If you're looking for free online tax software, Cash App Taxes (formerly Credit Karma Tax) is the only service offering truly free federal and state filing to all users.

While it doesn’t have all of the bells and whistles of the premium-priced TurboTax, it can handle the most common situations, including investments and taxes for your business or side hustle. The platform has undergone some changes for 2024, and it now provides even more high-quality options for most filers.

The following Cash App Taxes review breaks down everything you need to know about doing your taxes with this no-cost platform. If you want to see how Cash App Taxes compares to other DIY tax prep options, check out our top tax software picks for 2024.

Cash App Taxes Details | |

|---|---|

Product Name | Cash App Taxes |

Federal Price | $0 |

State Price | $0 |

Preparation Type | Self-Prepared |

Promotions | None |

Cash App Taxes - Is It Really Free?

Yes, Cash App Taxes is 100% free and doesn't have any paid tiers. If Cash App Taxes supports your needs, which it does for most people, you won’t have to enter a credit card number or pay for any upsells.

Some tax filers, such as those who worked in multiple states or earned foreign income, may not qualify to use Cash App Taxes. Users get free access to the software in exchange for downloading the Cash App and creating a Cash App account.

Cash App, formerly known as Square Cash, offers peer-to-peer money transfers similar to PayPal and Venmo. Block, Inc., the company behind the Square ecosystem of payment, payroll, and business products, owns the Cash App and Cash App Taxes.

In 2023, we named Cash App Taxes the Best Free Tax Software, Best Tax Software for Side Hustlers, and Best Value Tax Software. Honestly, if you are able to use Cash App Taxes, you should. You can't beat free tax filing!

What’s New In 2024?

With Cash App at the controls for a couple of tax filing seasons now, the app is solidly part of the Cash App family. Cash App is owned by the same company as Square, the popular payment platform for small businesses.

In 2024, Cash App Taxes still doesn’t work for filers needing to do taxes in multiple states, including if you moved to a new state mid-year. In our testing, we also noticed that it doesn’t handle underpayment penalty calculations, which can be problematic for some filers, notably self-employed business owners and freelancers.

While you can’t import investment data, you can import a W2 if your W2 is provided by a qualifying partner.

Due to excellent pricing and other quality features, we named Cash App Taxes to our Best Free Tax Software list. It’s our top pick for free tax software and the best value in the online DIY tax space.

However, in our testing, it’s not perfect and may not be the perfect fit for your own tax situation. The product didn’t catch errors like over-contributions to self-employed 401(k) plans and led to challenges in accurately entering taxes for investments for a member of our team.

You can find the full rankings of the Best Tax Software here.

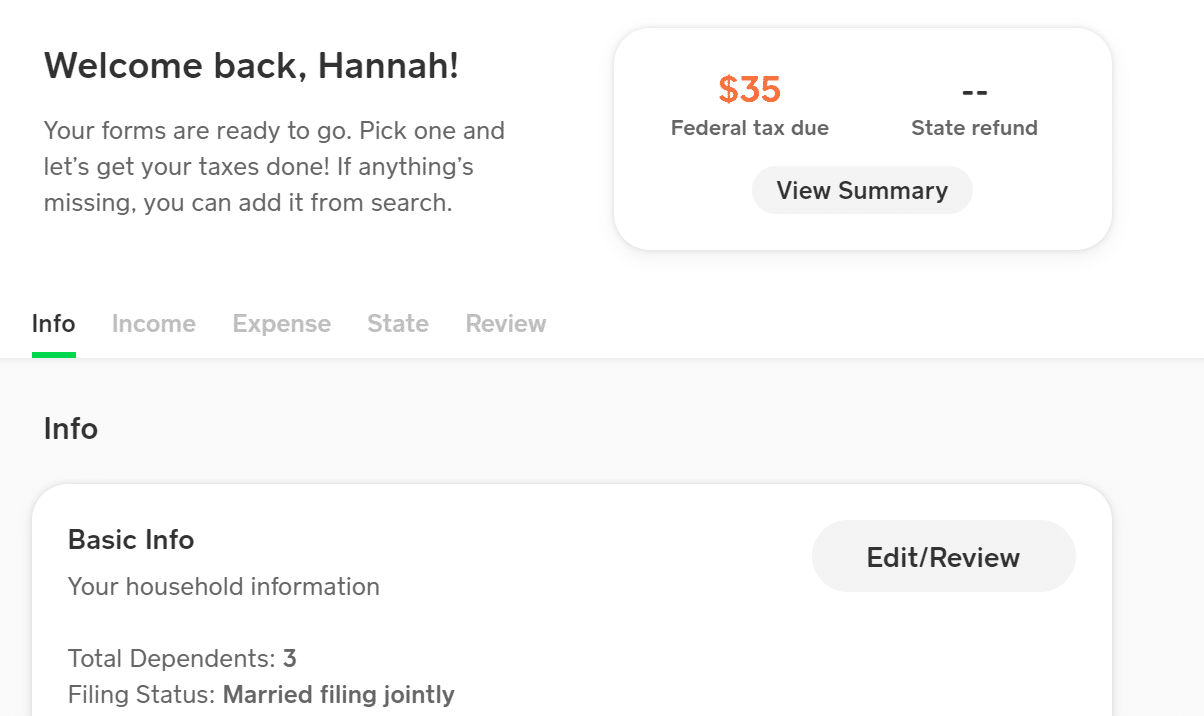

Cash App Taxes new navigation format

Does Cash App Taxes Make Tax Filing Easy In 2024?

Cash App Taxes makes tax filing relatively easy for most users. It only supports some W-2 imports but has decent calculators and a good user interface. Cash App Taxes is a top choice if you mostly have information from employment, bank interest, passive investments, or a small business.

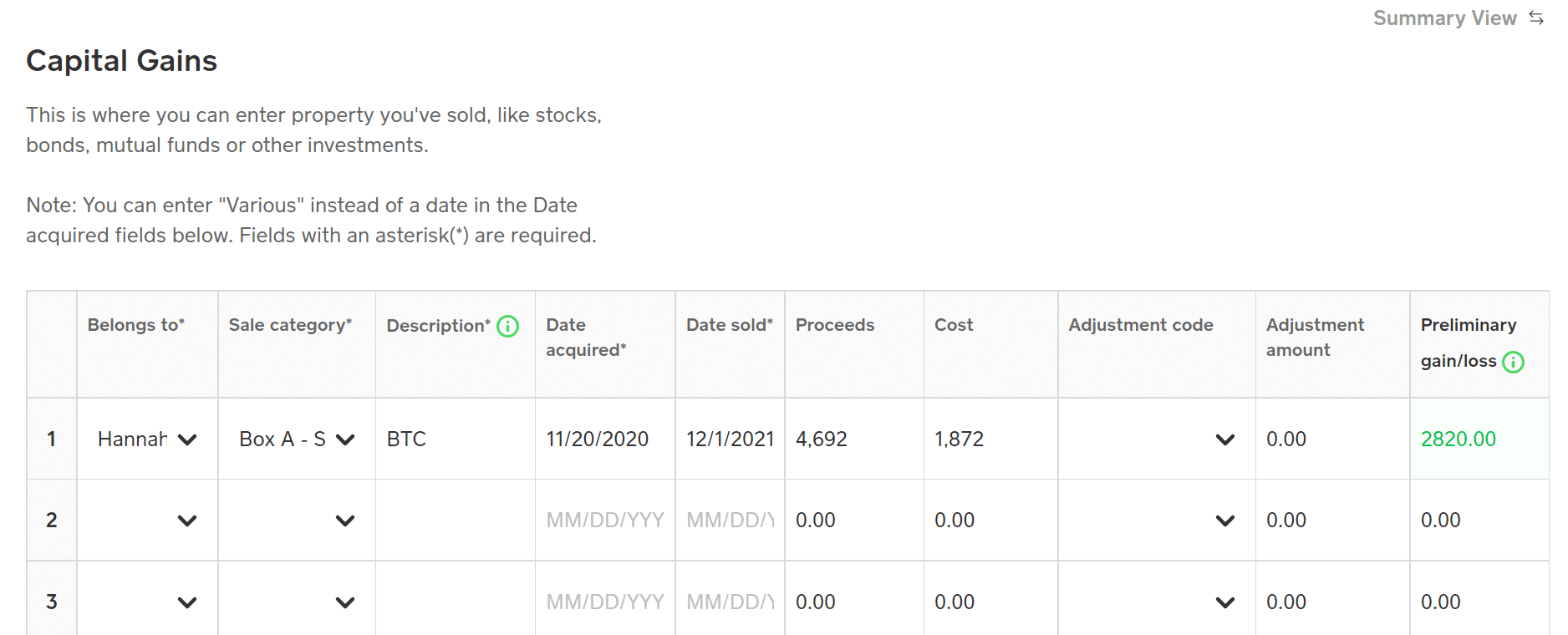

However, active traders (crypto or stocks) must manually enter each trade, which is tedious, and can result in errors. It also doesn’t support those who live in two states, work across state lines, or have to file in two states for any other reason.

Additionally, we found one issue associated with over-contributions to self-employed 401(k) plans. That said, these limitations won’t apply to most users. Cash App Taxes is an excellent tax software for most common situations.

Cash App Taxes Features

Cash App Taxes offers free tax filing for most people, but the software is more robust than its price tag implies. These are a few of the product’s best features.

Completely Free Federal And State Filing

With many tax software companies, the free tier is incredibly limited, so most taxpayers are forced to upgrade to a paid tier. Not so with Cash App Taxes. It offers all of its features for free. Users only need to download the Cash App to access the robust software.

Customized Filing Experience

Filers complete a short questionnaire at the start of the filing process. This streamlines the filing process, so users don’t have to open or review the information that isn’t relevant to them.

Required Multi-Factor Authentication

Cash App Taxes takes security very seriously. It requires users to use multi-factor authentication. A physical second form of authentication is a best practice that few other companies offer (much less require).

Free Audit Support

Cash App Taxes provides free Audit Support (through a third party) for anyone who files using Cash App Taxes. The support includes organizing tax documents, writing to the IRS, and attending hearings associated with the audit.

Cash App Taxes Drawbacks

Cash App Taxes is suitable for the typical tax filing scenario but has a few drawbacks, especially for those seeking premium features. You can check Cash App Support to see what situations they don't support.

Limited Form Imports

Cash App Taxes only supports limited W-2 imports. If your employer or its payroll provider supports the feature, you can download your income details right into Cash App taxes with a few clicks. Otherwise, you’ll have to type it in manually.

They don't allow users to import 1099 forms from banks and brokerages. This may be a dealbreaker, especially for crypto or stock traders who don’t want to enter every transaction manually.

Manual entry for stock or crypto trades

Possible To Skip Or Overlook Certain Sections

Cash App Taxes' new navigation relies on customized menu navigation. A short questionnaire simplifies the software, so users aren’t overwhelmed by irrelevant selections. However, users must manually click into each section to enter their information. Users may accidentally skip certain sections if they don’t realize it applies to them.

Cash App Taxes Pricing Plans

Cash App Taxes offers free Federal and State filing. Users don’t have to pay for anything, including free Audit Defense.

How Does Cash App Taxes Compare?

Cash App Taxes is a surprisingly robust software, especially when it's compared to bargain and mid-tier software. Here's a quick look at how it compares to FreeTax USA, TaxAct, and TaxSlayer.

Header | ||||

|---|---|---|---|---|

Rating | ||||

Stimulus Credit | Free | Free | Free+ | Classic+ |

Unemployment Income | Free | Free | Deluxe+ | Free+ |

Student Loan Interest | Free | Free | Deluxe+ | Free+ |

Import Last Year's Taxes | Free | Free | Free+ | Classic+ |

Snap Pic of W2 | N/A | N/A | Free+ | Classic+ |

Multiple States | Not supported | $14.99/state | Not advertised | Free+ |

Multiple W2s | Free | Free | Free+ | Classic+ |

Earned Income Tax Credit | Free+ | Free | Free+ | Classic+ |

Child Tax Credit | Free | Free | Free+ | Classic+ |

Dependent Care Deductions | Free | Free | Deluxe+ | Classic+ |

HSAs | Free | Free | Deluxe+ | Classic+ |

Retirement Contributions | Free | Free | Free+ | Classic+ |

Retirement Income (SS, Pension, etc.) | Free | Free | Free+ | Classic+ |

Interest Income | Free | Free | Deluxe+ | Classic+ |

Itemize | Free | Free | Deluxe+ | Classic+ |

Dividend Income | Free | Free | Deluxe+ | Classic+ |

Capital Gains | Free | Free | Premier+ | Classic+ |

Rental Income | Free | Free | Premier+ | Classic+ |

Self-Employment Income | Free | Free | Self-Employed | Premium+ |

Audit Support | Free | Deluxe ($7.99) | Not Offered | Premium+ |

Support From Tax Pros | N/A | Pro Support ($29.99) | Xpert Help Upgrade | Premium+ |

Small Business Owner (over $5k in expenses) | Free | Free | Self-Employed | Classic+ |

Free Tier Price | $0 Fed & | $0 Fed & | $0 Fed & $39.99 State | $0 Fed & |

Second Tier Price | N/A | Deluxe $7.99 Fed & $14.99/State | Deluxe $49.99 Fed & $59.99/State | Classic $37.95 Fed & $44.95/State |

Third Tier Price | N/A | Pro Support | Premier $69.99 Fed & $59.99/State | Premium $57.95 Fed & |

Fourth Tier Price | N/A | N/A | Self-Employed $99.99 Fed & $59.99/State | Self-Employed $67.95 Fed & $44.95/State |

Cell |

How Do You Log In To Cash App Taxes?

Cash App Taxes significantly improved access to its product last year. Last year, users were required to login via their phone, scan a QR code, and then move back to their computer. It was challenging.

This year, however, users can simply file their taxes from their phone or computer at cash.app/taxes. When logging in for the first time this year, you’ll have to enter a new password for Cash App Taxes and authenticate your login using a code sent to you via text message.

How Do I Contact Cash App Taxes Support?

When using completely free tax software, you should expect to make a few compromises. In the case of Cash App Taxes, one of those compromises is limited support options.

Cash App does have a new dedicated Help Center for Cash App Taxes. But unlike premium tax software companies, you won't have the option to upgrade to tiers that include access to tax pros.

If you have a technical problem with the app, you can call the company's main customer service at 1-800-969-1940. But if you want the ability to ask tax-related questions to experts, you'll likely want to choose a different tax software.

Is It Safe And Secure?

Using any tax software involves certain risks, but Cash App takes security more seriously than most tax companies. It leverages its experience as a banking/brokerage company to protect user information.

To keep your data safe, use unique passwords for every site you use, particularly financial ones like your banking and tax apps. If you’re doing your taxes on a public WiFi network, investing in a VPN can better secure your information.

Why Should You Trust Us?

The College Investor team has spent years reviewing all of the top tax filing options, and our team has personal experience with the majority of tax software tools. I personally have been the lead tax software reviewer since 2022, and have compared most of the major companies on the marketplace.

Our editor-in-chief Robert Farrington has been trying and testing tax software tools since 2011, and has tested and tried almost every tax filing product. Furthermore, our team has created reviews and video walk-throughs of all of the major tax preparation companies which you can find on our YouTube channel.

We’re tax DIYers and want a good deal, just like you. We work hard to offer informed and honest opinions on every product we test.

How Was This Product Tested?

In our original tests, we went through Cash App Taxes and completed a real-life tax return that included W2 income, self-employment income, rental property income, and investment income. We tried to enter every piece of data and use every feature available. We then compared the result to all the other products we've tested, as well as a tax return prepared by a tax professional.

This year, we went back through and re-checked all the features we originally tested, as well as any new features. We also validated the pricing options.

Who Is This For And Is Cash App Taxes Worth It?

Cash App Taxes offers a free product that is more robust than most paid products on the market today. It doesn’t rival premium services (like TurboTax, H&R Block, and TaxSlayer), but it's serviceable for most filers who don’t actively trade stocks or crypto.

Given the ease of use, we’re recommending Cash App Taxes as a top free tax filing option for this year. If your situation qualifies to use Cash App Taxes, you should use it and save on tax preparation costs.

If you're still not sure, check out our list of Cash App Taxes alternatives.

Cash App Taxes FAQs

Let's answer a few of the most common questions people ask about Cash App Taxes:

Can Cash App Taxes help me file my crypto investments?

If you traded one or two tokens, you might want to use Cash App Taxes to file your taxes. Figuring out the cost basis on these trades won’t be too difficult. However, active traders must manually enter dozens or hundreds of transactions. This is too time-consuming to be worthwhile. Active traders should consider TaxAct or TurboTax Premier to reduce the time spent filing.

Can Cash App Taxes help me with state filing in multiple states?

No. Cash App Taxes can help you file your Federal taxes, but it does not support multi-state filing. Tax filers who filed in multiple states should consider an alternative software like Free Tax USA.

Do I have to pay if I have a side hustle?

Cash App Taxes is free for all users, including self-employed business owners and side hustlers.

Does Cash App Taxes offer refund advance loans?

Cash App Taxes doesn’t offer refund advance loans, but filers can get their returns six days earlier if they deposit to a Cash App account. This is an FDIC-insured account.

Does Cash App Taxes offer any deals on refunds?

Cash App Taxes doesn’t offer any deals or incentives associated with refunds.

Cash App Taxes Features

Federal Cost | Free |

State Cost | Free |

Audit Support | Yes |

Printable Tax Return | Yes |

Tax Extension | Yes |

Import Tax Return | Yes, from Credit Karma Tax, TurboTax, H&R Block, or TaxAct |

W-2 Import | Yes |

Brokerage Integrations | No |

Self-Employment Income | Yes |

Itemize Deductions | Yes |

Deduct Charitable Donations | Yes |

Customer Service Options | Help Center, Phone |

Customer Service Phone Number | 1 (800) 969-1940 |

Web/Desktop Software | Yes |

Mobile Apps | Yes, iOS and Android |

Promotions | None |

Cash App Taxes Review 2024

-

Ease Of Use

-

Features And Options

-

Customer Service

-

Plans And Pricing

Overall

Summary

Cash App Taxes (formerly Credit Karma Tax) is the only tax software offering free federal and state filing to all users. It’s not quite as user-friendly or feature-rich as premium tax software, but it’s an excellent choice for budget-conscious tax filers.

Pros

- Completely free filing

- Free audit support

- Excellent depreciation calculators

Cons

- Limited tax form imports (only W2)

- No multi-state support

- Tax pro support isn’t available

Eric Rosenberg is a financial writer, speaker, and consultant based in Ventura, California. He holds an undergraduate finance degree from the University of Colorado and an MBA in finance from the University of Denver. After working as a bank manager and then nearly a decade in corporate finance and accounting, Eric left the corporate world for full-time online self-employment.

His work has been featured in online publications including Business Insider, Nerdwallet, Investopedia, The Balance, Huffington Post, and other financial publications. When away from the computer, he enjoys spending time with his wife and three children, traveling the world, and tinkering with technology. Connect with him and learn more at EricRosenberg.com.

Editor: Colin Graves Reviewed by: Robert Farrington