If you invest in cryptocurrency, you are legally required to report capital gains and income when filing your annual tax return. If you have multiple cryptocurrency exchange accounts and wallets, completing your crypto taxes manually isn't practical.

That's why most active crypto investors opt for a crypto-specific tax app like Koinly to help with their tax prep needs.

Koinly is cryptocurrency-specific tax and tracking software that automatically calculates your crypto taxes. It also generates any required tax forms and reports, which you can add to your tax return with an app like TurboTax or hand off to an accountant.

If you’re looking for comprehensive tax software that can streamline your crypto taxes, Koinly might be a good option. However, before you sign up and pay, get to know the features Koinly offers and how it stacks up against other tax software.

This Koinly review covers everything you need to know about this leading tax software to help you decide if it’s right for you.

Koinly Details | |

|---|---|

Product Name | Koinly |

Product Type | Cryptocurrency tax software |

Price | $0 to $279 per year |

Exchange & Wallet Integrations | 750+ |

Promotions | None |

What Is Koinly?

Koinly is a cryptocurrency tax software that caters to the serious crypto investors. Cryptocurrency investors and accountants created Koinly with their own needs in mind, which likely overlaps with your needs if you’re also filing cryptocurrency taxes.

Launched in 2018, the company operates out of London. For 2023 taxes filed in the 2024 tax season, Koinly is our top pick for the best cryptocurrency and NFT tax liability calculator.

Check out our picks for the best tax software platforms here.

What Does It Offer?

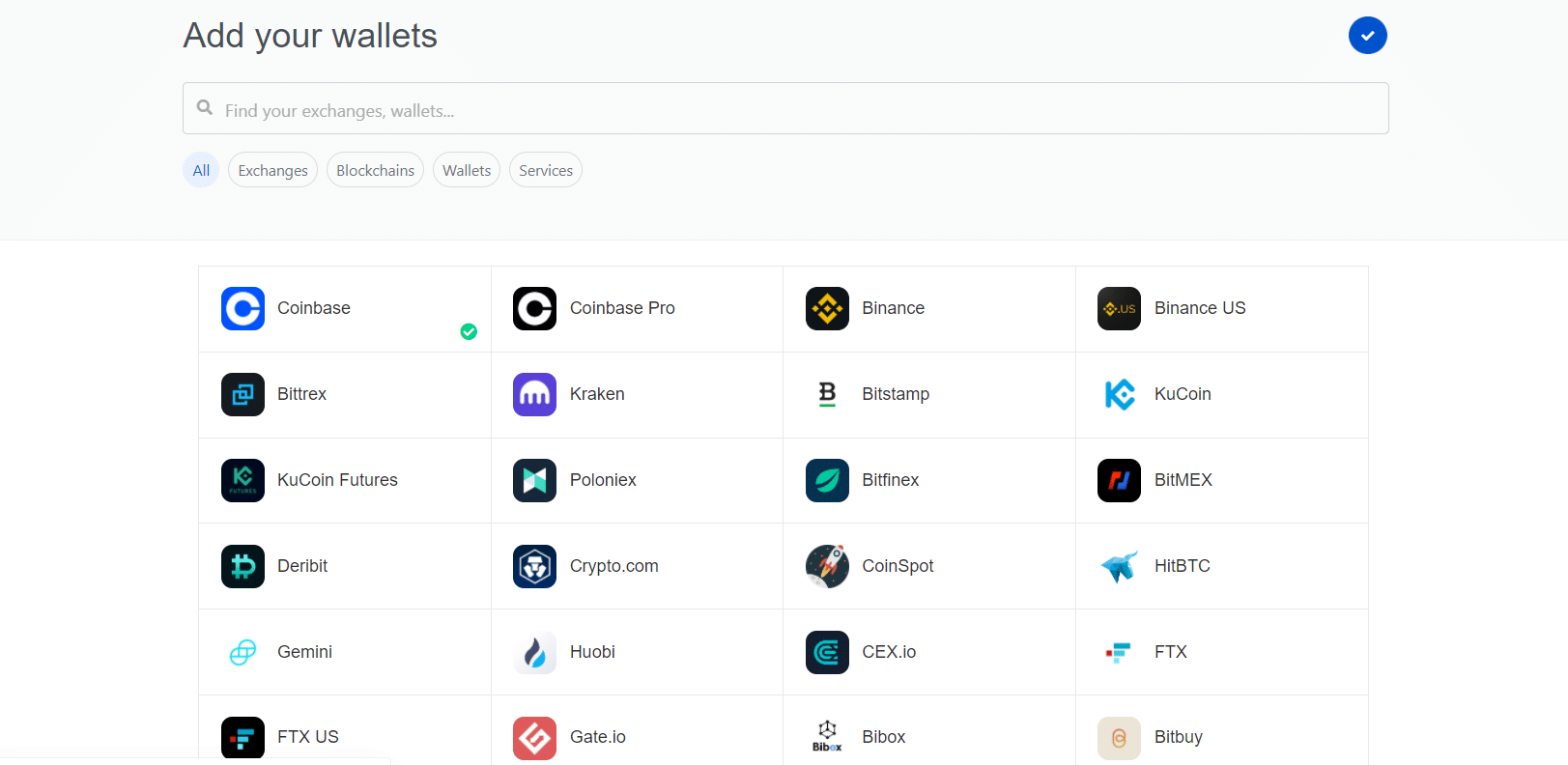

Extensive Wallet And Exchange Support

Koinly integrates with around 750 cryptocurrency exchanges and wallets and automatically syncs your transactions to your Koinly dashboard. This feature helps you consolidate all crypto investing activity in Koinly to begin preparing your tax forms. It’s also excellent for tracking your cryptocurrency holdings throughout the year.

Some popular exchanges Koinly supports include:

Koinly supports 100+ wallets and plenty of crypto savings accounts as well, including popular companies like:

- Ledger

- Nexo

- Trezor

- Trust Wallet

- Yoroi

Connecting an account to Koinly requires read-only access to import your transaction data. Where you use an API to share cryptocurrency data, creating unique read-only keys for each tracking app is essential so they can’t be used to execute trades or transfers.

Koinly can detect the type of income you earned different transactions. For example, it can differentiate margin and futures trading from exchanges like BitMEX and Binance.

It can also identify if transactions include income from staking or various lending platforms. With its error reconciliation feature, Koinly uncovers missing transaction data and duplicates it to ensure you’re filing accurately.

The bottom line is that Koinly makes importing all your crypto activity easy. Whether you primarily use API connections or upload CSV reports is up to you.

One-Click Crypto Tax Reports

Koinly’s Tax Reports tab provides an overview of your cryptocurrency activity for a given year. Right off the bat, you get a snapshot of:

- Capital gains and profits or losses

- Other gains from sources like futures and derivatives

- Income from sources like airdrops, forks, and crypto savings accounts

- Cost and expenses not included in capital gains

- Gifts, donations, and lost coins

You can also adjust your account settings before generating tax reports. This allows you to adjust your home country, currency, and income sources such as airdrops or mining.

Koinly supports several different cost basis methods, including some that are less common:

- Shared Pool

- Spec ID

- Average Cost Basis (ACB)

- First In First Out (FIFO)

- Last In First Out (LIFO)

- Highest In First Out (HIFO)

Once you choose your cost basis method and import transactions, Koinly can create several tax reports automatically:

- Form 8949 and Schedule D: Form 8949 is for the Sales and Dispositions of Capital Assets and is critical for filing crypto taxes. You then include net capital gains and losses on Form Schedule D.

- Income Report: This includes income from sources like airdrops, forks, mining, and staking.

- Capital Gains Report: A breakdown of your short- and long-term capital gains, including exactly when you sold specific assets, the original cost, and your proceeds.

- End-Of-Year Holdings: This report is helpful in the event you’re audited since it outlines your cryptocurrency holdings at year's end.

- Gifts, Donations, And Lost Assets: Koinly outlines the crypto you’ve given as gifts or donations. Crypto that has been lost or stolen is also included, as this could count as a capital loss.

Koinly lets you export these reports to popular tax software like TurboTax and TaxAct so you can finish filing.

Tax-Loss Harvesting

Tax-loss harvesting is a popular tactic you can use to offset capital gains in order to reduce your tax burden. In a nutshell, it involves selling securities to realize a loss that you can apply against some of your capital gains. After selling off assets, you purchase similar assets to maintain your portfolio composition.

You can leverage tax-loss harvesting on crypto as well as stocks. Because Koinly tracks all of your capital gains and losses per crypto asset, it’s easy to tell which coins you can sell and how much you’ll realize in losses.

A slight downside of Koinly is that it doesn’t have an independent tax-loss harvesting calculator. Other crypto tax software like ZenLedger has a standalone tool that breaks out tax-loss harvesting in a spreadsheet, so you can certainly go to ZenLedger to use theirs.

In contrast, Koinly highlights your unrealized gains and losses on its dashboard. This is essentially the same information, but having a dedicated calculator that spells everything out per asset is preferred.

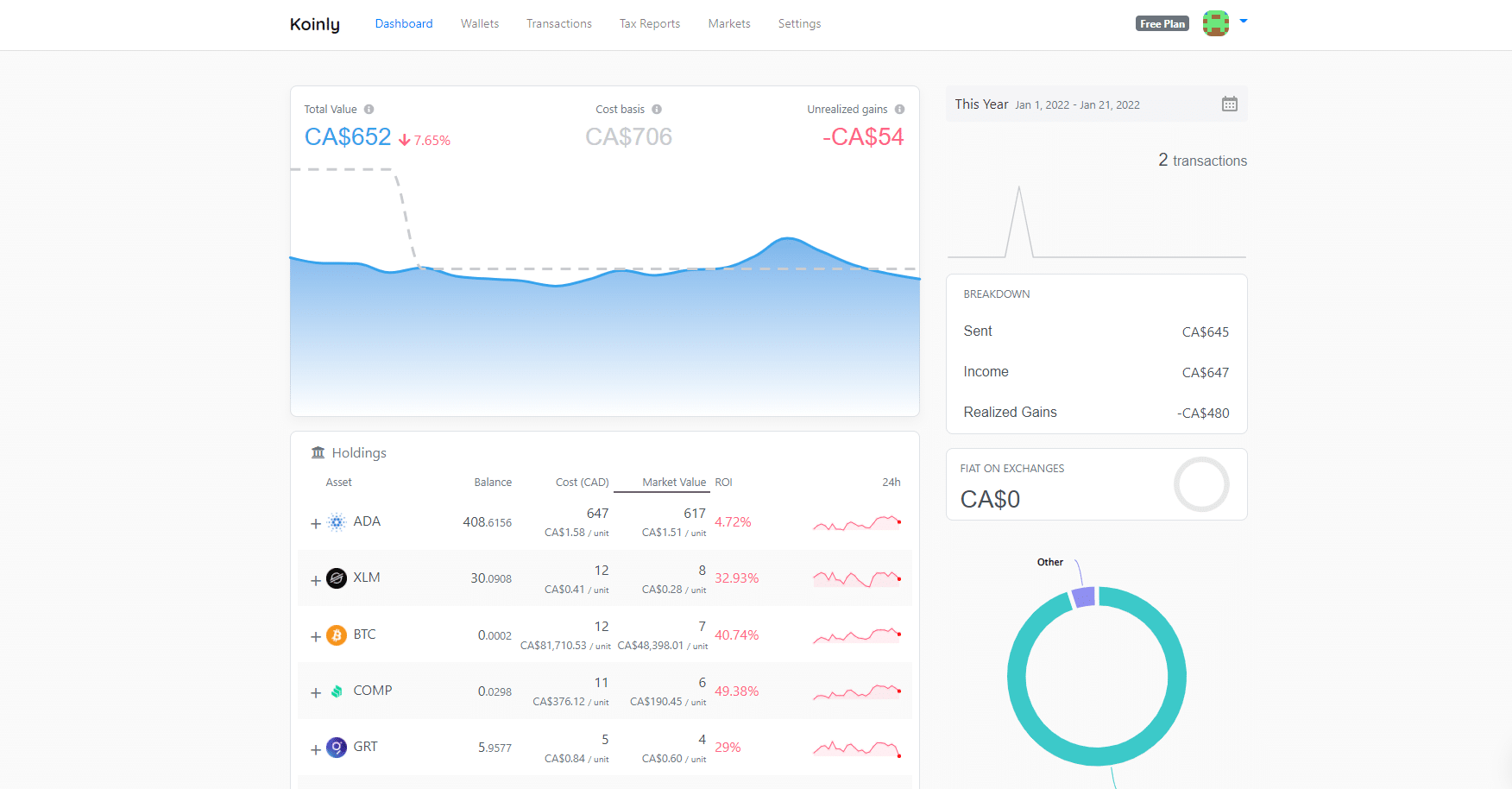

Portfolio Tracking

Koinly’s dashboard provides a sleek overview of your portfolio value, holdings, performance by holding, and the number of transactions. It shows you how much fiat you’re holding on exchanges and displays a pie chart breakdown of all your assets.

The dashboard is quite minimal, and less robust than a portfolio tracker like Kubera. However, the dashboard is still useful for helping you spot transaction discrepancies or and missed transactions.

International Support

An advantage of Koinly over most crypto tax software is its international support. Currently, Koinly is available in over 20 countries for taxes, including:

- Australia

- Belgium

- Canada

- Denmark

- Finland

- France

- Germany

- Japan

- Norway

- South Korea

- Spain

- Sweden

- United States

When you change your home country, Koinly creates localized versions of your tax reports. This means it’s doing more than just changing currency figures around. For example, if you select Sweden as your home country, Koinly will provide additional tax report options like a K4.

Are There Any Fees?

Koinly has a free plan, but you must pay for usable tax reports and forms. However, Koinly has several plans that are both flexible and affordable:

Free | Newbie | HODLer | Trader | Pro | |

|---|---|---|---|---|---|

Annual Cost | $0 | $49 | $99 | $179 | $279 |

Transactions | 10,000 | 100 | 1,000 | 3,000 | 10,000+ |

Wallets & Exchanges | Unlimited | Unlimited | Unlimited | Unlimited | Unlimited |

DeFi & Other Trades | Yes | Yes | Yes | Yes | Yes |

Form 8494, Schedule D | No | Yes | Yes | Yes | Yes |

International Tax Reports | No | Yes | Yes | Yes | Yes |

Audit Reports | No | Yes | Yes | Yes | Yes |

TurboTax And TaxAct Exports | No | Yes | Yes | Yes | Yes |

Crypto Income Tracking | Yes | Yes | Yes | Yes | Yes |

Email Suport | Yes | Yes | Yes | Yes | Yes |

Cell |

The free plan is perfect for testing Koinly’s user interface to see if you like the software. For tax reporting purposes, consider transaction limits when choosing a plan.

Another nice Koinly feature is the option to add dual nationality to any plan for $49. The feature adds tax report downloads for one additional country, which can be helpful for digital nomads and expats.

You can also add an expert review to any plan. This feature has a Koinly tax expert double-checking your account to highlight potential issues. This review could be worth it if you have a large and complex portfolio. But be prepared to spend a hefty amount for the expert review, which is currently listed as a $999 add-on to your self-service tax reports.

How Does Koinly Compare?

Koinly is one of the market’s most affordable crypto tax software, and the free plan means you can test it out before paying. Even if you don’t use it for taxes, the free version’s tracking features are good enough that you may want to sign up regardless.

However, there are plenty of other tax options out there. Here’s how Koinly stacks up against ZenLedger and CoinLedger, two other popular contenders.

Header |  |  |  |

|---|---|---|---|

Rating | |||

Pricing | $0 to $279 per year | $0 to $999 per year | $49 to $199 per year |

Exchange & Wallet Support | 750+ | 400+ | 280+ |

Tax Software Integrations | TurboTax, TaxAct | TurboTax | TurboTax, TaxAct |

Tax-Loss Harvesting | Supported, but there's no independent tool | Included in paid plans | Included in all plans |

Cell |

Koinly is an excellent choice if you don’t trade too often and want cheap plans. It’s also a great option if you have a lot of DeFi and NFT transactions since you can add them manually. However, Koinly has better international support than ZenLedger and CoinLedger.

ZenLeger has better native DeFi support since it integrates with 100+ protocols, but this is a small advantage unless you’re heavily involved in DeFi or use less-popular platforms.

Koinly and ZenLedger are two of our favorite crypto tax software options. Both have free plans, making it easy to try out each platform before you upgrade and pay for your tax reports.

How Do I Open An Account?

You can sign up for Koinly with your Coinbase or Google account. You can also sign up with your name, email, and password. You don’t need to enter your credit card to try Koinly’s free features, which is another plus.

Once you sign up with a free account, you can connect unlimited wallets, exchanges, and DeFi services to start testing the software. Koinly doesn’t require KYC (Know Your Customer, which identifies and verifies clients) requirements either.

You can set up a brand new account in a few minutes. Depending on the complexity of your crypto holdings, importing transaction data from exchanges can take around 15 to 20 minutes.

Is It Safe And Secure?

Like other crypto tax software, Koinly uses read-only API connections to import transactions. This means Koinly can’t make changes to any of your crypto exchanges or wallets. Koinly doesn’t require any private keys or write access to do its job.

Furthermore, Koinly encrypts data in transit and doesn’t store your payment details. Overall, these practices make Koinly a safe and secure crypto tax software. You can read more about Koinly’s commitment to security on its website.

How Do I Contact Koinly?

There are several ways to contact Koinly customer support. The simplest method is to use its live chat feature to message a customer support agent.

Each pricing tier offers direct email support from experts. You can also send general inquiries to hello@koinly.io.

Koinly currently has a 4.8-star rating on Trustpilot with nearly 1,500 reviews, and several users cite reliable customer service as a perk. Negative comments mainly stem from transaction import errors, but customer support isn’t a complaint users typically have.

Is It Worth It?

Active cryptocurrency investors definitely need some type of crypto tax software. Yes, you can file taxes on your own, but the amount of time and potential mistakes you save using software is usually worth the annual price.

As for Koinly, it’s one of the best crypto tax software on the market. It has DeFi support and lets you add NFT transactions manually, making it rather robust. When you tack on international support, Koinly is a reliable choice for both U.S. and international crypto investors.

You should still do your own bookkeeping throughout the year and double-check Koinly’s tax reports. But if you need a helping hand with filing your taxes, Koinly could be for you.

Why You Should Trust Us

Our team consists of cryptocurrency investors and experts. We have hands-on experience with many crypto tax apps and other tax software. Our goal is to help you find the right product at the right price for your crypto tax filing needs. We focus on the costs and benefits of every product and work hard to give you honest, unbiased feedback so you can make an informed decision.

Koinly Features

Product Type | Cryptocurrency tax software |

Supported Wallets & Exchanges | 750+ |

Tax Software Pricing |

|

Tax Filing Included | No |

Tax Software Integrations |

|

Cost Basis Methods | ACB, HIFO, FIFO, LIFO |

Audit Trail Report | Yes, on all paid plans |

Report Revisions | Unlimited |

Tax-Loss Harvesting | Available |

Refund Period | 7 days |

Customer Service Options | Chat or email |

General Customer Service Email Address | hello@koinly.io |

Mobile App Availability | None |

Web/Desktop Account Access | Yes |

Promotions | None |

Koinly Review

-

Pricing

-

Products & Services

-

Third-Party Integrations

-

Customer Service

Overall

Summary

Koinly’s tax software lets you automatically import and track your cryptocurrency transactions.

Pros

- Affordable pricing on paid plans

- Robust exchange & wallet integrations

- Support for international tax filing

Cons

- No standalone tax-loss harvesting tool

- The free plan doesn’t include any tax reports

- Users with thousands of transactions pay a significant fee for tax reporting

Eric Rosenberg is a financial writer, speaker, and consultant based in Ventura, California. He holds an undergraduate finance degree from the University of Colorado and an MBA in finance from the University of Denver. After working as a bank manager and then nearly a decade in corporate finance and accounting, Eric left the corporate world for full-time online self-employment.

His work has been featured in online publications including Business Insider, Nerdwallet, Investopedia, The Balance, Huffington Post, and other financial publications. When away from the computer, he enjoys spending time with his wife and three children, traveling the world, and tinkering with technology. Connect with him and learn more at EricRosenberg.com.

Editor: Claire Tak Reviewed by: Robert Farrington