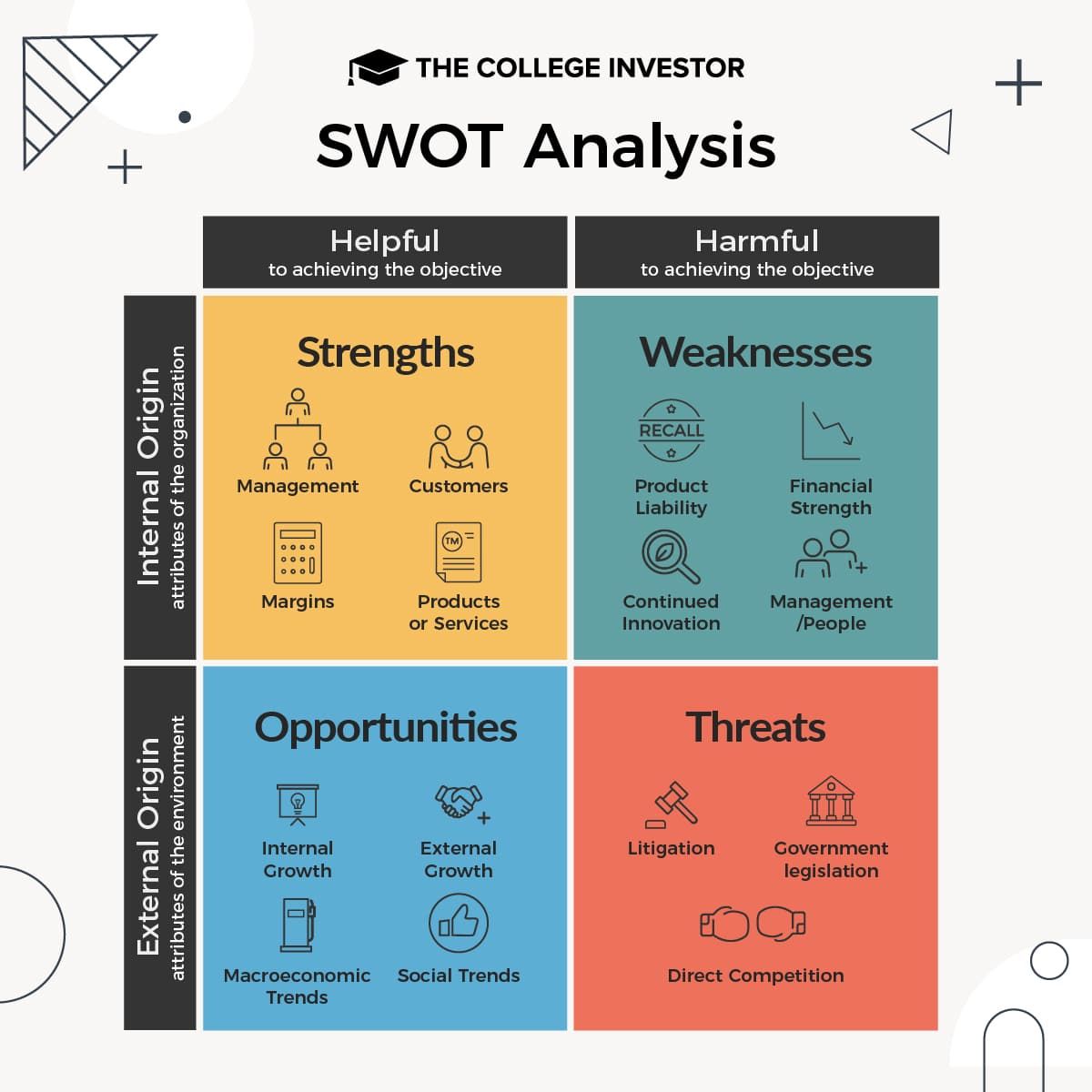

If you're thinking about investing in an individual stock or company, you need to do you research. Your research on a stock should have a solid framework that thinks about the company's strengths and weaknesses. That's where a SWOT analysis comes in. SWOT analysis is a strategic planning method that looks at:

- Strengths

- Weaknesses

- Opportunities

- Threats

It is commonly used in business development and marketing, but it is a great tool to apply to long-term investing strategies as well. When making any investment decisions about a company, you should carefully analyze these points. As such, here are different aspects to consider when making an investment in an individual company.

Here's how to conduct a SWOT analysis for investments:

Strengths

Understanding the strengths of the company you are investing in is a big deal. For many companies, leveraging their strengths is what has made them successful over the years.

For example, for many companies, it is rare there isn't a competitor in their space. Google is a prime example. It has been so successful because it has strength in developing a superior search product. Others try to compete, but are not as successful. The same is true for many companies.

Here are some potential strengths to consider:

- Management (or people, employees, research, etc.)

- Products or services (superior, patent-protected, quality, speed, etc.)

- Margins (reflection of operations, product, etc.)

- Customers (loyal customer base, need vs. want)

Every company and every market will have different strengths. For example, many tech and pharmaceutical companies rely on patent protection for their products. However, these patents are granted because of people or research, or maybe good acquisitions. It is important to know the reasons why and analyze the strengths.

Related: How To Buy Individual Stocks

Weaknesses

This is just as important as knowing the strengths of the company — the weaknesses will tell you the potential downfalls. Many times, it can be hard to figure out a company's weaknesses, because most companies work very hard to only show their strengths.

A good place to look for company weaknesses is in the annual report, especially the notes to the financial statements. It is in the section that the company discloses their potential liabilities, as well as where they see potential competition. With this information, you can gauge the company's weaknesses and make a more informed investment decision.

Here are some potential weaknesses to consider:

- Product liability

- Financial strength

- Management/people

- Continued innovation

Once again, depending on the market, every company's potential weakness will be different. For example, utilities don't have to worry about competition because they have a monopoly over their service area. However, regulation of utilities can impact financial strength, and can also create high liabilities in areas such as environment or safety.

Opportunities

This can be a hard one for individual investors to figure out. It basically means opportunities this company has to grow further, or otherwise increase profitability for shareholders.

Some companies can benefit from macroeconomic trends that are easy to spot. However, for other companies they can be difficult to spot. For example, it may have been hard to understand the opportunity Apple was pursuing with its first iPod, since it was such a revolutionary product.

Here are some common opportunities to think about:

- Internal growth opportunities (new markets, new product)

- External growth opportunities (mergers and acquisitions)

- Macroeconomic trends (resource scarcity; for example, oil)

- Social trends (social networking, the cloud, what's next?)

This is where reading through an entire annual report for a company can be so useful. Usually, in the first section (which is in color and printed on high-quality paper), companies will discuss what opportunities they are going after. This can be a good indicator of what to expect, and you can analyze it and decide on an investment based on your thoughts.

Related: How To Invest For Free

Threats

Finally, every investor needs to look at direct threats to their investments. This is more than just the weaknesses of the company — these are direct-impact items that everyone needs to pay attention to.

For example, a weakness of a toy company could be that it has high liability potential around selling toys to kids. However, the direct threat to the company can be pending litigation around toy safety.

Every company has threats, and these external factors need to be carefully considered by potential investors.

Some common threats include:

- Litigation

- Government legislation

- Direct competition

Once again, the notes to the financial statements can provide great insights into potential threats to the company.

Some good examples are: a class action lawsuit against tobacco companies, bans on drilling for oil and gas companies, or the creation of generic drugs for pharmaceutical companies. Each one of these examples highlights a threat to the company, the company's profitability, and as a result, the investment in the company.

Readers, do you do this type of analysis when considering an individual investment? Is there anything else you consider?

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Chris Muller