Ernst & Young is a top-five accounting firm nationwide with more than 100 years of business experience. While it’s best known in the business world for supporting the accounting needs of Fortune 500 companies, the company expanded into personal and self-employment tax returns for the 2020 tax filing season and continues to offer the service through its EY TaxChat service.

The EY TaxChat app gives users a price quote for tax preparation services. Those who choose to move forward can chat with their tax preparer through the app or by phone.

If you’ve considered hiring an accountant to prepare your tax return but don’t want to work with a small, local preparer, EY TaxChat could be a good option for your needs. Here’s what you need to know if you’re considering EY TaxChat.

EY TaxChat Details | |

|---|---|

Product Name | EY TaxChat |

Federal Pricing | Starts at $199 |

State Pricing | Base Fee Includes One State |

Preparation Type | Prepared by Tax Experts (EAs or CPAs) |

Promotions | None |

EY TaxChat - Is It Free?

EY TaxChat does not offer a free plan. It’s a premium full-service tax preparation service and all customers have to pay. Users can fill out a short interview form to receive a price quote. The cost of the return is fixed unless the tax preparer learns about additional complexity that wasn’t covered in the interview.

Does EY TaxChat Make Tax Filing Easy In 2024?

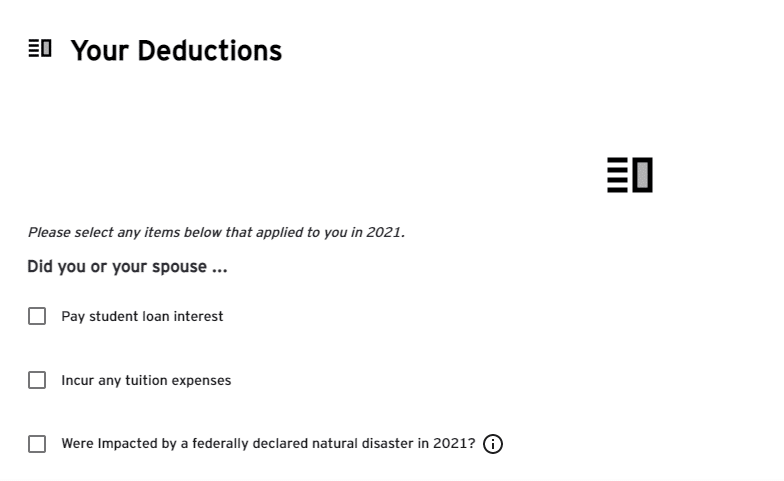

EY TaxChat strives to make tax filing easy. They perform the onboarding interview in plain English where you don’t need to know a lot of tax jargon. Based on your responses, the tax preparer will request needed information and tax forms. Filers can securely load all their documents into the TaxChat app or website and can communicate with their tax preparer through the app.

Easy to answer questions about tax filing situations

EY TaxChat Benefits

These are a few areas where EY TaxChat stands out from other tax preparation companies.

Secure Document Upload

Users can upload their tax documents through a mobile app or via the TaxChat website. Both the app and the website are secured. This secured portal makes it much easier to ensure your tax preparer has the necessary information.

Safe Messaging With Tax Preparers

Filers can message their tax preparers through the EY TaxChat app. This ensures that the chat information is safe and secure. If the tax preparer needs additional information or if you have more questions, you may schedule a phone call to discuss your taxes.

EY TaxChat Drawbacks

Although Ernst & Young has a strong brand reputation, the EY TaxChat app has a few drawbacks that are worth mentioning.

High Cost Compared To Alternatives

A tax return through EY TaxChat can cost more than $1,000 for people with complex tax situations. Other companies, such as TurboTax Full Service (where a TurboTax Expert prepares your return) charge less for similar levels of service. Even Picnic Tax, which offers tax returns prepared by CPAs, is less expensive than EY TaxChat.

Tax Preparers May Not Be CPAs

EY says that its tax preparers may be enrolled agents (EA) or certified public accountants (CPA). Between these two designations, the CPA typically has a broader range of expertise and more experience helping clients develop tax plans. While both EAs and CPAs are qualified to prepare returns, an EA may not be suitable for more nuanced tax discussions.

However, this might not be a drawback for you. EY matches individuals with the most qualified preparer – that could mean an EA with crypto experience vs. a CPA with no crypto experience. Given the breadth of differing experience between individuals, it really depends on preference.

No Tax Planning Advice

EY Tax Preparers can help filers maximize their refund, but they cannot provide detailed planning advice. Most CPA firms provide year-round support for tax filers. And with the reputation Earnst & Young has for offering tax planning for large businesses, it’s surprising you can’t get advice for your personal and small business tax returns.

EY TaxChat Pricing

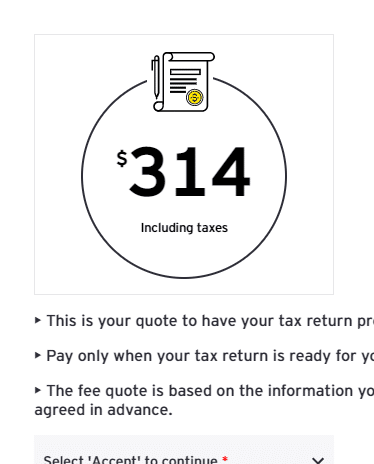

The EY TaxChat app provides customized price quotes based on the complexity of filing. We tested different combinations and found that straightforward returns (with a few deductions and credits) cost starting at $199 while the most complex was more than $1,600. According to EY TaxChat, most people pay $199 to $499.

Example price quote for a simple tax return.

Filers considering EY TaxChat should take the time to complete the interview. It takes just a few minutes and provides a detailed price quote.

How Does EY TaxChat Compare?

EY TaxChat has a tax preparer for even the most complex tax situations. The company can help prepare returns for everyone from crypto traders to rental property owners to self-employed people.

EY TaxChat also has a built-in messaging application that makes it easy to securely communicate with your tax preparer. Overall, EY TaxChat has an offering similar to Picnic Tax or TurboTax Full Service.

The chart below compares prices and services offered by these companies. EY TaxChat is somewhat more expensive than these competitors.

Header |  |  |  |

|---|---|---|---|

Rating | |||

Minimum Price | Varies (Starts At $199 for Federal and State) | $225 Federal, | $0 (Free filing) $64 Deluxe DIY |

Maximum Price | $1,600+ Federal, $75 Per Added State (First State Is Free) | $1,000+ Federal, $50 Per State | $389 Federal, |

Secure Data Upload | Yes | Yes | Yes |

CPAs Only | No | Yes | No |

Same Tax Preparer Each Year | Likely | Likely | No |

Cell |

Is It Safe And Secure?

As a global company, EY TaxChat has more security measures than most small CPA firms. It has a secure and encrypted app and website that houses tax documents. It also uses strong passwords to keep user information safe.

Surprisingly, EY TaxChat doesn’t have multi-factor authentication. If a user’s email and password were hacked, the user could have their personal information stolen. Overall, EY TaxChat has more security than the typical CPA firm, but it still has opportunities to enhance security for users.

How Do I Contact EY TaxChat?

EY encourages users to reach out to their tax preparers via the app and website's chat function. But if you'd prefer to talk over the phone, you can call 1-833 TAX CHAT (1-833-829-2428). You can also email EY TaxChat at taxchat.support@ey.com.

Operating hours for the TaxChat customer service team are Monday through Friday, 9 AM to 9 PM (ET). EY has been accredited with the Better Business Bureau (BBB) since 1952 and is currently rated A+.

Why You Should Trust Us

At The College Investor, we have more than a decade of experience reviewing tax software and preparation services. We personally test out tax services we review, and have filed our own tax returns with a wide range of services for the full experience. We look at more than a dozen tax filing options every year and look at costs, services, and ease-of-use. Our goal is to bring you unbiased reviews and help you find the best solution for your budget and unique needs.

Is It Worth It?

Not everyone needs a professional tax preparer. Most people can file their own taxes if they choose the right tax software program. Choosing a service like EY TaxChat will cost most people a lot of money, but it won’t save a lot of time.

However, people with highly complex returns may happily spend the money for professional tax preparation. These complex filers are the best candidates for EY TaxChat, but they should price shop Picnic Tax and review its offerings to compare. The costs at Picnic Tax tend to be lower for most filers for a similar service, plus tax planning is available as an add-on service.

EY TaxChat FAQs

Can EY TaxChat help me file my crypto investments?

Yes, EY TaxChat supports filing for all types of crypto activity. Filers who earned money through staking or mining can use EY TaxChat as can those who made money through buying and selling crypto.

Can EY TaxChat help me with state filing in multiple states?

Yes, EY TaxChat supports multi-state filing. The increased cost of multi-state filing is baked into the price quote from the interview form.

Does EY TaxChat offer refund advance loans?

EY TaxChat does not offer refund advance loans.

EY TaxChat Features

Federal Pricing | Starts at $199 |

State Cost | Base fee includes one state. $75 for each additional state |

Pay With Tax Refund | No |

Audit Support | Unclear |

Support From Tax Pros | Yes (EAs and CPAs) |

Full Service Tax Filing | Yes |

DIY Tax Filing | No |

Printable Tax Return | Yes |

Crypto Tax Filing | Yes |

Self-Employment Income | Yes |

Itemize Deductions | Yes |

Deduct Charitable Donations | Yes |

Refund Anticipation Loans | Not offered |

Customer Service Options | Chat, phone, and email |

Customer Service Phone Number | 1-833 TAX CHAT (1-833-829-2428) |

Customer Service Email | taxchat.support@ey.com |

Web/Desktop Software | Yes |

Mobile Apps | iOS and Android |

Promotions | None |

EY TaxChat Review

-

Features & Options

-

Ease of Use

-

Plans & Pricing

-

Customer Service

Overall

Summary

EY TaxChat is a website and app that securely connects filers with certified tax preparers who prepare and file their returns for them.

Pros

- Returns are prepared by tax pros

- Fast and free customized price quotes

- Secure messaging and file storage

Cons

- One of the highest-cost tax prep options

- No multi-factor authentication

- No detailed tax planning

Eric Rosenberg is a financial writer, speaker, and consultant based in Ventura, California. He holds an undergraduate finance degree from the University of Colorado and an MBA in finance from the University of Denver. After working as a bank manager and then nearly a decade in corporate finance and accounting, Eric left the corporate world for full-time online self-employment.

His work has been featured in online publications including Business Insider, Nerdwallet, Investopedia, The Balance, Huffington Post, and other financial publications. When away from the computer, he enjoys spending time with his wife and three children, traveling the world, and tinkering with technology. Connect with him and learn more at EricRosenberg.com.

Editor: Colin Graves Reviewed by: Robert Farrington