Modern trading apps and platforms have made it incredibly easy for the average person to start investing. Many platforms allow you to open accounts with $0, and start investing with just a few bucks.

But a ton of these newer apps get users hooked on trading or buying and selling stocks. For some investors, trading leads to big gains. But long-term wealth growth is typically the result of holding positions for long periods and letting the value of the portfolio compound by itself. And investors can supercharge that growth by setting up mechanisms to reinvest dividends.

Over the long haul, dividend reinvestment is the key to amazing investment performance. Here’s how the “secret sauce” to portfolio performance works.

Mechanisms For Portfolio Growth

When you buy stocks and hold them for a long time, the value of your portfolio can increase through two major mechanisms.

- The price of a stock (or the stock fund) can increase. “Growth” companies often see sustained increases in their stock prices over time. You may buy a share of a company at $30 per share, and hold it for ten years. In 10 years, an excellent growth stock may be worth $60. You still own one share, but the value has increased. (Certain financial moves such as stock splits and buy-backs may influence the price of a stock, but these are not specific drivers of stock prices).

- Reinvesting the dividends to buy additional shares of stock. If a particular stock is worth $30 and issues a $1.50 dividend, a shareholder could reinvest the dividend to purchase an additional .05 shares of the stock. If the shareholder continuously reinvests the dividends for 10 years (assuming no new price changes), the shareholder will own 1.63 shares of the stock. The stock position will be worth $48.90, assuming the price didn't increase. If the price does increase, you see "compound growth".

Some investors or investment funds tend to emphasize “Growth” or try to pick stocks that will increase in price over time. Other investors or investment funds tend to emphasize “Income” or stocks that are expected to pay high dividends.

Both price increases and dividend reinvestment drive portfolio values up. In recent years, many of the “headline” companies drove portfolio performance by increasing stock prices rather than issuing dividends. The “FAANG” companies (Facebook, Amazon, Apple, Netflix, and Google) famously issued negligible dividends relative to the value of their stock.

However, as these high-flying stocks start to take a beating, it may be worth re-evaluating the importance of dividends (and dividend reinvestment) as a driver of long-term portfolio growth.

Comparing The S&P 500 With And Without Dividend Reinvestment

The power dividend reinvestment depends on several factors including:

- The weighting of the portfolio.

- The time considered.

- The length of time invested.

Portfolios that emphasize “dividend aristocrats” rely on dividend reinvestment for growth. Likewise, dividend heavy portfolios tend to do well do bearish or stagnant markets.

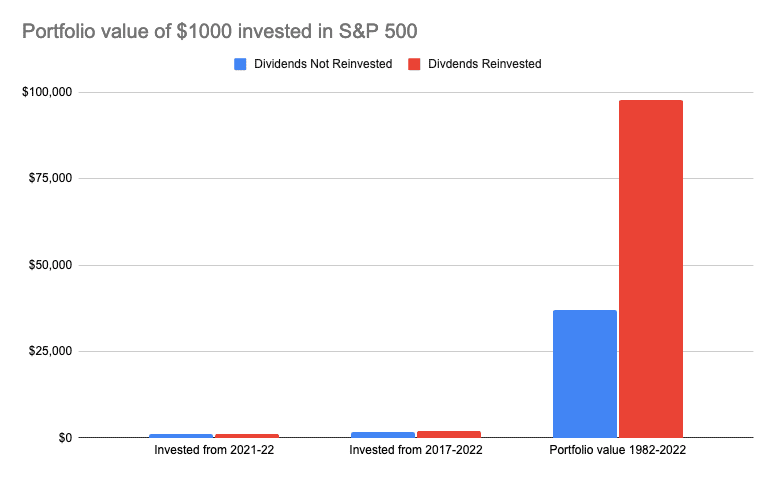

But on the whole, the power of dividend reinvestment shows up strongest during long holding periods. This is because dividend reinvestment boosts the annualized returns of a portfolio. And those returns compound over time. Using a calculator from DQYDJ, we saw the following:

If a person invested $1000 in the S&P Between March 2021 and March 2022:

- They would have $1,075 if they did not reinvest dividends.

- They would have $1,086 if they reinvested the dividends.

If a person invested $1000 in the S&P Between March 2017 and March 2022:

- They would have $1,776 if they did not reinvest the dividends.

- They would have $1,993 if they reinvested the dividends.

If a person invested $1000 in the S&P 500 Between March 1982 and March 2022:

- They would have $36,945 if they did not reinvest.

- They would have $97,881 if they reinvested the dividends.

Note - that's a $60,936 difference over 40 years for simply electing to reinvest the dividends.

Information Using DQYDJ.net Investment Calculator

Dividend Reinvestment Supercharges Compounding

As an investor, you can choose whether to reinvest your dividends or whether to spend them as you earn them. When you see numbers like 9.5% returns vs. 12.2% returns, it’s easy to dismiss dividend reinvestment as an unnecessary sideshow. But the compounding effect is real. Over the forty years considered in our example, the investor who re-invested dividends had a portfolio that was almost 3X the size of the person who failed to reinvest dividends.

As a beginner, your ability to save money and add to your stockpile drives your portfolio value. But as your portfolio grows, the emphasis switches to rate of return or growth rates. Anything you can do to boost your portfolio’s return will dramatically increase your wealth over time. The easiest thing most investors can do to boost their returns is to reinvest the dividends.

How To Setup Dividend Reinvesting

Investors who want to boost their portfolio returns through dividend reinvestment can choose a few different methods to reinvest.

- DRIP (Dividend Re-Investment Programs) allow investors to automatically reinvest dividends into a specific stock or index. Typically, brokerages make it easy for investors to click a button that specifies whether to re-invest dividends. Index fund investors especially benefit from this type of program because it allows the investors to be hands-off on the investment front.

- Regular reinvestment into specific stocks. Most dividends are paid every quarter, so individual stock investors may choose to let their dividends pile up as cash in their brokerage account. Then, once per quarter, the investor can buy new shares of existing stocks or new stocks that they want to add to their portfolio. This method allows investors to rebalance their portfolios while also deploying dividends to boost returns.

At the end of the day, both methods can work to boost returns. I opt for automatic DRIP options whenever possible. With these in place, I can rebalance my portfolio once a year, and remain hands-off the rest of the time. However, I invest heavily in ETFs and only hold a few individual stock positions. Investors who hold individual stocks may decide that the automatic reinvestment of dividends doesn’t suit their investment style. They may prefer the option to select how to use their dividends.

Regardless of the dividend reinvestment style you pick, reinvesting dividends can massively boost your portfolio’s returns. A few percentage points may not seem like a big deal, but over time, reinvesting dividends pays off handsomely.

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.