinance. You must be a US citizen or permanent resident.

In reality, we've found that to get the best rates and terms, you need to have good credit and stable income. In using the platform, we've also found that most lenders require a minimum credit score in the mid-600s. You can read all about the basics of student loan refinancing here.

In many cases, if you don't have great credit or a stable income yet, you can qualify with a cosigner.

Are There Any Fees?

Credible doesn't charge any fees to its users. And none of the student loan lenders that are available on its platform charge application fees, origination fees or prepayment penalties.

However, you may be charged fees (from the lender, not Credible) for other types of loans. For example, you'll likely pay an origination fee if you take out a personal loan with one of Credible's partners.

How Does Credible Compare To Other Lending Marketplaces?

Credible was one of the first student loan marketplaces to integrate lenders and make the application a seamless experience. Unlike other platforms which might compare lenders and link you to various applications, Credible streamlines the process to let you obtain prequalified offers from multiple lenders all at once.

With that being said, there are several other companies that offer similar services. Here's a quick comparison:

Header |  |  | |

|---|---|---|---|

Rating | |||

Refinancing? | |||

Private Loans? | |||

Personal Loans? | |||

Single Application | |||

Bonus | $1,000 Giftcard | $500 | None |

Cell |

Credible Reviews

The vast majority of reviews about Credible highlight how easy their system is to use. They make the process very user friendly. The main negatives users report about Credible all relate to not being approved by a lender (which is likely not the fault of Credible).

As of writing, Credible has a 4.8/5 star rating on Trustpilot out of over 7,000 customer reviews.

Motley Fool gives them 4 out of 5 stars.

U.S. News & World Report gives it 4.8 out of 5 stars for Private Student Loans and 5 out of 5 stars for Student Loan Refinancing.

How Do I Contact Credible?

Credible has three customer service options. You can chat with a team member live at any time on their website, email them at support@credible.com, or call them at 866-540-6005.

Is It Safe And Secure?

While Credible doesn't receive any money from its users, it does receive a lot of sensitive personal information including Social Security numbers. Thankfully, the website does use industry-standard encryption to protect your privacy.

You'll also be automatically logged out of your account after a few minutes of inactivity to prevent unauthorized access. Note that you won't lose any of your application progress though as Credible will auto-save everything before logging you out.

Credible FAQ

Let's answer some common questions about Credible.

What is Credible?

Credible is a comparison tool that allows you to enter your information once, and find multiple offers in the marketplace. They currently offer student loans, student loan refinancing, personal loans, mortgages, and more.

Is Credible Legit?

Yes, they are a comparison engine that allows you to compare various student loan lenders (and more).

Does Credible Affect Your Credit Score?

Credible provide prequalified rates and completes a soft pull on the consumer’s credit report. If you apply for a loan, there will be a hard inquiry on your credit report.

What Minimum Credit Score Do I Need For Credible?

There is no set minimum credit score to use Credible, but the lowest rate lenders will require a very high score and strong debt-to-income ratio. If you don't have a good credit score, you may need a cosigner on your loan application.

Does Credible Sell Your Information?

Credible will sell your information for the purpose of targeted advertising. You can learn more in their Privacy Policy.

How Much Does Credible Cost?

There is no cost to use Credible. Credible is an online marketplace for lenders.

Does Credible Offer A Bonus?

Yes, Credible offers a gift card bonus offers to people who complete the student loan refinancing process.

Why Should You Trust Us

I am America’s Student Loan Debt Expert™ and have been actively writing about and covering student loans since 2009. Myself and the team here at The College Investor have been actively tracking student loan providers since 2015 and have reviewed, tested, and followed almost every provider and lender in the space.

Furthermore, our compliance team reviews the rates and terms on these listing every weekday to ensure they are accurate. That way you can be sure you're looking at an accurate and up-to-date rate when you're comparison shopping.

Who Is Credible For And Is It Worth It?

We're big fans of Credible because they make it easy to shop for student loan refinancing by comparing multiple lenders in just minutes.

If you're looking to refinance your student loan, or even to take out new private student loans, make sure you shop around. We also compare all of the student loan refinancing lenders, so leverage us to do your research as well. And don't forget you'll get up to a $1,000 gift card bonus if you use Credible to refinance your student loans!

Credible Features

Service | Loan comparison shopping |

Types of Loans |

|

Fees | None |

Application Type | Online-Only (no mailed, emailed, or faxed applications allowed) |

Pre-Qualified Offers | Yes |

Min Loan Amount | Varies by lender |

Max Loan Amount | Varies by lender |

Partner Lenders |

|

Security | Transmissions between Credible and lenders are encrypted with HTTPS transport layer security (TLS) technology |

Customer Service Options | Phone, email, and live chat |

Customer Service Number | 1-866-540-6005 |

Customer Service Email | support@credible.com |

Promotions | Get up to a $1,000 gift card bonus when your loan closes |

¹ To check the rates and terms you qualify for, Credible or our partner lender(s) conduct a soft credit pull that will not affect your credit score. However, when you apply for credit, your full credit report from one or more consumer reporting agencies will be requested, which is considered a hard credit pull and will affect your credit.

² Prequalified rates are based on the information you provide and a soft credit inquiry. Receiving prequalified rates does not guarantee that the Lender will extend you an offer of credit. You are not yet approved for a loan or a specific rate. All credit decisions, including loan approval, if any, are determined by Lenders, in their sole discretion. Rates and terms are subject to change without notice. Rates from Lenders may differ from prequalified rates due to factors which may include, but are not limited to: (i) changes in your personal credit circumstances; (ii) additional information in your hard credit pull and/or additional information you provide (or are unable to provide) to the Lender during the underwriting process; and/or (iii) changes in APRs (e.g., an increase in the rate index between the time of prequalification and the time of application or loan closing. (Or, if the loan option is a variable rate loan, then the interest rate index used to set the APR is subject to increases or decreases at any time). Lenders reserve the right to change or withdraw the prequalified rates at any time.

* Limited time offer: In order to qualify for the $1,000 bonus, the amount refinanced must be equal to or more than $100,000. Borrowers who refinance a balance below $100,000, will receive a $300 bonus. All bonus payments are by gift card. See terms.

Reviews

Trustpilot, accessed on March 21, 2024: https://www.trustpilot.com/review/www.credible.com

Motley Fool, accessed on March 21, 2024: https://www.fool.com/the-ascent/personal-loans/credible-personal-loans-review/

US News & World Report, accessed on March 21, 2024: https://money.usnews.com/loans/student-loans/reviews/credible-student

Credible Student Loans Review

-

Commissions And Fees

-

Ease of Use

-

Customer Service

-

Loan Options

-

Features

Overall

Summary

We’re big fans of Credible because they make it easy to shop for student loan refinancing by comparing multiple lenders in just minutes. They also offer private student loans, mortgages, personal loans, and more.

Pros

- Get pre-qualified offers in minutes

- Works with 10+ student loan refinance lenders

- Easy experience from pre-qualification to closed loan

Cons

- Not every lender is available

- Some supported lenders on the platform don’t show all their offers

- Not all lenders will offer cosigner release

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Ashley Barnett