I thought it would be interesting to look at some of the best investors in modern time. These are all individuals who made significant amounts of money by sticking to solid investment philosophies.

If you look at their strategies as well, they aren't very difficult or complex - they stick to basic financials of a company and look for value. If they believe there is value, they invest, and make tidy profits!

Some of these names may be very familiar, but others you might not know about! There's no particular order, as all of these individuals have an interesting path to investing over the long run.

John "Jack" Bogle

Jack Bogle was the founder of The Vanguard Group, which most people associate with low cost mutual funds. However, that is not how he stated. He graduated from Princeton University and went to work at Wellington Management Company, where he quickly rose through the ranks to Chairman. Although he was fired for a bad merger, he learned a huge lesson and went on to found The Vanguard Group.

With his new company and a new idea for index mutual funds, Bogle would grow The Vanguard Group into the second largest mutual fund company. Bogle likes to keep his investing style extremely simple, and has highlighted eight basic rules for investors:

- Select low cost funds

- Consider carefully the added cost of advice

- Do not overrate past fund performance

- Use past performance only to determine consistency and risk

- Beware of star managers

- Beware of asset size

- Don't own too many funds

- Buy your fund portfolio and hold it!

He even has dedicated followers known as bogleheads.

Check out his most well known book, The Little Book of Common Sense Investing, where he shares a lot of these views.

Estimated Net Worth: $80 Million

While his $80 million net worth may not seem like much, Vanguard has grown to managing over $5 trillion in assets.

Warren Buffett

Warren Buffett is widely regarded as the most successful investor in the world based on the amount of capital he started with and what he was able to grow it into. Prior to his partnerships, Buffett held various investment jobs, with his last earning him $12,000 per year. When he stated his partnerships, he had a personal savings of around $174,000. Today, he has turned that initial amount into around $100 billion!

Buffett's investment focus is very simple... buying companies for a low price, improving them via management or other changes, and realizing long term improvements in stock price (also known as value investing). He looks for companies he understands and keeps it very simple. Many have criticized him for avoiding tech companies and other industries, but by sticking to what he knows, he has been able to realize amazing returns.

Check out his biography, The Snowball: Warren Buffett and the Business of Life. It's one of my favorite books of all time.

Estimated Net Worth: $98 Billion

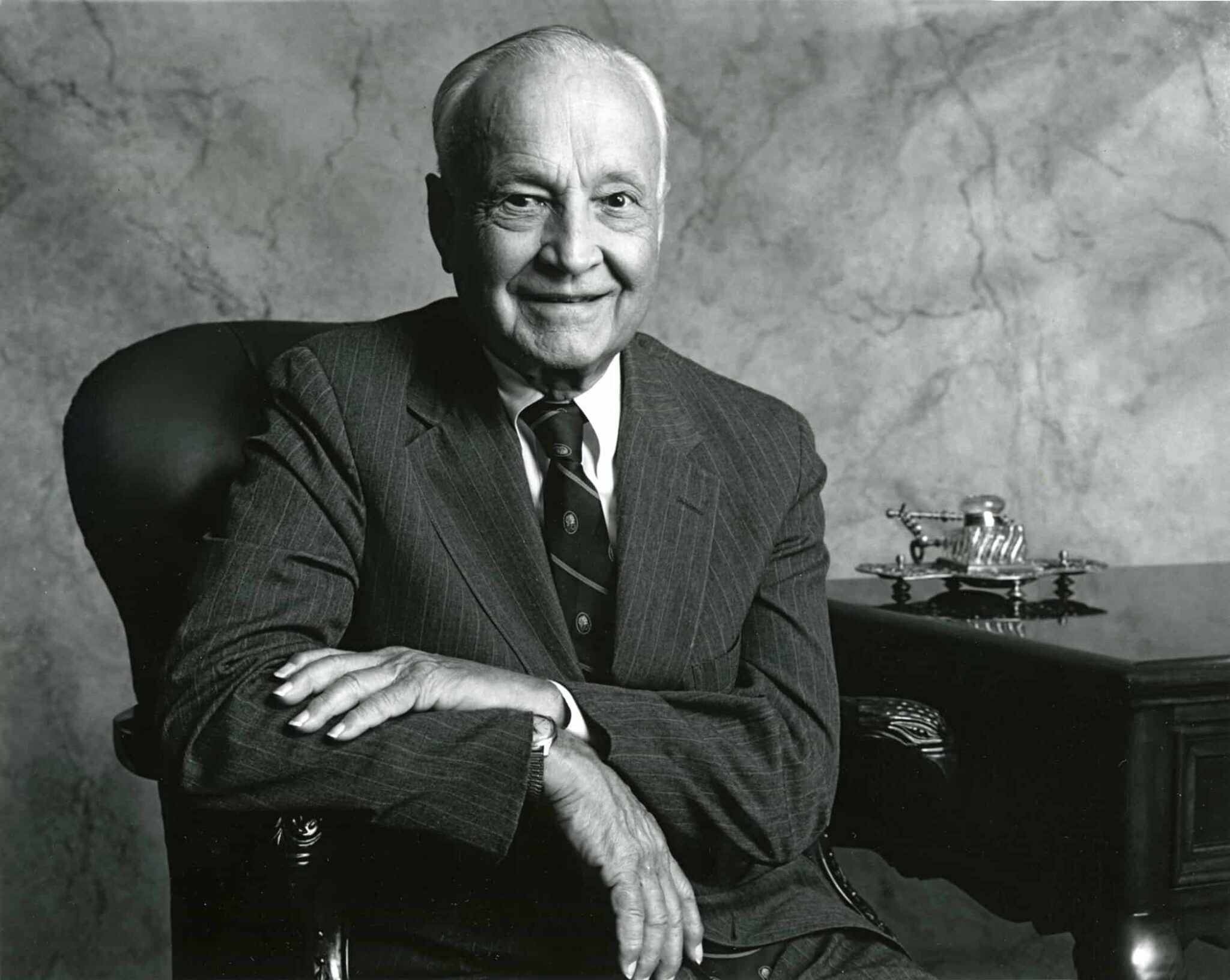

Philip Fisher

Philip Fisher is the father of investing in growth stocks. He started his own investment firm, Fisher & Company, in 1931, and managed it until his retirement in 1999 at the age of 91. Fisher achieved excellent returns for himself and his clients during his 70 year career.

Fisher focused on investing for the long term. He famously bought Motorola stock in 1955, and held it until his death in 2004.

He created a fifteen point list of characteristics to look for in a common stock and were focused on two categories: management's characteristics and the characteristics of the business. Important qualities for management included integrity, conservative accounting, accessibility and good long-term outlook, openness to change, excellent financial controls, and good personnel policies. Important business characteristics would include a growth orientation, high profit margins, high return on capital, a commitment to research and development, superior sales organization, leading industry position and proprietary products or services.

If you want to follow his lead more closely, his book is called Common Stocks and Uncommon Profits.

Estimated Net Worth: $5 Million

Benjamin Graham

Benjamin Graham is most widely known for being a teacher and mentor to Warren Buffett. It is important to note, however, that he attained this role because of his work "father of value investing". He made a lot of money for himself and his clients without taking huge risks in the stock market. He was able to do this because he solely used financial analysis to successfully invest in stocks.

He was also instrumental in many elements of the Securities Act of 1933, which required public companies to disclose independently audited financial statements. Graham also stressed having a margin of safety in one's investments - which meant buying well below a conservative valuation of a business.

He also wrote one of the most famous investing books of all time, The Intelligent Investor, where he spells out his investment philosophy.

Estimated Net Worth: $3 Million

It's important to note that his net worth at the time of his death was low because he had given away most of his money during his lifetime.

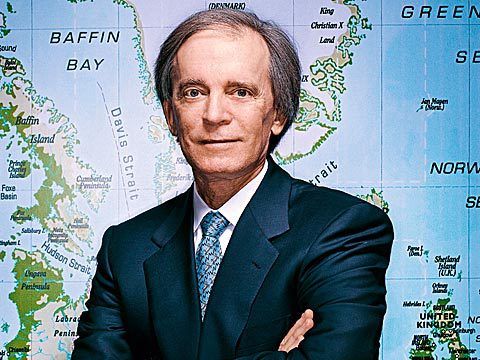

Bill Gross

Bill Gross is considered by many the "king of bonds". He is the founder and leading manager for PIMCO, and he and his team have over $600 billion under management in fixed-income investments.

While Bill's main focus is buying individual bonds, he has an investment style that focuses on the total portfolio. He believes that successful investment in the long-run rests on two foundations: the ability to formulate and articulate a long-term outlook and having the correct structural composition within ones portfolio over time to take advantage of this outlook. He goes on to say that long-term should be about 3-5 years, and by thinking this far out, it prevents investors from getting emotional whiplash of the day-to-day markets.

Estimated Net Worth: $2.6 Billion

John Templeton

John Templeton is the creator of the modern mutual fund. He came to this idea by his own experience: in 1939, he bought 100 shares of every company trading on the NYSE below $1. He bought 104 companies in total, for a total investment of $10,400. During the next four years, 34 of these companies went bankrupt, but he was able to sell the entire remaining portfolio for $40,000. This gave him the realization of diversification and investing the market as a whole - some companies will fail while others will gain.

John Templeton was described as the ultimate bargain hunter. He would also search out companies globally when nobody else was doing so. He believed that the best value stocks were those that were completely neglected. He also managed all of this from the Bahamas, which kept him away from Wall Street.

Estimated Net Worth: $1.5 Billion

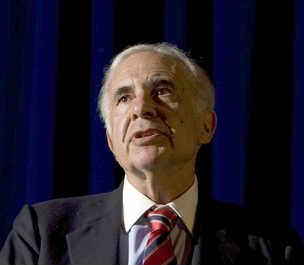

Carl Icahn

Carl Icahn is known throughout the investing world as either a ruthless corporate raider or a leader in shareholder activism. Your view, I guess, depends on your position within the company he is going after. Icahn is a value investor that seeks out companies that he believes are poorly managed. He tries to get on the Board of Directors by acquiring enough shares to vote himself in, and then changes senior management to something he believes is more favorable to deliver solid results. He has had a lot of success with this over the past 30 years.

While not true value investing, hr does focus on companies that are undervalued. He just looks for ones that are undervalued due to mismanagement - something he believes is pretty easy to change once you are in charge.

Estimated Net Worth: $17 Billion

Peter Lynch

Peter Lynch is best known for managing the Fidelity Magellan Fund for over 13 years, during which time his assets under management grew from $20 million to over $14 billion. More importantly, Lynch beat the S&P500 Index in 11 of those 13 years with an average annual return of 29%.

Lynch consistently applied a set of eight fundamentals to his selection process:

- Know what you know

- It's futile to predict the economy and interest rates

- You have plenty of time to identify and recognize exceptional companies

- Avoid long shots

- Good management is very important - buy good businesses

- Be flexible and humble, and learn from mistakes

- Before you make a purchase, you should be able to explain why you are buying

- There's always something to worry about - do you know what it is?

Estimated Net Worth: $450 Million

George Soros

George Soros is most commonly known as the man who "broke the Bank of England". In September 1992, he risked $10 billion on a single trade when he shorted the British Pound. He was right, and in a single day made over $1 billion. It is estimated that the total trade netted almost $2 billion. He is also famous for running his Quantum Fund, which generated an average annual return of more than 30% while he was the lead manager.

Soros focuses on identifying broad macro-economic trends into highly leveraged plays in bonds and commodities. Soros is the odd-man out in the Top 10 Greatest Investors, has he doesn't have a clearly defined strategy, more of a speculative strategy that came from his gut.

Estimated Net Worth: $7 Billion

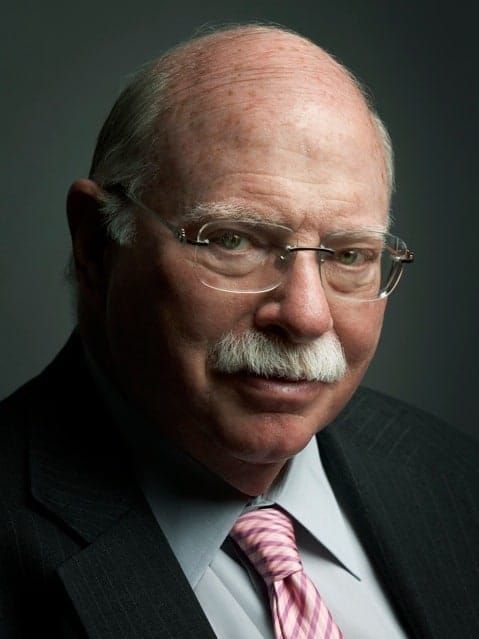

Michael Steinhardt

This is another investor that few will recognize outside of Wall Street. Steinhardt achieved a track record that still stands out on Wall Street: 24% compound average annual returns - more than double the S&P500 during the same period - over 28 years! What's more amazing is that Steinhardt did it with stocks, bonds, long and short options, currencies, and time horizons ranging from 30 minutes to 30 days. He is credited with focusing on the long-term, but investing in the short term as a strategic trader.

Later in life he told of the six things that investors need to stay grounded:

- Make all of your mistakes early in life. The more tough lessons early on, the fewer errors you make later.

- Always make your living doing something you enjoy.

- Be intellectually competitive. The key to research is to assimilate as much data as possible in order to be to the first to sense a major change.

- Make good decisions even with incomplete information. You will never have all the information you need. What matters is what you do with the information you have.

- Always trust your intuition, which resembles a hidden supercomputer in the mind. It can help you do the right thing at the right time if you give it a chance.

- Don't make small investments. If you're going to put money at risk, make sure the reward is high enough to justify the time and effort you put into the investment decision.

Estimated Net Worth: $1.2 Billion

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor