Fear - it's the number one thing holding people back from investing in the stock market. It's crazy how much fear controls money decisions.

We recently surveyed The College Investor readers on what's holding them back from investing (and fear was talked about a lot). Here's some of the things that were shared:

- I'm uncertain about investing after the stock market crash a few years ago.

- I know I need to invest but I don't want to lose money.

- I think about starting to invest almost daily now, but I just can't do it.

- I want to get a better return on my money, but I'm not sure about the risk.

- I was doing my taxes and I realized that I really hadn't invested outside of my 401k. It made me think I could be losing out on $1 million dollars or more when I retire.

Do you see the common fear of investing trends?

- Losing Money Today

- Losing Money in the Future

- Risk

- Not knowing where to start

All of these are valid fears! And they stem from valid reasons. But the truth is simple: not investing is probably the worst outcome of all (even if you don't realize it), so you need to overcome your fear of investing in the stock market.

Why Do You Fear Investing?

Fear stems from the original 'fight or flight" mechanism that we needed when we were hunters and gatherers. It helped us through overriding our senses to keep us out of danger. The feeling of fear overrides logic and other emotions, and takes over your body.

But how does this apply to investing? Because in today's society, not having money is as serious as not having food or shelter was in the Neanderthal days. Our mind knows that money = shelter = food = safety. So, losing money can cause huge amounts of fear.

The trouble is, fear causes you to ignore logic. And you have to battle yourself to accept the truth - and that's just plain tough. But there are ways to overcome this fear, and here are some steps to take.

Accept the Truth

The first step in overcoming fear is accepting the truth about the situation. In our case, the truth is fear of investing. But what does that mean?

It's typically a fear of losing money, or a fear of the risk involved with your money. It could also be not knowing where to start - which increases anxiety that you might make mistakes with your money.

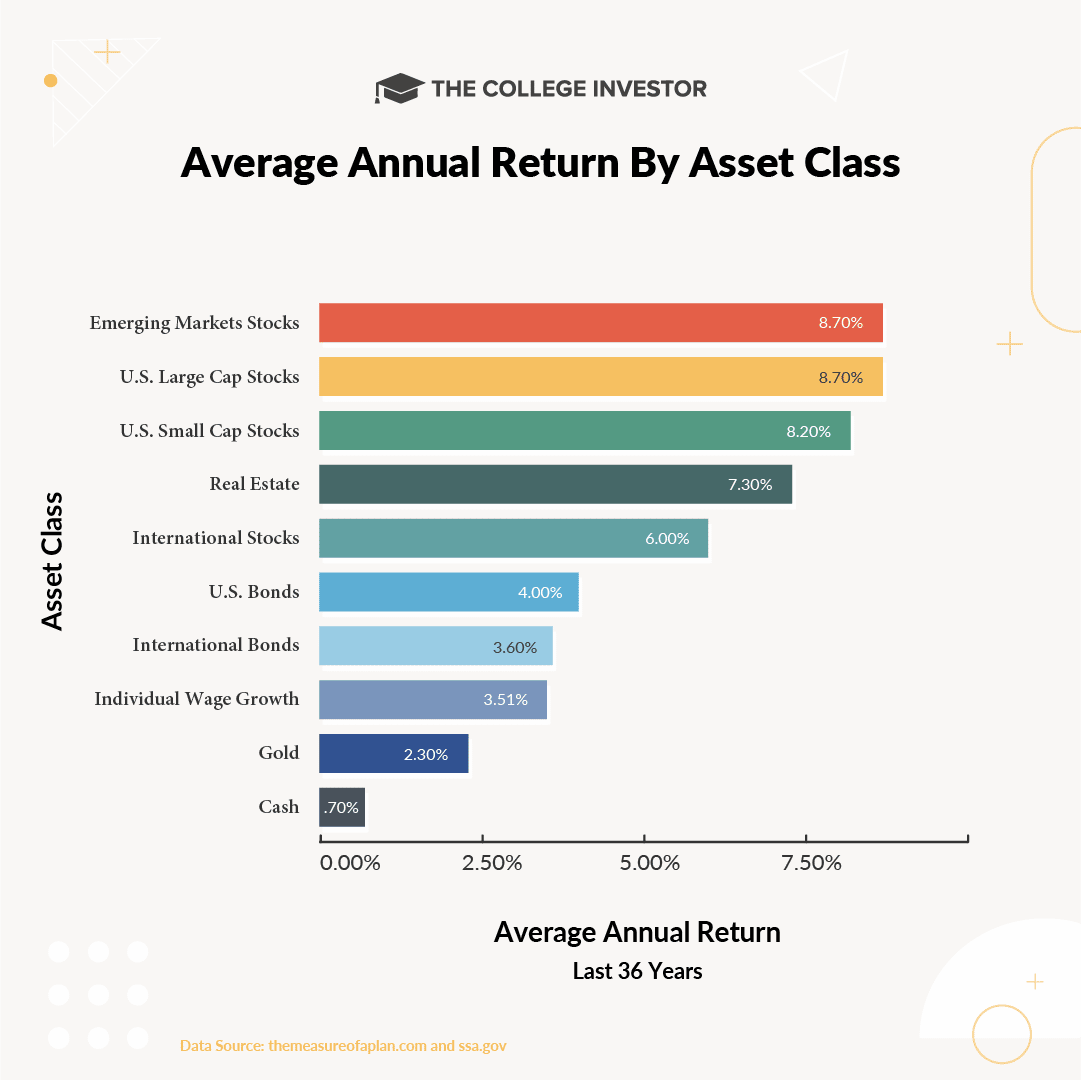

The truth is, investing in broad index funds (or the total stock market) is the best way to grow your money over the long run (i.e. 30+ years or more). Over the history of the stock market, it has averaged an 8% return, which is higher than any other investment or savings account.

The flip side is this - if you don't grow your money by investing, you could run the real risk of not having enough for retirement. Then, all of your fears come true for a different reason - you just didn't invest. If your money only grows at 1-2% per year, you WILL come up short in retirement. All of your fears will be realized when you are living on food stamps in your 80s. That's the truth.

Let me show you:

- Investing: If you invest $200 a month for 40 years, at a 8% return, you'll grow your money from $0 to $602,000.

- Saving: If you only save $200 a month for 40 years, at a 1% return, you'll grow your money from $0 to just $22,000.

That's a huge difference. That's honestly a life or death difference. You should be fearing NOT investing.

Agree on Change

Once you've accepted the truth, you have to agree with yourself (remember, that internal battle) to change. The change can be simple - maybe set an action plan to move towards that change.

With investing, the change has to be overcoming your fear of losing money. So, your change could involve steps:

- Educate yourself on investing (read How To Start Investing)

- Read a book (read our picks for the best books here)

- Open an account - this can be your 401k, or a Roth IRA, or a regular brokerage account

- Deposit money into the account, but keep in cash

- Then invest a small portion when you're ready

If you setup the plan, you are more likely to accomplish it later. And if you don't know where to start, you can consider something like a robo-advisor or even a financial planner. Check out Vanguard's Personal Advisor Services for a low-cost option.

Secure A New Solid Ground

Finally, you have to build on your bases and setup a new solid ground. Use your action plan and start with education. Once you have an education in investing, you'll notice that your fear will be lessened (simply because you're more confident).

Then, once you have an education, you need to open an account. You don't have to move quickly - progress through your action plan as you feel comfortable, and build from there.

Doing this over and over again will slowly help you overcome your fear of investing and losing money. Education is key.

What other tips do you have for overcoming fear of investing in the stock market?

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Chris Muller