In anticipation of possible interest rate changes by the Fed, there are some interesting investment opportunities. When people panic-sell, they don't think about the true value of investing - instead, they are looking to lock-in a profit or avoid losing a little bit of cash. But long term investors should take notice - take notice of the book value, that is.

You see, in the panic to avoid losing money from rising interest rates, many stocks and mutual funds suddenly started trading below their book value, and this could make for a good future investment.

What is Book Value?

The book value of a company is exactly what it sounds like - the total assets on the balance sheet minus the liabilities. In theory, this is the net worth of the company, and it's what shareholders actually own. If the company ceased to exist, paid off its bonds, this is the amount of money that would be left to pay the shareholders.

Another way to look at book value is to compare it to its stock price. If the stock price is way over book value, it could be over-priced. However, realize that stock prices factor in future earnings, while book value just looks at current assets.

However, the opposite is true as well - a stock that trades under book value is theoretically worth more than people are currently paying for it on the stock market. Once again, it doesn't take into consideration future earnings, but it could be an interesting metric to look at.

Why Book Value Matters (Especially to Buffett)

Book value matters because it's what the company is worth. It's not the only value of what a company is worth, but it's a useful one.

In fact, Warren Buffett, in his letters to shareholders, almost always looks at the book value of Berkshire Hathaway, especially when talks of stock buy backs or dividends arise. In 2012, Buffett issued a share buyback of Berkshire Hathaway stock at 116% of current book value. His reason? He felt that the intrinsic future value of the company would be worth much more than that investment.

When Book Value Doesn't Matter

That gets us to when book value doesn't matter - intrinsic value. Share prices of companies regularly exceed book value when investors believe that there is some intrinsic value that is worth much more than the company currently is. For example, future earnings. Let's say the company is only making $100 today, but if investors believe that it will soon be making $1,000 on the same operating costs, they would buy up the stock price.

However, fear sometimes drives investors out of stocks, which in turn can drop the share price below book value. A good example of this was the financial crisis. During the peak of the Wall Street sell-off in 2007, Goldman Sachs had a book value of around $84. However, at its lowest share price, the company traded for around $50. If you would have bought at that price, you'd be sitting on a nice $100 gain per share at this point.

Some Current Examples

There are two main areas (probably more), where there are fears pushing securities below book value: the REIT market and Closed-End Funds.

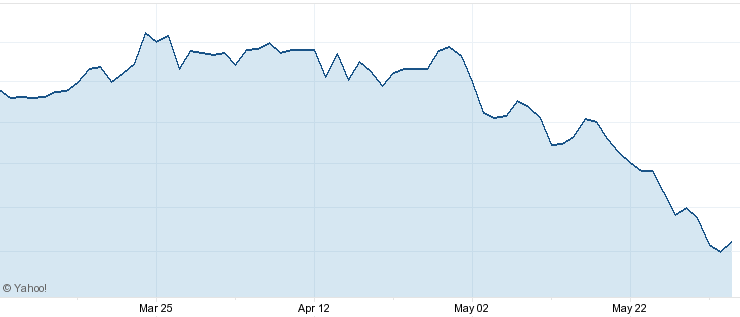

In the Mortgage REIT market, investors are incredibly scared that the Fed is going to stop Operation Twist. There isn't much fear about a rise in short term rates, but there is a fear about rising long term rates. As a result, there was a huge sell off during the second half of May. Many of the top Mortgage REITs, like Annaly (NLY) and American Capital Agency (AGNC), are now trading below their book values.

The fear in this market is that bond prices inside these funds will drop, thus lowering book value. So the risk is this - are investors selling in fear, or are they selling in anticipation of the companies announcing a drop in book value?

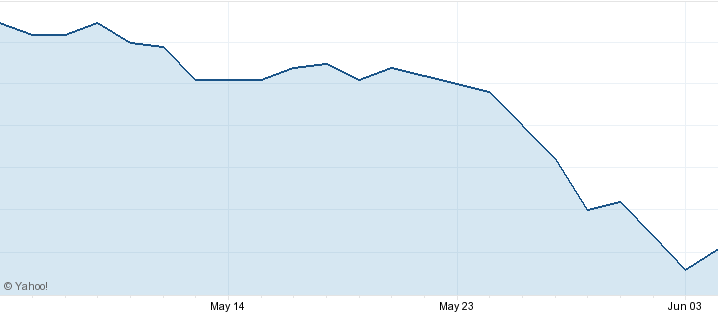

The other area where there could be potential opportunities lies with closed end funds. Like we've talked about before, closed end funds invest in niche specialties in the market - fixed income, special types of bonds and securities, or specific real estate investments. Many of the same fears that pushed down the REIT market have also pushed down the closed end fund market:

The chart above shows a popular closed end fund (AllianceBernstein Income Fund - ACG) mimicking the sell off of the mREIT market. The pressure from the potential to lose low interest rate funding has spooked a lot of investors out of these securities.

So Is Now The Time to Invest?

The real question is - is it a fear-based or founded sell off? I think that in the mREIT sector, it is a fear based sell-off. The Fed has announced that it will end Operation Twist first - which will make long term interest rates rise. However, as long as unemployment remains high and there is economic uncertainty, the Fed has mentioned it will keep short term rates near 0%. The result? This makes for potentially amazing returns on mREITs. Remember, these funds make money from borrowing in the short term to buy long-term loans that pay a higher interest rate. If they can borrow cheaply, and loan rates rise, these companies profit more.

In the tumultuous short-term, hedging could reduce profits since the market is shaky, but I think as it pans out over the medium term, the Fed's actions will ultimately help the mREIT market, not hurt it. So, this fear selling could be a buyers opportunity.

Closed-end funds are a little tougher to figure out, since they are so diverse. The key is to look at funding sources, leverage, and interest rate implications on future profitability. If the name of the game is a rate-spread play, the profitability of that will improve with time. However, if the fund is depending on the fixed income return of long-term bonds, the fund will suffer in the short term.

What are your thoughts? Does book value matter? Should you invest in mREITs or other companies trading below book value?

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Chris Muller