Wealthfront was one of the first robo-advisors, and has grown into a full-service investing and banking platform.

Wealthfront offers automated investment management services, financial planning options, high-yield cash accounts, and lines of credit for clients with brokerage accounts.

Since it's one of the largest robo-advisors based on assets under management, it's probably one of the options you should consider if you're looking for automated investing or automated guidance.

In this space, the big players are Betterment, SoFi Wealth, and Wealthfront. See how Wealthfront compares and whether it makes sense for you to invest. You might also look at how they compare to the best online robo-advisors.

Wealthfront also has a savings account. It currently offers 5.00% APY with no fees! Check out the Wealthfront Cash Account here >>

Wealthfront Details | |

|---|---|

Product Name | Wealthfront |

Min Investment | $500 |

Annual Fee | 0.25% AUM |

Account Type | Taxable, IRA |

Promotions | $50 Bonus |

How Does Wealthfront Work?

Wealthfront’s primary product is automated portfolio management. It uses an investment philosophy called Modern Portfolio Investing to help clients invest their assets. Modern Portfolio investors believe that it’s really hard to beat the market. As a result, these investors try to manage portfolio volatility and keep costs low.

Wealthfront is an investing platform for prudent investors who want to see their money grow, but don’t want to spend much time thinking about their investments. First, Wealthfront always starts with your goals and your risk tolerance. Wealthfront asks 4 objective questions, and six subjective questions. Then after assessing your risk, Wealthfront allocates your investments between stocks, bonds and other asset classes.

If you have more than $100K at Wealthfront, they will allow you to use value add features that are part of their PassivePlus investment suite. PassivePlus is a first of its kind suite of tax efficient passive investment products that includes Smart Beta. Smart Beta investing tries to used decreased downward portfolio volatility (Beta) to increase portfolio returns (Alpha).

It’s clear that Wealthfront’s captures systemic tax advantages. Wealthfront also makes the case that their five-factor investing model combined with indexing boosts returns. That’s a claim you would have to investigate on your own. I don’t buy into the factor investing model as a long term sustainable advantage (although I admit it worked in the past).

These are the elements of Wealthfront’s PassivePlus program:

- Tax Loss Harvesting: Wealthfront’s algorithms check for daily capital loss opportunities. Over the course of a year, an investor can claim a tax credit for $3000 in capital losses, plus you can offset any gains with losses. Wealthfront virtually guarantees that you’ll never pay the government more than you have to. If you’ve got a big after-tax brokerage account, you should take advantage of tax loss harvesting. For accounts over $100,000 this is available at the stock level rather than an ETF level. Stock level tax harvesting is also known as direct investing.

- Stock-Level Tax-Loss Harvesting: Available for no extra cost to taxable accounts over $100,000, Stock-level Tax-Loss Harvesting is an enhanced form of Tax-Loss Harvesting that looks for movements in individual stocks within the US stock index to harvest more tax losses and lower your tax bill even more.

- Risk Parity: Risk Parity, also known as mean variance optimization helps investors more effectively weigh volatility against expected returns. This feature costs an additional .03% annually and is only available for portfolios over $100,000.

- Smart Beta: Wealthfront isn’t completely straightforward about what’s in their “Secret sauce,” but their newest algorithm is clearly based off of the well-renowned five factor investing model. Smart Beta accounts for Value, Momentum, Dividend Yield, Low Volatility, Volatility relative to the market. Historically, a Five Factor model would not only beat the market, it would reduce portfolio volatility. It’s not clear that it’s true today. Smart Beta is available for portfolios over $500,000.

What Are Its Plans And Pricing?

Wealthfront charges 0.25% per year for all of its portfolios. If you have a portfolio under $100,000 you’ll also pay 0.07-0.16% per year for fund fees. With direct investments, you won’t have to pay the fund fee.

If you want to start an automated savings plan, you can link your Wealthfront account directly to a checking or savings account.

Wealthfront supports the following types of investment accounts:

- Traditional IRAs

- Roth IRAs

- SEP IRAs

- IRA transfers

- Rollover 401(k)

- 529 plans for college

- Individual and joint taxable brokerage accounts

What Other Features Does It Offer?

Wealthfront’s newest features include free financial planning software, a high-yield cash account, individual stock investing, and a portfolio line of credit. This is what you should know about these features.

Wealthfront’s Free Financial Planning Software

Wealthfront offers free financial planning software to anyone who wants to use it. You don’t have to be a Wealthfront customer to use it.

The software connects directly to user’s financial accounts, so users can easily track their goals. If you’ve never set financial goals before, Wealthfront has a Financial Health Guide which provides a framework for helping you think about your financial and life goals.

Using the free software, you can make informed tradeoffs. The app helps you answer questions like: Should I take time off work now and work a few years longer before full retirement?

The software still can’t tell you exactly which questions to ask, so it doesn’t have quite the same value as a CFP or financial coach, but it will help you move in the right direction. This is one of the better free planning tools that I’ve seen, but if you want to work with a human, not a bot you’ll need to find an alternative. Consider connecting with a financial coach at the Financial Gym or with a planner form the XY Planning Network.

Wealthfont Cash Account

Wealthfront launched Wealthfront Cash Account as the next important step towards automating all of its client’s finances. Cash Account is a secure place to stow away cash you may plan to invest, spend within a few years or use in an emergency.

The account offers an interest rate of 5.00% and is FDIC insured for up to $8 million for individuals and $16 million for joint accounts through partner banks. That’s above the national average interest rate and eight times the insurance you’d receive at a traditional bank. Wealthfront clients can open a cash account with as little as $1.

A cool feature of the Cash Account is that you can deploy this money into your Wealthfront Brokerage account within minutes. Unlike other companies where investing takes forever, you get your cash working for you faster.

The account isn’t subject to any market risk and offers unlimited and free transfers all for no fees.

This account is separate from a regular managed account, so there is no management fee.

Stock Investing

In March 2023, Wealthfront announced a new stock investing account, giving its members the ability to purchase individual stocks. Like the best online brokers, the account features fractional shares, no commissions on trades, and a low $1 account minimum.

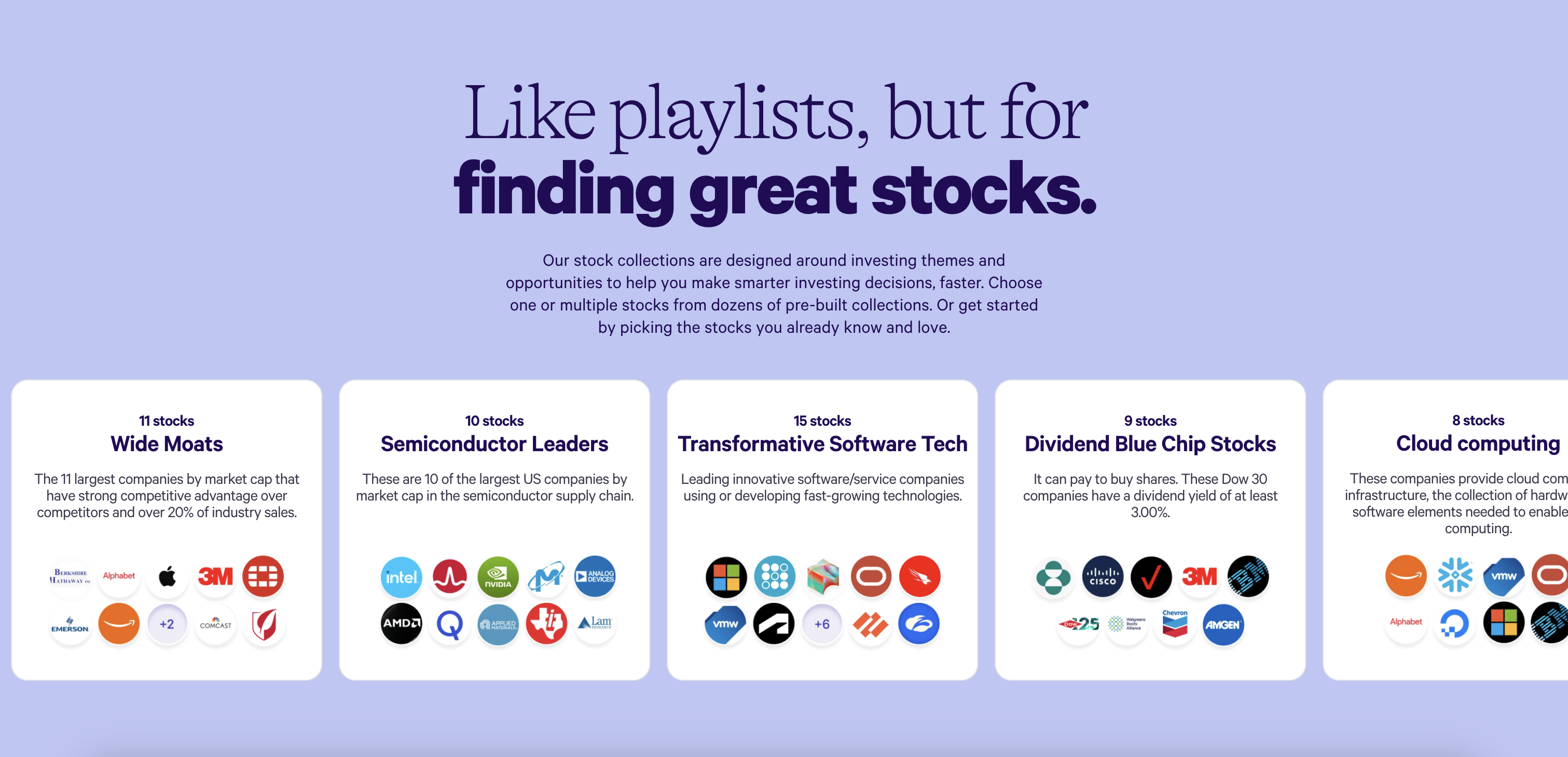

Comparing its stock search tool to a music playlist, Wealthfront makes it easy to find the companies you want to invest in. You can browse various collections of stocks, such as Semiconductor Leaders, Transformative Software Tech, Dividend Blue Chip Stocks, Cloud Computing Stocks, etc.

Portfolio Line Of Credit

If you’ve got at least $25,000 in a taxable brokerage account, you’re eligible for a portfolio line of credit worth 30% of your account value. The loan is secured by your account, so the rates on the loan are often below most home equity lines of credit. You can pay back the loan on your own schedule, but interest accrues until the loan is paid in full.

This sounds like a great loan, but I’m skeptical about borrowing against assets in general. If you’ve got investments in a taxable brokerage account, and you need money to start a business or buy a car, you should probably liquidate the account to pay for your needs.

Still it should be noted that Wealthfront's interest rates are highly competitive. Depending your account size, the rate you receive will range from 7.65% - 8.90%. If you're considering this option, you should see how it compares to a similar service called M1 Borrow.

How Does Wealthfront Compare?

Wealthfront is not the only robo-advisor in town. However, it's now one of the largest, and that's due in part to its great features at solid pricing.

See how Wealthfront fully compares and why we list it as a top robo-advisor here. Or check out this quick comparison below:

Header |  | ||

|---|---|---|---|

Rating | |||

Annual Fee | 0.25% | 0.25% to 0.40% | 0.15% to 0.30% |

Min Investment | $500 | $0 | $3,000 to $50,000 |

Advice Options | Auto | Auto and Human | Auto and Human |

Banking? | |||

Cell |

Wealthfront Promotions

Right now, Wealthfront is offering a promotion of $50 when you open and fund a taxable investment account with at least $500 and maintain the funds for 7 days.

See how this promotion compares with other investing bonus and promotional offers.

How Do I Open An Account?

You can visit the Wealthfront website to get started with opening an investment account. You'll have to complete a short questionnaire which Wealthfront will use to decide which type of portfolio will be best for your financial goals and risk tolerance.

Once Wealthfront's automated algorithm have built your portfolios, you'll have the opportunity to edit some of the asset weightings if you'd like. Otherwise, you can move on to the final step of linking to your bank (or Wealthfront Cash account if you have one) and funding your account.

Generally, it will take 1-2 business days for ACH deposits to arrive and be invested. However, if you fund your investment account with a transfer from a Wealthfront Cash Account, the money could be invested within minutes (if the transfer is submitted between 10 AM and within an hour of market closing).

Is It Safe And Secure?

Yes, Wealthfront investment accounts are insured by the SIPC (up to $500,000) and its Cash accounts are protected by FDIC insurance (up to $250,000) through its partner banks. As far as data security goes, Wealthfront website is encrypted with HTTPS and it says that it submits to third-party security audits on an annual basis.

How Do I Contact Wealthfront?

When Wealthfront first launched, it proudly proclaimed that its algorithms were so well-crafted that clients would have no need to for human financial advice. And it has held stubbornly to that stance even while many of its competitors have added premium tiers that include unlimited CFP access.

You also won't find a customer service phone number, email address, or even a live chat function on Wealthfront's Contact page. However, you can find both by digging through its IRA Client Agreement. That document states that customers can reach Wealthfront's support team at 844-995-8437 or support@wealthfront.com.

Why Should You Trust Us?

I've been writing about investing and have reviewed brokerage firms since 2009. When Wealthfront launched in 2011, we were one of the first platforms that covered the "new" space of robo-advisors. And since then, we've reviewed most robo-advisor platforms in the United States.

Since then, I've regularly updated and tested the new features that Wealthfront has launched. Wealthfront is also consistently voted on by our readers each year when we survey the best robo-advisors.

Finally, our compliance team regularly checks and updates the rates in this review as needed.

Who Is Wealthfront For And Is It Worth It?

I’m quick to recommend Wealthfront to novice investors, and anyone who wants to outsource investing to an algorithm. The only automated investing platform that is less expensive is M1 Finance, and M1 Finance doesn’t have the robust investing theory that Wealthfront has.

The clearest advantage of Wealthfront is its ability to do systemic tax loss harvesting. Of course, that only matters in unsheltered tax accounts.

The biggest drawback to Wealthfront is an overemphasis on conservative asset classes. The asset allocation it suggested for me was very conservative despite my long time horizon to retirement.

Overall, Wealthfront is an excellent option, and it’s still one of my top recommendations for automated investing platforms.

Wealthfront FAQs

Let's answer a few of the most common questions we see online about Wealthfront:

Can you buy individual stocks on Wealthfront?

Yes, you can. In 2023, Wealthfront expanded into stock investing. In fact, their Stock Investing Account supports fractional shares, zero commissions, and has a low $1 account minimum.

Is Wealthfront good for beginners?

Yes, Wealthfront could be a great choice for new investors who want help with building and managing their portfolios but don't want to hire a dedicated financial advisor.

Does Wealthfront offer Solo 401(k)s?

No, Wealthfront doesn't currently support individual 401(k) accounts. However, it does offer SEP IRAs for self-employed investors in addition to Traditional and Roth IRAs for W-2 employees.

Does Wealthfront have hidden costs?

While Wealthfront certainly doesn't hide these costs, some investors may not realize that the ETFs used in its portfolios each have their own expense ratios. The average expense ratio for a taxable Wealthfront portfolio ranges from 0.07% to 0.16%.

Wealthfront Features

Account Types |

|

Minimum Investment | $500 |

Management Fees | 0.25% |

Average ETF Expense Ratios | 0.07% to 0.16% |

Socially Responsible Investments | Yes |

Access to Human Advisor | No |

Automatic Rebalancing | Yes |

Tax-Loss Harvesting | Yes |

Cash Account APY | 5.00% |

Portfolio Line Of Credit Interest Rates | 5.40% - 6.65% |

Customer Service Number | 844-995-8437 |

Customer Service Email | support@wealthfront.com |

Other Customer Support Options | Help Center |

Web/Desktop Account Access | Yes |

Mobile App Availability | iOS and Android |

Promotions | $50 Bonus |

Disclosure

The College Investor receives cash compensation from Wealthfront Advisers LLC (“Wealthfront Advisers”) for each new client that applies for a Wealthfront Automated Investing Account through our links. This may create an incentive that results in a material conflict of interest. The College Investor is not a Wealthfront Advisers client. More information is available via our links to Wealthfront Advisers.

Wealthfront Review

-

Commission & Fees

-

Customer Service

-

Ease Of Use

-

Tools & Resources

-

Investment Options

-

Asset Allocation Metholodgy

Overall

Summary

Wealthfront is one of our favorite robo-advisors because of their low fees, asset allocation strategy, and their different investment options.

Pros

- Solid AUM pricing at 0.25%

- Automatic rebalancing

- Great banking solutions

- DIY financial planning tools

Cons

- No option to access human advisors

- No custodial or Solo 401(k) accounts

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Ashley Barnett