When your student loans are discharged due to disability, you may be limited in whether you can work or go to school for a period of time. Otherwise, your student loans may be reinstated.

This can be an especially difficult issue to navigate if your loans are discharged while you're attending school, or plan to. And it can happen even if you never planned on asking for a disability discharge.

Here's what to know about disability discharge, and how to navigate your choices if your loans are automatically forgiven.

Total and Permanent Disability Discharge

Federal student loans may be discharged if the borrower has a Total and Permanent Disability (TPD).

Eligible loans include:

- All loans in the William D. Ford Federal Direct Loan Program (Direct Loans)

- Federal Family Education Loan Program (FFELP)

- Federal Perkins Loan Program

- Federal Stafford Loans

- Federal Parent PLUS Loans

- Federal Grad PLUS Loans

- Federal consolidation loans.

- A TEACH Grant service obligation is also eligible for a TPD discharge.

There are three methods of qualifying for a TPD discharge:

If the TPD discharge is approved, payments made on or after the disability date will be returned to the borrower. The disability date is the date of the VA’s disability determination, the date the U.S. Department of Education received documentation of the SSA notice of award or the date of the doctor’s certification.

About half of private student loans have a disability discharge that is similar to the TPD discharge for federal education loans, albeit without automated discharge based on a VA or SSA determination.Automatic Disability Discharge

The TPD discharge through a VA or SSA determination is automatic through a quarterly data match between the U.S. Department of Education and these federal agencies. Borrowers who qualify for a TPD discharge through a data match do not need to submit a TPD discharge application or provide documentation of their disability determination.

Borrowers can opt out of the automatic discharge. If a borrower opts out, they can apply for a TPD discharge later. Sometimes a borrower will delay the TPD discharge application to ensure that all of their federal education loans are discharged or because they are concerned about state income tax liability.

Disability Discharge by Application

If the borrower does not receive a disability discharge through the automated process, they can also qualify by submitting the TPD discharge application along with documentation of a VA or SSA determination. For the SSA, documentation can include:

- A copy of the SSA notice of award for SSDI

- SSI benefits

- Benefits Planning Query (BPQY form 2459) indicating the next disability review will be in 5-7 years from the date of the most recent SSA disability determination.

How to submit an application

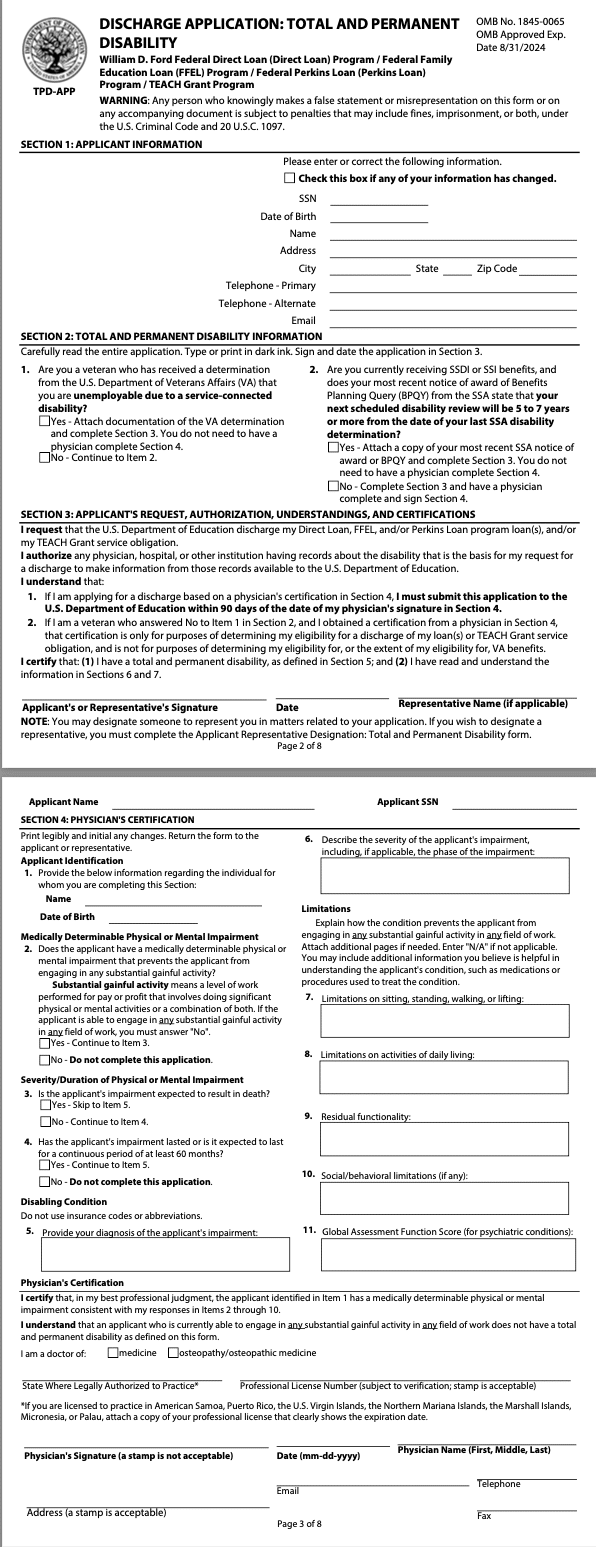

To receive a TPD discharge through a doctor’s certification, the borrower must submit an application with the doctor’s certification in section 4.

The application may be obtained in the following ways:

- Phone: 1-888-303-7818

- Email: disabilityinformation@nelnet.net

- Online

The application can be submitted by the borrower’s representative, but borrowers must submit an Applicant Representative Designation Form first. A power of attorney is not enough.

The federal government requires disabled borrowers, who may be unable to complete a form due to their disability, to submit a form so someone else can complete the form on their behalf.

While the TPD discharge application is being processed and verified, the borrower’s loans will be placed in a forbearance for up to 120 days.

The actual disability discharge for only requires 2 pages to be completed:

Tax Liability from the Cancellation of Student Loan Debt

The amount of discharged debt may be treated as income by the IRS. The borrower may receive an IRS Form 1099-C to report the amount of canceled debt.

Disability discharges are tax-free on federal income tax returns through December 31, 2025. This provision is likely to be extended or made permanent. President Biden has proposed making the tax-free status permanent.

Disability discharges may also be subject to state income tax in some states.Post-Discharge Monitoring Period

If the borrower receives a TPD discharge because of a SSA determination or a doctor’s certification, the borrower will be subject to a three-year post-discharge monitoring period starting on the date the discharge is approved. Borrowers who qualify for a TPD discharge because of a VA determination are not subject to the three-year post-discharge monitoring period.

If the borrower has annual earnings from employment during the post-discharge monitoring period that exceeds the poverty line for a family of two in the borrower’s state, the discharged loans and TEACH Grant service obligation will be reinstated. Only earned income from employment starting on the date of discharge will count.

Earned income prior to the date of disability discharge and unearned income, such as interest, dividends and capital gains, does not count. Disability and retirement income does not count.

The repayment obligation will also be reinstated if the borrower receives a new federal education loan or TEACH Grant during the post-discharge monitoring period. If the borrower receives a disbursement of a previous federal education loan or TEACH Grant during the post-discharge monitoring period and does not return it within 120 days of the disbursement date, the repayment obligation will be reinstated.

If the borrower qualifies for a TPD discharge because of a SSA determination and receives a notice from the SSA that they no longer satisfy the requirements for a TPD discharge during the 3-year post-discharge monitoring period, the repayment obligation will be reinstated.

Borrowers are required to notify the U.S. Department of Education in these circumstances or if their address or telephone number changes. Borrowers must also submit a form annually that documents their earnings from employment. If they fail to notify the U.S. Department of Education, submit the annual form or respond to a request for documentation, the repayment obligation will be reinstated.

There is a pending proposal to eliminate the three-year post-discharge monitoring period. This is because in almost all cases, a borrower’s loans were reinstated because of a failure to provide documentation and not because the nature of the borrower’s disability or amount of earnings had changed.

Going Back to School

As noted above, borrowers who obtain a new federal education loan or TEACH Grant during the three-year post-discharge monitoring period will have their repayment obligation reinstated.

Borrowers can continue their college enrollment or go back to school during the three-year post-discharge monitoring period. However, if they do not want their repayment obligation to be reinstated, they cannot request a new federal education loan or TEACH Grant during the post-discharge monitoring period.

After the three years are over, the borrower can obtain a new federal education loan or TEACH Grant without having the repayment obligation reinstated. Borrowers who qualified for a TPD discharge due to a VA determination can also obtain new federal education loans immediately and TEACH Grants without having the repayment obligation reinstated, since loans discharged because of a VA determination are not subject to the post-discharge monitoring period.

However, to obtain a new federal education loan or TEACH Grant, the borrower must obtain a certification from a doctor that they are able to engage in substantial gainful activity, even if there was no post-discharge monitoring period.

The borrower must also acknowledge that the new federal education loan or TEACH Grant service obligation cannot be discharged on the basis of the borrower’s current disability unless the borrower’s condition deteriorates enough for total and permanent disability.

Note that the same rules apply to parent borrowers of a Parent PLUS Loans, if the parent borrower previously had federal education loans qualifying for a TPD discharge. Only the borrower of a Parent PLUS Loan can have the loan discharged because of the borrower’s disability. If the student on whose behalf the Parent PLUS Loan was borrowed becomes disabled, the Parent PLUS Loan will not be discharged.

Typically, a disabled student will wait until they graduate or drop out of college to apply for a TPD Discharge.Impact of Disability Discharge on Eligibility for Student Financial Aid

The TPD discharge does not affect the student’s eligibility for other federal student aid, such as the Federal Pell Grant or Federal Supplemental Educational Opportunity Grant (FSEOG).

Vocational rehabilitation assistance does not affect eligibility for federal student aid.

If the vocational rehabilitation assistance does not fully cover the student’s disability-related expenses, the college financial aid administrator can include these expenses in the student’s cost of attendance. This move can yield an increase in the student’s demonstrated financial need.

ABLE accounts are not reported as an asset on the Free Application for Federal Student Aid (FAFSA).References

The rules concerning a Total and Permanent Disability Discharge appear in the regulations as follows:

- Federal Perkins Loan Program. 34 CFR 674.61(b) and (c)

- Federal Family Education Loan Program. 34 CFR 682.402(c)

- Federal Direct Loan Program. 34 CFR 685.213

- TEACH Grants. 34 CFR 686.42(b)

These regulations are based on the statutory language at 20 USC 1087 and 20 USC 1087dd(c)(1)(F).

Mark Kantrowitz is an expert on student financial aid, scholarships, 529 plans, and student loans. He has been quoted in more than 10,000 newspaper and magazine articles about college admissions and financial aid. Mark has written for the New York Times, Wall Street Journal, Washington Post, Reuters, USA Today, MarketWatch, Money Magazine, Forbes, Newsweek, and Time. You can find his work on Student Aid Policy here.

Mark is the author of five bestselling books about scholarships and financial aid and holds seven patents. Mark serves on the editorial board of the Journal of Student Financial Aid, the editorial advisory board of Bottom Line/Personal, and is a member of the board of trustees of the Center for Excellence in Education. He previously served as a member of the board of directors of the National Scholarship Providers Association. Mark has two Bachelor’s degrees in mathematics and philosophy from the Massachusetts Institute of Technology (MIT) and a Master’s degree in computer science from Carnegie Mellon University (CMU).

Editor: Robert Farrington