NewRetirement is a retirement planner tool that can help you build your path to financial independence, set retirement savings goals, and maximize your estate.

While building a financial plan can often be expensive, NewRetirement offers their most popular online tools for free. And if you feel like you need extra help from a human being, you can pay for one-time or ongoing support from a NewRetirement Advisors CFP®.

But it should be noted that NewRetirement doesn't actually manage any of their member's investments. So their financial planning options are meant to complement, rather than replace, your current stock broker or robo-advisor. Find out more about how NewRetirement works in our full review.

New Retirement Details | |

|---|---|

Product Name | NewRetirement |

Services | Online Retirement Planning Tools |

Cost | $0 to $96 per year Live Plan Reviews Start at $150 |

Promotions | 14-Day Free Trial of PlannerPlus |

Who Is NewRetirement?

NewRetirement is a website that helps people plan for retirement. It was founded in 2005 by Stephen Chen and his brother Tim. NewRetirement is located in San Leandro, CA.

“I realized that retirement planning involves a lot more than just savings and investments and yet there were no resources — especially trustworthy and affordable resources — that were helping people navigate this really important aspect of their lives.

We decided to start NewRetirement.com — a new way to approach retirement planning,” said Chen in an interview with Forbes.

NewRetirement has been a Better Business Bureau member since 2005 and has an A+ rating.

You can see where NewRetirement lands on our list of the best retirement calculators here.

What Do They Offer?

NewRetirement has two main plans for customers to choose from when planning out and managing their retirement. Many people will find that the free plan does most of what they need. It includes the all-important retirement calculator and score.

Also, you can upgrade at any time to the paid plan as your needs change. In addition to the two main subscriptions, you can also purchase one-off services from NewRetirement. Here's a closer look at what it offers.

Planner — Free

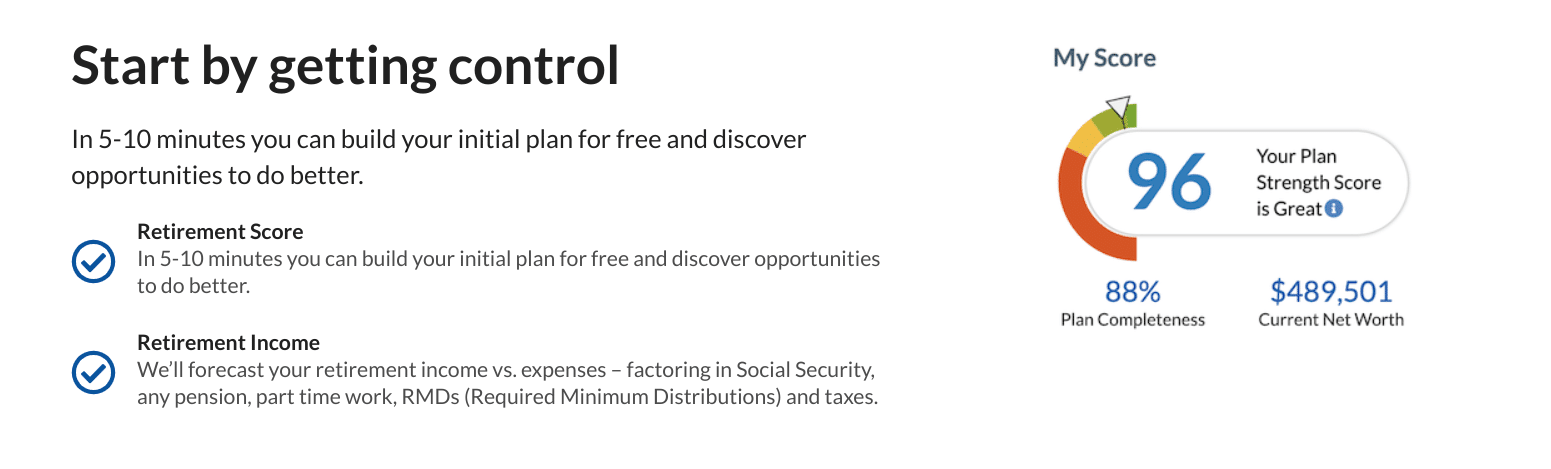

This is the free plan and allows you to create a personalized retirement plan. In 5 to 10 minutes, you’ll be able to fill out NewRetirement’s intake form and get an analysis of your retirement.

Data is collected using a conversational format that seamlessly guides you through inputs. The analysis will forecast your retirement income vs. expenses – factoring in Social Security, any pension, part-time work, RMDs (Required Minimum Distributions), and taxes.

After Biden signed the Omnibus Spending Bill in late December 2022, there are changes to watch out for, specifically for RMD ages on projected income, taxes, and Roth conversion strategies. It will impact how you may affect your finances moving forward.

RMD changes are as follows:

If you are born:

- Before Jan. 1, 1951, your RMDs have already started and nothing changes

- Between Jan. 1, 1951 and Dec. 31, 1959, then your RMDs must start at age 73

- After Jan. 1, 1960, then your RMDs will begin at age 75

The NewRetirement Planner helps you make better decisions about your money and help you understand the impact of the new RMD ages. You can use the NewRetirement Planner to:

- See projected RMDs for each year on the Lifetime Income Projections chart, Savings Insights, and/or Income & Expenses Insights

- PlannerPlus users can use Tax Insights to assess the impact of RMDs on tax thresholds

- Assess Roth conversion strategies

You can also do scenario comparisons, which helps you makes better decisions with a side-by-side analysis of 2 to 3 scenarios or projections.

Examples:

- What is your estate value in a worst vs. a best case scenario?

- Will you run out of money if you buy the lake house?

- What are the tax implications of moving to Arizona?

- What are the income differences if you retire at 50, 60, or 65?

You can then make decisions about better opportunities using what-if modeling. You’ll also receive a retirement score, which lets you know at a glance how efficient and optimized your retirement plan is. Get started with NewRetirement's free plan.

NewRetirement continues to roll out new features every few weeks. And while it doesn't currently have a dedicated mobile app, it says that each of its updates are mobile- and tablet-friendly. Most recently, it added new graphs, an updated goals section, an easy way to update account balances, and the ability to exclude certain accounts from your default withdrawal strategy.

PlannerPlus — $8/mo (Charged At $96 Annually)

PlannerPlus includes everything in the free plan. But for $96 per year, you can access to a lot more functionality. Here's all the extra features that NewRetirement packs in to their PlannerPlus tier.

- Multiple Scenarios: Run scenarios for 15 different variables like your savings rate, your social security start age, your investment returns, and more.

- Detailed Charting & Printable Reports: Get greater insight into your plan so you can discover opportunities and make better decisions.

- Plan Monitoring and Alerts: NewRetirement will monitor your plan and alert you to big risks, oversights, and options to improve your plan.

- Budgeting: Budgeter will help you achieve more reliable projections, improved tax planning abilities and better asset and income strategies.

- Tax Modeling: Model Roth conversions and withdrawals to stay below marginal tax rates.

- Manage Your Healthcare Costs: Research and choose the right Medicare Plan and related insurance.

- Increase & secure your income: Model smart withdrawals, annuities, and pensions.

- Inspector: Make a reasonable estimate of your total lifetime out of pocket medical spending after age 65.

- Explorers: Let the planner suggest how to optimize your plan against a goal, such as how to maximize your Social Security Benefit, estate value and withdrawal strategy.

- Expert Help: Get suggestions from the Coach or access a Certified Financial Planner who is completely aligned with you.

PlannerPlus members also get unlimited product support. You can try PlannerPlus for 14 days before you’ll be charged. It’s a risk-free trial, so If you cancel within the 14-day trial period, you won’t be charged anything.

Services

Want to work one-on-one with a financial advisor to develop a plan or make sure that the plan you have is still the right for your needs and goals? If so, you may want to schedule a "Live" or "Advisor" session. Here's what they offer.

Live — Starting At $150

Live allows you to work with a coach to check your plan and discuss financial questions on your mind. You can use these sessions to:

- Configure your plan for accuracy

- Confirm that your plan is on track

- Answer your PlannerPlus questions

- Discuss criteria to make decisions

Your coach can teach you how to use the PlannerPlus tool, educate you on financial strategies, and provide all the information you need to make informed decisions for your future.

Advisor — Starting At $999

Get access to a Certified Financial Planner (CFP®) (rather than a coach), who can help you customize your retirement plan and provide advice.

Note that NewRetirement doesn’t manage investment or retirement accounts so you aren’t charged based on assets under management (AUM). The advisor option is fee-only and you’ll know exactly what the advisor fee is upfront.

Live Events

NewRetirement also regularly hosts live demos, Q&A sessions, and "Ask Me Anything (AMA)" webinars about specific topics. For example, when we visited NewRetirement's site, it had upcoming AMAs about "Donor-Advised Funds and Roth Conversions" and "Solo 401ks."

To view all of NewRetirement's upcoming live events, visit this page.

Are There Any Fees?

Not for the free plan. The paid plan costs $8/mo (billed annually at $96). You can also use an advisor at any time, which starts at $150. Other than that, there are no fees.

How Does NewRetirement Compare?

NewRetirement isn't the only company that offers digital financial planning tools and retirement calculators. There are several other companies that offer similar tools including Savology and Personal Capital.

Savology's model is most similar to NewRetirement's in that it doesn't actually manage assets and it has both a free and paid plan that costs $96 per year. But the main difference is that the Savology "Plus" plan includes live chat with coaches.

Like NewRetirement and Savology, Empower offers a huge number of calculators, analyzers, and savings tools. But unlike the other two sites, Empower can also manage your assets for an advisory fee of 0.89% (for the first $1 million). Here's a quick look at how NewRetirement compares:

Header | |||

|---|---|---|---|

Rating | |||

Pricing | Free to $96/yr | Free to $96/yr | Free to 0.89% AUM |

Advice Options | Auto and Human | Auto and Human | Auto and Human |

Unlimited Access To Coaches/CFPs | No | Yes, on Plus Plan | Yes, for Wealth Management clients |

Cell |

How Do I Open An Account?

Visit https://www.newretirement.com to open an account online.

Is It Worth It?

While there are other retirement planning and money management tools available, NewRetirement takes a straightforward, simple approach to help you plan for retirement. Just about everything you need to plan for retirement comes with the free plan. And you can upgrade at any time if, and when, you feel like it.

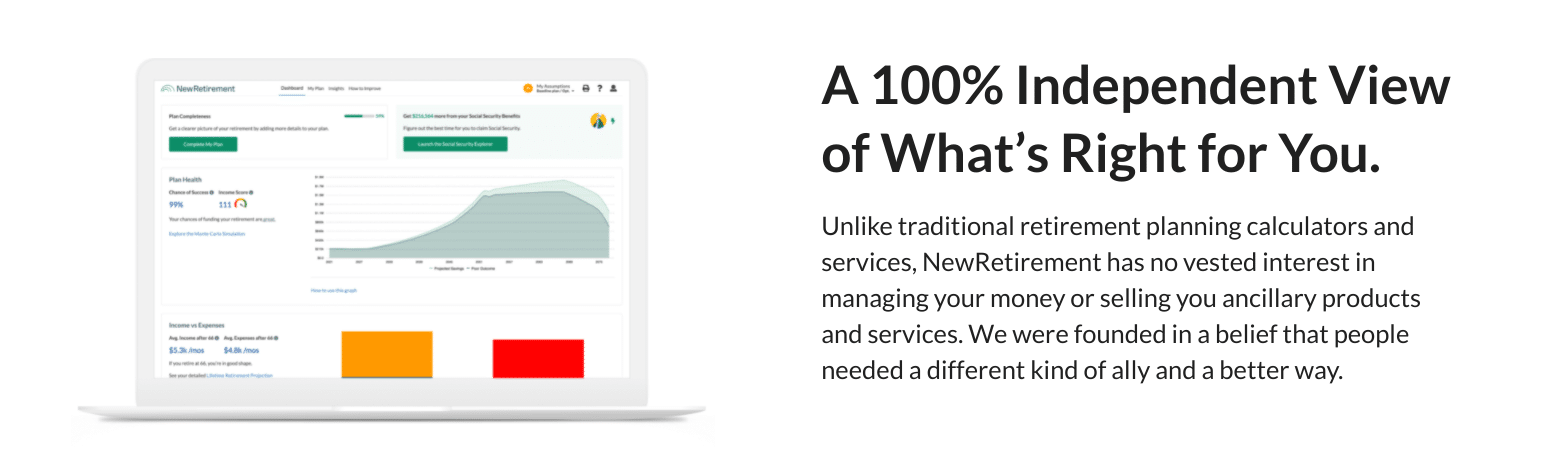

Unlike other websites, NewRetirement also won’t bombard you with upsell phone calls or emails. And their retirement score and dashboard visuals are unlike any other retirement planners on the market.

However, since NewRetirement doesn't offer wealth management services, you'll need to take it upon yourself to implement their investing advice. If you're comfortable with buying and selling investments yourself on a discount stock broker's platform, that might not be a problem. But if you prefer a more hands-off investing approach, a low-cost robo-advisor may be a better fit.

NewRetirement FAQs

Let's answer a few common questions that people ask about NewRetirement:

Does NewRetirement have an app?

Not yet, but all of its financial planning tools are optimized for mobile browsers.

How many inputs can NewRetirement's planner evaluate?

NewRetirement's free planner can consider up to 100 inputs while PlannerPlus can handle 250+ inputs.

Is NewRetirement secure?

Yes, it uses 128-bit encryption for its servers, never sells user data, and uses Plaid (a popular and highly-trusted financial technology platform) to link to its users' financial accounts.

Does NewRetirement make money when you choose certain investments?

No, NewRetirement never assumes management of its customers' assets. Therefore, it has no vested interest in the investments they choose.

NewRetirement Features

Product Name | NewRetirement |

Services | Online Retirement Planning Tools |

Plans |

|

Promotions | 14-day risk free trial of PlannerPlus |

Access to Human Advisors? | Yes. Session-based Coach support available on PlannerPlus plans. |

Wealth Management Services Available? | No |

Tax Modeling Available? | Yes, on the PlannerPlus plan |

CFP Consultation Pricing Structure | Flat Fee |

Mobile Apps? | No |

NewRetirement Review

-

Product Cost

-

Ease Of Use

-

Tools And Features

-

Customer Service

Overall

Summary

NewRetirement is an online financial planning tool that offers free retirement calculators and planners and fee-only support from CFPs.

Pros

- Free retirement calculators

- Robust calculations and planning scenarios

- Support from coaches and CFPs

Cons

- No wealth management services

- No mobile app

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Ashley Barnett