Each year, college graduates face increasing student debt loads as they enter the workforce. However, these graduates are armed with a degree that's likely to translate to higher earnings throughout their careers.

Student loan borrowers who take out loans but are unable to finish college often face even larger issues. These borrowers still must repay their student loans, but may not have a high-paying job to cover the costs. One reason students drop out of school is due to a funding gap. They're unable to cover costs with subsidized student loans, and their parents or grandparents can't take out loans on their behalf. As a result, these students can't afford to continue their education.

Edly, a private company offering Income-Based Repayment (IBR) loans, wants to create an alternative loan scheme to fund that gap. Their private IBR loans have built-in protections to adjust the loan repayment schedule to fit each borrower’s unique income limitations. Borrowers who have income that falls below $30k per year pay nothing until their earning power is restored.

The unique Edly IBR loan may sound like a good fit for students seeking private loans. However, the loans can be deceptively costly, so borrowers should understand the program before committing. Here’s what you need to know about these loans.

Edly Details | |

|---|---|

Product Name | Edly IBR (Income-Based Repayment) Loan |

Borrowing Limit | $15,000 Per Academic Year and $25,000 Lifetime |

Repayment Period | Up To 12 Years |

Payment Cap | 60 or 84 Completed Payments (depending on product) |

Promotions | None |

What Is Edly?

Edly is a private student loan company that offers income-based repayment loan options. The company’s goal is to create a private student loan product that allows more students to graduate from school which increases the likelihood that the borrower can repay their loans.

Edly raises funds for its loans through a private investment marketplace. Investors in the marketplace can direct their loans to certain institutions or towards certain education programs (majors). Read our review of Edly's investor options.

What Does It Offer?

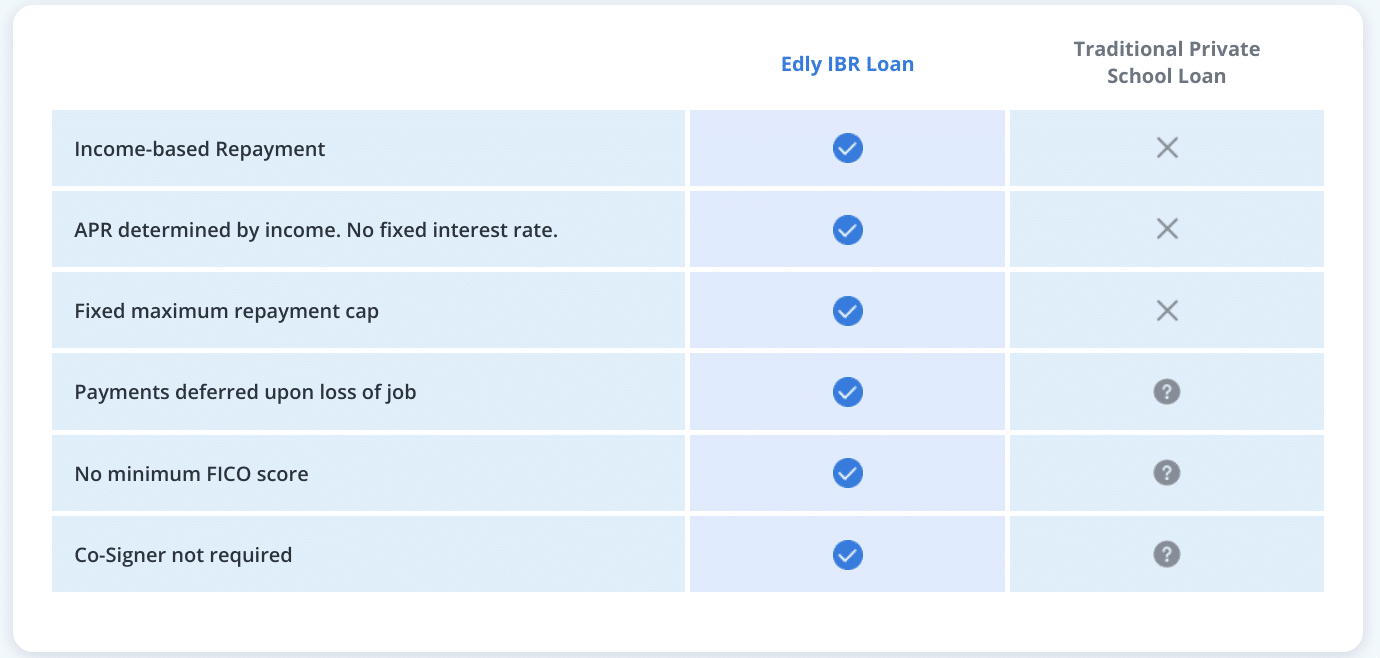

Edly considers a borrower’s credit history when issuing its loans, but students aren't required to have a credit history or a minimum credit score. Instead, Edly focuses on a student’s time to graduate and their potential post-graduation earnings.

Depending on their major and school, students may be able qualify for an Edly IBR loan without a cosigner, even if they have limited credit histories. Edly says that students are three times more likely to qualify to be approved for its IBR loan without a cosigner than for a traditional private student loan.

Income-Based Repayment Loans

Edly IBR Loans have floating payments based on a borrower’s income. If income falls below a threshold ($30k), the loan goes into deferment until the borrower can repay again. Borrowers can expect to spend up to 12 years making payments towards their loan.

When your income rises, your payments on your Edly IBR Loan will increase as well. Payment increases will typically be proportional to your income.

Loans Issued Based On Major

Edly says that students in high-income potential majors are no more likely to receive a loan than lower-income potential students. And it also plans to expand its eligible academic program list to a wide range of majors beyond STEM, business, and healthcare by the end of the year.

Rather than sheer income potential, eligible programs are determined by performance statistics, like graduation rates, job placement rates, certification exam pass rates, etc. However, it should be noted that while your estimated starting salary won't affect your loan eligibility, it will impact your specific loan terms.

Payments Can Be Deferred Due To Job Loss Or Low Income

If a borrower loses their job or their income falls below $30k, they can defer their loans for up to 12 months. The deferment period simply adds time to the end of the loan. However, borrowers cannot defer their loans for graduate school.

Total Payment Cap

A borrower's repayment period ends after they complete 60 or 84 payments or they hit a repayment cap of 23% APR. When Edly first launched, the repayment cap was 23% APR OR 2.25x the loan amount, but they're no longer capping payments at 2.25x.

A borrower can choose to pay off his or her remaining loan balance at any time. But note that if you decide to pay off your loan before the end of your term, the maximum 23% APR will added to your payoff amount.

Are There Any Fees?

Edly borrowers don’t pay any up-front fees on their loans. However, borrowers will effectively pay interest when they make repayments. The Edly borrower website allows users to check specific loan terms. But it doesn't offer general guidance on the average interest rate borrowers can expect to pay.

Edly’s investor website advertises that most borrowers repay the loans in three to five years, and investors earn an average of 8% before fees. This means borrowers should expect repayment terms ranging from three to five years, and their expected interest rate will be above 8% (accounting for defaults and slow payments).

How Does The Edly IBR Loan Compare?

As a private student loan company, Edly isn't trying to compete with subsidized federal student loans. Instead, it's trying to fund private loans that borrowers will be able to repay.

Although interest rate information is scant, the expected interest rates on the Edly student loans would be on the high end of what traditional private lenders charge undergraduate students. But Edly offers more protections for borrowers. The income-based repayment plan reduces payments when income is low. And it allows borrowers to defer their loans in the event of job loss.

However, Edly is likely to be a more costly option in the long run. This is because Edly borrowers face an unusual situation when refinancing their loans. To refinance, borrowers must refinance the “max repayment amount.” That means they're effectively paying all the interest at the point of refinancing which makes it an ineffective option. By contrast, borrowers who take on traditional loans can refinance to a lower interest rate as soon as they qualify.

If you think that a traditional private student loan is a better option for you, you can compare our top lenders here. But if the income-based-repayment element of Edly's loans appeals to, know that other companies like Stride and offer similar products. Stride, in particular, still caps your total payment amount rather than just capping your APR. Here's a quick look at how Edly compares:

Header |  |  | |

|---|---|---|---|

Rating | |||

Borrowing Limit | $15,000 per year and $25,000 lifetime | $25,000 per year | $200,000 aggregate |

Payback Period | Up To 12 Years | 5-10 Years | 5–20 years |

Income-Based Payments | Yes | Yes | No |

Repayment Cap | 60 or 84 Payments or | 2x Loan Amount | N/A |

Cosigner | Not required | Not required | Allowed, not required |

Cell |

How Do I Apply For A Loan?

Students who want to take out a loan can start by checking their loan terms on the Edly site. The site uses a soft credit pull to provide a loan estimate, so it does not impact a borrower’s credit score.

Edly says that only adverse credit history is a factor in your approval or denial (like defaults, collections accounts, bankruptcies, etc.). There's no minimum credit score requirement. And it doesn't require students to have a cosigner when they apply.

A borrower who officially applies must provide information about their graduation date, major, school of attendance, and proof of income among other information. If a borrower is approved, Edly sends a check directly to their school at the start of the next semester.

Is It Safe And Secure?

Edly issues its loans through FinWise bank, an FDIC-insured bank. Borrowers will receive a Truth in Lending Act form before they have to sign any loan forms. This protects borrowers who may be confused by the terms of an income-based repayment loan.

When Edly issues a loan, it pays the school directly, so borrowers never have to handle the money. The loan repayment platform has bank-level security, and the company has not had any reported security breaches.

How Do I Contact Edly?

Edly is headquartered in Briarcliff Manor, New York. Its street address is 555 Pleasantville Road, Suite N202, Briarcliff Manor, NY, 10510.

The company does not advertise a customer service telephone number or a chat service. Students who are interested in applying for a loan can check their repayment terms through the Edly website. or use the Contact Us form.

Is It Worth It?

Generally speaking, income-share agreements tend to trick students into taking on more debt. The loans from Edly are no exception. Despite the claims of affordability and protection, borrowers are likely to be locked into a loan with double-digit interest rates for three to five years.

Of course, most of these borrowers will be able to afford to repay the loans as Edly specifically targets students with high-income potential. But whether a borrower can eventually repay the debt doesn’t reflect the quality of the debt for the borrower. With Edly, you could pay up to 23% APR on your borrowed amount. And there's no longer a 2.25x payment cap.

We recommend private student loans as the last resort for college students. Scholarships, grants, savings, earnings from work, contributions from family members, and federal student loans are all better ways to fund college. Only after all those sources are exhausted should borrowers look at Edly or other private lenders.

Borrowers who consider Edly should try to minimize their repayment window. If you plan to have a loan for more than three years, you'll probably do better with another lender. Even if the other lender has a higher interest rate, borrowers will likely have the option to refinance to more favorable terms after graduating.

Edly IBR Student Loan Features

Product | Income-Based Repayment (IBR) Loan |

Borrowing Limit | $15,000 per academic year and $25,000 lifetime |

Origination Fees | None |

Min FICO Score | None |

Percentage Of Income Shared | Varies |

Cosigner Required | No |

Min Income Threshold | $30k |

Repayment Period | Up to 12 years |

Payment Cap | 60 or 84 completed payments or 23% APR |

Soft Credit Check | Yes |

Maximum Deferment For Job Loss Or Income Dropping Below $30k Threshold | 12 months |

Grace Period | Four months after scheduled graduation date |

Deferment For Enrolling In Grad School | No |

Late Fees | Unclear |

Death or Disability Discharge | Unclear |

Customer Service Options | Contact form only |

Mobile Apps Available | No |

Promotions | None |

Edly IBR Loan Review

-

Terms & Requirements

-

Repayment Costs

-

Ease of Use

-

Customer Service

Overall

Summary

Edly IBR Student Loan payments adjust with your income. But this extra flexibility could come at a cost.

Pros

- Floating payments move up and down with your income

- Protects borrowers in the case of job loss

- Loan cosigners are not required

Cons

- Overall cost could be more than you’d pay with a traditional student loan

- Borrowers are likely to have trouble refinancing

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Claire Tak