Fundrise is an online real estate investing platform that allows everyday investors to access real estate markets and deals that they couldn’t invest in on their own.

Through Fundrise, you can invest in either professionally managed residential real estate called eFunds or a diversified portfolio of commercial real estate called eREITs.

In this review, I’ll cover the basics of investing in Fundrise, why so many investors love the platform and investment opportunities, and why I haven’t put my money with the company… yet.

You can get started with Fundrise here.

Fundrise Details | |

|---|---|

Product Name | Fundrise |

Min Investment | $10 |

Annual Fee | 1.00% AUM |

Accredited Investor? | Open to both Accredited and Non-Accredited |

Promotions | None |

Fundrise Basics

The best way to think of Fundrise as a private real estate investment trust (REIT) without all the fees. If you're not familiar with a REIT, it means that you are investing in a basket of properties. Think of it like an ETF for real estate. Inside the REIT, it holds a bunch of different investments in properties. As an owner of the REIT, you get passed along your small percentage of the income generated by these properties.

Although Fundrise is not publicly traded, they allow you to liquidate your investment up to four times per year with a 30 day notice. This is different than a publicly traded REIT, which allows you to immediately sell. However, for a private REIT, this is one of the best we've seen.

So, how can you invest in Fundrise? Right now they offer three ways:

Starter Portfolio

With the starter portfolio, you can invest in eREITs for a starting investment of just $10. You’ll gain access to over 20 different properties in major cities throughout the country.

You’ll pay a 0.85% fund management fee to Fundrise and a 0.15% account management fee for a total of 1% in combined annual fees.

If you choose to invest, you’ll be in a 50/50 blend of the income eREIT and the growth eREIT. You should expect to hold onto both investments for five or more years, but you will have the chance to liquidate once per quarter.

Goals-Based Portfolios

If you invest at least $1,000, you can upgrade to a Goals-Based Portfolio. Fundrise’s goals based-portfolios include up to 7 eREITs, and dozens of properties. You can select between a balanced portfolio, a passive income portfolio or an aggressive growth portfolio. Your mix of eREITs will depend on your goals.

You can find more about each eREIT, the properties they own, leverage and gain perspectives on future growth and income right from the Fundrise website.

As with the starter portfolio you’ll pay a 0.85% annual management fee and a 0.15% portfolio management fee.

Direct Investments

If you choose to invest in an eFund rather than an eReit, you’re actually investing in a real estate project. You cannot expect a liquidity event before the project completes. Right now, you can invest in a Washington DC fund or a Los Angeles Fund.

To invest in these funds, you’ll pay a .85% annual fee, and a .15% portfolio management fee (which is waived in select circumstances, but not many).

One unique feature of becoming an eFund investor is the “first look” program. If you live in the area, you can purchase a home before it goes onto the market. You can use your investment in the eFund as a part of your down payment.

I don’t want to oversell the first look program, you will have to buy your house at the market rate, but I think this is a good program to consider. Housing markets in major cities are on fire right now. If you ever want to buy, it makes sense to “peg your down payment fund” to a comparable investment in your city of choice.

Fundrise Pro

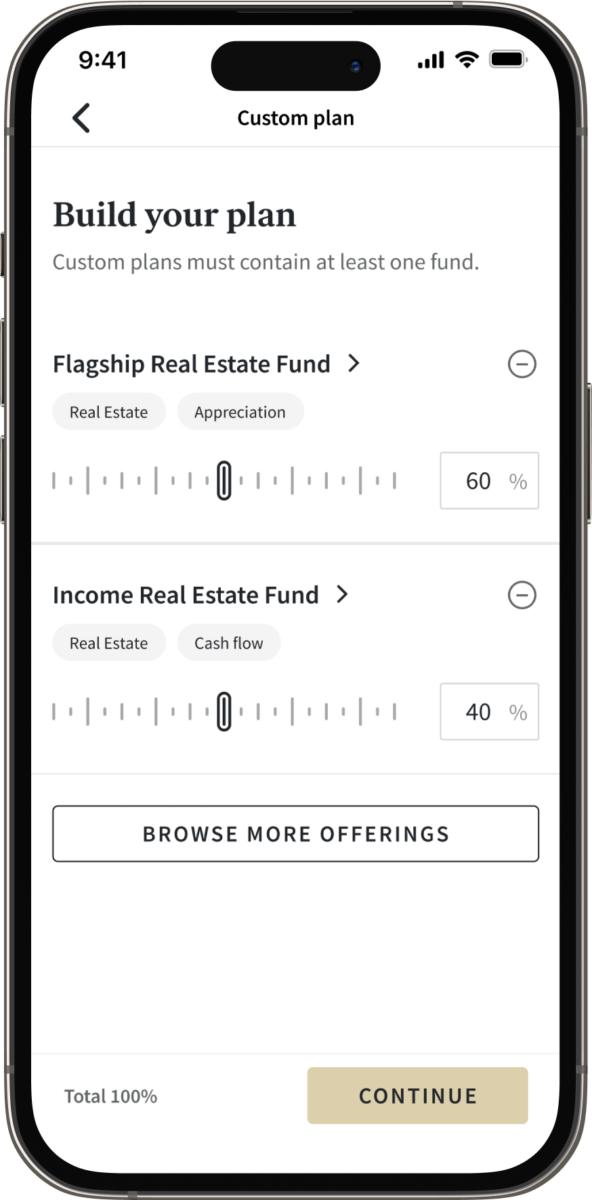

Their latest product is Fundrise Pro, which is an optional subscription and is made for the active investor who wants more control over allocations and strategy. Existing members with an account balance of $5,000 or more get grandfathered into Fundrise Pro for free. Those investors who have previously placed a direct investment also get grandfathered in for free.

Fundrise Pro members can:

- Concentrate investments into specific funds

- Build a custom investment plan with your preferences, including setting a target allocation across various investments

- Dive deeper in to the data with Fundrise's unique tools to make better investment decisions

Cost for Fundrise Pro:

- $10 a month or $99 a year paid upfront

You can try it out for free for 30 days.

Self Directed IRA

Recently, Fundrise released a Self Directed IRA program for people looking to shelter their income for the IRS. You will pay a $75 annual fee for the service, but you can invest in any of the portfolios offered by Fundrise.

See if it makes more sense to open your own self directed IRA here: Best Self-Directed IRA Providers.

Why People Love Fundrise

I’ve spoken to numerous people who have invested in Fundrise, and they all rave about the experience. These are the three features that most real investors love.

Transparency - Fundrise makes it easy to understand what you’re investing in. It helps that you can look at a picture of the property, find where it is on a map. You can also dig into the financials of every single property. Have a question? Customer service will respond to emails and phone calls.

Lack of liquidity - Logically, most people want money easily accessible, but having money “locked” into an investment is a great way to keep your money growing. Fundrise has seen phenomenal returns, and part of their success comes from “forcing” their investors to stay the course. However, note, that during tough times (like a pandemic), Fundrise may prevent you from withdrawing your funds.

Competitive Advantage - Fundrise is a company that prides itself on its competitive advantage. They invest primarily in projects that have between a $5 million and $100 million market cap. These are too large for most private investors, but they get overlooked by banks who cannot accurately rate the risk profile of the developments. In some cases, Fundrise has an advantage because banks face such high costs due to burdensome regulations.

However, if you browse the Fundrise Reddit, you'll see that there are concerns or confusion from various investors. I highly recommend that you educate yourself on the product before diving in.

Fundrise Performance

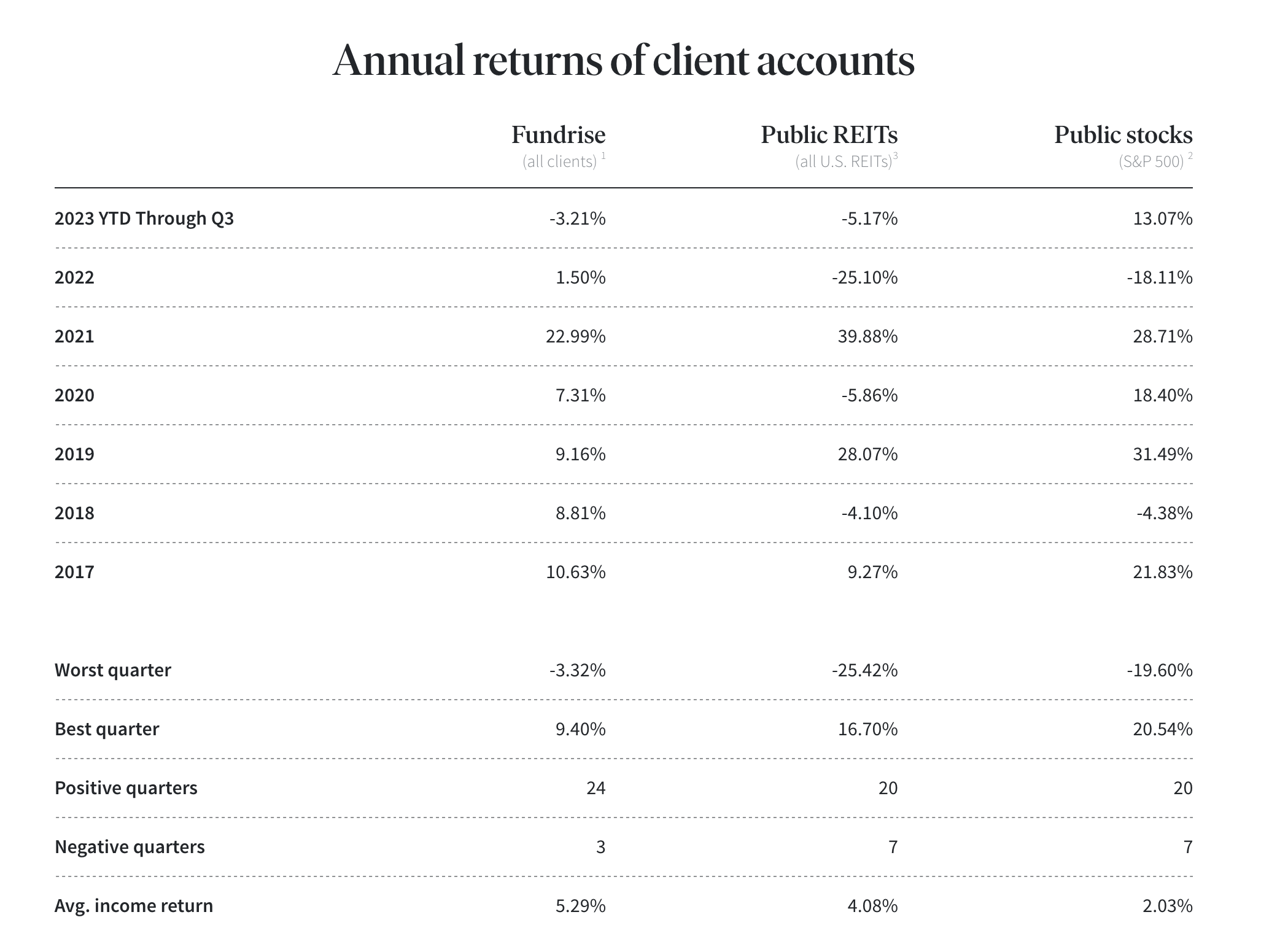

Along the same lines of transparency that we mention above, Fundrise does publish it's historical performance and returns.

It's important to realize that Fundrise (and real estate as a whole) is a non-correlated asset to stocks. That's why you see things like 2023 - where the stock market is up double-digits, but real estate (and Fundrise) have significantly underperformed. However, in other years, the opposite is true.

How Does Fundrise Compare?

Fundrise is one of the most popular real estate investment platforms online, but it's certainly not the only one. In fact, over the last few years, a fierce competition has emerged in the space.

Check out these main Fundrise competitors and see how Fundrise compares:

Header |  | ||

|---|---|---|---|

Rating | |||

AUM Fees | 1.00% | 0.30% to 0.50% | 2.00% |

Min Investment | $10 | $1,000 | $1,000 |

Open To Non-Accredited Investors? | |||

Cell |

How Is Fundrise Taxed?

Another big difference with Fundrise versus simply owning stocks in the stock market is how it's taxed.

Depending on which specific investment in Fundrise you own, you'll receive a different tax document and you'll be taxed differently.

You should receive a Form 1099-DIV for each eREIT or interval fund in your portfolio that generated aggregate distributions of at least $10 or more in the given tax year.

If you own shares of the Fundrise eFund, you should receive a Schedule K-1.

If you liquidated any eREIT/interval fund shares in the prior year, you should expect to receive a Form 1099-B for each fund.

However, you also need to be on the lookout for any corrections! REITs are notorious for issuing corrected 1099s and delaying the tax filing of their customers.

If you own a REIT, chances are you love the fact that they pay great dividends, but hate the fact that at tax time, you have to wait for a corrected 1099 to come in March. The reason for this is that many REITs, as well as some mutual funds, widely-held mortgage trusts, and real estate mortgage conduits, reallocate their dividends or reclassify their long term capital gain distributions. Because they must pass through so much of their income, the government gives them until the end of their fiscal year, which for most of these companies occurs in February.

Make Sure You Understand The Risks

I learned about Fundrise more than six years ago. At the time, they still allowed individuals to invest in particular properties. At the time, investing online in properties I’ve never seen made me nervous. The introduction of the eREIT (and the added benefit of diversification) eased my fears, but there is still a risk.

My primary concern is the level of leverage that Fundrise considers sustainable. While most would consider a 78% leverage ratio conservative (and it is), many of the properties are development projects. If demand for housing in any major city falls, the leverage could doom the profitability of the investments.

Most of the properties purchased are not done with a buy and hold forever mentality. Rather, the eREITs want regular liquidity events to enable growth.

In my personal real estate investments, I only take on debt when I can profitability hold a rental property for the long haul. I’ve been trapped underwater once, and it is not a good time. Certainly, the 100% passive nature of Fundrise should assuage my concerns, but I can’t shake them.

Why Should You Trust Us?

I have been writing about and reviewing investment firms and covering real estate investments for 10 years. I have personally owned single family, multi-family, real estate syndications, private partnerships, and more. I'm well versed in both the investment aspect and tax aspect of these products and services.

Furthermore, we have our compliance team that regularly checks and updates the facts on our reviews.

Who Is This For And Is It Worth It?

Fundrise is a great platform for anyone that is looking to get real estate exposure in their overall portfolio with a low minimum. It is a private REIT, so there are risks, and you should understand that the investment return that has historically happened may not happen going forward.

However, the low entry price of just $10 does limit downside risk. I would recommend Fundrise as a great starter platform for getting started in real estate. As always, before committing large amounts of capital do your own due diligence first.

You might also want to check out these Fundrise alternatives.

What do you think of Fundrise? Have you ever tried it?

Common Fundrise Questions

Here are the most common questions we get about Fundrise.

Is Fundrise a good investment?

It can be. Fundrise is a specialized real estate investment, and for some individuals, it could be the type of investment you're looking for in your portfolio. It invests in a basket of real estate, which does have higher risks than other types of investments. But the rewards can be better as well.

How does Fundrise work?

Fundrise is what's know as a REIT, a Real Estate Investment Trust. It basically owns a basket of real estate (multi-family housing, commercial buildings, etc.), and you get a small ownership slice of it. As a result, you get rewarded with your share of any rents received, appreciation on sale, etc.

Is your money trapped at Fundrise?

No, while Fundrise is targeted at long-term investors (5+ years), its Flagship Fund offers penalty-free redemptions every quarter.

Does Fundrise pay dividends?

Historically Fundrise has paid dividends quarterly. But like all investments, dividends are subject to performance of the underlying assets.

Is Fundrise a scam?

No! Fundrise is not a scam. Fundrise is an SEC regulated investment that focuses on real estate.

DISCLAIMER

The information contained herein neither constitutes an offer for nor a solicitation of interest in any securities offering; however, if an indication of interest is provided, it may be withdrawn or revoked, without obligation or commitment of any kind prior to being accepted following the qualification or effectiveness of the applicable offering document, and any offer, solicitation or sale of any securities will be made only by means of an offering circular, private placement memorandum, or prospectus. No money or other consideration is hereby being solicited, and will not be accepted without such potential investor having been provided the applicable offering document. Joining the Fundrise Platform neither constitutes an indication of interest in any offering nor involves any obligation or commitment of any kind.

The publicly filed offering circulars of the issuers sponsored by Rise Companies Corp., not all of which may be currently qualified by the Securities and Exchange Commission, may be found at www.fundrise.com/oc.

Fundrise Review

-

Pricing And Fees

-

Ease Of Use

-

Customer Service

-

Products and Services

-

Diversification and Risk Management

Overall

Summary

Fundrise is a real estate investment platform that allows you to start investing for just $10. It’s a private Real Estate Investment Trust (REIT) with low minimums and easy to use.

Pros

- Low minimums to start and low fees relative to other REITs

- You don’t have to be an accredited investor

- The REIT typically pays quarterly distributions

Cons

- Investing in a private REIT isn’t liquid, and your funds may be locked up during economically uncertain times

- Taxes on these types of investments are different than you may be used to

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Ashley Barnett