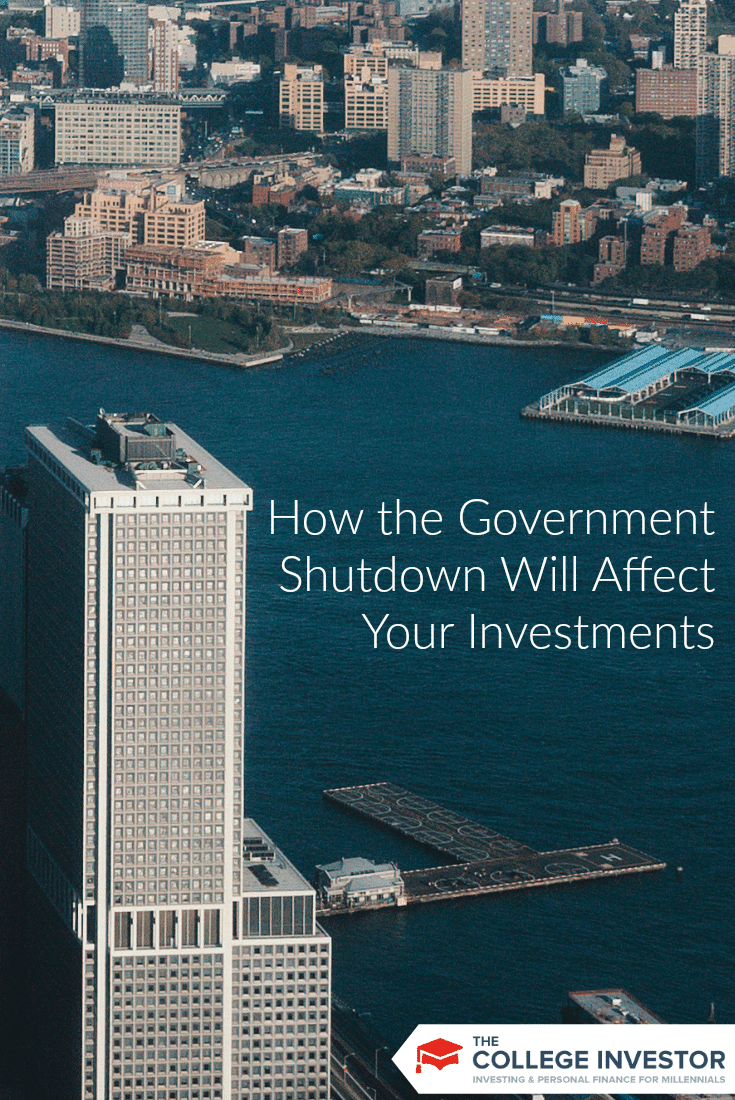

Everyone is talking about the government shutdown — the battle of partisan politics, the 800,000+ jobs that have been furloughed, the irritation of not being able to visit a national park. But what’s going to happen to your investment portfolio?

Everyone is talking about the government shutdown — the battle of partisan politics, the 800,000+ jobs that have been furloughed, the irritation of not being able to visit a national park. But what’s going to happen to your investment portfolio?

It’s tough to give a definitive answer to what’s going to happen, but we can make some very educated guesses. Let’s start with some history.

The History of Government Shutdowns and the Stock Market

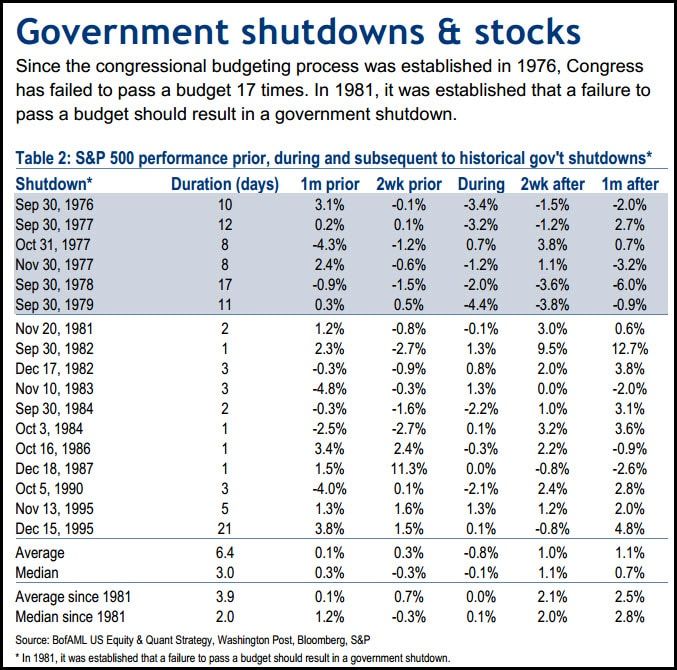

Here are a few quick stats on the history of government shutdowns:

- The longest government shutdown was the last shutdown in 1995 — it lasted 21 days.

- The average government shutdown lasts for 6.4 days, the median shutdown has been 3 days.

And here’s what happens to the stock market during these shutdowns:

- Since 1981, the stock market is flat, on average, during government shutdowns.

- In the weeks leading up to a government shutdown, the market is also flat — an average return of 0.3%, but a median return of −0.3%.

- However, since 1981, the stock market has averaged returns greater than 2% after the shutdown ends.

Here’s a history of the stock market and all government shutdowns from @andrewunknown on StockTwits:

How This Government Shutdown is Different

There are several reasons why this government shutdown is different than past ones. These reasons are what makes this shutdown scarier than past government shutdowns:

We Don’t Have Strong Growth

First, we don’t have the same corporate growth (and economic growth) that we had in the past government shutdowns. For example, in 1995, we were experiencing 8% EPS (earnings per share) growth rates, while this year has just been at 2%. Plus, that period of time saw one of the biggest bull markets in recent history emerge after the shutdown. It was the start of the tech bubble, and huge changes were occurring across the economy. In some ways, this could be what’s happening now — huge economic changes ahead of a long-term bull market. However, earning growth is weak — which is scary.

The Reliance on Government Spending

Second, the economy is extremely reliant on government spending. Right now, money is flowing at a much freer rate than in the history of this country. With cheap money, and government aid for companies nationwide, the economy is more dependent on the government than at any time in the past.

For example, the federal funds rate was 5.50% in 1995 (during the last shutdown), and it’s 0% now. In 1995, GDP growth was 2.5%, and it’s the same this year — but it’s taking a boatload of free money to achieve it. This just highlights that dependence on the government to keep the economy afloat.

Consumer Dependence on Social Welfare Programs

Finally, there are more consumers dependent on government social welfare programs than at any other time in history. From Social Security and Medicare, to food stamps and SNAP, consumers are more dependent on government programs than ever before. This is a direct result of the Great Recession, but also from the poor economic growth (and employment growth) that we’ve been experiencing.

This worries me for several reasons. First, many federal benefits have stopped being paid because of the shutdown. This will directly impact the pocketbooks of consumers, and could lead to even lower economic growth during the quarter (and even during fourth-quarter holiday spending). Second, even the benefits not directly stopped by the shutdown are the same benefits being debated on in Congress. This could result in them being ended in a compromise, and could further damage the economy long-term.

What Should Investors Do?

All of these things point to a government shutdown that will have a different long-term impact on the economy and stock market. I think there will be a much more negative impact from this shutdown, compared to past shutdowns, simply because this is just another gust in the perfect storm.

The perfect storm brewing for the end of the year includes these factors:

- Low economic growth.

- Tempered retail hiring and buying due to consumer spending fears.

- The government shutdown.

- The fiscal cliff debate.

I wouldn’t be surprised if this shutdown, combined with the upcoming debate on the fiscal cliff, send the economy into an official recession. As such, investors should brace for the possibility of a recession.

This means several things:

- Buy-and-hold investors should stay the course, and maybe invest more during a downturn.

- Sector investors should look at consumer staples and utilities.

- It may be a good time to lock in any gains you have for the year.

How has the government shutdown impacted your investments? What do you see coming as a result?

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Chris Muller