One of the biggest questions I've been seeing this year are what the various reference codes mean on the IRS Refund Status Tool (previously known as "Where's My Refund") - or on the IRS2Go app. A lot of tax filers are getting IRS Reference Codes back, but don't know what they mean and don't know if they are in trouble.

That is closely followed by what do the various codes on the IRS tax transcript mean (for those that diligently check their transcript daily during tax season).

For more information on when to expect your tax refund if you don't want to worry about transcript codes, check out When To Expect My Tax Refund Tax Calendar.

Also, if you're concerned about a generic message that says "Refer to Tax Topic 152", all that means is check out these tips about getting your refund. Here is a link to Tax Topic 152.

We put together a list of common errors and issues, you can check it out here: IRS Where's My Refund Common Questions.

What Is A Tax Transcript And Why Does It Matter?

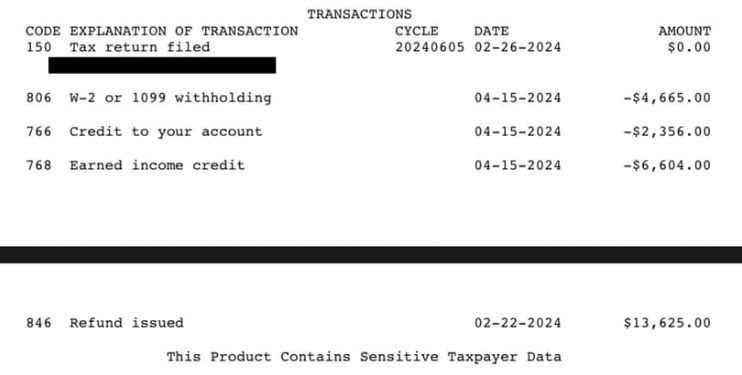

The IRS tax transcript is the readout of your personal IRS Master File account where your tax return is processed. Every tax filer has an account at the IRS tied to your Social Security or Tax Payer ID number, and you can pull the transcript of everything happening to your file.

Transcript Codes show what actions are being performed on your tax file. Savvy filers know that they can pull their tax transcript and potentially see when they will be getting their tax refund early. It will also show any errors or issues.

Common things you can see in your tax transcript:

- When your tax refund is set to be issued

- If your tax refund is subject to offset

- Any adjustments to your tax refund

- And issues or IRS notices

The transaction list is in the lower half of your tax transcript and you can see the codes and dates of transactions.

Important IRS Transcript Codes

Now that you know what to look for, what codes should you be checking? Here are the "most important" IRS transcript codes that you should know.

The main code everyone looks for is 846, which means your tax refund will be issued!

Transaction Code | Description |

|---|---|

150 | Tax Return Filed |

424 | Examination Request Indicator |

425 | Reversed TC 424 |

810 | Refund Freeze |

811 | Reverse TC 810 |

846 | Tax Refund Issued |

971 | Miscellaneous Transaction (Letter in Mail) |

Full List IRS Transaction Codes

There are a LOT of transaction codes that can appear on your tax transcript. Some of these apply to personal returns, and other codes may only apply to entity (business) returns.

Transaction Code | Description |

|---|---|

000 | Establish Account |

001 | Resequence Account (TIN Change) |

002 | Resequence Merge Fail |

003 | Duplicate Tax Modules are not Resequenced |

004 | BMF Partial Merge |

005 | Resequenced Account or Plan For Merge |

006 | Merge Plan Resequenced |

007 | Carrier Transaction |

008 | IMF/BMF Complete Merge |

011 | Change EIN or SSN or Plan Number |

012 | Reopen Entity Account or Plan |

013 | Name Change |

014 | Address Change |

015 | Location and/or Zip Code Change |

016 | Miscellaneous Entity Code Change |

017 | Spouse SSN |

018 | Release Undeliverable Refund Check Freeze |

019 | Area Office Change |

020 | Close Account |

022 | Delete EO Submodule |

023 | Reverse The Election To Lobby |

024 | Election To Lobby |

025 | No Resequence SSN |

026 | Delete Changed TIN |

030 | Update Location Codes |

040 | Direct Change To Valid SSN |

041 | Direct Change To Invalid SSN |

052 | Reversal of TC 053, 054, 055 |

053 | Plan Year Ending Month Change |

054 | Retained FYM |

055 | Change or Adopt New FYM |

057 | Reversal of TC 054, 055 |

058 | Rejection of Form 8716 |

059 | Rejection of Form 1128 |

060 | Elect Foreign Sales Corporation (FSC) |

061 | Revoke Reverses TC 060, 063, 064, or 065 |

062 | Erroneous |

063 | FSC Election Received |

064 | FSC Election Denied |

065 | FSC Revocation Received |

066 | Terminate FSC Received |

070 | Church Exemption from Social Security Taxes |

071 | Revocation of Church Exemption from Social Security Taxes |

072 | Deletion of TC 070 Input in Error |

073 | Correction of Erroneous Revocation / Termination |

076 | Acceptance of Form 8832 |

077 | Reversal of TC 076 |

078 | Rejection of Form 8832, Entity Classification Election |

079 | Revocation of Form 8832, Entity Classification Election |

080 | Validates Spouse’s SSN |

082 | Acceptance of Form 8869 |

083 | Reversal of TC 082 |

084 | Termination of Form 8869 |

085 | Reversal of TC 084 |

086 | Effective Date of Revocation |

087 | Reversal of TC 086 |

090 | Small Business Election |

091 | Terminate Small Business |

092 | Reverses TC 090, 093, 095,097 |

093 | Application for Small Business Election |

094 | Application for Small Business Denied |

095 | Application for Small Business Pending |

096 | Small Business Election Terminated |

097 | Application for Small Business Pending National Office Approval |

098 | Establish or Change in a Fiduciary Relationship |

099 | Termination of Fiduciary Relationship |

100 | Acceptance of Qualified Subchapter S Trust (QSST) |

101 | Revocation of Qualified Subchapter S Trust (QSST) |

102 | Acceptance of Electing Small Business Trust (ESBT) |

103 | Revocation of Electing Small Business Trust (ESBT) |

110 | Designates Windfall Profits Tax Return to GMF Unpostable System |

120 | Account Disclosure Code |

121 | Employee Plan Characteristics |

122 | Reversal of Employee Plan Characteristics |

123 | Update of Employee Plan Characteristics |

125 | Plan Termination |

126 | Reversal of Termination |

127 | Administrator Data Change |

128 | Administrator Data Change |

129 | HHS Request |

130 | Entire Account Frozen from Refunding |

131 | Reversal of TC 130 Refund Freeze |

132 | Reversed TC 130 |

136 | Suppress FTD Alert |

137 | Reverse Supress |

140 | IRP Delinquency Inquiry |

141 | Delinquency Inquiry |

142 | Delinquency Investigation |

148 | Issuance of TDA |

149 | Reversal of TC 148 |

150 | Return Filed & Tax Liability Assessed |

151 | Reversal of TC 150 or 154 |

152 | Entity Updated by TC 150 |

154 | Posting F5330 Data |

155 | 1st Correspondence Letter Sent |

156 | Subsequent Correspondence Sent |

157 | Schedule A |

159 | Settlement Data |

160 | Manually Computed Delinquency Penalty |

161 | Abatement of Delinquency Penalty |

162 | Failure to File Penalty Restriction Deletion |

166 | Delinquency Penalty |

167 | Abate Delinquency Penalty |

170 | Estimated Tax Penalty |

171 | Abatement of Estimated Tax Penalty |

176 | Estimated Tax Penalty |

177 | Abatement of Estimated Tax Penalty |

180 | Deposit Penalty |

181 | Deposit Penalty Abatement |

186 | FTD (Deposit) Penalty Assessment |

187 | Abatement of FTD Penalty Assessment |

190 | Manually Assessed Interest Transferred In |

191 | Interest Abatement |

196 | Interest Assessed |

197 | Abatement of Interest Assessed |

200 | Taxpayer Identification Number Penalty Assessment |

201 | Taxpayer Identification Number Penalty Abatement |

234 | Assessed Daily Delinquency Penalty |

235 | Abates Daily Delinquency Penalty |

238 | Daily Delinquency Penalty |

239 | Abatement of Daily Delinquency Penalty |

240 | Miscellaneous Penalty |

241 | Abate Miscellaneous Civil Penalty |

246 | Form 8752 or 1065 Penalty |

247 | Abatement of 1065 Penalty |

270 | Manual Assessment Failure to Pay Tax Penalty |

271 | Manual Abatement of Failure to Pay Tax Penalty |

272 | Failure to Pay Penalty Restriction Deletion |

276 | Failure to Pay Tax Penalty |

277 | Abatement of Failure to Pay Tax Penalty |

280 | Bad Check Penalty |

281 | Abatement of Bad Check Penalty |

286 | Bad Check Penalty |

287 | Reversal of Bad Check Penalty |

290 | Additional Tax Assessment |

291 | Abatement Prior Tax Assessment |

294 | Additional Tax Assessment with Interest Computation Date |

295 | Abatement of Prior Tax Assessment with Interest Computation Date |

298 | Additional Tax Assessment with Interest Computation Date |

299 | Abatement of Prior Tax Assessment Interest Computation Date |

300 | Additional Tax or Deficiency Assessment by Examination Div. or Collection Div. |

301 | Abatement of Tax by Examination or Collection Div. |

304 | Additional Tax or Deficiency, Assessment by Examination, Div.with Interest Computation Date |

305 | Abatement of Prior Tax Assessment by Examination Div. with Interest Computation Date |

308 | Additional Tax or Deficiency Assessment by Examination or Collection Div. with Interest Computation Date |

309 | Abatement of Prior Tax Assessment by Examination Div. with Interest Computation date |

310 | Penalty for Failure to Report Income from Tips |

311 | Tip Penalty Abatement |

320 | Fraud Penalty |

321 | Abatement of Fraud Penalty |

336 | Interest Assessment on Additional Tax or Deficiency |

337 | Abatement of Interest Assessed on Additional Tax or Deficiency |

340 | Restricted Interest Assessment |

341 | Restricted Interest Abatement |

342 | Interest Restriction Deletion |

350 | Negligence Penalty |

351 | Negligence Penalty Abatement |

360 | Fees & Collection Costs |

361 | Abatement of Fees & Collection Costs |

370 | Account Transfer-In |

380 | Overpayment Cleared Manually |

386 | Clearance of Overpayment |

388 | Statute Expiration Clearance to Zero Balance and Removal |

389 | Reversal of Statute Expiration |

400 | Account Transfer-out |

402 | Account Re-Transferred-In |

420 | Examination Indicator |

421 | Reverse Examination Indicator |

424 | Examination Request Indicator |

425 | Reversed TC 424 |

427 | Request Returns from SERFE file |

428 | Examination or Appeals Case Transfer |

429 | Request AIMS Update from MF |

430 | Estimated Tax Declaration |

432 | Entity Updated by TC 430 |

446 | Merged Transaction Indicator |

450 | Transferee Liability Assessment |

451 | Reversal of TC 450 |

459 | Prior Quarter Liability, Forms 941 and 720 |

460 | Extension of Time for Filing |

462 | Correction of a TC 460 Transaction Processed in Error |

463 | Waiver to File on Mag Tape |

464 | Reversal of TC 463 |

468 | Extension of Time to Pay Estate Tax |

469 | Reversal of TC 468 |

470 | Taxpayer Claim Pending |

471 | Reversal of Taxpayer Claim Pending |

472 | Reversal of Taxpayer Claim Pending |

474 | Interrupts Normal Delinquency Processings |

475 | Permits TDI Issuance |

480 | Offer-in-Compromise Pending |

481 | Offer-in-Compromise Rejected |

482 | Offer-in-Compromise Withdrawn/Terminated |

483 | Correction of Erroneous Posting of TC 480 |

488 | Installment and/or Manual Billing |

489 | Installment Defaulted |

490 | Mag Media Waiver |

494 | Notice of Deficiency |

495 | Closure of TC 494 or correction of TC 494 processed in error |

500 | Military Deferment |

502 | Correction of TC 500 Processed in Error |

503 | TC 500 changed to 503 when posting TC 502 |

510 | Releases Invalid SSN Freeze on Refunds |

520 | IRS Litigation Instituted |

521 | Reversal of TC 520 |

522 | Correction of TC 520 Processed in Error |

524 | Collateral Agreement Pending |

525 | Collateral Agreement No Longer Pending |

528 | Terminate Stay of Collection Status |

530 | Currently not Collectible Account |

531 | Reversal of a Currently not Collectible Account |

532 | Correction of TC 530 Processed in Error |

534 | Expired Balance Write-off, accrued or assessed |

535 | Reversal of Expired Balance Write-off |

537 | Reversal of Currently not Collectible Account Status |

538 | Trust Fund Recovery Penalty Cases |

539 | Trust Fund Recovery Penalty Case Reversal |

540 | Deceased Taxpayer |

542 | Correction to TC 540 Processed in Error |

550 | Waiver Extension of Date Collection Statute Expires |

560 | Waiver Extension of Date Assessment Statute Expires |

570 | Additional Liability Pending/or Credit Hold |

571 | Reversal of TC 570 |

572 | Correction of TC 570 Processed in Error |

576 | Unallowable Tax Hold |

577 | Reversal Of TC 576 |

582 | Lien Indicator |

583 | Reverse Lien Indicator |

586 | Transfer/revenue receipt cross ref. TIN |

590 | Satisfying Trans. Not liable this Tax period |

591 | Satisfying Trans. No longer liable for tax for same MFT if not already delinquent |

592 | Reverse 59X Trans. |

593 | Satisfying Trans. Unable to locate taxpayer |

594 | Satisfying Trans. Return previously filed |

595 | Satisfying Trans. Referred to Examination |

597 | Satisfying Trans. Surveyed satisfies this module only |

598 | Satisfying Trans. Shelved - satisfies this module only |

599 | Satisfying Trans. Returned secured-satisfies this module only |

600 | Underpayment Cleared Manually |

604 | Assessed Debit Cleared |

605 | Generated Reversal of TC 604 |

606 | Underpayment Cleared |

607 | Reversal of Underpayment Cleared |

608 | Statute Expiration Clearance to Zero Balance and Remove |

609 | Reversal of Statute Expiration |

610 | Remittance with Return |

611 | Remittance with Return Dishonored |

612 | Correction of 610 Processed in Error |

620 | Initial Installment Payment: Form 7004 |

621 | Installment Payment Check Dishonored |

622 | Correction of TC 620 Processed in Error |

630 | Manual Application of Appropriation Money |

632 | Reversal of Manual Application of Appropriation Money |

636 | Separate Appropriations Refundable Credit |

637 | Reversal of Separate, Appropriations Refundable Credit |

640 | Advance Payment of Determined Deficiency or Underreporter Proposal |

641 | Dishonored Check on Advance Payment |

642 | Correction of TC 640 Processed in Error |

650 | Federal Tax Deposit |

651 | Dishonored Federal Tax Deposit |

652 | Correction of FTD Posted in Error |

660 | Estimated Tax |

661 | ES payment or FTD Check Dishonored |

662 | Correction of TC 660 Processed in Error |

666 | Estimated Tax Credit Transfer In |

667 | Estimated Tax Debit Transfer Out |

670 | Subsequent Payment |

671 | Subsequent Payment Check Dishonored |

672 | Correction of TC 670 Processed in Error |

673 | Input of a TC 672 Changes an existing TC 670 to TC 673 |

678 | Credits for Treasury Bonds |

679 | Reversal of Credits for Treasury Bonds |

680 | Designated Payment of Interest |

681 | Designated Payment Check Dishonored |

682 | Correction of TC 680 Processed in Error |

690 | Designated Payment of Penalty |

691 | Designated Payment Check Dishonored |

692 | Correction of TC 690 Processed in Error |

694 | Designated Payment of Fees and Collection Costs |

695 | Reverse Designated Payment |

700 | Credit Applied |

701 | Reverse Generated Overpayment Credit Applied |

702 | Correction of Erroneously Applied Credit |

706 | Generated Overpayment Applied from Another Tax Module |

710 | Overpayment Credit Applied from Prior Tax Period |

712 | Correction of TC 710 or 716 Processed in Error |

716 | Generated Overpayment Credit Applied from Prior Tax Period |

720 | Refund Repayment |

721 | Refund Repayment Check Dishonored |

722 | Correction of TC 720 Processed in Error |

730 | Overpayment Interest Applied |

731 | Reverse Generated Overpayment Interest Applied |

732 | Correction of TC 730 Processed in Error |

736 | Generated Interest Overpayment Applied |

740 | Undelivered Refund Check Redeposited |

742 | Correction of TC 740 Processed in Error |

756 | Interest on Overpayment Transferred from IMF |

760 | Substantiated Credit Payment Allowance |

762 | Correction of TC 760 Processed In Error |

764 | Earned Income Credit |

765 | Earned Income Credit Reversal |

766 | Generated Refundable Credit Allowance |

767 | Generated Reversal of Refundable Credit Allowance |

768 | Earned Income Credit |

771 | Interest Reversal Prior to Refund Issuance |

772 | Correction of TC 770 Processed in Error or interest netting |

776 | Generated Interest Due on Overpayment |

777 | Reverse Generated Interest Due Taxpayer or interest netting |

780 | Master File Account Compromised |

781 | Defaulted Account Compromise |

782 | Correction of TC 780 Processed in Error |

788 | All Collateral Conditions of the Offer Completed |

790 | Manual Overpayment Applied from IMF |

792 | Correction of TC 790 Processed in Error |

796 | Overpayment Credit from IMF |

800 | Credit for Withheld Taxes |

802 | Correction of a TC 800 Processed in error |

806 | Credit for Withheld Taxes & Excess FICA |

807 | Reversed Credit for Withheld Taxes |

810 | Refund Freeze |

811 | Reverse Refund Freeze |

820 | Credit Transferred |

821 | Reverse Generated Overpayment Credit Transferred |

822 | Correction of an Overpayment Transferred In Error |

824 | Overpayment Credits Transferred to Another or to Non-MF Accounts |

826 | Overpayment Transferred |

830 | Overpayment Credit Elect (Transferred) to Next Periods Tax |

832 | Correction of Credit Elect |

836 | Overpayment Credit Elect Transferred to Next Periods Tax |

840 | Manual Refund |

841 | Cancelled Refund Check Deposited |

842 | Refund Deletion |

843 | Check Cancellation Reversal |

844 | Erroneous Refund |

845 | Reverse Erroneous Refund |

846 | Refund of Overpayment |

850 | Overpayment Interest Transfer |

851 | Reverse Generated Overpayment Interest Transfer |

852 | Correction of TC 850 Processed in Error |

856 | Overpayment Interest Transfer by Computer |

860 | Reverses Erroneous Abatement |

876 | Interest on Overpayment Transferred to BMF |

890 | Manual Transfer of Overpayment Credits to BMF |

892 | Correction of TC 890 Processed in Error |

896 | Overpayment Credit Offset |

897 | DMF Offset Reversal |

898 | FMS TOP Offset |

899 | FMS TOP Offset reversal or Agency Refund/Reversal |

901 | Delete IDRS Indicator |

902 | Campus IDRS Indicator |

903 | Master File IDRS Entity Delete |

904 | Notify IDRS Entity or Module not Present |

920 | IDRS Notice Status |

922 | IRP Underreporter |

924 | IRP Communication |

930 | Return Required Suspense |

932 | Reverse Return Required Suspense |

960 | Add/Update Centralized Authorization File Indicator Reporting Agents File |

961 | Reverse Centralized Authorization File Indicator |

970 | F720 Additional Schedules; or F945 liability amounts from F945-A and related dates, F941 liability amounts from Schedule B and related dates |

971 | Miscellaneous Transaction |

972 | Reverses Amended/ Duplicate Return XREF TIN/ Tax Period Data |

973 | Application for Tentative Refund F1139 Processed Return Filed-8038 Series Return and Additional Filing of Form 5330 |

976 | Posted Duplicate Return |

977 | Posted Amended Return Posted Consolidated Generated Amended, Late Reply, or DOL Referral |

980 | W-3/1096 Transaction |

982 | CAWR Control DLN Transaction |

984 | CAWR Adjustment Transaction |

986 | CAWR Status Transaction |

990 | Specific Transcript |

991 | Open Module Transcript |

992 | Complete or TaxClass Transcript |

993 | Entity Transcript |

994 | Two Accounts Failed to Merge/ Transcript Generated |

995 | Difference in Validity Status/ Transcript Generated |

996 | Follow-up on Uncollectible |

998 | Update Entity Information |

IRS WMR Error And Reference Codes

Here are the IRS Where's My Refund Tool Reference codes. This is slightly different than your tax transcript. These error codes are specific to the WMR app (Where's My Refund app).

You read this chart by first looking for your code, then seeing what the error is. Each error has a specific set of steps that the IRS will follow, called Inquiry Response Procedure. Here is the list of what the IRM Codes mean.

These are the IRS Reference Codes we've been able to source for the IRS internal documentation. If you're seeing new codes or something different, please drop a comment below so we can research it.

1001 - Refund paper check mailed more than 4 weeks ago

1021 - BFS part offset, check mailed more than 4 weeks ago (contact BFS at 1-800-304-3107)

1061 - BFS part offset, direct deposit more than 1 week ago (contact BFS at 1-800-304-3107)

1081 - IRS full or partial offset, paper check mailed more than 4 weeks ago

1091 - IRS full or partial offset, direct deposit more than one week ago

1101 - No data, taxpayer filed paper return more than 6 weeks ago

1102 - No data, taxpayer filed electronic return more than 3 weeks ago

1121 - Problem identified; P-Freeze (We've discovered that this is typically a typo on the return)

1141 - Refund delayed liability on another account (this means you owe a government entity money)

1161 - Refund delayed, bankruptcy on account

1181 - Refund delayed, pulled for review, not within 7 cycles conduct account analysis

1201 - All other conditions not covered by a status code conduct account analysis

1221 - Refund delayed, pulled for review, within 7 cycles conduct account analysis

1241 - Paper return received more than 6 weeks ago; in review, notice for additional information will be received

1242 - Electronic return received more than 3 weeks ago; –E Freeze; in review, notice for additional information will be received

1261 - Paper return received more than 6 weeks ago; –Q Freeze; in review, notice for additional information will be received

1262 - Electronic return received more than 3 weeks ago; -Q Freeze; in review, notice for additional information will be received

1301 - Fact of Filing Electronic return received more than 3 weeks ago; no other information See IRM 21.4.1.3.1.2, Return Found/Not Processed

1341 - Refund delayed, liability on another account

1361 - Refund withheld for part/full payment of another tax liability

1381 - Refund withheld for part/full payment of another tax liability

1401 - Refund withheld for part/full payment of another tax liability

1421 - Refund delayed bankruptcy on account; -V Freeze; more than 8 weeks

1441 - Refund delayed, SSN, ITIN or Name mismatch with SSA/IRS; return posted to Invalid Segment

1461 - Taxpayer is advised their refund check was mailed undelivered by the Postal Service. Taxpayer is provided the option to update their address online. Check account to determine if the taxpayer changed their address online. If address is changed, advise taxpayer their request is being processed. If taxpayer did not change their address, follow instructions in IRM 21.4.3.4.3, Undeliverable Refund Checks.

1481 - Refund delayed, return Unpostable

1501 - Direct Deposit between 1 and 2 weeks ago, check with bank, file check claim

1502 - Direct Deposit more than 2 weeks ago, check with bank, file check claim

1521 - No data, paper return taxpayer filed more than 6 weeks ago; TIN not validated

1522 - No data, taxpayer filed electronic return more than 3 weeks ago; TIN not validated

1541 - Offset Overflow freeze set when offset storage within IDRS is not large enough to hold all generated transactions, or credit balance has been completely offset and two or more debit modules still exist

1551 - Frivolous Return Program freeze

1561 - Excess credit freeze set when the taxpayer claims fewer credits than are available

1571 - Erroneous refund freeze initiated

1581 - Manual refund freeze with no TC 150, or, return is Coded CCC "O" and TC 150 posted without TC 840

2007/2008 - Taxpayer’s check returned undelivered by the Postal Service and taxpayer does not meet Internet Refund Fact of Filing (IRFOF) eligibility. For example account may have an additional liability, or a freeze code other than S-. Analyze account and take appropriate action.

2009 - Taxpayer’s check returned undelivered by the Postal Service and taxpayer does not meet IRFOF eligibility. Taxpayer does not pass disclosure through IRFOF due to lack of data on IRFOF.

2015 - Savings bond request denied - partial offset - more than 3 weeks from refund date

2016 - Savings bond request denied - total offset

2017 - Savings bond request allowed - more than 3 weeks from refund date

5501 - Split direct deposit - partial offset - more than 2 weeks from refund date

5510 - Split direct deposit - returned by the bank - check mailed - with partial offset

5511 - Split direct deposit - returned by the bank - check mailed

8001 - Paper return taxpayer filed more than 6 weeks ago, failed authentication

8002 - Electronic return taxpayer filed more than 3 weeks ago, failed authentication

8028 - A security condition is preventing you from accessing the system.

9001 - Where's My Refund System Error. Before you freak out and leave a comment, read our full article on IRS Code 9001 and What It Really Means?

9021 - Reference Code for all math error conditions Analyze account and follow appropriate IRM

9022 - Math error on return. Direct deposit more than 1 week ago Analyze account and follow appropriate IRM

9023 - Math error on return. Refund paper check mailed more than 4 weeks ago Analyze account and follow appropriate IRM

9024 - Math error on return. Balance due more than $50 Analyze account and follow appropriate IRM

If You Get a Reference Code on Your WMR

If you check Where's My Refund (WMR) and see you have a reference code, you should identify the code and see if any action is required.

In many cases, no action is required on your part. One of the most common codes is 9001, which, as you can see, just means you accessed WMR using a different SSN or TIN. Once the IRS analyzes to ensure no fraud has taken place, you will get your return like normal.

If there is an issue, the IRS will typically send you a letter to your mailing address within 90 days stating what the issue was, and any additional information required.

If you have any questions, you can contact the IRS directly at 800-829-1040.

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Ashley Barnett