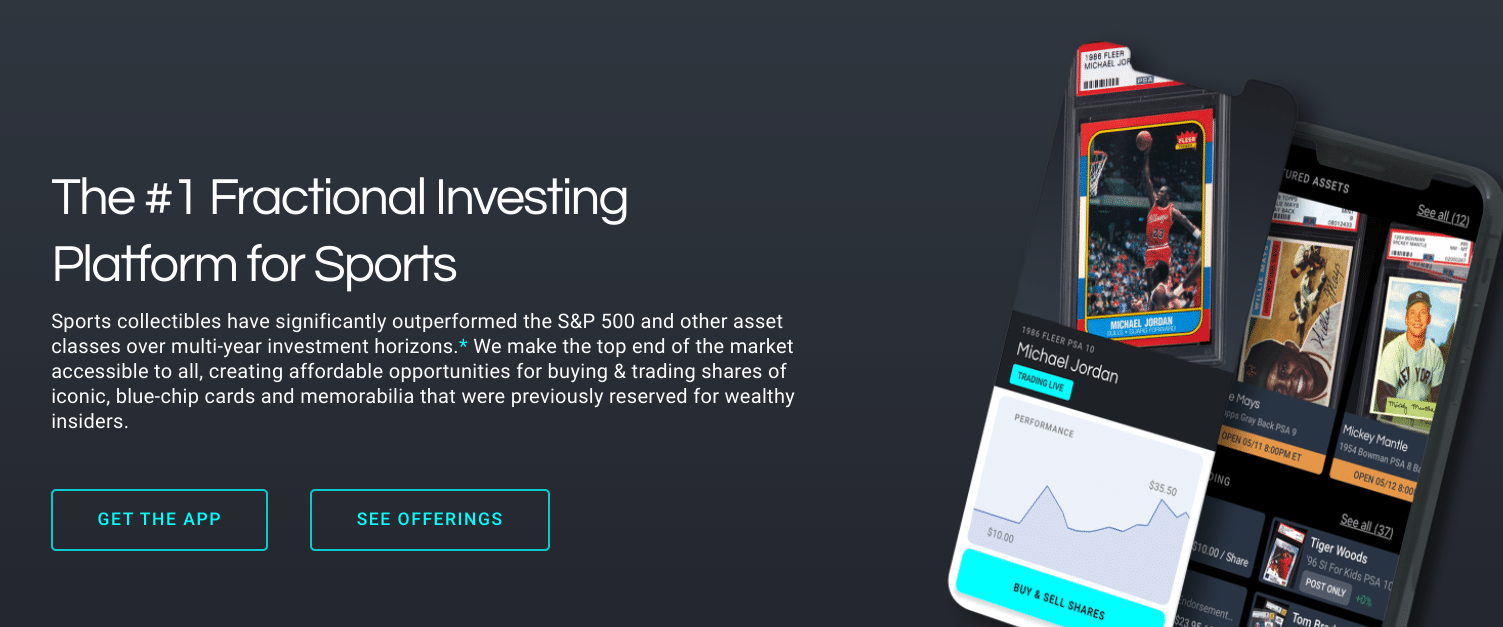

Collectable is a company that specializes in converting sports memorabilia into fractional share ownership. The company actually holds the memorabilia and allows individual investors to buy shares.

Growing up, I loved collecting baseball cards. I hoped that I would eventually stumble into paper gold by holding onto cards for years.

After hoarding cards tucked in plastic sleeves for years (at my parents’ house), I had only a few cards worth any money. I also had a bunch of cards with sentimental value.

While I no longer have Trapper Keepers full of baseball cards, I’ve never lost my love of sports memorabilia. If you’re someone who loved “investing” in sports memorabilia as a kid, or you’re interested in diversifying your portfolio, Collectable may provide an interesting investment opportunity for you.

Here’s what you need to know about it.

Quick Summary

- Purchase fractional shares of sports memorabilia

- Invest in IPO offerings with as little as $10

- Buy and sell shares instantly on a secondary market

Collectable Review | |

|---|---|

Product Name | Collectable |

Min Invesment | $10 |

IPO Fees | Vary |

Secondary Market Trading Fees | 1% |

Open To Non-Accredited Investors | Yes |

Platforms | iOS and Android |

Promotions | None |

What Is Collectable?

Collectable buys valuable sports memorabilia and converts it into fractional shares. The company employs experts to analyze memorabilia that's likely to increase in value over time. Company experts validate the authenticity of certain items. And the company buys the most promising options.

Then, Collectable securitizes their inventory.That means the company offers shares of the memorabilia to the public. Investors who cannot afford a $250,000 baseball card can buy a $10 share of that same card. Investors don’t get to keep the memorabilia. But they do get a digital shares certificate. After an IPO is fully funded, there is a 90-day lock-up period. This means that shares cannot be traded for at least 90 days.

Investors who don’t manage to buy into an “IPO” for particular memorabilia may find luck in Collectable’s secondary market. Collectable matches buyers and sellers in a secondary market. So an investor may manage to snag a share their as well.

Collectable also continually offers its memorabilia for sale to the general public. When a legitimate offer comes through, shareholders can vote whether to sell the memorabilia (and their stake in it) or to hold onto the item. If a majority votes to sell, the distributions are made on a per-share basis.

How Does The Secondary Market Work?

One thing that makes Collectable unique is its continuous secondary market. This allows investors to sell their shares to potential investors when the price is right. It does this by hosting an online market every weekday from 3-4 PM Eastern Time, hosted by Templum Markets, LLC, a licensed broker dealer.

During the daily online market period, investors can post bids (intentions to buy at a certain price) and asks (intentions to sell at a given price). Investors can back out of asks or bids until a match is made. Once the match clears, money and shares will exchange hands.

The secondary market mimics the stock market. However, investors shouldn’t expect instant trades the way they can trade through Robinhood or other stock brokers. There are fewer investors on Collectable, so the matching process isn’t instantaneous. You should not plan to sell your shares overnight in most cases.

Can Someone Buy Items From Shareholders?

Investors who choose to hold onto their shares may have an “exit opportunity” if a collector wants to buy a piece of memorabilia for their collections. When this happens, Collectable vets out the legitimacy of the offer.

If it's legitimate, Collectable presents the offer to shareholders. At that time, trading on the item halts. Shareholders have 48 hours to vote on whether to accept the buyout offer. If the buyout is accepted, shareholders will receive prorated payments based on the number of shares they own.

Are There Any Fees?

Yes, Collectable receives a sourcing fee on each offering that is funded. It says that this fee will be a cash and equity within the offering. These fees will vary on each listed offering but will be fully disclosed in the Offering Circular.

Templum Markets LLC, which conducts Collectable's secondary trading market, charges 1% fee on every trade. This fee applies to both the buyer and the seller.

Funding your account is free if you link your bank account using Plaid. But if you use a credit card, you'll be charged a fee of 3.15% + $0.70.

How Do I Open An Account?

If you try to sign up for Collectable on its website the company will send you an SMS message to download the app. Web support is still in development.

All US Citizens over age 18 can buy shares on Collectable, but the app is not yet available internationally. You don’t need to be an accredited investor to invest.

Are Sports Cards Good Investments?

Collectable captures the fun of sports card collecting. It offers a great way for everyday people to “own” valuable memorabilia. From an enjoyment perspective, it's an easy way to buy a few shares of iconic pieces.

But from a financial perspective, the risks are larger. Valuable pieces today could turn out to be worthless junk a decade from now. That’s particularly true when the sports hero is still living and could have some personal downfall that disbars them from “superstar” status.

Even dead heroes may fall out of favor, and their memorabilia may go down in value. That’s the risk associated with investing in collectibles. The value for the item is entirely driven by demand. Several items on Collectable saw massive returns after an exit, but many items continue to trade with limited price changes over time.

Is It Worth It?

Memorabilia may be part of a diversified portfolio. But it's risky to invest in something that has low liquidity. This isn’t like investing in stocks, bonds, or real estate. The value is volatile and it could be tough to sell your shares if you need money.

However, Collectable lowers the risk by making the share prices accessible for everyday people. It also offers valuable research for each asset listed on its site and makes a reasonable option for secondary market selling.

This is not the type of investment that's likely to be the cornerstone of your investment portfolio. But it could be a great way to add some diversity and have some fun along the way.

Collectable Features

Account Types | Taxable |

Minimum Investment | $10 |

Secondary Market Hours | Weekdays, 3-4 PM (EST) |

Fractional Shares | Yes |

IPO Fees | Vary |

Secondary Market Trading Fees | 1% |

Funding Fees |

|

Bank Integration | Connects with over 2,000 financial institutions through Plaid |

Open to Non-Accredited Investors | Yes |

Availability | Open to U.S. residents only |

Share Certificates Issued | Yes, digitally |

Customer Service Options | SMS and email |

Customer Service SMS Number | 833-995-2178 |

Customer Service Email Address | support@collectable.com |

Web Availability | No |

Mobile App Availability | Yes, iOS and Android |

Promotions | None |

Collectable Review

-

Commissions and Fees

-

Ease of Use

-

Products and Services

-

Diversification and Risk Management

-

Liquidity

-

Customer Service

Overall

Summary

Collectable is an online marketplace for buying and selling fractional shares of high-value sports memorabilia. Learn how it works!

Pros

- All items authenticated by third parties

- IPOs start at $10/share

- Live secondary trading every weekday

- Open to non-accredited investors

Cons

- 1% fee for secondary market trades

- Can’t invest or trade on the web

- Not available outside the U.S.

Hannah is a wife, mom, and described personal finance geek. She excels with spreadsheets (and puns)! She regularly explores in-depth financial topics and enjoys looking at the latest tools and trends with money.

Editor: Clint Proctor Reviewed by: Chris Muller