ezTaxReturn takes the pain out of tax filing…for some filers. However, some may find they can’t use the software due to its limitations.

For those who can use ezTaxReturn and don't qualify for the free tier, the pricing isn't that competitive in comparison to similar tax return software programs.

If you’re considering ezTaxReturn, there may be a better alternative unless you qualify for the free file program. In this ezTaxReturn.com review, we explore how the app compares to the other top tax software options.

ezTaxReturn Details | |

|---|---|

Product Name | ezTaxReturn |

Federal Price | Free or $29.95 |

State Price | $19.95 Per State |

Federal + State | $39.95 |

Audit Protection | $39.95 |

Preparation Type | Self-Prepared |

Promotions | Pre-register for a 20% discount on your 2024 tax filing |

ezTaxReturn - Is It Free?

ezTaxReturn advertises a free tax return for “simple filers,” but this is limited. Taxpayers who qualify for the simple return can get free federal filing only. You still have to pay $19.95 for a state return. Unless you live in a state with no state income tax return requirement, you’ll have to pay to use ezTaxReturn no matter how you file.

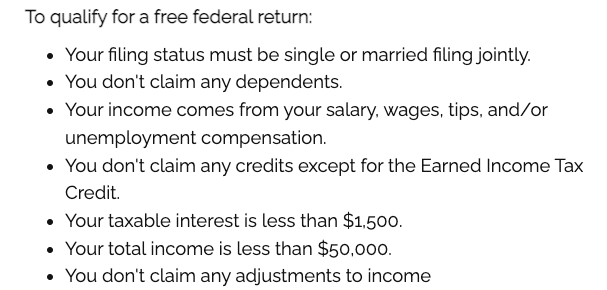

Additionally, ezTaxReturn is quite strict about who qualifies for free federal returns. You must meet the following criteria:

- Earn less than $50,000 per year

- Have no dependents

- Have taxable interest income under $1,500

The only credit users can claim with the free tier is the Earned Income Tax Credit (EITC). The free option also only supports W-2 income and unemployment income. HSA contributions require an upgrade. Due to these many restrictions, it seems many people won’t qualify for this "Free" tier.

You can see our picks for the best free tax software here.

What's New In 2024?

The biggest updates for 2024 focused on changes to the tax code from the IRS. The government implemented new brackets and limits for many deductions and credits, and ezTaxReturn made the necessary changes to keep up.

You may notice a maximum refund and accuracy guarantee on this and other tax software. These are industry standards, as your tax results should be nearly identical no matter how you file.

Does ezTaxReturn Really Make Tax Filing Easy In 2024?

If you fall into the simple tax qualifying for free federal returns, then yes. ezTaxReturn has an intuitive user experience that makes filing easy for tax filers with simple situations. However, it doesn’t offer imports for your tax forms or W2 data.

ezTaxReturn isn't ideal for more complex tax filing scenarios, including anyone with investment accounts. It also doesn’t have built-in depletion or depreciation calculators, so real estate investors must do calculations elsewhere. Because of this shortcoming, we suggest real estate investors look to TurboTax, H&R Block, and other premium software packages.

Self-employed retirement plans are also not well supported. ezTaxReturn doesn’t allow users to claim contributions to certain self-employed retirement plans, such as Keogh or SEP accounts.

ezTaxReturn Features

Although ezTaxReturn doesn’t support all tax situations, it has a few positive features making it worth consideration.

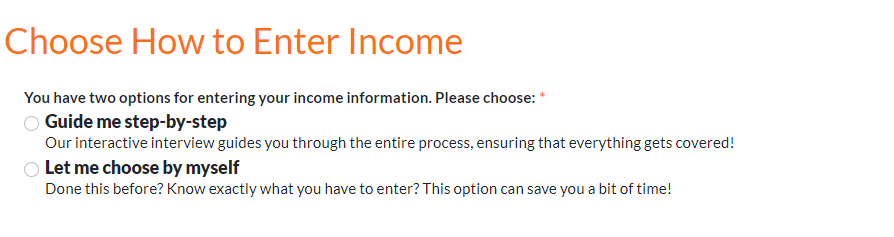

Guided Navigation

ezTaxReturn uses questions and answers to guide users through the software. The wording of the questions makes it easy for filers to respond correctly.

Robust Error Detection

ezTaxReturn has built-in error detection to prevent users from entering information in the wrong box or entering the wrong value. The error detection prevents users from moving forward without first checking on an issue. Error messages are descriptive enough to help users solve the problem.

ezTaxReturn Drawbacks

Despite ezTaxReturn’s straightforward user interface, the software has several shortcomings.

Restrictive Free Tier

ezTaxReturn’s free tier supports very few tax filers. And those who qualify will still have to pay for state filing. If you earn more than $50,000 per year, have dependents, or have any income beyond your W-2 job and bank account interest, you won’t qualify.

No Depreciation Calculators

ezTaxReturn doesn’t have depreciation or depletion calculators. So landlords and self-employed people with depreciable assets can’t claim this legitimate tax deduction through the software.

Limitations On Filing

The ezTaxReturn software only supports one rental property per return. Landlords with multiple properties can’t use the software. It also doesn’t support options trading or wash sales.

As mentioned above, there are no depreciation calculators available, so people with “complicated” tax filing situations may find that the software simply won't work for them.

EzTaxReturn also has limitations on state filing. Unsupported states include Connecticut, Delaware, Hawaii, Kansas, Maine, Nebraska, New Mexico, Utah, Idaho, Indiana, Iowa, Kentucky, Minnesota, Montana, North Dakota, Oklahoma, Oregon, Rhode Island, Vermont, and West Virginia. If you live or file in any of those states, look elsewhere for your tax filing needs.

ezTaxReturn Plans And Pricing

Since ezTaxReturn has a restrictive Free tier - most filers will need to pay. State filing costs $19.95 regardless of which plan you use. The company offers a Federal + State filing combination with a package price of $39.95.

Users should confirm whether ezTaxReturn supports tax returns in their state before starting to use the software.

Free | Paid | |

|---|---|---|

Best For: | No dependents, W-2 or unemployment, earn less than $50,000, no credits or deductions. | All others |

Federal Pricing: | free | $29.95 |

State Pricing: | $19.95 | $19.95 |

Combined Pricing: | $19.95 | $39.95 |

How Does ezTaxReturn Compare?

ezTaxReturn prices itself near the middle of the pack. Even with its annual improvements, the software may still not be worth the price.

Cash App Taxes and TaxHawk support more complex filing at a lower price. Here's a closer look at how ezTaxReturn compares:

Header |  | |||

|---|---|---|---|---|

Rating | ||||

Stimulus Credit | Free | $25 | Free | Free |

Unemployment Income (1099-G) | Free | $25 | Free | Free |

Student Loan Interest | Paid | $25 | Free | Free |

Import Last Year's Taxes | Only Returns Prepared By EzTaxReturn | $25 | Free | Free |

Snap a Pic of W-2 | Not Supported | Not Supported | Not Supported | Not Supported |

Multiple States | Not Supported | $25 | Not Supported | $14.99 Per State |

Multiple W2s | Free | $25 | Free | Free |

Earned Income Tax Credit | Free | $25 | Free | Free |

Child Tax Credit | Paid | $25 | Free | Free |

HSAs | Paid | $25 | Free | Free |

Retirement Contributions | Paid | $25 | Free | Free |

Retirement Income (SS, Pension, etc.) | Paid | $25 | Free | Free |

Interest Income | Free ($1,500 Limit) | $25 | Free | Free |

Itemize | Paid | $25 | Free | Free |

Dividend Income | Paid | $25 | Free | Free |

Capital Gains | Paid (No wash sales or options) | $25 | Free | Free |

Rental Income | Paid (no depreciation, only one property supported) | $25 | Free | Free |

Self-Employment Income | Paid (no depreciation or depletion supported) | $25 | Free | Free |

Small Business Owner (Over $5k In Expenses) | Paid (no depreciation or depletion supported) | $25 | Free | Free |

Audit Support | 39.95 Add-On | $29.95 Add-On | Free | Deluxe ($7.99) |

Advice From | Not available | Not available | Not available | Pro Support ($34.99) |

Free Tier Pricing | $0 Fed & | N/A | $0 Fed & $0 State | $0 Fed & |

Paid Tier Pricing | Federal & State Combo: $39.95 or $29.95 Fed & | $25 | N/A | All forms and deductions are available on the Free tier, but users can upgrade to Deluxe ($6.99) or Pro ($24.99) to access Audit Assist or advice from tax pros. |

Cell |

Is It Safe And Secure?

ezTaxReturn uses industry-standard encryption technology to keep user information safe. It has strong password requirements, and users must use a second form of authentication to log in.

By combining encryption and multifactor authentication, ezTaxReturn offers strong protections to prevent data breaches or hacks. The company hasn’t suffered major data breaches and has historically received accolades for its security protocols.

How Do I Contact ezTaxReturn?

ezTaxReturn boasts that its software is "so easy, it's unlikely you'll need customer service." And it says that only about 10% of its customers reach out for help. But if you do need assistance, your options are far more limited than competing tax software companies.

Right now they only have email support (with a one business day turnaround time), and an FAQ on their website. They typically have a phone number you can call during tax season, but this isn't available as of the time of writing.

There's no option to get in contact with a tax pro. The only way to contact the company's support team is to submit an email-based inquiry.

Who Is This For And Is It Worth It?

ezTaxReturn continues to increase its usability but still has several limitations. It's not ideal for landlords nor for those with self-employment income. Features are also far from ideal for most investors.

Filers with less complicated tax situations could benefit from ezTaxReturn. However, the software price is still too high for what it offers, in our opinion, unless you qualify for free federal filing.

Users looking for a better experience, coupled with mid-range pricing, should consider Cash App Taxes or FreeTaxUSA. Those seeking a more robust experience may want to consider TurboTax, H&R Block, or TaxSlayer.

Not sure which software meets your needs? We’ve got you covered with recommendations for software based on your filing situation.

Why Should You Trust Us?

The College Investor team has spent years reviewing all of the top tax filing options, and our team has personal experience with the majority of tax software tools. I personally have been the lead tax software reviewer since 2022, and have compared most of the major companies on the marketplace.

Our editor-in-chief Robert Farrington has been trying and testing tax software tools since 2011, and has tested and tried almost every tax filing product. Furthermore, our team has created reviews and video walk-throughs of all of the major tax preparation companies which you can find on our YouTube channel.

We’re tax DIYers and want a good deal, just like you. We work hard to offer informed and honest opinions on every product we test.

How Was This Product Tested?

In our original tests, we went through ezTaxReturn and completed a real-life tax return that included W2 income, self-employment income, rental property income, and investment income. We tried to enter every piece of data and use every feature available. We then compared the result to all the other products we've tested, as well as a tax return prepared by a tax professional.

This year, we went back through and re-checked all the features we originally tested, as well as any new features. We also validated the pricing options.

ezTaxReturn FAQs

Let's answer a few of the most common questions that filers ask about ezTaxReturn:

Can ezTaxReturn help me file my crypto investments?

ezTaxReturn technically supports filing taxes for crypto investments. However, this isn’t made easy. Users must convert all their trades to USD and manually enter each into ezTaxReturn. This is a cumbersome task that most people will want to avoid.

Most users with crypto investments will want to use a crypto tax software that integrates with TurboTax.

Can ezTaxReturn help me with state filing in multiple states?

EzTaxReturn supports multi-state filing, but it doesn’t support every state. States that aren’t supported include the following: Connecticut, Delaware, Hawaii, Kansas, Maine, Nebraska, New Mexico, Utah, Idaho, Indiana, Iowa, Kentucky, Minnesota, Montana, North Dakota, Oklahoma, Oregon, Rhode Island, Vermont, and West Virginia.

Does ezTaxReturn offer refund advance loans?

No, ezTaxReturn is not offering refund advance loans in 2024. You can pay your software fee using your refund for an extra $29.95, which is definitely not worthwhile.

ezTaxReturn Features

Federal Cost |

|

State Cost |

|

Pay With Tax Refund | Yes, $29.95 extra cost |

Audit Support | Available as a $39.95 add-on |

Support From Tax Pros | Not available |

Full Service Tax Filing | Not available |

Printable Tax Return | Yes |

Import Tax Return From Other Providers | No |

Import Prior-Year Return For Returning Customers | Yes |

Import W-2 With A Picture | No |

Stock Brokerage Integrations | None |

Crypto Exchange Integrations | None |

Self-Employment Income | Yes (but (no depreciation and depletion is not supported) |

Itemize Deductions | Yes |

Rental Properties | Yes, but only one property can be added per return |

Refund Anticipation Loans | Not offered |

Customer Service Options | Contact form and FAQs |

Customer Service Phone Number | None listed |

Web/Desktop Software | Yes |

Mobile Apps | No |

Promotions | Pre-register for a 20% discount on your 2024 tax filing |

ezTaxReturn.com Review

-

Navigation

-

Ease Of Use

-

Features And Options

-

Customer Service

-

Plans And Pricing

Overall

Summary

ezTaxReturn could be a great low-cost tax software option for filing simple tax returns. But its free tier is very restrictive.

Pros

- Easy-to-use interface for simple filing situations

- Some filers can do federal taxes for free

- Multi-factor authentication is required

Cons

- No depreciation or depletion calculators

- Only one real estate property supported

- No section summaries

- Higher prices than competitors

Eric Rosenberg is a financial writer, speaker, and consultant based in Ventura, California. He holds an undergraduate finance degree from the University of Colorado and an MBA in finance from the University of Denver. After working as a bank manager and then nearly a decade in corporate finance and accounting, Eric left the corporate world for full-time online self-employment.

His work has been featured in online publications including Business Insider, Nerdwallet, Investopedia, The Balance, Huffington Post, and other financial publications. When away from the computer, he enjoys spending time with his wife and three children, traveling the world, and tinkering with technology. Connect with him and learn more at EricRosenberg.com.

Editor: Colin Graves Reviewed by: Robert Farrington