Grants for college are a source of financial aid that's effectively free money.

If you’re applying for college, you’ve probably heard students complain about grants and scholarships – everything from the application process to the stringent requirements. But it's extremely possible to find grants to pay for college.

If you explore all of your options and keep track of your results, the process doesn’t have to be painful. We’ve cut down on your research by providing you with resources that will help you find grants right for you.

While scholarships are awarded on merit and need, grants are primarily awarded based on need. For most grants, grades are not a determining factor. It’s no wonder that grants are the most sought after form of financial aid – grants are like “free money” that can be used for tuition and other college expenses.

Below, we’ll show you where to look for grants and how to apply. Keep reading!

The Difference Between Scholarships And Grants

Unlike student loans, you don’t have to pay back grants or scholarships. Both scholarships and grants for college are free money options to help you pay for higher education. Gants are typically awards by the Federal and state government, while scholarships are awarded by the college or private organizations.

People often confuse grants and scholarships or use the terms interchangeably because grants and scholarships share many similarities.

The biggest difference between college grants and scholarships is that grants for college are typically need-based, while scholarships may be need-based or merit-based. What does merit-based mean? It means the scholarship is awarded based on something you do, such as an ability, hobby or achievement.

Like grants, scholarships can also be awarded based on ethnicity, religion, or other background related criteria. Grants are considered free money for college that doesn’t have to be paid back except under these rare circumstances.

Find Free Money For College With Federal Grants

What is a grant? A federal grant is a form of federal financial assistance where the U.S government redistributes its resources to eligible recipients who demonstrate financial need.

Below, we’ve got you covered for Federal grants, State Grants, College Grants, and other grants in special situations. Just follow these steps, and you’ll have a higher chance of uncovering grants that are the perfect fit for you.

Find this infographic useful? You can download the full version here.

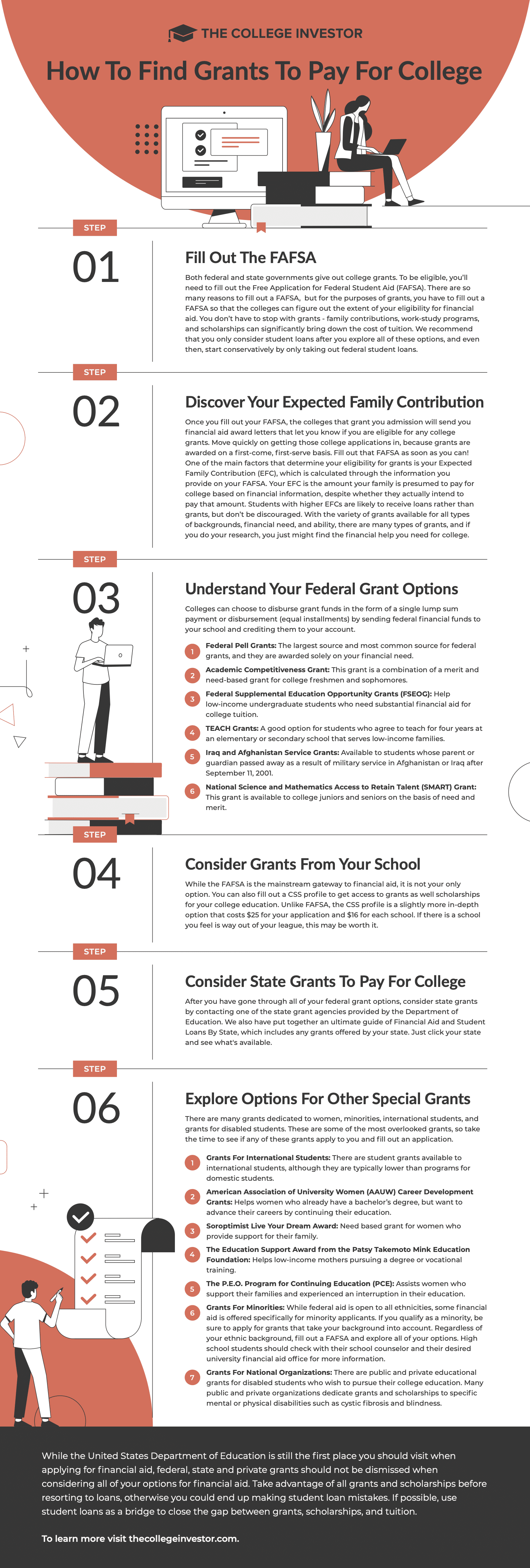

Step 1: Fill Out The FAFSA

Both federal and state governments give out college grants. To be eligible, you’ll need to fill out the Free Application for Federal Student Aid (FAFSA).

There are so many reasons to fill out a FAFSA, but for the purposes of grants, you have to fill out a FAFSA so that the colleges can figure out the extent of your eligibility for financial aid.

You don’t have to stop with grants - family contributions, work-study programs, and scholarships can significantly bring down the cost of tuition. We recommend that you only consider student loans after you explore all of these options, and even then, start conservatively by only taking out federal student loans.

Learn why federal student loans are the best kind of student loan you can take out (if you need to take out a loan at all).

Step 2: Discover Your Student Aid Index

Once you fill out your FAFSA, the colleges that grant you admission will send you financial aid award letters that let you know if you are eligible for any college grants.

Move quickly on getting those college applications in, because grants are awarded on a first-come, first-serve basis. Fill out that FAFSA as soon as you can!

One of the main factors that determine your eligibility for grants is your Student Aid Index. This is a new metric that replaces the Expected Family Contribution.

Your SAI is amount your family is presumed to pay for college based on financial information, despite whether they actually intend to pay that amount. Students with higher SAIs are likely to receive loans rather than grants, but don’t be discouraged.

With the variety of grants available for all types of backgrounds, financial need, and ability, here are many types of grants, and if you do your research, you just might find the financial help you need for college.

Step 3: Understand Your Federal Grant Options

Colleges can choose to disburse grant funds in the form of a single lump sum payment or disbursement (equal installments) by sending federal financial funds to your school and crediting them to your account.

Step 4: Consider Grants From Your School

While the FAFSA is the mainstream gateway to financial aid, it is not your only option. You can also fill out a CSS profile to get access to grants as well scholarships for your college education.

Unlike FAFSA, the CSS profile is a slightly more in-depth option that costs $25 for your application and $16 for each school. If there is a school you feel is way out of your league, this may be worth it.

Step 5: Consider State Grants To Pay For College

After you have gone through all of your federal grant options, consider state grants by contacting one of the state grant agencies provided by the Department of Education.

We also have put together this ultimate guide of Financial Aid and Student Loans By State, which includes any grants offered by your state. Just click your state and see what's available.

States like California have their Cal-Grant program, which may require you to apply or create another portal application as well.

Step 6: Explore Your Options For Other Special Grants

There are many grants dedicated to women, minorities, international students, and grants for disabled students. These are some of the most overlooked grants, so take the time to see if any of these grants apply to you and fill out an application.

Grants For International Students

There are student grants available to international students, although they are typically lower than programs for domestic students. You can research your options here to get started.

Grants For Women

Women’s grants make it possible for female students of all backgrounds to pursue educational programs and careers that have historically not been available to women. Many organizations have taken steps to support women for equal footing in education, opportunities, and career development.

Grants For Minorities

While federal aid is open to all ethnicities, some financial aid is offered specifically for minority applicants. If you qualify as a minority, be sure to apply for grants that take your background into account.

Regardless of your ethnic background, fill out a FAFSA and explore all of your options. Ethnic foundations, private corporations and government agencies each issue college grants that should be considered by minority students.

Ethnic minority grants help support educational advancement for minorities. There are different grants available based on ethnic background such as Asian Americans, Native Americans and Hispanics. High school students should check with their school counselor and their desired university financial aid office for more information.

Grants For National Organizations

There are public and private educational grants for disabled students who wish to pursue their college education. Many public and private organizations dedicate grants and scholarships to specific mental or physical disabilities such as cystic fibrosis and blindness.

Final Thoughts

While the United States Department of Education is still the first place you should visit when applying for financial aid, federal, state and private grants should not be dismissed when considering all of your options for financial aid.

Take advantage of all grants and scholarships before resorting to loans, otherwise you could end up making these student loan mistakes. If possible, use student loans as a bridge to close the gap between grants, scholarships, and tuition.

What is your experience with grants? If you were awarded a grant, was it from any of the sources listed above, or from somewhere else? Tell us your experience with college grants in the comments below.

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Chris Muller