Investing is something that everyone should do. There are so many benefits of investing that it makes no sense not to get started.

If you want to build wealth and financial stability investing is what will get you there. Honestly, it's the only way to get there - you can't save your way to being a millionaire (although you can earn and invest your way there).

Still not convinced? Here are five benefits of investing.

Why Invest?

First, why should you be investing versus simply saving money? Or why not just earn more and more, and use that higher earnings to live on?

Let's start with the second thought first - at some point in time, you're going to want to stop working. Most people call this retirement - but it's important to remember that retirement is an amount of money, not an age. You might have heard of the FIRE Movement - Financial Independent, Retire Early. These are people that want to retire early, but focusing more on hitting their number.

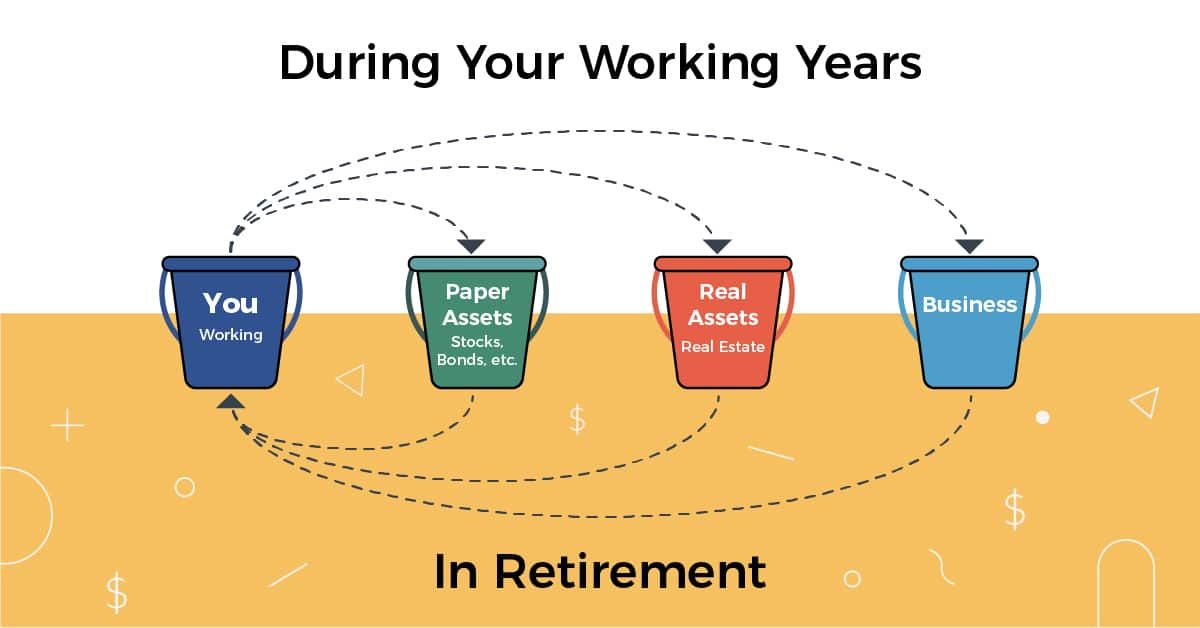

Here's how investing should work - you put aside money from your working bucket into other buckets - stocks, bonds, real estate, etc. Then, when you stop working, those buckets pay you!

Okay, so now that you understand how it works, why not simply earn more money or simply save? Why do you have to invest?

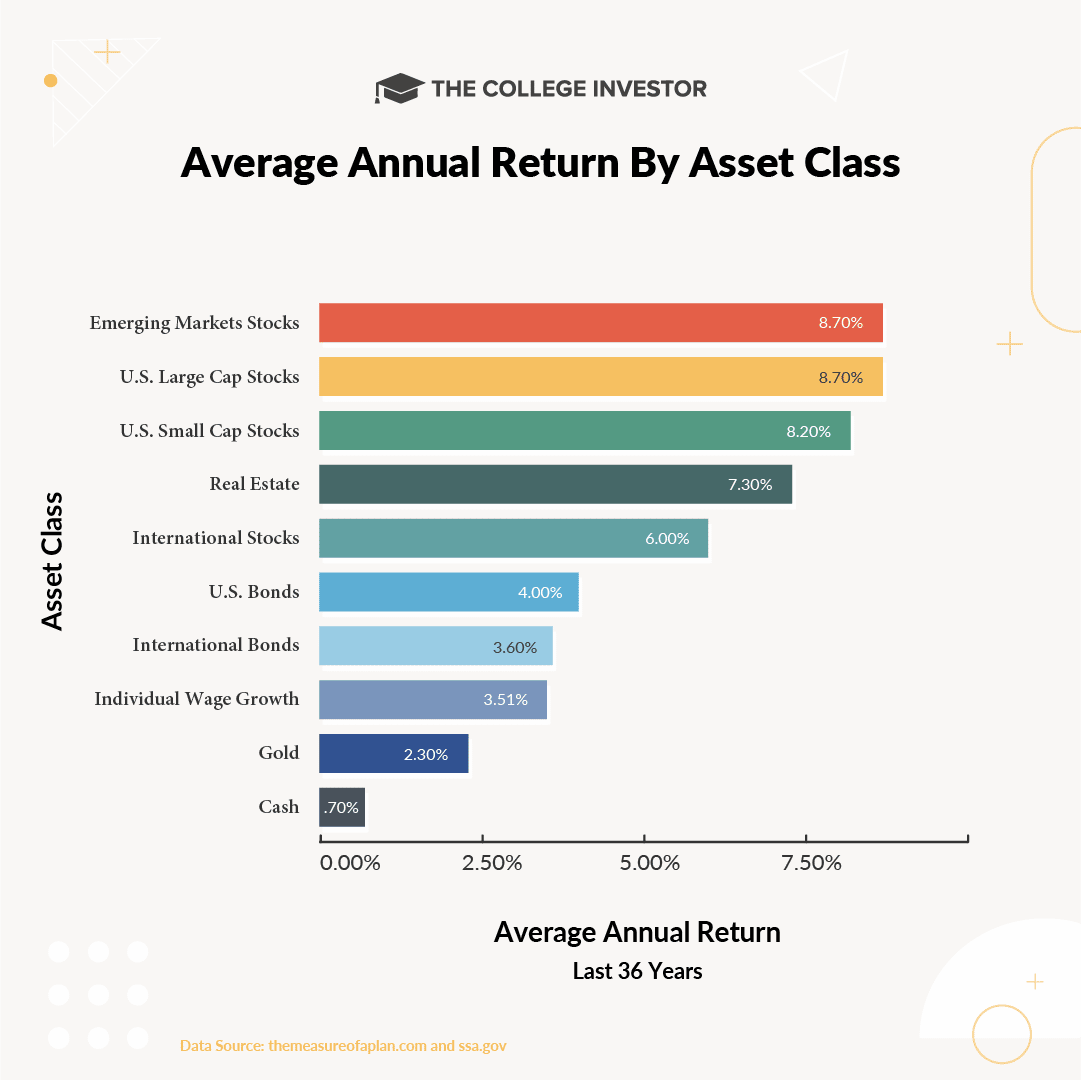

The reason is simple: your wage growth rate and savings account rates are too LOW. You won't grow your money enough over time.

Sadly, wage growth over the last 30+ years has only averaged about 3.5% per year. And savings rates have average 0.70% per year. That's terrible! You need to invest to keep ahead!

Okay, so let's dive into these benefits more!

# 1- You Stay Ahead of Inflation

If you don’t invest and grow your money, you’ll actually end up losing money over time. This is all thanks to inflation.

Inflation is the general increase in prices that happens every year and the decline in purchasing power of your money. The rate of inflation can vary widely but historically inflation has averaged to around 3%.

If you invest your money and say, earn a rate of return of 7% on average, then you’ll stay way ahead of inflation and will be to increase the value of your money.

But if you don't invest - both your wage rate and your savings return rate wouldn't keep up. Basically, the cost of goods you buy (like food, gas, housing) would rise and any additional money you make would simply be offset by these higher prices.

# 2 – Investing Will Help You Build Wealth

I think this should go without saying, but I’m going to say it anyway: Investing is how you build wealth.

There are a hundred and one ways to invest and grow your money. If you’re serious about building wealth then you need to create an investing plan that suits you and your goals.

The wealthy invest, the broke do not.

It can be hard to put money away in investments when you don't have a lot of money to begin with. But here are some ways that you can start investing with little money. My favorite: take advantage of free money like a 401k or HSA match.

# 3 – Investing Will Get You To Retirement (Or Early Retirement)

In order to have enough money to retire you need to make your money work for you. Like we illustrated above, leaving your money sitting in savings will actually work against you!

The more you invest the more you’ll be able to take advantage of the power of compound interest.

Compound interest is what happens when your interest starts earning interest.

Here’s a super simple example:

- You invest $100.

- In one year that $100 earns $10 in interest, now you have $110 sitting in your brokerage account.

- The next year that $110 earns you $11 in interest. You now have $121 without ever putting any extra money in your account.

- The next year your $121 earns $12 in interest. You now have a total of $133.

- This cycle keeps repeating itself as long as your investments do well.

# 4 – Investing Can Help You Save on Taxes

Another HUGE advantage of investing is your ability to save on taxes!

For example, the money you put into a 401k, SEP IRA, or Traditional IRA is not taxed the year you earn it. Instead you pay taxes on it when you withdraw during retirement. This saves you a lot tax dollars the year that you contributed.

If you’d rather pay tax now you can elect to use a retirement account like the ROTH IRA. With this option you pay tax now and don’t pay any tax when you withdraw.

Even in a taxable account, capital gains tax rates are much lower than ordinary income tax rates that you'd pay for working at a normal 9-5 job!

These are just basic examples. There are tons of loopholes in the tax code that favor investors. This is how the rich stay rich and pay so little in taxes!

If you need to lower your tax burden I’d highly suggest you speak with your CPA or Financial Advisor to come up with a custom investing plan that will meet your specific needs.

Fun Fact: Investing in your retirement accounts can lower your student loan payments. By lowering your Adjusted Gross Income (AGI), your income-driven repayment plan amount will also be lowered.

# 5 – Invest To Meet Other Financial Goals

You can also consider investing to help grow your money to meet other financial goals. For instance, investing in your child’s college fund.

When you have a long term goal of ten or more years it may make sense to invest that money to help you reach your goal faster!

There are many benefits of investing. If you want to create financial stability, grow your wealth, and stay on track for retirement you need to come up with an investing plan that suits your needs.

If you're ready to start investing, be sure to check out these articles:

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Claire Tak Reviewed by: Chris Muller