Juno student loans is a platform that helps match you with a private student loan lender, but with a twist. The process typically works by pre-qualifying, going through a list of lenders, and then hopefully choosing the one with the best rate.

But what if you could get with a group of friends and approach a single lender for a loan? Would that lender be more willing to lower their rate?

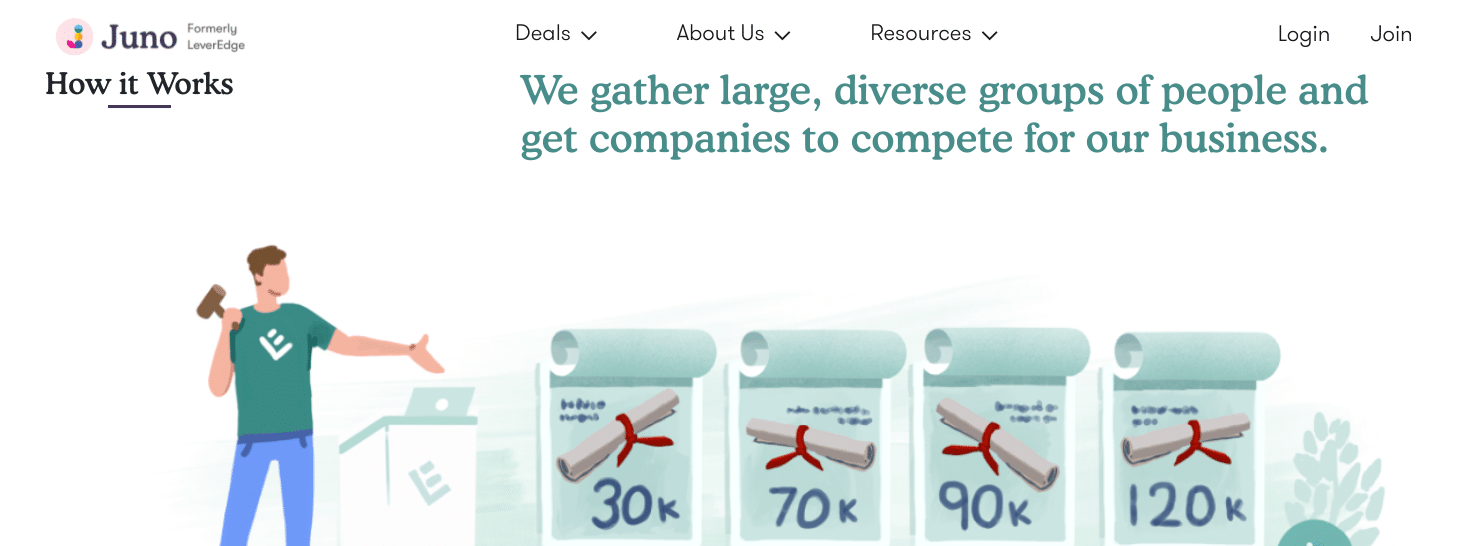

Juno thinks the answer is yes because that's exactly what its strategy is built on. Juno takes a group of borrowers and presents them to its network of partner lenders. It then negotiates a lower rate based on a group of borrowers vs. a single borrower. In this article, we’ll review how Juno works.

Juno Student Loan Details | |

|---|---|

Product Name | Juno |

Fees | None |

Variable APR | Starting At 5.72% |

Fixed APR | Starting At 5.19% |

Loan Terms | 5 to 15 years |

Promotions | Up to $1,000 cash back on refinancing |

Who Is Juno?

Juno, formerly LeverEdge, negotiates better student loan rates for groups of student loan borrowers. Its founders are Christopher Abkarians and Nikhil Agarwal, who pioneered the "group student loan" strategy themselves during their years as Harvard students. The company has raised $2.5 million through a seed round.

“Juno is the first collective bargaining group for student loans,” Abkarians said to KTEN TV. “Our mission is to help students minimize the cost of education, from the day they take out their first loan to the day they finish paying it off.”

“Juno is the ultimate team effort...The more people involved, the greater our ability to negotiate lower rates. We’re committed to doing whatever we can to minimize the cost of student loans.”

What Do They Offer?

Juno offers private student loans and student loan refinancing. By working with its lending partners, Juno is able to negotiate lower rates on student loans. As Abkarians stated in the above quote, the more borrowers that are involved, the more negotiating leverage they'll have with lenders.

Traditional lender matching platforms pair up a lender with a borrower. Each loan is negotiated one at a time. It can be a slow, boring, and very time-consuming process. Some platforms will pre-qualify borrowers, however, which can greatly speed up the process.

Juno takes a group of borrowers and submits their information to its partner lenders. This can potentially be a win-win for both sides. Lenders receive a block of borrowers, which is far more efficient for them than working with just one borrower at a time. In return, the group of borrowers receives lower rates.

One drawback of this process is that it can take weeks or even months before lenders finalize any deal. Lenders still need time to analyze the group's overall credit risk, which is where the lag comes in. Students looking to get better rates with Juno should factor in their tuition due dates against how long it may take a deal to finalize. Of course, this doesn’t keep students from shopping around just in case.

Which Loan Types Are Available?

Private student loans and student loan refinancing are available from Juno. Here are the types of private student loans that it currently offers:

- Undergraduate Loans

- Graduate Loans

- MBA Loans

- Parent Loans

- DACA Loans

- Degree Abroad Loans

Refinancing is available as well with terms of 5-15 years from the following partner lenders — Earnest, Splash, and Laurel Road. If you're refinancing medical loans, you'll be routed to Laurel Road. All other loan types are made through Earnest or Splash.

Juno is currently building a negotiation group for international student loan refinancing. Once it's reached 2,000 sign-ups, it will begin reaching out to lenders to negotiate a group rate.

Cash Back And Rate Reductions

Juno is currently offering up to $1,000 cash back for borrowers who refinance with Splash. For Earnest and Laurel Road borrowers, it promises a rate reduction of 0.25%. With Laurel Road, you can also make $100 payments while you're in medical residency or fellowship.

Is Juno Better Than Federal Student Loans?

The short answer is no. Federal student loans offer many advantages over private student loans. Some benefits of using federal student loans include:

- Lower rates

- Flexible repayment terms

- Eligible for Income-Driven Repayment (IDR)

- Eligible for Public Service Loan Forgiveness (PSLF)

In regard to the last two bullet points, private student loans are not eligible. Also, during the pandemic, federal student loans have been in a 0% interest forbearance period. For many private loans, this option has not been available.

However, if you've already hit your annual or lifetime federal borrowing cap, Juno's private student loans offer great benefits and competitive rates. Also, if you aren't taking advantage of IDR and aren't pursuing PSLF forgiveness, refinancing your federal loans to a lower rate with Juno could make sense.

Are There Any Fees?

No, Juno doesn't charge any application or origination fees. There also no prepayment penalties if pay off your loans before the end of your repayment term.

How Does Juno Compare?

Since Juno isn't actually a lender, its "secret sauce" is its rate reduction and cash back deals. But it's important to understand that you might be able to find a lower rate or even more cash back by applying with an individual lender directly or using another comparison platform like Credible.

Here's a quick look at how Juno compares:

Header |  |  |  |

|---|---|---|---|

Rating | |||

Variable APR | Starting At 5.72% | 5.24% - 12.43% | 5.28% - 8.99% |

Fixed APR | Starting At 5.19% | 5.24% - 12.43% | 5.48% - 8.69% |

Bonus Offer | Up to $1,000 | Up to $1,000 | Up to $1,100 |

Cell |

What Borrower Protections Are Available?

There is a 9-month grace period after graduating or withdrawing from school before repayment begins. But all other benefits such as forbearance and deferment periods will vary by lender. You can read our reviews of Splash, Earnest, and Laurel Road to learn more about the benefits they provide.

How Do I Open An Account?

You can visit Juno's website to get started. Expect to provide the following when filling out an application:

- Name

- Email Address

- School / University Information

- Educational Program Information

- Graduation Year

- Immigration Status

- Social Security Number

- Loan Balance

- Employment information (if applicable)

- Annual Income (if application)

- Cosigner Information (if applicable)

- Cosigner's Immigration Status (if applicable)

How Do I Contact Juno?

Juno can be reached by phone or email from Monday - Friday, 8 AM to 5 PM (EST). Their phone number is 201-482-1269 and their email address is hello@joinjuno.com. You can also schedule a Zoom meeting with a Juno team member here.

Why Should You Trust Us

I am America’s Student Loan Debt Expert™ and have been actively writing about and covering student loans since 2009. Myself and the team here at The College Investor have been actively tracking student loan providers since 2015 and have reviewed, tested, and followed almost every provider and lender in the space.

Furthermore, our compliance team reviews the rates and terms on these listing every weekday to ensure they are accurate. That way you can be sure you're looking at an accurate and up-to-date rate when you're comparison shopping.

Who Is This For And Is It Worth It?

If you need to take out private loans or you're looking to refinance your existing student loans, Juno could be worth it. They charge no fees, offer flexible terms, and may be able to offer you a lower rate than traditional lenders. However, Juno's application process may be more time-consuming so you’ll want to apply well before your tuition deadlines.

Before applying with Juno, make sure that you’ve filled out a FAFSA for federal loans first as they offer more protections than private loans. And, as with any loan, it's important to shop around for the best deal. Compare Juno with our top private student loan companies and student loan refinancing lenders.

Juno FAQs

Here are a few of the questions people ask most often about Juno student loans:

Is Juno legit?

Yes, since its founding in 2018, Juno has already had more than 78,000

members sign up to join one its negotiation groups and it has secured over $420 million in loans.

Does Juno offer scholarships?

Yes, it offers a monthly no-essay $1,000 scholarship as well as a $1,000 essay/video scholarship.

Can you refinance international student loans with Juno?

Not yet, but you should be able to soon. It's currently building a negotiation group and over 1,000 members have already joined. Once there are 2,000 members in the group, Juno will begin running bids with lenders.

Does Juno offer any cash back bonuses?

Yes, it's currently offering up to $1,000 back to borrowers who refinance.

Juno Features

Min Loan Amount | Varies by lender |

Max Loan Amount | Varies by lender |

Loan Types | Private student loans:

Refinance loans

|

Variable APR | Starting At 5.72% |

Fixed APR | Starting At 5.19% |

Auto-Pay Discount | 0.25% when applicable |

Loan Terms | 10 years |

Application Fees | No |

Origination Fees | No |

Prepayment Penalty | No |

In-School Repayment Options | Varies by lender |

Co-signers Allowed? | Yes |

Grace Period | 9 Months |

Eligible Borrowers |

|

Customer Service Phone Number | 339-330-4147 |

Customer Service Email | hello@joinjuno.com |

Mobile App | None |

Promotions | Up to $1,000 cash back on refinancing |

Juno Student Loans

-

Loan Options

-

Customer Service

-

Rewards and Perks

-

Rates and Fees

-

Ease of Use

Overall

Summary

Juno student loans uses collective bargaining power to negotiate better rates on undergraduate, graduate, and refinance student loans.

Pros

- No fees

- Competitive interest rates

- Up t0 $1,000 cash back on refinance loans

Cons

- Potentially longer approval process

- Negotiates with only a few private lenders

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Claire Tak