Income-Contingent Repayment (ICR) is one of the income-driven repayment plans that can potentially save you money on your student loan payment each month.

IDR plans are student loan repayment plans that change the amount of money that you pay each month depending on the amount of income that you make (as well as some other factors). Income-driven plans differ from most standard repayment plans in that your monthly payments depend on your annual income.

Income-Contingent Repayment (ICR) plan is a unique repayment plan in that it won't be the right option for many borrowers, but could be the only option for some. If after reading this, you’re still looking for more information and guidance on the best ways to repay your student loans and minimize your total costs, check out Chipper. It's a service that helps you determine the best repayment and loan forgiveness options for you.

Different Types Of Income-Driven Repayment Plans

There are four main types of income-driven repayment plans:

With a standard or extended repayment plan, your monthly payment is determined solely by the interest rate, principal balance, and repayment period. That means that a higher interest rate, a higher balance or longer repayment period will all contribute to a higher month. With the 10-Year Standard Repayment plan, there's no thought given to whether you can afford your monthly repayment amount.

Income-driven repayment plans are the flip side of that and set your monthly payment to a specific percentage of your total income. The exact percentage depends on the specific type of income-driven repayment plan, but it will generally range from 5-20%.

What Do All Income-Driven Repayment Plans Have In Common

The 4 different income-driven repayment plans have a few unique differences but they all share a few things in common:

What Is Income-Contingent Repayment (ICR)?

ICR and SAVE are the only two income-driven repayment plans that do NOT have an income requirement. So unlike PAYE and IBR, no matter what your income is you're able to choose the ICR as a repayment plan.

Your payment under the ICR is the lesser of 20% of your discretionary income or what your payment would be on a fixed 12-year payment plan, after you adjust it for income. This is twice as high as SAVE and PAYE which cap payment at 5-10% of discretionary income.

IBR also has a 10% discretionary income cap for new borrowers. But if you borrowed your student loans before July 1, 2014, you'll pay 15% of your discretionary income on IBR.

How Is Discretionary Income Calculated On ICR?

With SAVE, and PAYE, and IBR, discretionary income is calculated by taking your adjusted gross income and subtracting 150% of the annual federal poverty amount in your state for your size of family (note, SAVE will change to 225% in 2024). But with ICR, you income only 100% of the federal poverty line will be subtracted from your income. This means that your discretionary income (and your monthly payments) will be higher with ICR than with the other three repayment plans.

The interest rate under the ICR plan is fixed for the life of the plan. It will be equal to the weighted average of the interest rates on all loans that are under the plan, rounded up to the nearest ⅛ of a percentage point.

If you’re married and file jointly, your spouse’s income is also taken into account. However if you file your tax return as married married filing separately, only your income will be used to determine payments.

Does ICR Have An Interest Subsidy?

If you're monthly payment on an IDR plan is so low that it doesn't cover all of your interest charges, your loan will begin to accrue unpaid interest.

But on the SAVE, PAYE, and IBR plans, the government will pay all of that unpaid interest for you on your subsidized loans for your first three years of repayments. And on the SAVE plan, you can qualify for a student loan interest subsidy for as long as you're on the plan.

Unfortunately, Income-Contingent Repayment does not offer such an interest subsidy. While on ICR, unpaid interest will be added to your loan balance during all periods.

Which Loans Are Eligible For ICR?

So far just about everything we've said about ICR has been negative. To recap, ICR makes you payment 20% of your discretionary income instead of 10% to 15%, it bases your income on the difference between your AGI and 100% of the poverty level instead of 150%, and doesn't provide any interest subsidy.

With all this in mind, why in the world would anyone choose ICR? Well because, for some people, it might be their only income-driven repayment plan option. And who exactly what that be? Parent PLUS borrowers.

If you have Parent PLUS Loans, Income-Contingent Repayment is the only income-driven repayment you're eligible to join. And even with ICR, you won't qualify until your loans have been consolidated via a Direct Consolidation Loan. In addition to Parent PLUS Loans, Direct Loans, FFEL Loans, and Perkins Loans can all be repaid on ICR.

How To Apply For Income-Contingent Repayment

You apply for Income-Contingent Repayment in a similar way to applying for other student loan repayment plans. You can apply by filling out a form and mailing it to your student loan servicer. But an easier way is to go online to StudentAid.gov and log in with or create your Federal Student Aid ID.

You do have to reapply for ICR each year. This ensures that your income and family size are correctly reported as that will likely change your monthly payment. And if your life or income situation changes significantly, you can change your student loan repayment plan as often as necessary.

Calculating Your Total Cost Of Repayment On ICR

Let’s run through a scenario. We'll say you’re married with two kids (family size of four) and have $60,000 in federal subsidized loans at a 4% interest with a total adjusted gross income of $40,000 living in Florida.

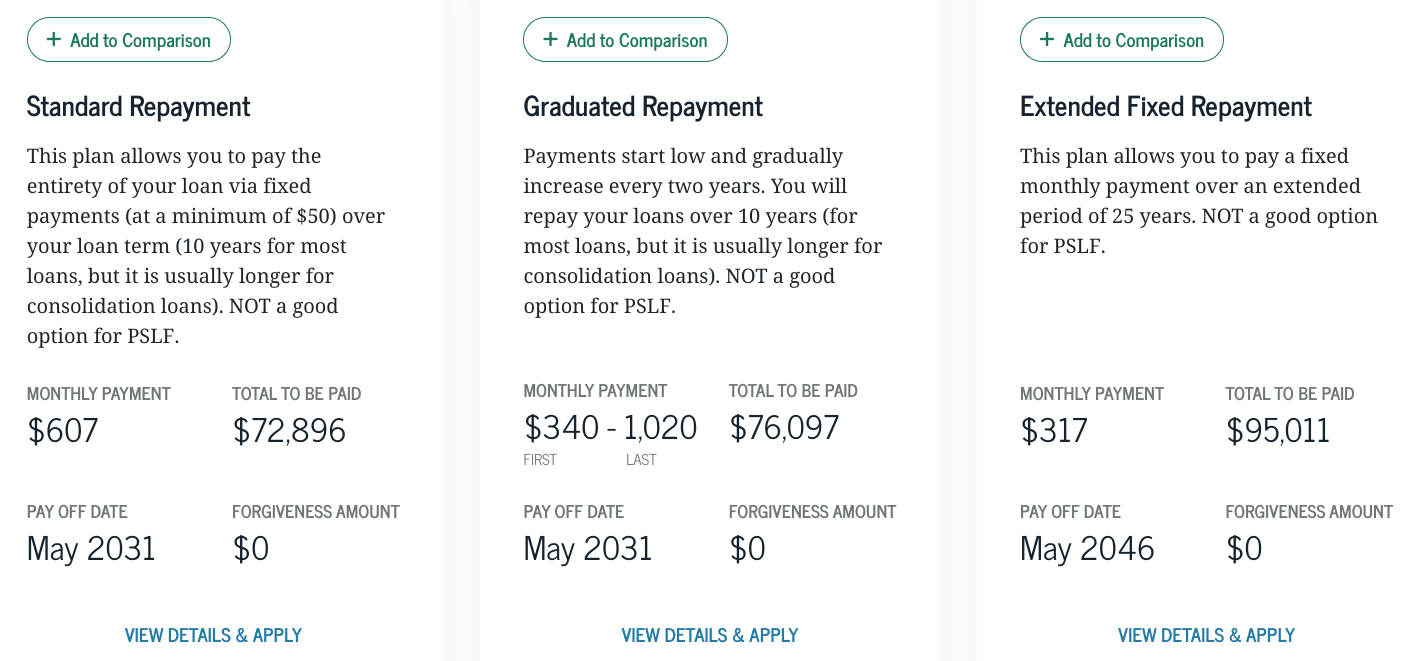

When you plug in those numbers to the Repayment Estimator at StudentAid.gov, the first thing you'll see are what you'd pay on the Standard, Graduated, and Extended Fixed Repayment plans. With these plans, your monthly payment would range from $317 to $607 and you'd pay $72,896 to $95,011 overall.

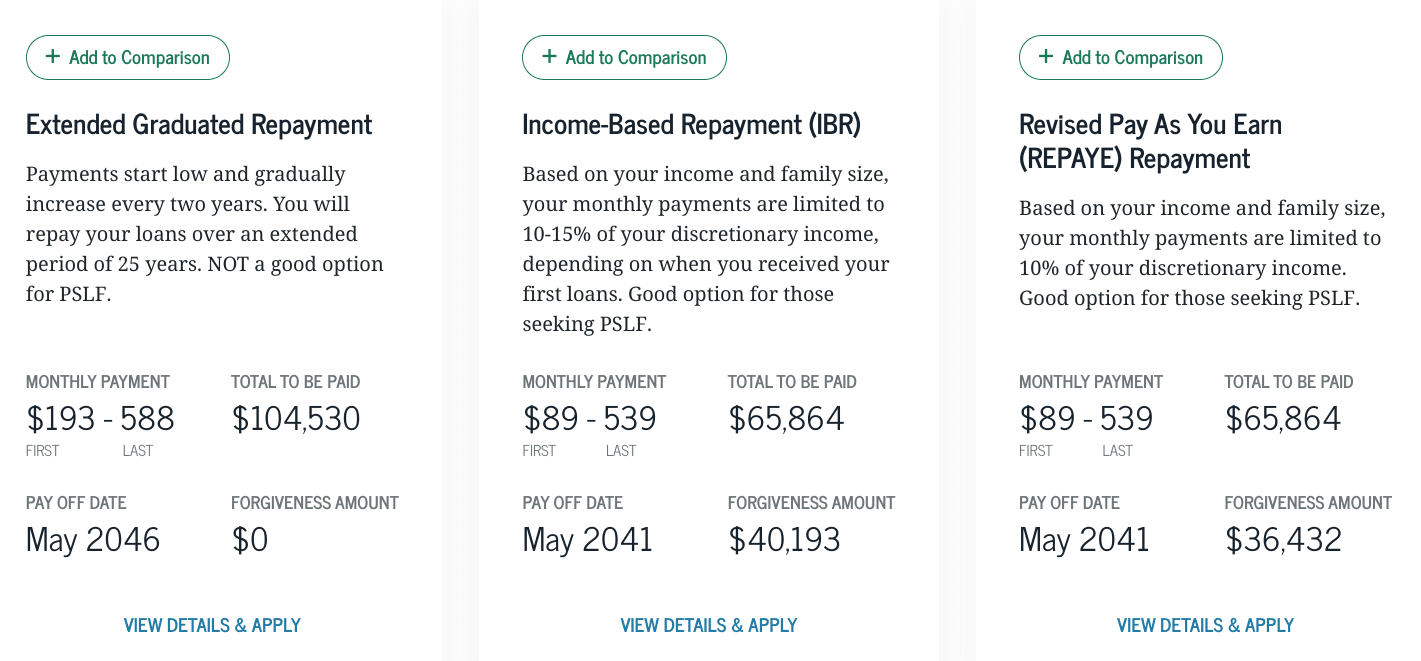

Next, StudentAid.gov's tool compares the Extended Graduated Repayment plan to IBR and REPAYE. Both IBR and REPAYE would cost nearly $40,000 less overall and their starting monthly payments would be just over $100 less.

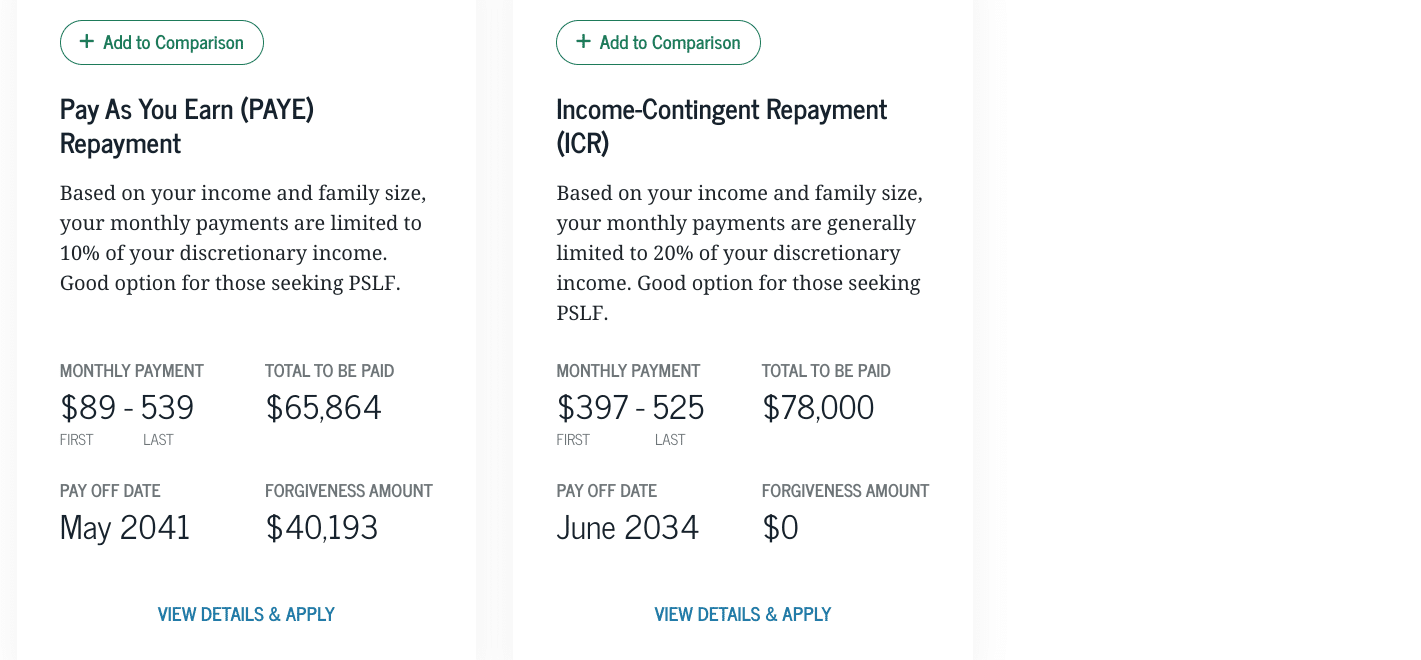

Finally, we see PAYE and ICR. PAYE's numbers look exactly the same as REPAYE's and IBR's. ICR, on the other hand, has a starting payment that's about $300 higher. And the overall cost with ICR would be over $12,000 more.

In this example, the Repayment Estimator recommended the SAVE/REPAYE plan for our sample scenario.

Why would it recommend SAVE/REPAYE when you'd pay the same amount with PAYE and IBR? Because its ongoing interest subsidy would result in you receiving $3,761 less in forgiveness ($36,423 vs $40,193). And that would mean a slightly lower bill from the IRS if you ended up having to pay taxes on your forgiven balance.

Who Should Choose Income-Contingent Repayment?

For the vast majority of circumstances, the only group of people that might want to consider ICR today would be those who have Parent PLUS loans. As previously mentioned, ICR is the only income-driven repayment plan that allows you to include these loans.

In the past, Income-Contingent Repayment was also a good option for those who couldn't qualify for PAYE or IBR due to their income eligibility requirements. But anyone can join REPAYE now too, regardless of income. And since REPAYE also bases payments on a lower discretionary income percentage (10% vs 20%) and offers a valuable interest subsidy, it's typically the better option.

There may be a few exceptions, though. For example, if you're planning to work in a high-income field, ICR could provide lower payments down the road. With REPAYE, your payment will always be 10% of your discretionary income, even if it's higher than what you'd pay on the Standard plan. But with ICR, your monthly payment will never be more than what'd pay over 12 years on a fixed repayment plan.

ICR could also be worth considering for married borrowers. On REPAYE, your spouse's income is always included in your discretionary income calculation. But with ICR, you can exclude your spouse's income if you file your taxes separately.

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Chris Muller