There is no "one size fits all" when it comes to the best investment strategy. But it's one of the questions I receive almost everyday.

From what do I invest in, to how to get started investing, to picking individual stocks, everyone is looking for a magic investment strategy that will make them millionaires overnight.

The truth is that doesn't happen. You invest in stocks because over the long run, investing in the stock market has outperformed other investments. But that doesn't mean you should invest everything in stocks.

Here's how to craft the best investment strategy and why you should always think about your portfolio and all your money as a whole. While we call this the investment strategy by age guide - your age is really subject to your investment time horizon. Check it out below.

Risk and Return by Asset Class

The first thing to remember when it comes to investing is that risk and return are always correlated. What this means is, if you want to earn more (i.e. have a higher return), you're going to have to accept higher risk (i.e. you might lose money).

Also, past performance doesn't guarantee future returns. That means just because something returned X% in the past, doesn't mean it will do it again in the future.

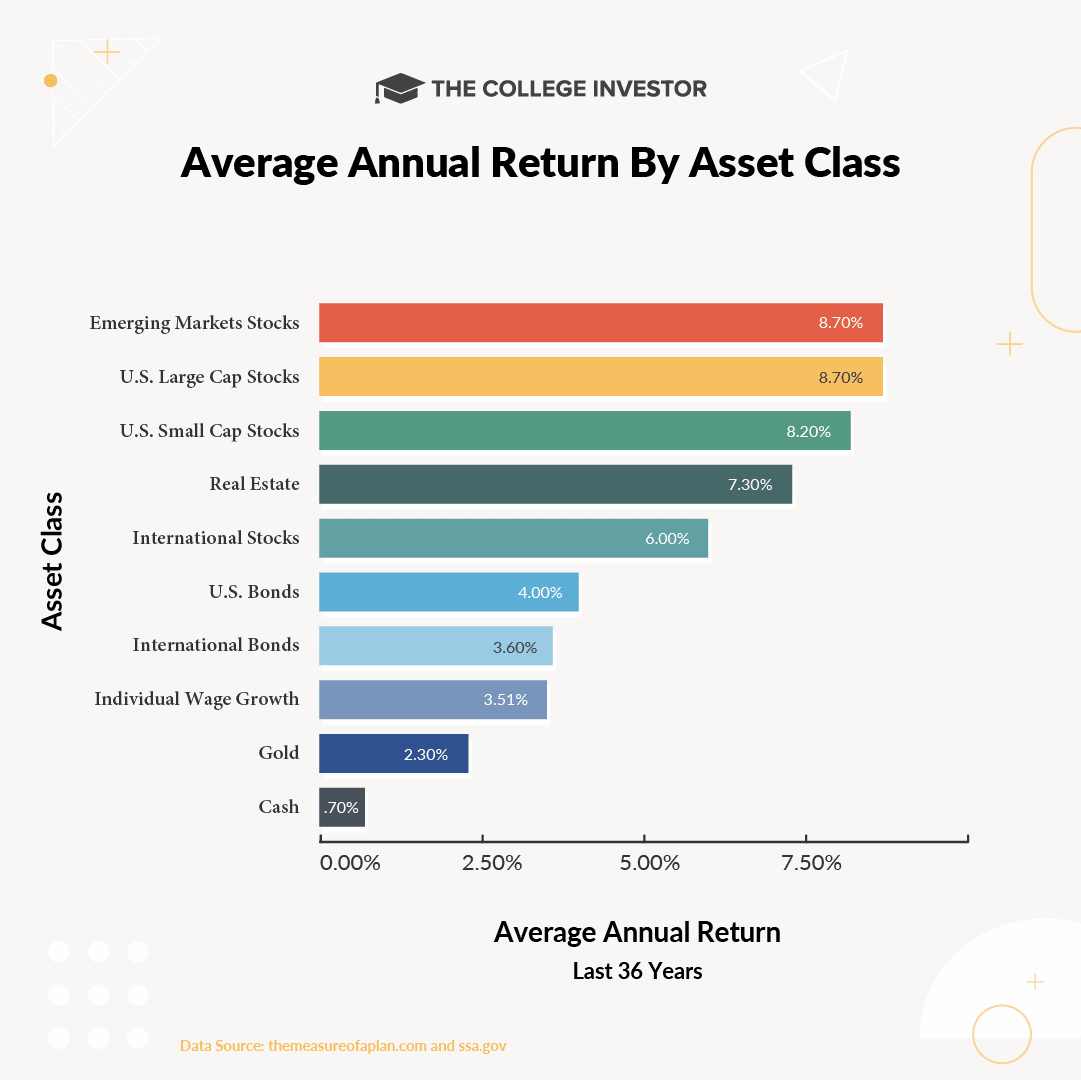

Here's a great example of average returns over the last 30 years:

As you can see, assets like stocks have a great average return versus cash. However, cash won't lose you money, where you could lose money in stocks in a one year period of time.

That's why, as you setup your investment strategy, you need to take your risk tolerance and time horizon into consideration.

Reminder: Investing is Long Term

Investing is not gambling - and investing is long term. If you invest today, could you lose money? Yes. 100%.

If you don't invest in a portfolio of diversified investments, do you increase your risk of losing money? Yes.

If you follow individuals who pick stocks and trade, do they win sometimes? Sure. But so do gamblers in Las Vegas.

If you go back to that table above, investing is long term because you want to take advantage of the long term behavior of an asset class - you're not betting on the individual behavior of one company. And to achieve that result, you need to stay in the market for a long period of time.

There is no way to predict what will happen tomorrow, next week, or next year. But over the long term (decades), we can extrapolate some historical data to build an estimate of what usually works.

That's why you consistently will hear me (and most other financial planners) say that you need to invest in index funds over the long term.

Do You Need A Financial Planner?

Maybe. When it comes to investing, it can be scary. And creating an investment strategy can be confusing. But many people won't need a financial planner to help them. There could be other financial professionals that make sense (read this: What Type Of Financial Professional Do You Need), but don't think it's mandatory to have a financial planner to start investing.

Where a financial planner can be helpful is in creating the plan, helping you navigate a life event financially (think marriage, baby, death of a parent), or if you really can't take the time or put in the effort and you need someone to kick you in the pants to make it happen.

There are also great DIY Tools like New Retirement to help get you started and even connect you with a financial planner if it makes sense.

The Tools And Tactics Of Your Investment Strategy

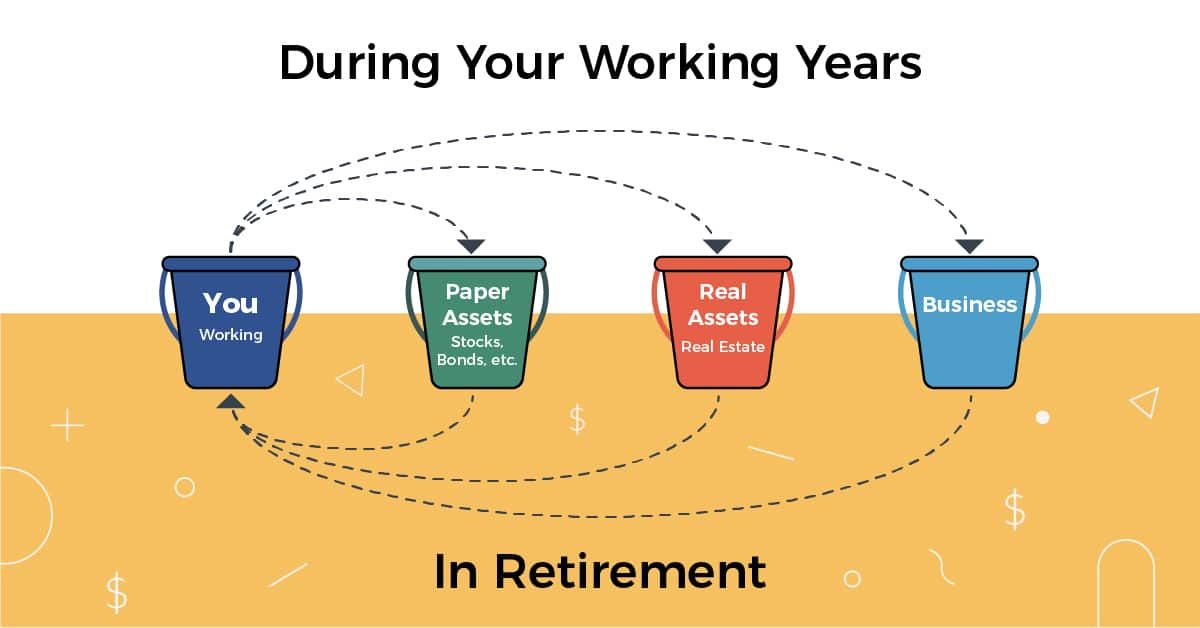

When you're investing, you have a wide variety of tools and assets at your disposal. And to get started, let's look at tools first.

There are a few main tools for investing for the long term:

- You and your earnings - this is your ability to generate cash flow over time

- A business - this is a business you own that generates cash flow

- Real Estate - this is property that generates cash flow and may appreciate

- Stocks, bonds, and other paper assets - these are holdings of larger firms that may generate cash flow and may appreciate

Outside of these tools, there are also important considerations on "how to hold them" - effectively what account to put them in. These are the account types that can be taxable or tax deferred.

The main accounts are:

- Taxable holdings

- IRA

- 401k

- HSA

Knowing your tools and tactics can help you frame the understanding of how to structure your investment strategy.

Note: This article dismisses the idea of your own risk tolerance and asset allocation because it's seeking my definition of "best". If you're thinking of your own risk tolerance to build a proper asset allocation, hopefully my guide below will give you some ideas.

Best Investment Strategy Long Term (20+ Years)

This should be the goal for most investors under 50. A 20+ year investment time horizon.

At the 20 year time horizon, your portfolio should be mostly assets that have growth potential, and may be riskier as a result. Equities and leveraged real estate are prime examples of assets you should focus on.

For a 20+ year portfolio, you should pick an investment allocation that is almost exclusively equities and real estate. Low cost index funds, maxing out retirement and tax deferred savings vehicles, and even consider business ownership.

All of these investments are well suited to long term growth.

Check out this order of operations for funding your retirement for a good guide on how to leverage accounts properly.

Best Investment Strategy Medium Term (5-19 Years)

This is the time when you need to really start thinking strategically about the future. You're getting close enough to the end that you need to plan drawdowns, and you should also be shifting your assets to something that likely won't lose value.

One of the biggest risks in early retirement is massive decline. Think about retiring in 2006, and then having 60% of your portfolio value gone in 2008. That would be detrimental.

Huge portfolio loss in retirement or approaching retirement means one of two things will happen: you will have to work and save longer, or you will have to live on less (potentially much less).

To avoid this as much as possible, as you approach the 5-10 year out mark, you should be moving into asset classes that historically don't lose as much in a downturn.

Go back to the chart above - this is why people start shifting to more and more bonds into their portfolio. They still have a slightly better return than cash, without as much risk as equities.

For other assets, like real estate, you should be moving from a leveraged real estate position to a de-leveraged one. This means paying off the debt so you can enjoy the cash flow.

If you have a business, you need to being exit planning if you're thinking about using the business to fund your retirement.

Best Investment Strategy Short Term (Less Than 5 Years)

When you're getting to the end, and you need a short term investment strategy, it's really time to think outside the investment box, and more into the capital preservation box.

Now, there's a difference between retirement and short term. Retirement, you have a mix - short term, and medium term. Just because you retire at 65 doesn't mean you're dead at 70. You need to have a mix of strategies for both short term and medium term, because it's very possible to live until 90 or beyond (my grandfather turned 97 this past weekend).

Short term investment strategies are inherently cash and bond heavy. The reason is simple: you don't want to lose.

If you honestly can't stand any loss, check out a money market account and park your cash and earn the best rate you can get. Bonds are a little more risky, with bond funds definitely susceptible to loss.

If you have real estate, you should definitely be debt-free and cash flowing. You should also have your management in place, and thought about an exit strategy.

A business is very risky short term, and not recommended as a short term investment.

When To Not Invest

You should never invest money you can't afford to lose. For example, if you are saving for a house and plan to buy in the next 5 years, investing isn't the best approach. You could see your investment drop 50%, which sets you backwards in your goal of buying a house - when it would likely be a great time to buy a house.

A better approach for something like this would be a money market account.

Second, you should never, ever, invest in something you don't understand. Don't invest in something because "a friend said so". Don't invest if you don't understand the cost and fee structure. And never buy from an agent who won't tell you how much they are being paid to recommend this product and what possible alternatives may be.

Final Thoughts

Now that you have some ideas around investment strategy, you can create an investment plan for yourself. This means actually setting up an allocation and maybe even writing an investment plan out so you have it on paper. This will guide you as you make your decisions around what to invest in, and how to structure your holdings to achieve your financial goals.

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Chris Muller