You might be surprised to receive a 1099-NEC in the mail this year. If you are a contractor, or if you've hired contractors for your business, then you're probably familiar with Form 1099-MISC. This is the form that has traditionally been sent to contractors.

However, 1099-MISC is used for more than just contractor income. To make this distinction clear, the IRS is changing things up.

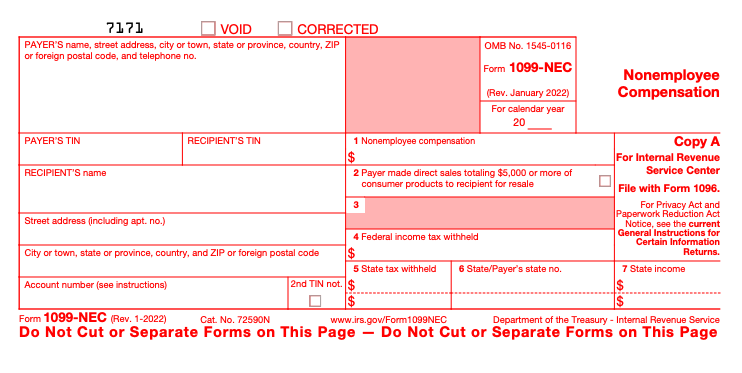

We’re getting a new 1099 called 1099-NEC that is exclusively intended to report freelance, side hustle, and contractor compensation. In this article, we’ll learn what this change is all about.

What Is A 1099-MISC?

Form 1099-MISC is like a W2 but for contractors. The MISC stands for miscellaneous income. It is used to report royalties, rents, and payments to independent contractors. In the case of independent contractors, after receiving this form from clients, they use it to report the income on their tax returns.

1099-MISC must be filed by the employer when payments of $600 or more are made for contract work or royalties. Property managers must also use this form to report rent payments made to property owners. The 1099-MISC is sent to contractors and also filed with the IRS.

What Is A 1099-NEC?

Form 1099-NEC is not a new form. Rather it's the 1099 form that was used 30 years ago before being discontinued. Now it's making a comeback.

NEC stands for non-employee compensation. The 1099-MISC isn't going away. It will still be used. But the 1099-NEC will be specific to independent contractor payments and those payments are being broken out of the 1099-MISC.

Prior to Form 1099-NEC, independent contractor payments were reported in box 7 of the 1099-MISC. Box 7 is now used for payer direct sales of $5,000 or more of consumer products to a buyer for resale, which is mainly applicable to wholesalers.

Why Is This Change Being Made?

Adding a new tax form that will be used only for freelancer and contractors might look like an IRS response to the gig economy's growth. But there's actually another reason for the re-introduction of Form 1099-NEC.

Before PATH (Protecting Americans from Tax Hikes Act), all miscellaneous income and non-employee compensation was reported on Form 1099-MISC and due on February 28th. In 2015, the date was changed to January 31st but only for the non-employee compensation component, requiring employers to file two Form 1099-MISCs.

Having to file two 1099-MISCs was confusing for both the employers and the IRS. But moving forward, the type of payments that employers are reporting (freelance/contractor income vs. other payments) will be crystal clear.

Who Should File Form 1099-NEC?

So who should file Form 1099-NEC? You'll need to file this form if you made payments of at least $600 (cumulative for the entire year) that meet the following criteria:

Other areas the 1099-NEC applies to are fees, prizes, awards, and other compensation for services.

1099-NEC must be provided to the contractor/payee and filed by the employer with the IRS by January 31st. There are several copies of Form 1099-NEC. Below explains what you'll need to do with each:

How Do You File Form 1099-NEC?

Form 1099-NEC can be filed electronically. This might be through your payroll system, bookkeeping software, or mailed in. It can also be filed directly with the IRS through their FIRE (Filing Information Returns Electronically) system.

When preparing to send the 1099-NEC to your contractor, the contractor will need to file out Form W9 (vs. the W4 for employees). The W9 information is used to complete the 1099-NEC. If the contractor doesn’t have a business tax ID (EIN), their Social Security number can be used.

If you're a freelancer or contractor, you'll need to file your copy of the 1099-NEC with your federal tax return. Depending on where you live, you may need to file it on a state return as well.

If you're using a tax software provider like H&R Block, you may want to spring for its "Self-employed" version as this tier generally make it easy to report 1099 income and claim business deductions and credits.

Final Thoughts

You might fall into the group of people who will not be filing a 1099-MISC. If you don’t have any miscellaneous income that applies to 1099-MISC, but you do have contractors, 1099-NEC is what you'll be switching to.

Freelancer or contractors who will be receiving a 1099-NEC will need to file it with their tax returns. Thankfully, it's easy to do so, especially if you're using tax software. Check out our best tax software guide to see our favorites for side hustlers and small business owners.

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Chris Muller