Groundfloor is a real estate investment company focused on fractional real estate investing, note investing, and more.

But in the last few years, a new type of real estate investing platform registered with the SEC. Groundfloor is the first company qualified by the SEC to offer real estate debt investments via Regulation A for non-accredited investors.

So far, Groundfloor has lent out over $1 billion across 4,800+ projects. Investors to date have received average returns of 10% with a loss ratio (the ratio of principal lost to total principal invested) of less than 1% since 2013.

The numbers sound enticing, but is Groundfloor right for you? Here’s what you need to know in our Groundfloor review.

Groundfloor Details | |

|---|---|

Product Name | Groundfloor |

Min Investment | $10 |

Annual Fee | None for Investors |

Account Type | Cash and SDIRA |

Promotions | None |

What Is Groundfloor?

Groundfloor is a fractionalized real estate lending and investing platform. As an investor, you are funding loans for residential real estate projects, including Fix and Flip properties, new construction properties, and buy-and-hold properties.

Potential borrowers submit a loan package that includes detailed numbers, pictures of the property and more. The Groundfloor team of experts reviews proposals, and then chooses to allow the loan into the pipeline or not. The SEC then qualifies each loan as an investment security called a Limited Recourse Obligation (LRO), which is then put on the Groundfloor platform for funding.

Once the deal is in the pipeline, investors can begin allocating funds to the loan. The minimum investment amount is only $10 and there are no fees to investors. Usually the loan is for a term of 12-18 months, but it could be shorter or longer. When the money is in the loan, it’s not liquid. You can’t sell it to another investor, and you can’t cash it out. Once the principal is returned, you’ll receive a repayment of your investment, plus the predetermined interest. You’ll have the option to invest again or withdraw the cash to your bank account.

Groundfloor has a mobile-first approach and its app makes investing easy and accessible for both non-accredited and accredited investors, though you can invest on your desktop and mobile browser as well. With the Auto Investor Account, which launched in fall 2023, your funds will automatically and instantly be invested and diversified across dozens or hundreds of available loans. Because you are automatically invested across dozens or even hundreds of projects at once, you can start to see repayments trickle within as little as seven days.

In the app, you can see your Portfolio Summary, a Projections chart, a Repayments Breakdown, and more. All of this shows you your accrued interest, total loans you’re invested in, an estimate of your portfolio’s value over time, your average realized return, and more. The Groundfloor app is available on iOS and Android devices.

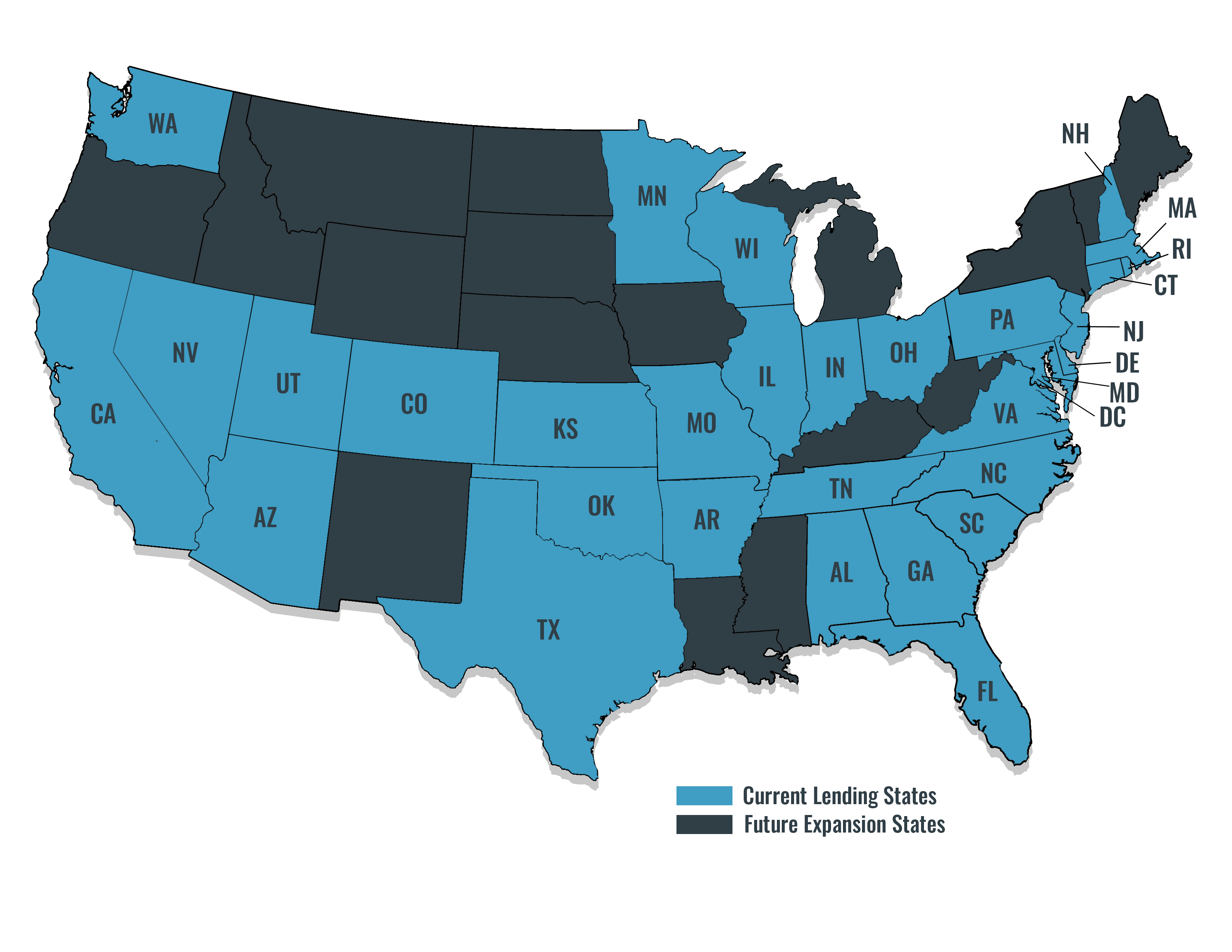

Groundfloor works with investors nationwide. They work with borrowers in 35 states.

Borrowers can get loans for $75K - $750,000 at rates as low as 2.75%. Anyone who has worked with a hard money lender knows that these are screaming deals. They will fund up to 100% of the cost of a project for qualified borrowers, and up to 70% of the after flip value, based on experience. Groundfloor also offers a unique deferred payment loan option, which means you will have no payments during the term of the loan.

How Groundfloor LROs Work

Many investors who will never pick up a hammer, talk to a home inspector, or rehab a house want access to Real Estate investments within their portfolio. Most of these investors will gain real estate exposure by purchasing REITs.

Groundfloor isn’t a REIT. It’s a lending marketplace. The Groundfloor Team is loaded with Real Estate Experts, with over 100 years of collective real estate experience, but there are no guarantees with Groundfloor LROs.

As mentioned, LROs are secured debt investments that provide a share of the interest and principal payments on a specific real estate loan. If you invest in a loan, and the loan goes into default and experiences a loss, you could lose your investment. However, it’s important to note that loans in default don’t always (or even usually) result in a loss.

According to Groundfloor’s recent analysis, loans that have gone into default have still historically returned over 8% interest on average. Groundfloor is always in first lien position on the home. So some or all of the principal can be returned to you in the event of a loss as well.

Since launching in 2013, Groundfloor’s loss ratio (the ratio of principal lost to principal invested) has been less than 1%. If a loan experiences a loss, it could be the loan you fund. As an investor, you don’t have control over the project. You’re outsourcing that work to others.

The key to successful investing on Groundfloor is diversification. Investors who have diversified their portfolios into a large number of loans can still realize high overall rates of return, even when losses occur. In fact, Groundfloor's analysis shows that a model portfolio consisting of an equal investment made into all 3,663 loans repaid as of 2023 would've earned an annualized net return of 9.84%. It’s a great concept, and Groundfloor now has over 10 years of data that you can review in the many analyses the company has available on its blog.

However, it’s a good idea to take some time to become comfortable with Groundfloor’s model before you commit money. Luckily, the company’s $10 minimum investment size and no fees allows you to try the platform out and get a feel for how it works first, without having to invest large sums.

Groundfloor Offers Broad Exposure Potential

Groundfloor doesn’t require you to fund an entire loan yourself. That’s a good thing because the loans are between $75k-$750K. You can gain exposure to loans in up to 32 states. Transparent deals in diverse geographic regions can give you a margin of safety.

A common maxim in real estate is “All Real Estate is Local.” It’s true, but that doesn’t mean that you need all your real estate in one location. To invest through Groundfloor you don’t have to be super-knowledgeable about one particular real estate market. Instead, you can diversify your lending into a number of loans spread across different borrowers in different geographic regions.

The opportunity for diversification across a growing number of high quality loans is one of Groundfloor's biggest strengths. Their $10 minimum investment per project is an intentionally low barrier to diversification, allowing you to easily diversify your portfolio across many projects if you so choose.

But as an investor, you also need to be mindful about maintaining diversification. As of fall 2023, with the Auto Investor Account, Groundfloor automatically diversifies you across all their open loans.

Remember, make sure you understand all the risks of crowdfunding platforms.

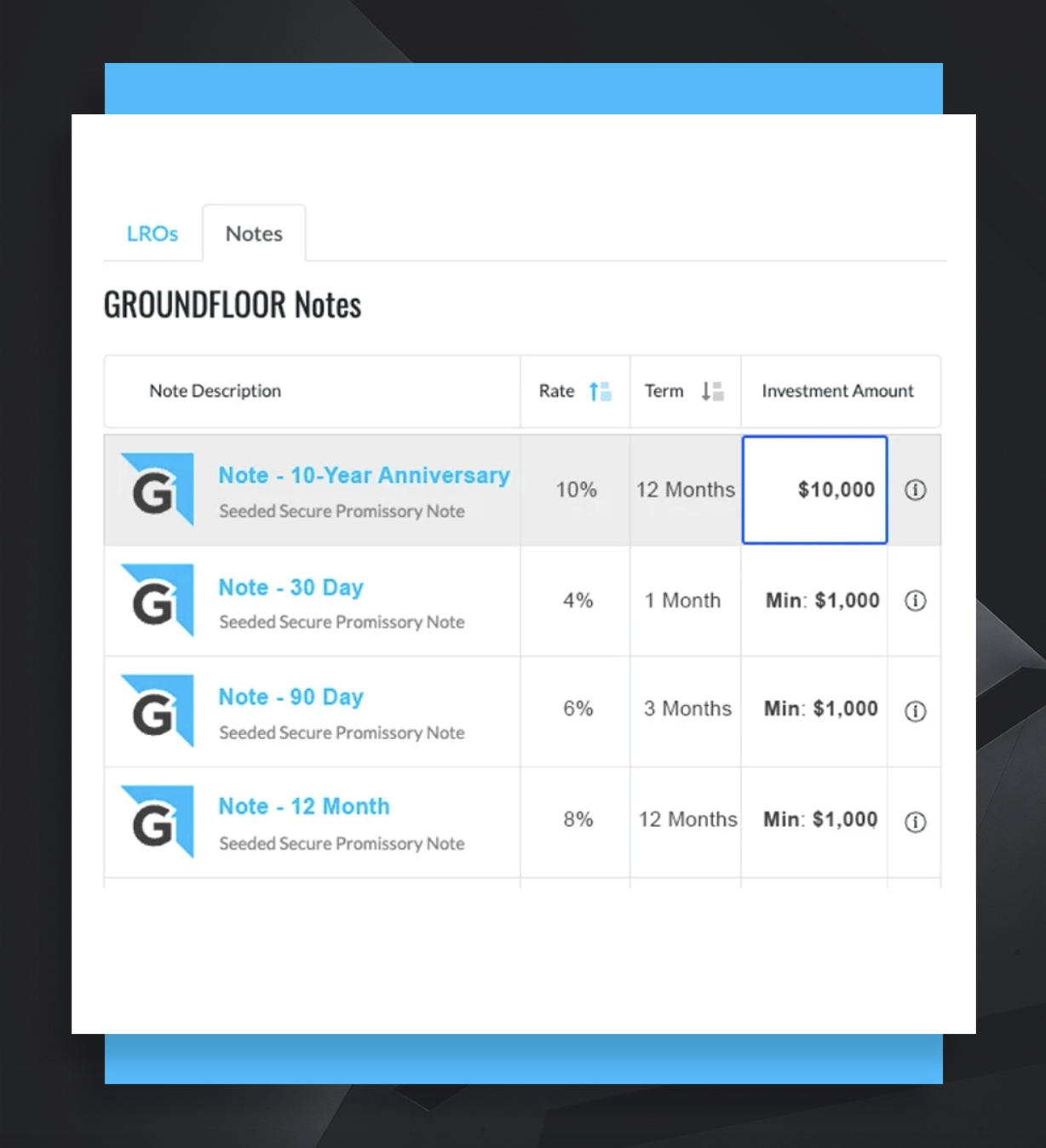

Introducing Groundfloor Notes

Groundfloor recently opened up access to a new product, Groundfloor Notes, which aims to provide investors with real returns and short-term liquidity. Groundfloor Notes are debt investments that provide a fixed interest rate for a fixed term. According to Groundfloor, Notes combine the benefits of savings and investing into a single convenient investment experience.

Groundfloor Notes are secured by pools of loans that Groundfloor has originated, but not yet funded as LROs. The shorter holding periods and fixed repayment dates mean that Notes have a lower risk profile than Groundfloor LROs.

Each Groundfloor Note offers different term lengths, interest rates, and investment minimums, and Groundfloor releases new Note options each month. For example, at the time of writing, Groundfloor is offering interest rates between 4% and 10% on Notes with terms ranging from 30 days to 12 months.

When Notes was first launched, it was only available to accredited investors, but all Groundfloor investors now have access. Current Notes offer 4%-10% interest with a minimum investment as low as $1,000.

Groundfloor Notes are not FDIC-insured.

Benefits Of Investing In Groundfloor Notes

- Passive income opportunity: Unlike physical real estate investing, which often requires a lot of hands-on effort, once you invest in Groundfloor Notes, your work is done, and you can enjoy receiving passive income.

- Offers Diversification: When you invest in Groundfloor Notes, your money is secured by a real physical property, making it a great way to diversify a portfolio otherwise made up of stocks and bonds.

- Potential for High Returns: If you're willing to tolerate some risk, Groundfloor Notes give you the potential to earn much higher returns than keeping your cash in a checking or savings account.

Who Shouldn’t Use Groundfloor?

Groundfloor isn’t an appropriate investment for someone who needs high liquidity. If you need your cash to pay for school, buy a car or start your own business, don’t use Groundfloor.

Groundfloor also isn’t appropriate for investors with little to no risk tolerance who are looking for a principal guarantee. While the platform has earned solid returns over the long-term, your investment is not guaranteed, nor is it FDIC-insured. If a borrower defaults on its loan, there is a chance that you could lose money.

How Does Groundfloor Compare?

Groundfloor is not the only platform where you can invest in real estate related assets. However, they take a different approach by focusing on lending (versus owning an actual cash flowing property). That does give them some unique angles.

Their closest competitor would be Peerstreet, however, Peerstreet declared bankruptcy on June 26, 2023, so its future is uncertain. There are also online platforms like Fundrise that allow you to invest in a pool of real estate.

See this quick comparison:

Header | |||

|---|---|---|---|

Rating | |||

AUM Fees | 0% | 1.00% | 1.00% |

Min Investment | $10 | $500 | $1,000 |

Open To Non-Accredited Investors? | |||

Cell |

Who Can Profit From Groundfloor?

If you’re willing to take on a bit more risk in exchange for somewhat higher returns, Groundfloor might be a great investment for you. Groundfloor could function like high-yield bonds in a well-diversified portfolio. It's not as liquid but the minimum to invest is just $10 per project.

Investors who don’t need immediate liquidity, and are willing to experiment, should look at Groundfloor LROs. It’s a passive way to get into the real estate project action. This will appeal to a lot of investors.

The addition of Groundfloor Notes offers investors liquidity, with terms as short as 30-days, and more attractive interest rates than savings accounts and T-Bills. Keep in mind, however, that Notes are not FDIC-insured.

Borrowers who can meet Groundfloor's rigorous standards will receive low-cost loans with terms that are favorable to flippers. The majority of Groundfloor's borrowers choose its deferred payment option, so they don’t have to make payments on the loan during the course of the fix and flip project. As a borrower, this should be a source to consider.

Groundfloor Review

-

Commissions and Fees

-

Ease of Use

-

Customer Service

-

Risk Mitigation And Due Diligence

-

Features

Overall

Summary

GroundFloor is a P2P real estate lending platform. As an investor, you can preview and fund loans for Fix and Flip properties. Potential borrowers submit a loan package that includes detailed numbers, pictures of the property and more. The GroundFloor team of experts reviews proposals, and then chooses to allow the loan into the pipeline or not.

Pros

- Real estate lending platform that allows peer-to-peer real estate loans

- Low minimum investment

- Groundfloor Notes offer more liquidity and attractive short-term rates

- Allows IRA investments

- Mobile app

Cons

- LROs are less liquid than other investments (terms of 12-18 months)

- Some concerning user experience comments

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Ashley Barnett