In the spirit of favorable combinations like cell phones and internet access, HoneyBricks fuses two financial trends of today, blockchain and crowdfunded real estate investing. If you’re interested in the power of what these trends can do together, HoneyBricks may be for you.

However, get to know how this combination works, since its “tokenized” real estate assets come with their own set of complications. Find out if HoneyBricks is right for you by learning how it works.

What Is HoneyBricks?

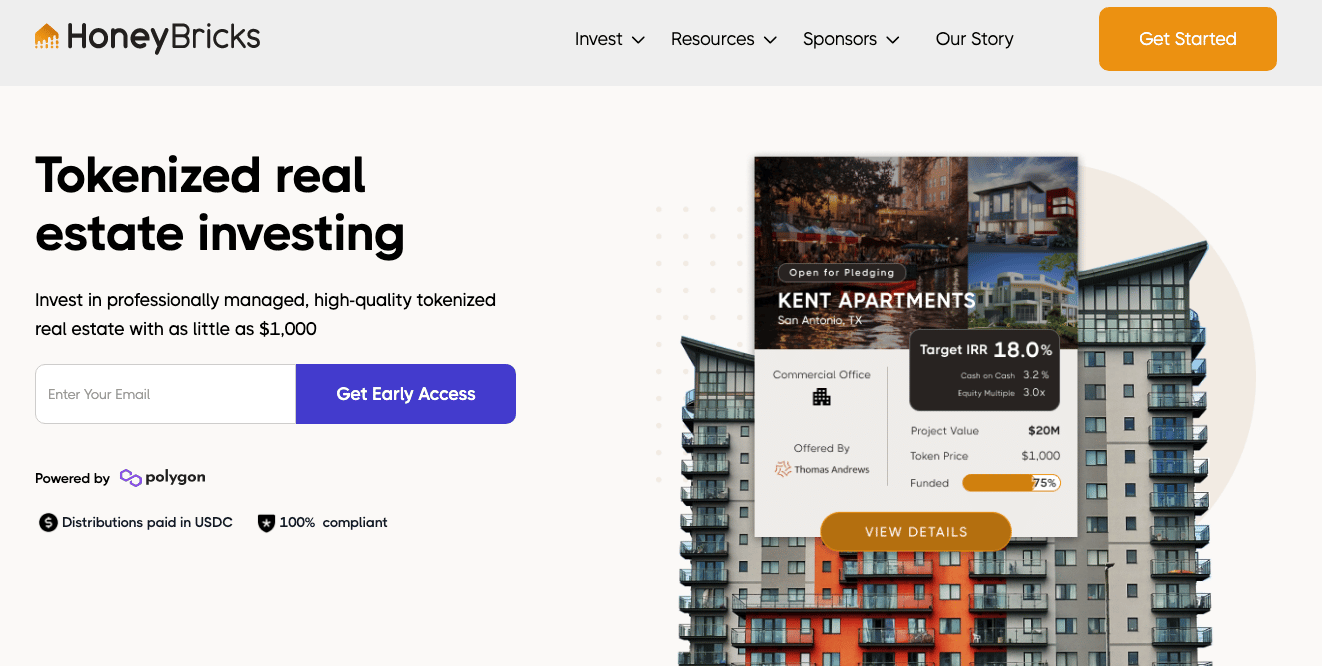

HoneyBricks is the world’s first crypto, crowdfunding real estate mashup. The company invests in large real estate projects as the “master partner.” According to the site, HoneyBricks “connects investors with high-quality commercial real estate opportunities through asset-backed security tokens.” The platform enables fractional shares of the ownership and token holders can distribute them directly to their crypto wallets.

Prospective investors can buy into the investment stream by purchasing HoneyBricks’ tokens via the blockchain. Those tokens can be sold after 12 or more months.

While there have been a few small-scale attempts to merge digital and physical ownership, HoneyBricks platform represents one of the largest test cases for the power of blockchain outside of the “metaverse.”

Regardless of whether you invest in one of HoneyBricks’ projects, the company is worth watching to see how this innovation unfolds.

What Does It Offer?

HoneyBricks is a crowdfunding real estate platform that issues ownership through tokens. These tokens represent ownership in a real estate investment trust, or REITs, a real estate investment structure where a general partner has full ownership of investment decisions. The idea is that these tokens will produce dividends and capital gains.

Ownership In Private REITs

As a HoneyBrick investor, you’re buying shares of privately held REITs. The token you receive represents an ownership stake as a Limited Partner in HoneyBricks’ REITs.

Buy And Sell HoneyBricks Tokens

HoneyBricks allows you to buy shares of its REITs directly from your crypto wallet. You can pay using crypto or fiat currency but you must hold your shares for at least 12 months. After that, you can sell your shares back to HoneyBricks or you can sell them in the secondary market. Because the assets are digital, you can transfer them quickly and directly to the highest bidder.

Receive Distributions In Crypto

HoneyBricks pays distributions (which include dividends and return of principal) to your crypto wallet. You can receive distributions in USDC or any other supported cryptocurrency. The ability to receive payments in alternative currencies can help you build out a well-rounded crypto portfolio.

Borrow Using Tokens As Collateral

HoneyBricks allows you to borrow money using your HoneyBricks tokens as collateral. The interest rate on the loan ranges from 4 to 12% depending on a variety of factors. Since your tokens remain invested, this loan is likely better than a 401(k) loan or another loan where your assets serve as collateral for the loan.

Minimum Holding Period Is A Year

According to the law, any assets you buy through HoneyBricks are subject to a 12-month holding period. After the holding period is up, you can sell your HoneyBricks tokens to anyone who wants to buy them from you. You can also choose to hold the tokens. Most of the projects on HoneyBricks have expected payoff periods ranging from three to six years.

Are There Any Fees?

The downside of HoneyBricks crypto and real estate collaboration are the mashup of fees. Unfortunately, you can expect to pay the typical crypto and crowdfunding investment real estate fees. These are the main ones you can expect to pay:

- Transaction Fees: HoneyBricks charges when you buy and sell HoneyBricks tokens. The fee covers the cost of maintaining the blockchain. These fees can range from 0.05% to 0.2% of all transactions.

- Management Fees: When you’re invested in a REIT, management fees can eat up a substantial portion of returns. The management fees that HoneyBricks charges vary by investment opportunity, but a typical fee on the platform is around 1% annually.

How Do I Contact HoneyBricks?

HoneyBricks advertises its primary contact information as an email—investments@honeybricks.com.

The HoneyBricks website also has a human chat functionality in the lower right corner of each webpage. It’s unclear if the chat is monitored constantly, as no specific hours are posted.

The company’s headquarter location is 1700 Van Ness Ave, #1351, San Francisco, CA,94109.

How Does HoneyBricks Compare?

HoneyBricks is the first company to combine real estate investing and cryptocurrency, but it has several close competitors in the real estate crowdfunding space.

One important thing to note is that if you’re not an accredited investor, you can’t invest through HoneyBricks. Consider Concreit, Fundrise, or Realty Mogul as alternative crowdfunding sites with excellent offerings. These are great sites for accredited investors too. Compared with HoneyBricks, these three sites tend to have excellent deal flow.

These companies also offer fairly good liquidity opportunities. Concreit typically honors requests to withdraw money as you make the requests. Fundrise and Realty Mogul both have quarterly liquidity opportunities or secondary markets that make withdrawing funds possible.

Header |  | ||

|---|---|---|---|

Rating | |||

AUM Fees | 1.00% | 1.00% | 1.00% |

Min Investment | $1,000 | $1 | $500 |

Open To Non-Accredited Investors? | |||

Cell |

How Do I Open An Account?

To open an account, select the “Get Started” button on the HoneyBricks website. You’ll need an email address, and basic information about your residency, your full name, and whether you’re an accredited investor.

At this time, only accredited investors within the U.S. and people outside of the U.S. can invest through HoneyBricks.

If you qualify and successfully open an account, you’ll have the opportunity to view open deals and buy tokens. You won’t receive tokens until you’ve paid and signed documents to affirm the deal structure.

Is It Safe And Secure?

HoneyBricks collects information from users on a need-to-know basis. It will only collect the “Know Your Customer” information if you request information or if you intend to buy a token through the site.

The use of Blockchain for transferring ownership dramatically reduces the likelihood that your shares of assets could be stolen or transferred without your knowledge.

HoneyBricks takes security very seriously, but even crypto exchanges and other blockchain-based technologies have suffered breaches. If you choose to invest on the site, it is wise to store your tokens in a cold storage wallet instead of in a digital wallet.

Is It Worth It?

HoneyBricks has the potential to be the future of real estate transacting. At this time, however, you can likely expect returns comparable with other crowdfunding real estate companies.

If you choose to invest in HoneyBricks, be sure to use other crowdfunding sites to build a well-diversified real estate portfolio.

Overall, HoneyBricks’ concept seems like a promising technology for security tokens and how it’ll impact the real estate industry. However, HoneyBricks’ lack of liquidity and limitations of only being open to accredited investors may make it a sub-par investment choice for you. Furthermore, you may face additional tax complications as a result of transacting both in fiat and crypto-assets.

HoneyBricks Features

Account Type | Individual |

Minimum Investment | $1,000 per token or REIT |

Management Fees | Varies by investment, but typically 1% |

Transaction Fees | .05% to 0.2% |

Investor Requirements | Must be a U.S.-based accredited investor |

Investment Type | Asset-backed security tokens |

Withdrawal Term | Minimum holding is 1 year |

Customer Service Email Address | investments@honeybricks.com |

Customer Service Phone Number | None |

Company Address | 1700 Van Ness Ave., #1351, San Francisco, CA 94109 |

Mobile App Availability | None |

Promotions |

HoneyBricks Review: Blockchain And Crowdfunded Real Estate In One App

-

Pricing and Fees

-

Ease of Use

-

Customer Service

-

Products and Services

Overall

Summary

HoneyBricks fuses two financial trends of today, blockchain and crowdfunded real estate investing. Find out if HoneyBricks is right for you by learning how it works.

Pros

- More opportunities to sell HoneyBricks tokens in a secondary market

- Income can be paid in any cryptocurrency

- Buy as little as $500 to $1000 in real estate investment trust shares

Cons

- Limited investment availability (currently a waitlist for the opportunity to buy)

- Pay asset management fees and crypto fees

- Must be an accredited investor in the U.S. to apply

Hannah is a wife, mom, and described personal finance geek. She excels with spreadsheets (and puns)! She regularly explores in-depth financial topics and enjoys looking at the latest tools and trends with money.

Editor: Claire Tak Reviewed by: Robert Farrington