Public is a commission-free investing app that focuses a lot on community and social networking.

In the race to free trading and fractional shares, there are new companies popping up all the time. But Public isn't new - it's actually a re-brand of one of the first app-based investing products called Matador.

However, they have cleaned up their app, made it easier to use, and continue to focus on their social network features. Plus, they offer commission-free investing and fractional share investing.

How do they compare now that most major brokerage firms also offer commission-free trading? Let's check it out in our Public investing app review.

Public Investing App Details | |

|---|---|

Product Name | Public |

Min Investment | $0 |

Commission | $0 |

Account Types | Taxable |

Promotions | Get up to $31,150* when you transfer your account from another brokerage. |

What Is Public.com?

Public is an app-based stock brokerage company that doesn’t charge commissions on trades. It was founded in 2017. There are four founders: Jannick Malling, Matt Kennedy, Peter Quinn, and Sean Hendelman.

The company’s legal name is Public Holdings, Inc. doing business as Open to the Public Investing, Inc., a registered broker-dealer and member of FINRA and SIPC. Public used to be called Matador but later changed the front-facing name of the company to Public.

On February 17, 2021, Public announced that it had raised $220 million in a Series D round at a $1.2 billion valuation. Investors included Accel, Greycroft, and Lakestar, Will Smith (via his Dreamers VC), Intuition Capital, Tiger Global, The Chainsmokers’ Mantis VC, and more.

In 2024, Public was named one of the best investing apps in our annual reader survey!

What Do They Offer?

Public.com is an investment platform where you can invest in any asset: from stocks, ETFs, crypto, fine art, collectibles, and more - all in one place, including fractional shares.

Public is also the first major investing platform to roll out Treasury Bills with on-demand liquidity. This means you can take advantage of their high yield rate of 5.3% (as of this writing), while being able to sell your T-bills anytime you want.

Beyond investing, Public gives you information about your portfolio through data, insights, and analytics to help you be a more informed investor.

Desktop And App-Based Experience

Public is available on both mobile and desktop (desktop support was recently added), and while many can say they prefer investing from desktop devices, their mobile app is available for iOS and Android.

The iOS app has a rating of 4.7/5.0 out of over 18,300 ratings. The Android app has a rating of 4.5/5.0 out of more than 13,200 ratings. Both apps seem to push out updates consistently.

Public Premium

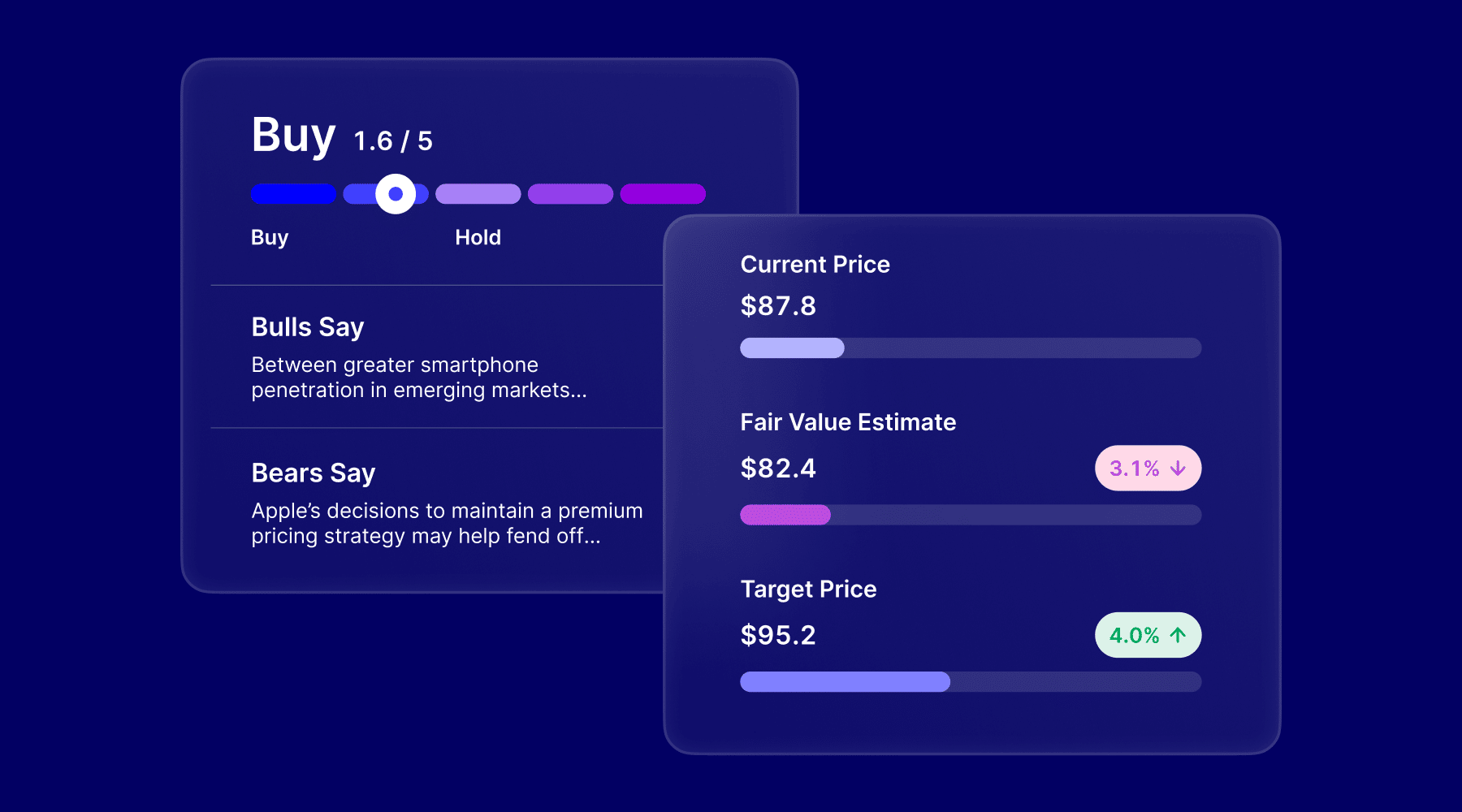

One new feature to Public is its Premium subscription that provides advanced data, portfolio management tools, and analyst insights to help investors make more informed decisions. Public Premium costs $10 per month (it's free if you have an account balance over $20,000) and provides the following perks:

- As a Public Premium member, you get unique data on all the companies you care about. Think of things like how many Teslas of a specific model have been delivered this quarter or Apple’s sales per continent, etc.

- You also get institutional-grade research from Morningstar, providing the bull and bear cases for many popular stocks, along with downloadable reporting on competitive pressures, business strategy, and more.

- Access to extended-hours trading—which adds an additional 5 hours trading time in the day for some stocks available for trading during extended trading hours.

- You can organize the assets in your portfolio into custom groups. Then, compare each group's performance side by side.

- When there’s a breaking story making the rounds, Public Premium’s expert analysts will give you the additional context you need with exclusive audio programming for Public Premium members only.

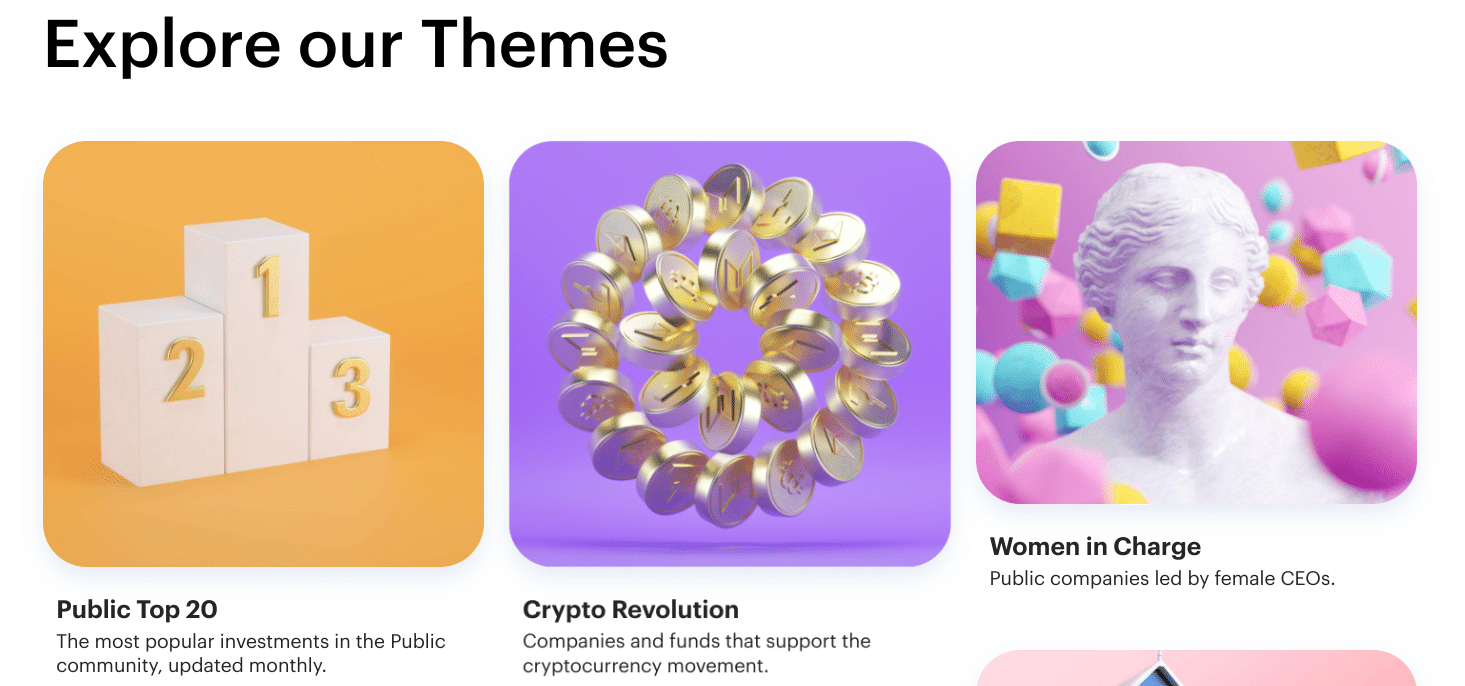

Themes

Moreover, Public organizes stocks within Themes to help people discover companies based on trends and personal interests. Themes include Green Power (green energy stocks and ETFs), Self-Driving Cars, Women in Charge (female-led companies), and dozens more.

You can also DM or build a group chat with other traders. There are a lot of chats around specific stocks, specific industries, and there are even chats that happen during earnings calls so investors can trade notes. This is chat designed for investors, so you can even embed custom charts.

Dollar-Cost Averaging And Fractional Shares

Dollar-Cost Averaging (DCA) can take the emotion out of investing. Instead of trying to time the market, it's all about building wealth over a longer term, and reducing the impact of market volatility. This way, you’re able to invest equal amounts of money on a regular basis—regardless of the market's ups and downs.

An example of this in practice can be with recurring crypto investments, which is especially helpful for investors who want to manage market risk with a dollar-cost averaging (DCA) strategy.

Public also supports crypto recurring investments. That means you’ll be able to automate the purchase of your favorite coins and tokens.

They are also one of a growing number of companies that allow you to invest in fractional shares - which means that you can get started investing in pricier stocks with less capital up front.

Public lets you buy fractional shares in stocks, ETFs, crypto, and alternative assets, all in one place.

However, Public acquired Otis, an alternative asset fractional share investing platform, in 2022. Public users are able to invest in fractional shares of assets like artwork, comic books, sports cards, NFTs, and other collectibles. Public is continuously keeping their alternative asset offerings fresh by being able to invest in assets like music royalties, real estate, wine, and even diamonds.

No Payment For Order Flow (PFOF)

As commission-free trading has quickly become an industry-wide standard, brokers have had to find other ways to make money. Some platforms have chosen to generate income by routing their trades to specific clearing firms. This revenue model is referred to as Payment For Order Flow (PFOF).

PFOF has been much maligned in the investing industry as many have said that it leads to a conflict of interest for brokerages. Despite this, it's still the primary revenue generator for several firms. However, Public isn't one of them. It announced on February 16, 2021 that it was officially a PFOF-free brokerage.

In an effort to replace some of the lost revenue, Public added an optional tipping feature on trades. To be clear, Public does not require any of its clients to leave a tip. But doing so is one way that clients can show their support for Public's desire to align their incentives with their customers.

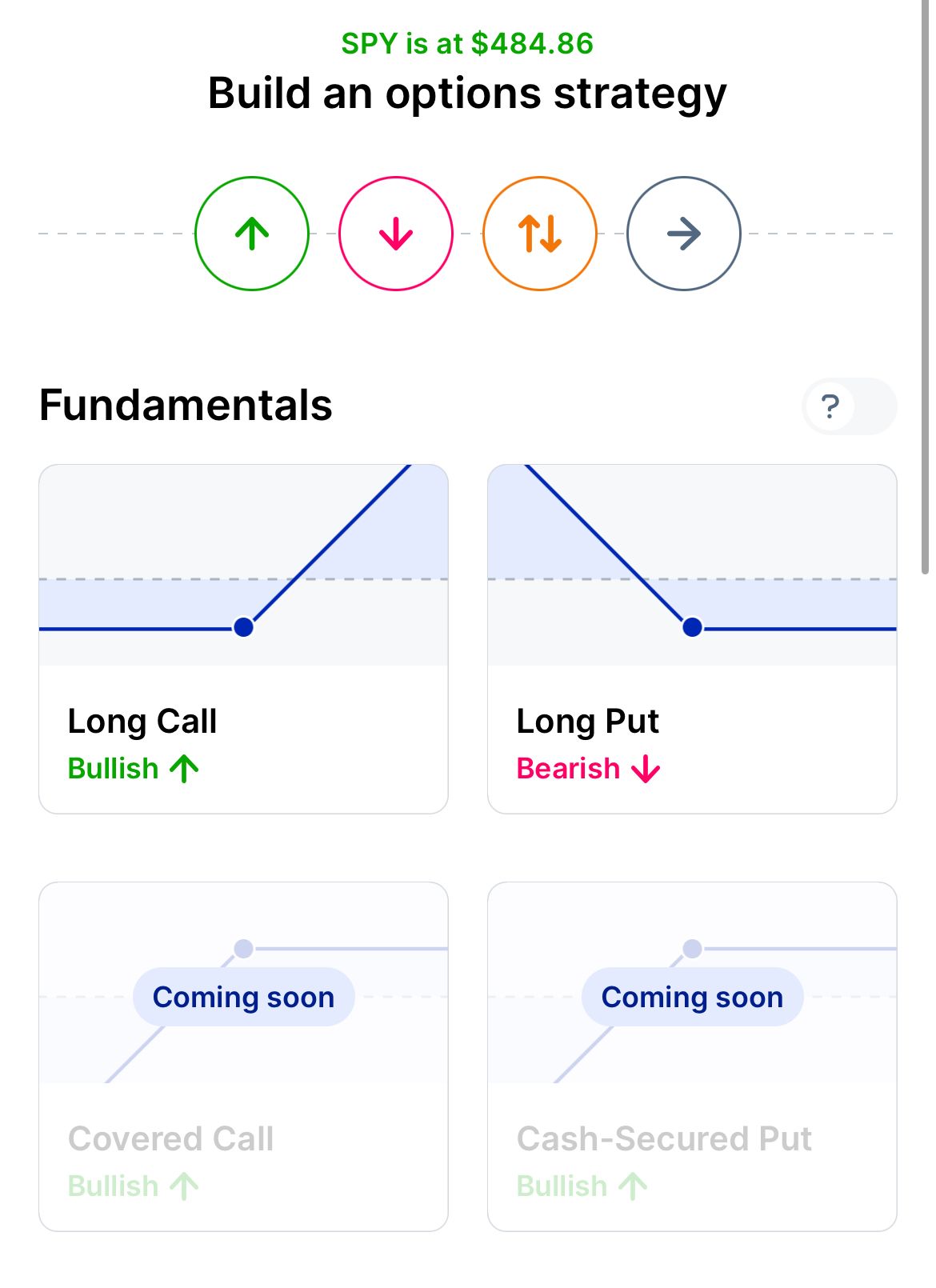

Options Trading

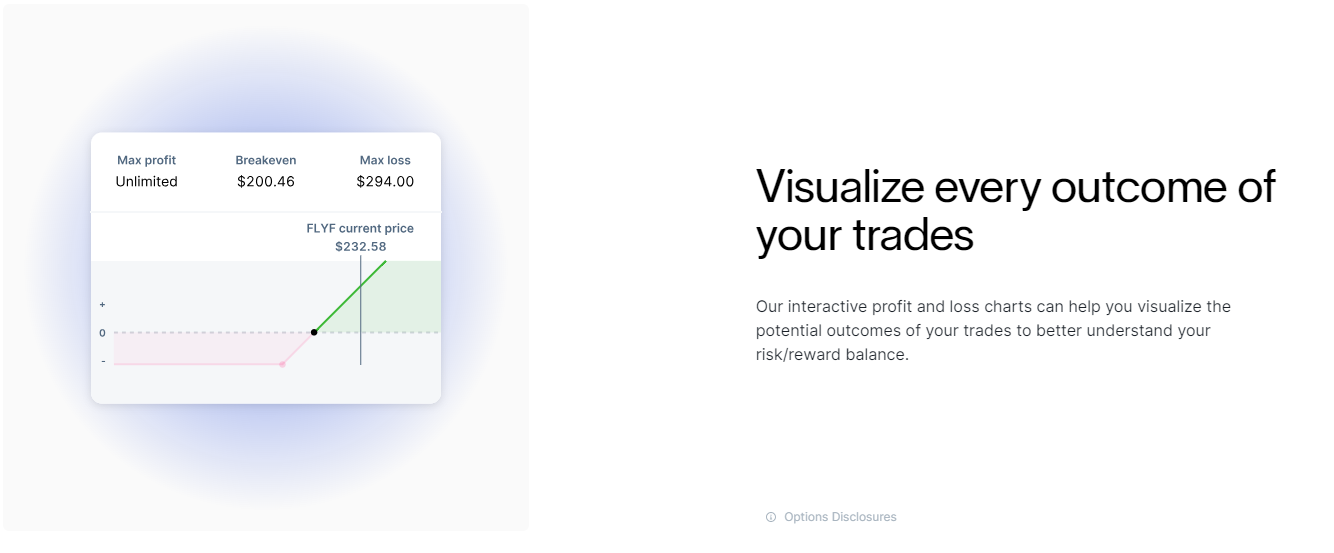

You can now execute options trading on Public. You'll have access to a strategy builder which allows you to plan your trades and predict potential outcomes.

Public has advanced charts that let you perform technical analysis, visualize your trades, and an options screener to help you find attractive options contracts.

The cost to execute an option is where things get really interesting. Public will share 50% of its options revenue with you.

Day Trading

For those who day-trade, Public may not be the best option. They allow periodic day trading. But if it's done all the time, the trader’s account will be restricted. Accounts that have four or more good faith violations will be restricted for 90 days by Public’s clearing firm, Apex Clearing. They also don't offer margin accounts.

If you are looking to trade, look for an app that specializes in trading like WeBull.

Cryptocurrency Investing

Public allows its users to invest in up to 7 different cryptocurrency options, including Bitcoin (BTC), Ethereum (ETH), Litecoin, and more.

However, Public does not offer a crypto wallet - this means you actually don't have control over your crypto, and can't use it to transact outside of the Public platform. As such, if you're really interested in investing in crypto, you should use a real cryptocurrency exchange.

Treasury And Corporate Bonds

Public is now offering Treasury Bonds. Their bond screener allows you to search over 10,000 Treasury and corporate bonds. You can sort by yield, maturity date, coupon, credit rating, and more.

There are no minimum hold periods or settlement days on U.S. Treasuries. And each corporate bond page has key financial information about the company, such as, debt-to-equity ratio and free cash flow so you can make informed decisions quickly and easily.

There is a flat 0.05% per month fee based on the average daily balance of your Treasury Account.

High-Yield Cash Account

Their high-yield cash account is a great place to store your uninvested funds. As of this writing this account earns a 5.10% APY and has no fees. There is a $20 minimum deposit required to open the account, but after that there are no minimum balance requirements.

Transfers from the high-yield cash account to your brokerage account happen instantly as long as you do the transfer between 7am and 8pm eastern time.

The account is also FDIC insured up to $5 million by spreading the funds around at partner banks, while the funds are being transferred they are covered by SIPC insurance.

Are There Any Fees?

Public is commission-free, but there may be small exchange fees incurred for trades. Additionally, there are fees for various services:

- All broker-assisted phone trades: $30

- Domestic wire transfer: $30

- Domestic overnight check: $35

- Returned check, ACH, wire and recall/stop payments: $30

- ACAT outgoing: $75

- Paper statements: $35

- Mark-up on crypto: 1-2%

How Do I Open An Account?

An account can be opened through the mobile app. You can download the mobile app for iOS or Android from https://public.com. Part of the application process includes an investor profile. This is standard across brokerages.

The requirements for opening an account are:

- Being 18 years of age

- Having a valid Social Security number

- Having a legal U.S. residential address

- Being a U.S. citizen or U.S. permanent resident, or having a valid visa

You can also transfer funds from another brokerage to Public, which Public does not charge a fee for. If the transferring firm does charge a fee, let Public know because for balances above $150, Public will cover the transfer fees from your former brokerage.

You can also fund the account with an ACH transfer from your bank. There is no minimum investment required. Note that Public charges $75 to transfer money out of Public to another brokerage.

You may not be able to withdraw money if funds have not yet settled from recent trades.

How Does Public Compare?

Public is not the only commission-free investing app. But they are one of the few options that allow fractional-share investing and their community features are different. However, it has fewer investment options than other brokers as it does not support mutual funds or bonds trades.

Check out how Public compares to some of the other popular apps here:

Header |  |  | |

|---|---|---|---|

Rating | |||

Commissions | $0 | $0 | $0 |

Min Investment | $0 | $0 | $0 |

Banking | |||

Cell |

Public Bonus Offer

Public is offering one of the most generous transfer incentive offers we've ever seen. For a limited time, Public will provide a custom transfer offer for members who move their stocks, ETFs, and/or cash, from another brokerage to Public.

Public's transfer offers are 2x higher than other brokerages, on average, and most offers are at least 2% of total portfolio value. It's estimated that 85% of users will get an offer of at least $20.

This table to show the range of bonuses you can earn dependent on the transfer amount:

Transfer Amount | Bonus Amount |

|---|---|

Under $,5000 | Up to $175 |

$5,000 - $24,999 | Up to $300 |

$25,000 - $99,999 | Up to $750 |

$100,000 - $249,999 | Up to $1,650 |

$250,000 - $499,999 | Up to $3,150 |

$500,000 - $999,999 | Up to $6,150 |

$1,000,000 - $4,999,999 | Up to $30,150 |

Is It Safe And Secure?

Yes — Public is a member of SIPC, which protects up to $500,000 in securities for each customer account. Public also uses AES 128-bit encryption and TLS 1.2 to secure data in transit.

How Do I Contact Public?

Public does not offer customer service by phone. However, it does provide live chat support from within the app. You can also email their team at hello@public.com. Their customer service hours are Monday through Friday, 9 AM and 5 PM (ET). Note that if you have a simple question, you may be able to find the answer on Public's FAQ page.

Is It Worth It?

There are similar commission-free brokerages available. Most have some social aspect and the quality of this social component is one thing that can really set these brokerages apart. Additionally, you may gravitate to the community of one brokerage and not the other.

There’s a low barrier to entry to find out if you like Public or not. App functionality will also play a role in your decision as Public gives you context around your portfolio through data, insights, and analytics. Is Public worth trying out? In our view, yes — it could turn out to be the one commission-free brokerage service that you enjoy the most.

Public FAQs

Let's answer a few popular questions about Public.

Does Public have a web platform?

Yes, Public recently launched a web platform which makes accessing statements and tax forms much easier.

Can you trade mutual funds on the Public app?

No, mutual funds, bonds, or any other assets besides stocks and ETFs aren't currently supported on Public's investing platform.

How does Public make money?

A few of the ways that Public is able to generate income include securities lending, optional tipping, and earning interest on uninvested cash balances.

Does Public offer any bonuses or incentives to new clients?

Yes, you can earn up to $30,150 when you transfer a new account to Public.

Public Features

Account Types | Taxable |

Tradable Assets |

|

Account Minimum | $0 |

Stock Commissions | $0 |

ETF Commissions | $0 |

No-Transaction-Fee (NTF) Mutual Funds | N/A |

Crypto Costs | 1-2% markup |

Basic Account Fee | $0 |

Miscellaneous Fees |

|

Margin Rates | N/A |

Banking Services | No |

Fractional Shares | Yes |

Customer Service Number | Not Available |

Customer Service Email | hello@public.com |

Customer Service Hours | Monday - Friday, 9 AM and 5 PM (ET) |

Web/Desktop Access Platform | Yes |

Mobile App Availability | iOS and Android |

Promotions | Get up to $30,150* when you transfer your account from another brokerage. |

DISCLOSURE

This does not constitute investment advice. Investing involves the risk of loss, including the potential loss of principal. Brokerage services for US-listed, registered securities available on Public are offered by Open to the Public Investing, Inc. (OTTP), a member of FINRA & SIPC, and a wholly-owned subsidiary of Public Holdings, Inc. Brokerage services for alternative investments are offered by the Dalmore Group, LLC, a member of FINRA & SIPC. Alternative investments are over-the-counter equity securities that have been issued pursuant to Regulation A of the Securities Act of 1933. Cryptocurrency trading is provided by Apex Crypto LLC (NMLS ID 1828849). Apex Crypto is licensed to engage in the virtual currency business by the New York State Department of Financial Services. New customers of OTTP receive free stock valued between $3 - $1,000 (0.3% receive the maximum value). *Cash bonus will be applied to qualifying accounts one (1) month after the transfer initiation date. Transferred funds must stay in your Public account for at least 6 months or the bonus will be revoked. Cash bonus terms and conditions are at public.com/transfer-account.

Public Review

-

Commission and Fees

-

Ease of Use

-

Customer Service

-

Products and Services

Overall

Summary

Public is an app-based investing platform that is commission-free, allows users to interact, and offers fractional shares.

Pros

- Commission-free trades

- Fractional shares (starting at $1)

- Social investing features

Cons

- Limited investment options

- No retirement accounts

- No phone-based customer service

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Colin Graves