TurboTax is the market leader in online tax preparation services and we just finished our early look testing and review of their 2023-2024 tax software options. Going into 2024, TurboTax remains the most popular tax preparation software for several reasons.

While it’s not the cheapest option for do-it-yourself tax preparation, it offers an industry-leading user interface that's easy to navigate and supports nearly any tax situation.

While it’s more expensive than other online and desktop tax prep programs, it remains our top pick due to its intuitive user interface, extensive integrations with financial institutions, and options to upgrade for varying levels of support from a tax professional.

Here’s a closer look at the pros and cons of TurboTax to help you understand if it makes sense for your needs. Also, check out how TurboTax compares in our annual list of the best tax software in 2024.

TurboTax Details | |

|---|---|

Product Name | TurboTax |

Federal Price* |

|

State Price* | $0* to $69+ |

Preparation Type | Do Your Own, Live Assistance, Live Full Service |

Promotions | None |

*~37% of filers qualify for $0 federal & state filing. Form 1040 + limited credits only.

**Price estimates are provided prior to a tax expert starting work on your taxes. Estimates are based on initial information you provide about your tax situation, including forms you upload to assist your expert in preparing your tax return and forms or schedules we think you’ll need to file based on what you tell us about your tax situation. Final price is determined at the time of print or electronic filing and may vary based on your actual tax situation, forms used to prepare your return, and forms or schedules included in your individual return.

TurboTax - Is It Really Free?

The Turbo Tax Free Edition offers free filing for limited users with simple taxes. This tier can be used by those with W-2 or Social Security Income, but it only supports Form 1040 and limited credits. According to TurboTax, ~37% of taxpayers will qualify for the TurboTax Free Edition, which includes Form 1040 + limited credits only.

Bank interest is also allowed, along with dividends not requiring Schedule B. Itemized deductions require upgrading. Free filing with the TurboTax Free Edition also allows filers to claim the Child Tax Credit, Student Loan Interest Deduction, and the Earned Income Credit.

Note that tax returns with HSAs, child care expenses, charitable contributions, unemployment income, other income, deductions, or credits won’t be able to use the TurboTax Free edition.

Related: Best free tax software this year

What's New In 2024?

TurboTax 2024 has officially launched with some big changes for 2024. You can start working on your taxes early, but the IRS doesn’t accept returns until late January. Because of last-minute changes from the IRS, it may be best to hold off until the IRS begins accepting returns to start doing your taxes.

This year, even with the changes we mentioned below, we named TurboTax our top overall tax software tool due to the ease-of-use, especially with all their import features. TurboTax is also best for those that itemize their tax returns, and best for investors.

The first big change for TurboTax specifically this year include the elimination of TurboTax Self-Employed from their online edition. Instead, self-employed will be in the TurboTax Premium tier.

Next, to make TurboTax exceptionally confusing in 2024, they have changed their pricing structure to make it less transparent. You read that correctly. For our review, we spent no less than 2 hours trying to figure out their pricing - and it really boils down to how they are setting up their product this year.

Instead of focusing on their online product this year (with common tiers like Free Edition, Deluxe, and Premium - which still exist), they have transformed their focus to three tiers of "service level" instead. You can choose to do you own taxes, get expert assistance while you file (Live Assisted), and have an expert file your taxes for you (Live Full Service). We share more later on - but the result is trying to figure out "what you're going to pay to file your taxes" is exceptionally difficult compared to every other tax software product on the market. Plus, they hide their pricing almost everywhere behind the "start for free" icons - which makes it hard to figure out.

The result of this change is a big drop in our rating for TurboTax pricing this year, along with some small drops in navigation and ease of use. We strongly believe in clear, transparent pricing, and this isn't it.

After a few years of significant tax changes related to the 2017 Trump Tax Changes and COVID-19 related programs, tax changes for 2024 filing (for tax year 2023) mostly focus on higher limits for deductions and credits due to inflation.

Here are the biggest changes to look out for:

- The standard deduction increased by $900 for married filing jointly households and $1,400 for heads of households.

- The Advanced Child Tax Credit has reverted to a standard credit, similar to before the COVID pandemic. The credit is $3,600 for 2023 taxes.

- Child and Dependent Care Credits returned to pre-COVID limits.

- Form 1099-K will go to a wider number of small business owners, including side hustle online sellers using eBay, Etsy, Airbnb, and similar platforms.

- The Solar Energy Credit is increased to 30% if you buy eligible products, such as solar panels and solar water heaters.

Two years ago, we also saw the addition of TurboTax Full Service, where you can hand off your tax return to a tax pro for full-service preparation. It remains one of the easiest ways to get your taxes done online if you’re willing to pay a premium price.

You can see all our picks for Best Tax Software in 2024 here.

Related: See our tax refund calendar for 2024.

Does TurboTax Make Tax Filing Easy In 2024?

TurboTax is the leader in easy-to-use tax software. It offers hundreds of integrations designed for every kind of filer. In many cases, you can connect directly with your bank, brokerage account, and even some cryptocurrency accounts to automatically download and calculate taxes for those accounts.

Rideshare drivers can connect their app to TurboTax to download income data for their taxes. Depending on your employer, you can look up and download your W-2 information without typing in any financial data. When you have a PDF version of a tax form, you can typically upload it into TurboTax, and the app will automatically add information from the form where needed.

The things TurboTax doesn’t automate are kept simple with clear guides for nearly every tax form and supported tax scenario. The software uses easy-to-understand questions to guide users through complex filing rules. With robust examples, plenty of information pop-ups, and a quick-search system, users are likely to get through filing without much confusion, even if they don’t have an accounting background.

TurboTax Top Features

TurboTax is perhaps the easiest, most robust tax filing software today. Its user experience is second to none. Here are some of its top features.

Question And Answer Guidance

TurboTax uses a simple question-and-answer model to guide users through the software. The questions are phrased so users don’t get overwhelmed when answering. If you get stuck or don’t know what something means, you can click a pop-up to get more information or search for the term or form from the top navigation bar.

Expert Tax Assistance

TurboTax has a pricey upgrade option that allows filers to work with a certified tax expert. TurboTax Live users can have their questions answered by tax experts, ensuring accurate returns. This can be a nice feature for people who think they have taxes under control initially but later find out they’re in over their heads.

If you’re midway through your taxes and decide you want or need help, you can upgrade anytime by accessing tax support for your questions or having a tax pro take care of your entire tax return.

Tax Form Integrations

TurboTax has hundreds of official integration partners. When you get a W-2, 1099, or 1098 from these partners, TurboTax can connect and download information from the employer or financial institution. These integrations can speed up the time it takes to complete your tax return and prevent manual error if you make a typo.

In addition to these integrations, TurboTax connects to QuickBooks, Uber, Lyft, Square, and other sources to simplify self-employed filing. When direct connections are not supported, you’re still often able to upload a PDF version of your tax form for TurboTax to process.

Cryptocurrency Support

TurboTax is the first leading tax software to partner with cryptocurrency exchanges and crypto accounting software programs. Coinbase users can directly import transactions from their accounts. People who use hardware wallets, CoinLedger (formerly CryptoTrader.Tax), CoinToken, and other official partners can also import data easily.

If you trade, invest, or transact with cryptocurrencies, you could easily have hundreds or thousands of transactions yearly. Manually entering that would be tedious and extremely time-consuming. Depending on the cryptocurrency account software you use, you may connect to TurboTax directly or have to download and import a spreadsheet, such as a CSV, XLS, or XLSX file.

Low Jargon

TurboTax makes tax filing simpler by cutting out unnecessary tax jargon. Info bubbles and explainers make it easy for anyone to use more “complex” features, such as depreciation or expense calculators. Real estate investors, small business owners, and side hustlers can likely navigate their tax returns without a professional.

Tax Calculators

TurboTax offers excellent calculators for retirement contributions that flag issues when filers accidentally over contribute to retirement accounts. You can also use TurboTax to calculate depreciation expenses, where applicable.

TurboTax Drawbacks

TurboTax offers excellent tax software designed to make filing easy for nearly everyone. With TurboTax, even filers with complex situations should be able to file independently. However, this software comes with drawbacks, notably related to cost.

Paid Tiers Are Expensive

TurboTax is the most expensive mainstream consumer tax software. Users who appreciate TurboTax’s features and integrations may decide the software is worth the added price. Plus, it can be difficult to know which tier you need if you're an inexperienced filer. There are a lot of stories of people who thought they qualified for the TurboTax Free Edition, only to end up paying a lot to file their taxes.

Some people may find suitable tax software from a competitor at a lower price.

Limited Free Filing

TurboTax’s Free Edition offers free tax filing to people with W-2 and Social Security income. Note that ~37% of taxpayers will qualify for TurboTax Free Edition, which supports Form 1040 and limited credits only.

Those with HSAs and deductible child care expenses won’t qualify for TurboTax's Free Edition. If you start through the IRS Free File portal, you can’t upgrade to a paid version, so be careful where you sign up and start working on your taxes.

You can only use TurboTax Free Edition with Form 1040 and limited tax credits and deductions.

Added Fees For Audit Support

Audit support is included with the TurboTax Free Edition. However, users who have to use the Deluxe level or higher will need to pay for MAX support to get this benefit, which costs $60. This costs more than the price of the FreeTaxUSA software, which includes audit support, and about three times as much as H&R Block's tax software audit support.

TurboTax Pricing And Plans

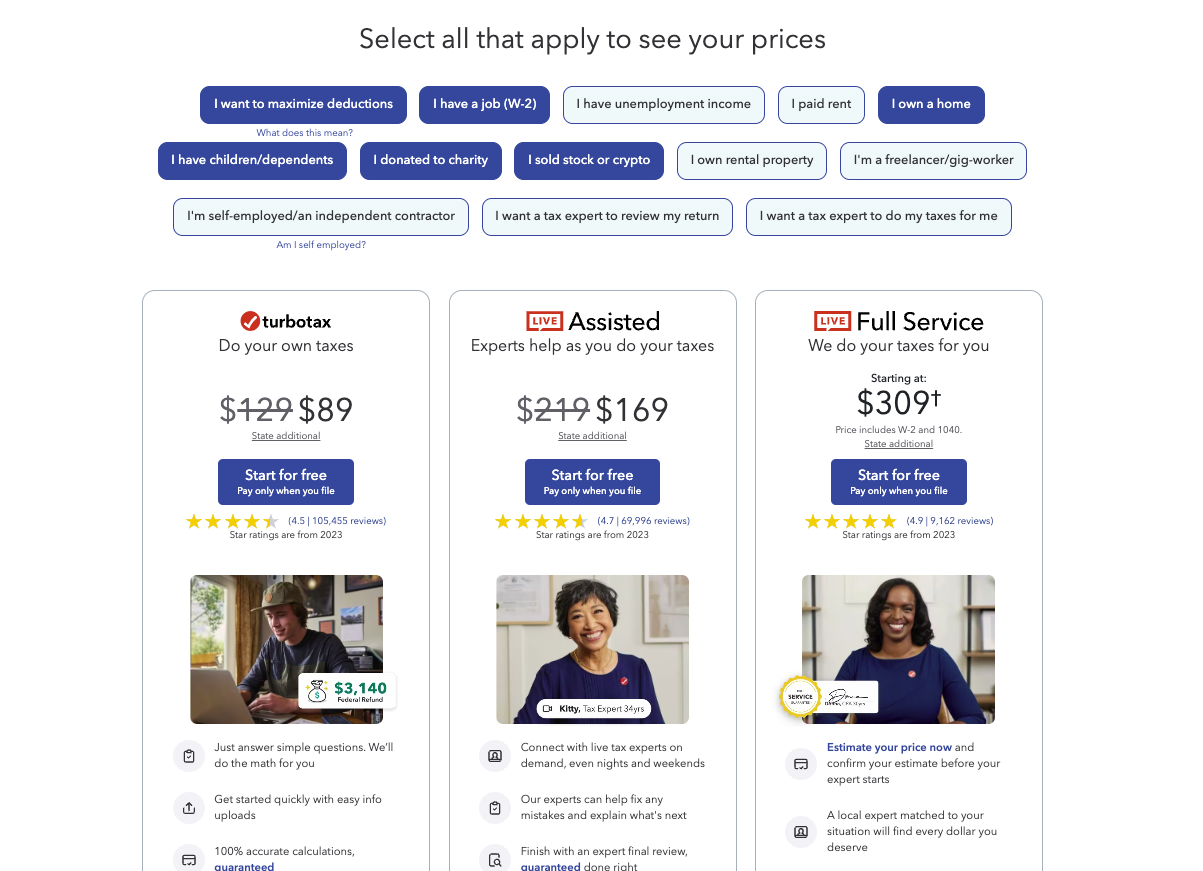

TurboTax significantly changed their product pricing and plans for 2024. They have moved from a "tier level" structure of Free, Deluxe, Premium, Self-Employed, to a "service level" structure focusing on their service options.

TurboTax offers three levels of tax filing. You can choose to do you own taxes, get expert assistance while you file (Live Assisted), and have an expert file your taxes for you (Live Full Service).

Generally, the more assistance you need, the more you'll pay.

TurboTax doesn't display exact prices on its website, displaying price ranges instead. To get a more precise estimate of the price you will pay, you can select various buttons above the pricing table on the TurboTax website, as per the image below. The prices will adjust in real-time as you select the buttons that pertain to your situation.

Frankly, we find this very disappointing - users should have clear, up-front pricing on each level of service without having to understand all the nuances of a service. And historically, this lack of up-front pricing has been a big point of contention with users of TurboTax.

Our team spent over 2 hours trying to figure out the pricing tiers this year. And the end result is that we still have to leave you with ranges in our review and "starts at", because it can vary so much and it's not that intuitive to figure out. As a result, we significantly reduced our review scores for TurboTax's pricing.

Note: TurboTax tends to adjust prices throughout the tax season, with discounts available at certain points of the year. December and January are generally the best time to lock in low rates. The steepest discounts tend to go away by March. Filers who wait until April typically pay the most.

Service | TurboTax | Live Assisted | Live Full Service |

|---|---|---|---|

Best For | Do Your Own Taxes | Experts help as you do your taxes | We do your taxes for you |

Federal Returns | *$0-$129 | $89 - $219 | Starts at $129 (price may vary) |

State Returns | *$0-$64 per state | $0-$69 per state | $69 per state |

* ~37% of taxpayers will qualify for the TurboTax Free Edition. The free tier can be used by those with W-2 or Social Security Income, but it only supports From 1040 and limited credits.

Note: TurboTax tends to adjust prices throughout the tax season, with discounts available at certain points of the year. December and January are generally the best time to lock in low rates. The steepest discounts tend to go away by March. Filers who wait until April typically pay the most.

How Does TurboTax Compare?

TurboTax is a leader in usability and functionality, but the superior experience comes with a premium price tag. TurboTax includes very little in the TurboTax Free Edition tier, and the next tier clocks in at over $100 when including a state tax return.

In many cases, filers don’t need everything that TurboTax offers. Less expensive solutions such as TaxSlayer or FreeTaxUSA often make more sense than TurboTax.

However, TurboTax is the number one choice for crypto traders, stock traders, rental property owners, and small business owners who can benefit from its usability.

Header | ||||

|---|---|---|---|---|

Rating | ||||

Stimulus Credit | Free+ | Free+ | Free+ | Free+ |

Unemployment Income (1099-G) | Deluxe+ | Free+ | Deluxe+ | Classic+ |

Student Loan Interest | Free+ | Free+ | Deluxe+ | Free+ |

Import Last Year's Taxes | Free+ | Free+ | Free+ | Free+ |

Snap A Pic of W-2 | Free+ (other imports also available) | Free+ | Free+ | Not Available |

Multiple States | Up to 5 | Not Free+ | Not advertised | Classic+ |

Multiple W-2s | Free+ | Free+ | Free+ | Free+ |

Earned Income Tax Credit | Free+ | Free+ | Free+ | Free+ |

Child Tax Credit | Free+ | Free+ | Free+ | Classic+ |

Dependent Care Deductions | Deluxe+ | Deluxe+ | Deluxe+ | Classic+ |

HSAs | Deluxe+ | Deluxe+ | Deluxe+ | Classic+ |

Retirement Contributions | Free+ | Free+ | Free+ | Free+ |

Retirement Income (SS, Pension, etc.) | Free+ | Free+ | Free+ | Free+ |

Interest Income | Free+ (Limited Income) | Free+ | Deluxe+ | Classic+ |

Itemize Deductions | Deluxe+ | Deluxe+ | Deluxe+ | Classic+ |

Dividend Income | Free (Limited Income) | Deluxe+ | Deluxe+ | Classic+ |

Capital Gains | Premium | Premium+ | Premier+ | Classic+ |

Rental Income | Premium | Premium+ | Premier+ | Classic+ |

Self-Employment Income | Premium | Premium+ | Self-Employed | Classic+ |

Audit Support | Included with Free, all others must upgrade | Worry-free audit support add-on only | Not Offered | Premium+ |

Small Business Owner (over $5k in expenses) | Premium | Self-Employed | Self-Employed | Classic+ |

TurboTax Free Edition Price | $0 Fed & | $0 Fed & | $0 Fed & | $0 Fed & |

Deluxe Tier Price | Starts at $59 Fed | $55 Fed & $49 Per State | $49.99 Fed & | $37.95 Fed & $44.95 Per State |

Premium | Starts at $129 Fed | $75 Fed & $49 Per State | $69.99 Fed & $59.99 Per State | $57.95 Fed & $44.95 Per State |

Self-Employed Tier Price | N/A; See Premium Plan | $115 Fed & $49 Per State | $99.99 Fed & $59.99 Per State | $67.95 Fed & $44.95 Per State |

Cell |

How Do I Contact TurboTax Support?

TurboTax users can access multiple levels of support. For basic software-related questions, you can select the ‘Help’ icon from the software menu to open the "TurboTax Assistant." From there, you can ask questions and find relevant help articles.

“Live Assistance” from enrolled agents or CPAs is available for a higher fee. TurboTax Live gives you access to tax professionals for questions beyond the software. If you have questions about your tax situation, this is the plan you would need if you can’t solve them yourself.

If you want an expert to handle everything from beginning to end, you can now choose TurboTax Live Full Service and hand off your tax documents to one of TurboTax's professional tax preparers.

Is It Safe And Secure?

TurboTax is a leading software company focusing heavily on data privacy and security. It encrypts all customer information at rest and requires multi-factor authentication.

Although TurboTax employs industry-standard security measures, it's still highly targeted by hackers seeking personal and financial information. The company updated its security measures in response to a vulnerability exposed in a January 2021 cyber attack.

Where To Buy TurboTax

We recommend you use the online version of TurboTax tax software rather than using a disk and installing it on your computer. Your data is usually safer online in a secure cloud managed by TurboTax owner Intuit. Online tax information is always saved as you go. If your computer crashes mid-way through preparing your return, you will retain all your hard work.

TurboTax Online: The easiest way to buy TurboTax is through their website. You can select the plan that works for you, or you can start at any level, and you'll be given the option to upgrade if your tax return requires those features. You only pay when you file, so try it risk-free to decide if you like it before you buy.

Amazon: Amazon offers an Amazon Exclusive where you can get a Federal and State return with one Federal e-File included. Check out the Amazon deal here.

Retail Stores: Many stores will also carry TurboTax for at least a few months of the year, typically from December through April. You can find TurboTax downloads and CDs at Target, Costco, Walmart, Office Depot, Office Max, Staples, and other retailers.

Why Should You Trust Us?

The College Investor team spent years reviewing all of the top tax filing options, and our team has personal experience with the majority of tax software tools. I personally have been the lead tax software reviewer since 2022, and have compared most of the major companies on the marketplace.

Our editor-in-chief Robert Farrington has been trying and testing tax software tools since 2011, and has tested and tried almost every tax filing product. Furthermore, our team has created reviews and video walk-throughs of all of the major tax preparation companies which you can find on our YouTube channel.

We’re tax DIYers and want a good deal, just like you. We work hard to offer informed and honest opinions on every product we test.

How Was This Product Tested?

In our original tests, we went through TurboTax and completed a real-life tax return that included W2 income, self-employment income, rental property income, and investment income. We tried to enter every piece of data and use every feature available. We then compared the result to all the other products we've tested, as well as a tax return prepared by a tax professional.

This year, we went back through and re-checked all the features we originally tested, as well as any new features. We also validated the pricing options.

Is It Worth It?

TurboTax consistently sets the standard for tax software usability. It's easy to use and motivates you to push through to the end. More importantly, TurboTax’s partnerships and integrations automate large portions of the tax filing process for many users.

TurboTax would be the top choice for nearly all filers if it weren't for the cost, and the difficulty to figure out what you're even going to pay. Lower-priced options like TaxSlayer Classic and FreeTaxUSA may be better for those on a budget.

We recommend H&R Block Premium as a solid alternative for side hustlers and the lowest tier version, which is more robust than what you get with the TurboTax Free Edition.

We recommend TurboTax as the top choice for landlords, cryptocurrency investors and traders, and most stock investors. People with complex tax needs often agree that saving time is worth the extra cost, and TurboTax's integrations still save a lot of time.

TurboTax FAQs

Here are some common questions we get about TurboTax every year:

Is TurboTax Free?

The TurboTax Free Edition offers limited, free tax filing. Only ~37% of taxpayers will qualify for TurboTax Free Edition, which only supports Form 1040 and limited credits, so some users may find that they need to upgrade to higher tiers.

Can TurboTax Online help me file my crypto investments?

Yes, TurboTax has a built-in integration with Coinbase that allows a direct import of all transactions from Coinbase. It is also an official partner of CoinLedger (formerly CrypoTrader.tax) and allows imports from sources like CoinTracker.

DoesTurboTax offer refund advance loans?

TurboTax is offering refund advance loans up to $4,000 this year. Refund advance loans are paid into Credit Karma Money checking accounts. Funds are accessible through the Credit Karma Visa® Debit Card or online banking. The loans are 0% interest loans and are repaid automatically as soon as the IRS refunds your money. Virtual cards are available instantly. Physical cards arrive in a week or two.

Does TurboTax offer any deals on refunds?

TurboTax Online software isn’t currently advertising any specific refund deals. However, certain downloadable software packages from Amazon advertise a 3% refund boost when users accept their refund on Amazon Gift Cards.

Is TurboTax Better Than H&R Block?

It depends. We found H&R Block to be better for cost and does a better job than most competitors in terms of usability. TurboTax includes an easier user interface, though, and it can make tax filing easier and faster. Your tax return results should be nearly identical with either.

TurboTax Features

Federal Cost |

|

State Cost per return |

|

Audit Support | Included with the TurboTax Free Edition, everyone else is $49.99 for Audit Defense |

Tax Extension | Yes (Free) |

Import Tax Returns | Yes, PDFs or tax data files |

Unlimited Amendments | Yes |

Self-Employment Income | Yes, with the Premium Tier |

Itemize Deductions | Yes (Deluxe+) |

Deduct Charitable Donations | Yes (Deluxe+) |

Customer Service Options | Help Center, Live Assistance From Tax Pros, Full Service |

Web/Desktop Software | Yes |

Mobile Apps | No |

Promotions | None |

TurboTax 2024 Review

-

Navigation

-

Ease Of Use

-

Features And Options

-

Customer Service

-

Plans And Pricing

Overall

Summary

TurboTax is easy to use tax software due to its simplicity and upgrade options for support from a tax professional.

Pros

- Easy, yet robust, user experience

- Many third-party integrations

- You can now hand off your tax return to a tax pro for full-service preparation if you need it

Cons

- Priciest option for doing your own taxes on the market (and pricing is not transparent)

- Most people don’t need everything it offers

- You may need upgrade to get answers from a tax professional

Eric Rosenberg is a financial writer, speaker, and consultant based in Ventura, California. He holds an undergraduate finance degree from the University of Colorado and an MBA in finance from the University of Denver. After working as a bank manager and then nearly a decade in corporate finance and accounting, Eric left the corporate world for full-time online self-employment.

His work has been featured in online publications including Business Insider, Nerdwallet, Investopedia, The Balance, Huffington Post, and other financial publications. When away from the computer, he enjoys spending time with his wife and three children, traveling the world, and tinkering with technology. Connect with him and learn more at EricRosenberg.com.

Editor: Colin Graves Reviewed by: Robert Farrington