Over the past decade, options for alternative investing have mushroomed.

In the past, investing in alternatives typically meant investing in a precious metals fund or physical metals if you were being particularly crazy. But today, alternative asset classes can mean anything from crowdfunded real estate, to digital currencies (like bitcoin), to startups and peer-to-peer loans.

While it’s easier than ever to find alternative asset classes online, it can be tough to take advantage of the opportunities for investment. In most cases, a regular investor has most (or all) of her investments locked away in retirement accounts. Getting enough money to invest for goals other than retirement is a real challenge.

Want to use your retirement money to invest in alternative investments? Alto IRA may have a solution for you - especially if you're looking for self-directed IRA.

Alto Details | |

|---|---|

Product Name | Alto IRA and Alto CryptIRA |

Min Invesment | Varies by investment ($10 for crypto) |

Setup Fee | $0 |

Account Fee | Starting at $10/mo or $100/yr |

Promotions | None |

Who Is Alto?

Alto is a brokerage company that facilitates investments in alternative asset classes through retirement accounts (IRAs). It calls its retirement account The Alternative IRA®, but it’s simply an IRA with flexible investment options (also known as a self-directed IRA).

Unlike many companies, Alto allows its investors to invest in almost anything (that’s legal). It partners with angel investing funds, real estate lending companies, crypto exchanges, and a variety of other online alternative investment providers to facilitate investment opportunities. Some of the investment partnerships are only open to accredited investors which are people earning at least $250,000 per year or having a net worth in excess of $1 million.

Additionally, investors can choose to invest directly in private deals. For example, you could use your IRA to buy a duplex in another city or to fund a loan to a friend starting a business.

What Does It Offer?

Alto IRA supports traditional IRAs, Roth IRAs, and SEP IRAs. If you have a rollover account, you can roll it into the traditional IRA account. It doesn’t currently support inherited IRAs or individual 401ks.

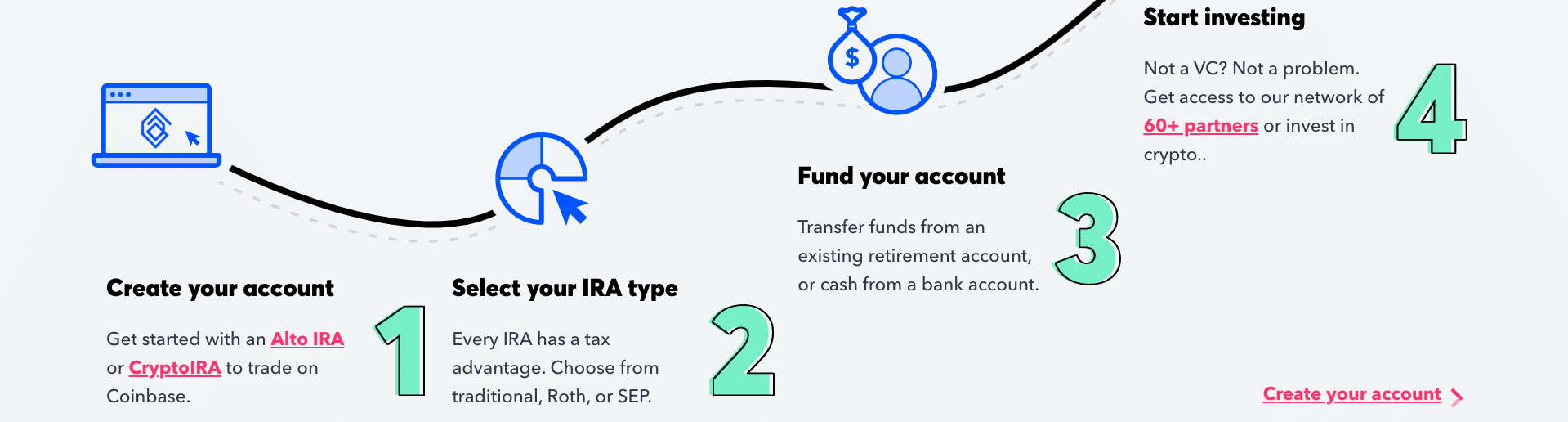

Once you've chosen the type of retirement account that you want to open with Alto, you can choose from two products: Alto IRA and Alto Crypto IRA. Here's a quick look at how both products work and what they offer.

Alto IRA

Alto IRA facilitates “Partner Investments.”

Partner investments can be a great choice if you're not a venture capital firm (i.e. most of us). Through Alto's list of partners, it's easy to start investing in a wide variety of alternative investments, including farmland, startups, art, and more. Notable Alto IRA partners include AcreTrader, AngelList, Republic, Masterworks, and more.

While Alto IRA allows most investments through its platform, it does have some restrictions. The investment must still be legal. For example, you can't buy yourself a house with your retirement funds.

You can buy, flip, and sell a property using your retirement funds without losing the tax-advantaged status. But you must be careful to follow all the rules associated with buying and selling property or you could accidentally create a taxable event.

Pro Plan: If you want to invest in investments outside of their partners, you'll need to upgrade to their Pro Plan, which has a higher monthly fee of $25/mo and a $75 per investment fee.

Alto CryptoIRA®

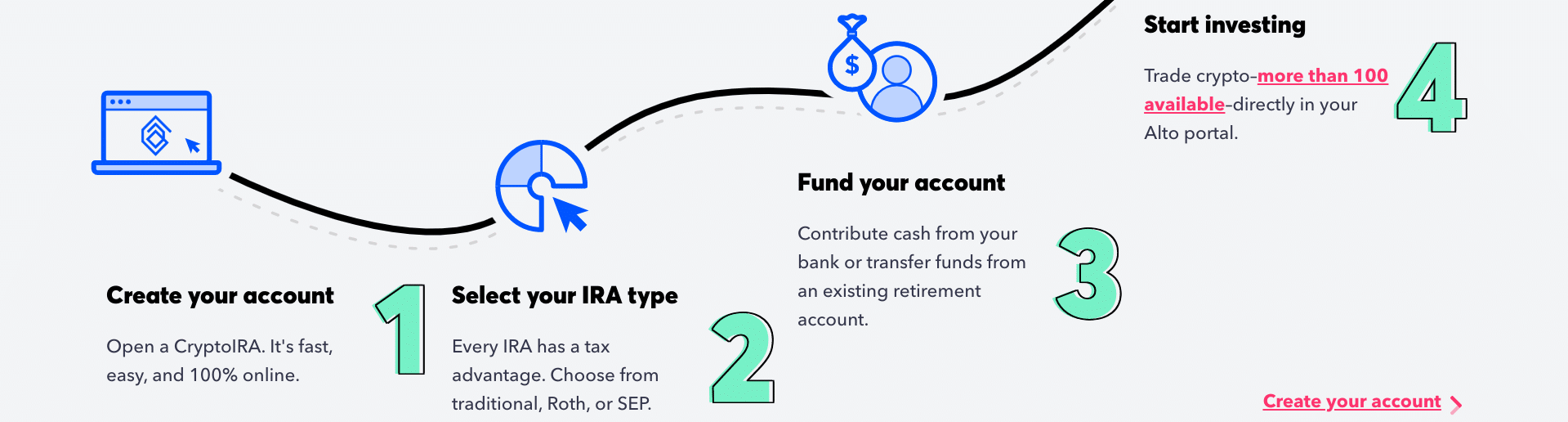

Cryptocurrency investing has been steadily gaining in popularity over the past few years. But options for investing in crypto with retirement funds are still few and far between. But Alto offers a simple and seamless solution.

Through the Alto CryptoIRA®, you can invest in any digital asset that's supported by the Coinbase exchange (currently over 200 currencies). Alto's direct integration with Coinbase makes it about as easy as possible to invest in crypto through your self-directed IRA.

The Alto CryptoIRA will allow you to trade coins 24/7 with minimum investments of just $10. From a tax standpoint, there isn't technically any fundamental difference between a standard Alto IRA and an Alto CryptoIRA. However, the company has decided to keep the accounts separate out of an abundance of tax caution.

How Much Does Alto IRA Cost?

Alto has a different cost structure for its Alto IRA than for the Alto CryptoIRA. Here's how the fees break down for each.

Alto IRA

Alto IRA has a different cost structure than most IRAs. Instead of charging a fee based on a percentage of assets, you'll pay flat monthly fees of $10 per month or $100 per year, and a separate fee per investment. You get a discount of two months by paying for the entire year up front.

Here's a quick look at the fees for the starter plan.

Alto IRA | |

|---|---|

Account Fee | $10/mo or $100/yr |

Custody Fee | $0/mo |

Direct Investment Fee | N/A |

Outbound Wire Transfers | $25 |

Account Closing Fee | $50 |

If you're interested in the Pro Plan, you'll pay $25/mo or $250/yr. You'll also have a $75 private investment fee if you don't use one of their existing partners.

Alto CryptoIRA

Unlike the standard Alto IRA, the CryptoIRA charges no monthly fees. You only pay when you trade. The trade fee is 1%.

This 1% fee includes the Coinbase fee, which is 1.5% unless you're using Coinbase Pro. So this is very competitive pricing from Alto.

Note that just as with the Alto IRA, you'll run against additional fees if you close your CryptoIRA account or initiate an outbound wire transfer. The account closure fee is $50 and the outbound wire fee is $25.

How Does Alto Compare?

Alto IRA is one of the lowest-cost self-directed IRA providers available today. Unlike most of its competitors, it doesn't charge a setup fee. And its ongoing fees are below-average as well.

If you know that you want to invest in an IRA (Traditional, Roth, or SEP), it's hard to beat Alto. However, if you're looking to invest in a self-directed Solo 401k, you'll need to look elsewhere. Here's a quick look at how Alto compares:

Header |  | ||

|---|---|---|---|

Rating | |||

Setup Fee | N/A | $360 to $600 | $525 |

Account Fee | $10/mo | $15 to $30/mo | $125/yr |

Plan Types | IRA | IRA & 401k | IRA & 401k |

Checkbook? | |||

Cell |

How Do I Open An Account?

You can get started with Alto by visiting its website here. From its homepage, look for the "Sign Up" button in the top right corner and click on it. Next, you'll create your account by entering your email address and providing a password.

Once your email has been verified, you'll need to choose which account you're planning to open: Alto IRA or Alto CryptoIRA. Next, you'll select your IRA type: Traditional, Roth, or SEP IRA.

Alto's KYC/AML Process is typically automatic and instant. However, in some cases an Alto team member may need to reach out to ask for more identity verification documents. Note that you won't be able to participate in any investments on Alto until you've passed its KYC/ALM screening.

Alto follows a "Seven-Day Rule" which means you'll need to wait seven days after account creation before you can make your first investment on the platform. But you can fund your account and even make investment commitments during that seven-day period provided that you've passed KYC/ALM.

Is It Safe And Secure?

Cash assets that are held with Alto IRA are protected up to $250,000 by FDIC insurance. However, unlike with stock brokerages, any funds that are invested with Alto are not protected by SIPC insurance.

It's important to understand that "alternative investments" tend to be riskier and have less liquidity than more traditional investments like stocks and bonds. Some of Alto's partners may have lock-up periods, for example, and may not provide a secondary exchange where you can sell your shares before your investment term ends.

Finally, it should be noted that Alto's site was targeted by hackers in July 2021. If you attempted to log in to your account on or after Tuesday, July 6, your credentials may have been compromised and you should immediately create a new user ID and password. It doesn't appear that any assets or funds were compromised during the breach.

How Do I Contact Alto?

You can contact Alto by phone at (877) 673-1557 or by submitting a support ticket here. Customer service hours are Monday - Friday, 8 AM–5 PM (CT).

Alto currently has a "Great" rating on Trustpilot of 4.2/5 from over 350 customer reviews. However, the company is not accredited or rated with the Better Business Bureau (BBB) as of writing.

Is It Worth It?

Whenever I talk about alternative investments, I think it’s important to remind people that with a high savings rate, you can probably become rich using investments like index funds in the stock market. You really don’t have to be fancy to become financially independent.

That said, I can certainly make a case for using a self-directed IRA. If you're a skilled real estate investor (or a skilled angel investor or Bitcoin investor), Alto IRA could help you put more funds towards your investment empire. You can also compare their options with competitors like Rocket Dollar.

Not sure whether alternative assets make sense in your retirement investment portfolio? I would urge you to stick with conventional investments until you determine whether these asset classes make sense for you.

Simply put, alternative assets don’t belong in every retirement portfolio. Be careful, but don’t let caution stop you from making the right investment choices for yourself.

Alto IRA FAQs

Let's answer a few of the most common questions that people ask about Alto:

Is Alto CryptoIRA legit?

Yes, due to its integration with Coinbase, the Alto CryptoIRA is able to offer one of the widest list of supported cryptocurrencies in the Bitcoin IRA space.

Have monthly fees been eliminated for the Alto CryptoIRA?

Yes, as of October 2021, the Alto CryptoIRA no longer charges monthly fees.

Do I need to be an accredited investor to open an Alto account?

No, however some of the offerings that are available on its platform may require accreditation.

Can I open a SIMPLE IRA with Alto?

No, Alto currently only allows investors to open a Traditional, Roth, or SEP IRA.

Alto IRA Features

Account Type |

|

Minimum Investment | Varies by partner ($10 for crypto) |

Setup Fee | $0 |

Account Fee | Alto IRA: $10/mo or $100/yr CryptoIRA: N/A |

Investment Fee |

|

Account Closure Fee | $50 |

Outgoing Wire Transfer Fee | $25 |

Investment Options | Virtually unlimited alternative investment options including:

|

Rollovers Allowed | Yes |

Checkbook Control | Yes |

Available Investment Partners | 60+ |

Customer Service Number | (877) 673-1557 |

Customer Service Hours | Monday - Friday, 8 AM–5 PM (CT) |

Mobile App Availability | None |

Web/Desktop Account Access | Yes |

Promotions | None |

Alto IRA Review

-

Pricing and Fees

-

Products and Services

-

Customer Service

Overall

Summary

Alto IRA is a self-directed IRA provider that allows you to invest in alternative assets inside your IRA (such as real estate, cryptocurrency, private stock, and more).

Pros

- Self-directed IRAs

- Easy onboarding process

- 16+ investment partners

- No setup fees and low monthly fees

Cons

- Doesn’t support Solo 401k account

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Claire Tak