If you’re young, healthy, and not hoping to give birth anytime soon, one of the best ways to save money is to go on a high-deductible health insurance plan with a Health Savings Account (HSA).

Many large employers offer high-deductible health insurance coverage as the employer-sponsored plan with the lowest monthly premium (that’s your monthly cost), and pretty much all marketplaces offer HSA eligible health insurance plans. If you run into medical trouble, you might pay more, but on a month-to-month basis, you’ll pay less.

And if your plan is “HSA-eligible,” you’re likely to get a few bonus opportunities for saving. Often your employer will contribute a certain amount to your HSA (usually somewhere between $500 and $1,000). On top of that, you can save and invest money within the HSA (up to $3,850 for an individual or $7,750 for a family). That’s money that you save without paying income taxes or Social Security taxes or taxes on the growth (provided that you use the money only for medical expenses).

The HSA can be an excellent savings and investment account for the young professional. However, the HSA requires you to fill out one extra form at tax time. This form explains how to use IRS Form 8889 for HSA contributions, distributions, and deductions.

What Is Form 8889?

Form 8889 is the IRS form that helps you to do the following:

- Report contributions to a Health Savings Account (HSA).

- Calculate your tax deduction from making HSA contributions.

- Report distributions you took from the HSA (hopefully for eligible medical expenses).

- Calculate taxes you owe on the distributions (if you used the money for something not medical related).

Since using an HSA correctly can lead to significant tax savings, it’s important to fill out the Form 8889 each year you use the HSA.

Keep an Eye Out for HSA Tax Documents

Filling out the Form 8889 can be a little confusing, because the information you need can come from several sources. Below are a few places to look for the information.

Employer Contributions and Contributions from Your Paycheck

To learn how much your employer contributed on your behalf, and how much you contributed, you will look at your W-2 form (in box 12 with the code W).

From my personal experience, this can be a little bit confusing. Code W seems to correspond to “employer contributions to HSAs,” but it really means employer and employee contributions to the plan.

Related: HSA Contribution Limits

Additional Contributions

If you’re either self-employed or you made contributions outside of payroll deductions, then you’ll need to account for those HSA contributions separately. You can almost always find information about these from an annual statement from the company that houses your HSAs.

Personally, I always head to my HSA website at tax time to download any tax documents that are available.

Information About Distributions

Unlike many tax-advantaged investment accounts, you may use your HSA long before retirement. If you break an arm, have a baby, or have some other medical need, you may decide to take a distribution from your HSA.

You may take a distribution from your HSA at any time, without incurring a tax penalty, so long as the distribution is used to pay for qualified medical expenses. However, you must file Form 8889 the year you take a distribution from the HSA.

Save Your Receipts for Medical Expenses

Different people approach HSA accounts differently. One camp uses the HSA almost entirely to pay for current or past medical needs.

One family I know experienced a large volume of medical needs over the course of a few years. This family now owes over $20,000 in medical bills, and all the bills are on a payment plan. Each month, one spouse contributes money to an HSA, pays the monthly payment on the medical debt, and reimburses herself for that payment. She gets the tax advantages of the HSA while paying off debt.

The other camp tries to keep as much money as possible in the HSA to let it grow through investments (we call it the HSA secret IRA). This can lead to massive account balances, and could reduce your need for long-term care insurance later in life. However, this camp may end up drawing from the HSA if they experience a cash flow crunch down the road.

Whether you’re in the first camp or the second camp, you need to save your medical receipts. The first group will use the medical receipts during tax season to prove they used the funds for qualified medical expenses. The second group needs to hang onto the receipts even longer, until they actually take a distribution from the HSA. Years or even decades from now, those receipts could keep you from paying extra taxes on HSA distributions.

Fill Out Form 8889 for Your Taxes

Come tax time, anyone who contributed to or received a distribution from an HSA will need to fill out Form 8889. Of course, most people don’t actually use Form 8889. Instead, you’ll probably use a tax software program like H&R Block or TurboTax. The software will fill out the form for you.

Note: If you use tax software, many programs require an upsell to the "Deluxe" or "Premium" versions to handle the HSA Form 8889. Check your tax software pricing if you have an HSA.

But even if you use software, it’s important to understand the form.

Form 8889 Contributions and Deductions

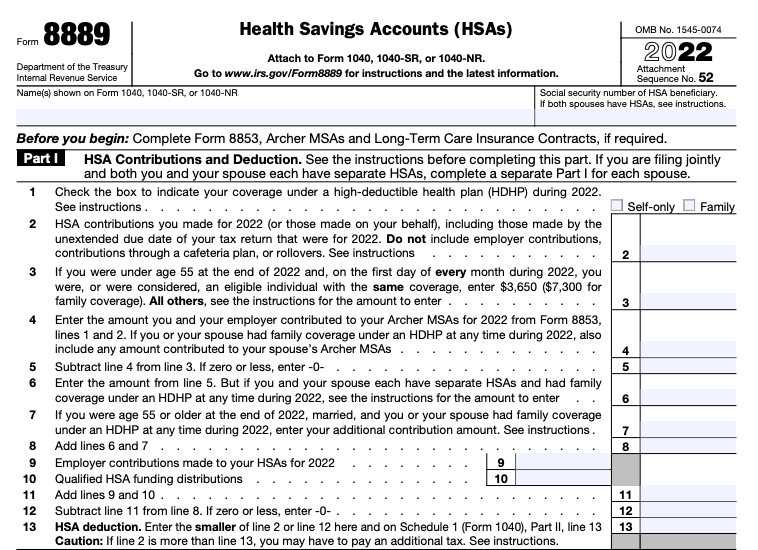

The first part of the form (line 1 through 13) has to do with HSA contributions. Since you get a tax deduction for eligible HSA contributions, this is important to do correctly. The IRS has robust instructions for filling out the form, so I’ll just go over a few common mistakes.

In line 2 of Form 8889, it says to enter the amount you contributed to an HSA. This only includes contributions you made outside of payroll deductions. Contributions through payroll deductions show up on line 9 — employer contributions to HSAs.

The other confusing part of this section has to do with line 3 — your contribution limit for the year. If you’re on a high-deductible health plan for the whole year, your contribution limit is $3,750 for individual coverage ($4,85 if you’re over age 55) or $7,750 for family coverage ($8,200 for age 55 or over).

These limits also apply if you’re on a high-deductible health plan on December 1st of the tax year.

But what if you change insurance part of the way through the year? Then the limit on line 3 changes. Basically, each month you have high-deductible health insurance, you can contribute 1/12 of the overall limit. So if you have high-deductible health insurance for six months, your limit is $1,750 for an individual.

Once you enter all the information into Form 8889, you’ll see your deduction in line 13. Use this amount to pay less money in taxes.

Form 8889 Distributions

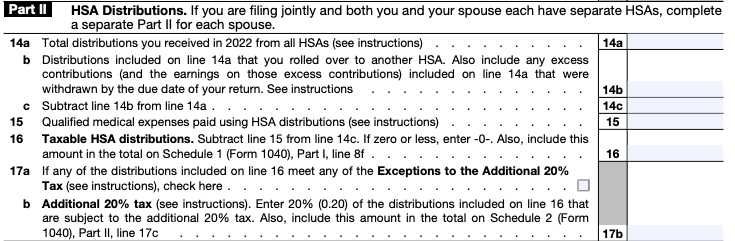

In addition to accounting for contributions, Form 8889 helps you keep track of your HSA distributions. Line 14a shows your total distributions from an HSA. This is the amount of money you take out from an HSA in a given year. For example, if you have cancer and need to withdraw $12,000 from your HSA, line 14a will show $12,000.

Line 15 is the amount of money you spent on qualified medical expenses. In the cancer example, you would put $12,000 on line 15. That means the amount you withdrew matched the amount you spent on eligible expenses.

That means you don’t owe a single penny on the amount you withdrew.

In this example, if you chose to withdraw more than $12,000 (to cover non-medical expenses), you would owe taxes on the additional funds plus a 20% penalty tax. Ouch! The details on these are found in lines 16 through 17.

Penalty Taxes for Not Maintaining HDHP Coverage

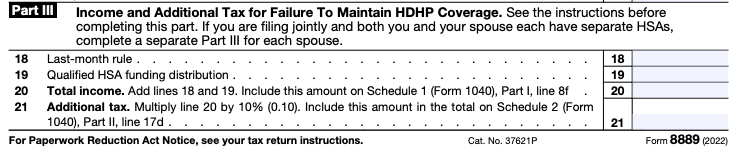

In general, the rules for HSA taxes are pretty easy. But there is one wrinkle called the “testing period” for HSA coverage. Essentially, you have to maintain high-deductible health insurance coverage for an entire tax year to qualify for the full contribution amount in both the current tax year and the previous tax year.

If you qualify for HDHP coverage in December 2023, and you load your HSA with $3,850, and then load it again in January 2022 with $4,150, and then switch insurance to a lower deductible plan, you will face a penalty. The penalty is the income tax you would have owed on part of the HSA contribution plus a 10% penalty tax.

However, if you only have partial HDHP coverage, then you can only make a partial contribution. You basically take the maximum annual contribution and multiply by the number of months you're eligible to make the correct contribution and avoid the penalty.

The details for this are in section 3, lines 18 through 21. Since the penalty is steep, be careful when you change insurance plans in the middle of the year. It can lead to some tax penalties if you aren’t careful about maintaining your high-deductible eligibility.

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Chris Muller