The gift of stock to a child is a fantastic way to help them financially, while also teaching them how to build wealth.

When you ask a parent what their kids want for Christmas, they’ll likely start with a long sigh followed by, “Well… She really likes Ninjago and Dress Up.”

If you press further, you’ll find out that the parent is overwhelmed by the toys that the kid has, and they really aren’t all that excited about giving more plastic crap to their kid.

Enter, the gift of stock and investments. Giving a share of stock to kids is a fantastic way to avoid stressing out parents, help prepare a kid for their financial future, and teach a few lessons along the way.

Plus, as a millennial family, I'm personally tired of receiving all this junk. Think about it. Your child might receive upwards of 20 gifts every holiday season (Mom, Dad, Siblings, Grandparents, Santa, etc.). But by the middle of January, what they actually play with is down to 1-2 toys.

So, instead of wasting all that money on gifts (and then having a bunch of junk lying around the house), why not use that same money to invest in your child's future. This is a great option for extended family who may want to gift.

If that's you, then these are the best ways to give a share of stock to a kid, gifting investments, and even teaching them financial literacy topics in a fun way!

If you want to give a real share certificate to a child (and they become an investor as well), check out GiveAShare. You can purchase a framed share of stock (which makes the perfect gift), and they become a shareholder as well. Check out GiveAShare here >>

Ask To Contribute To A 529

In my opinion, the single best way to give stock to kids is to contribute to their 529 or ABLE accounts. Many parents have a few hundred or a few thousand dollars invested for their kids future, and they will appreciate every extra dollar that can be invested on behalf of their kids.

If you plan to give thousands of dollars to a special kid, you can set up a 529 account on your own and name the kid as a beneficiary, but for most people that’s an excessive gift.

Here's a breakdown of the best 529 plan in your state:

A more practical way to contribute to a 529 plan is to ask the parents if they have one set up. If they respond positively, you can ask them to invest your $20 or $50 gift on your behalf. This sounds like a measly gift, but it adds up over time. I have two kids, and they both have 529 plans that we’ve funded through cash they received for birthday and Christmas gifts. Their accounts each have several thousand dollars in them.

A great way to give the gift of college via a 529 plan is to use a service like Backer. Backer makes it easy to setup and contribute to a 529 plan! After you set it up, your child gets a unique URL - for example backer.com/childsname. Plus, you can get $10 for every new backer that joins!

You can share that URL with your family, and they can easily gift into a 529 plan! In our family, this is the #1 way that grandma and grandpa give money to our kids, and it really goes a long way! Check it out here.

A close runner-up to Backer is Upromise. Upromise has been around a long time and they let you link a 529 to a bunch of rewards programs, shopping rebates, and even a credit card. This is a great tool for grandparents to use to help save for a grandchild's college.

Related: How Grandparents Can Save And Gift Money To Grandchildren For College

Gift A Share Of Stock

If a contribution to a 529 plan isn’t a realistic option (or your preferred choice for whatever reason), consider giving an actual share of the kid’s favorite stock (or an ETF). There are a number of websites dedicated to this exact option.

GiveAShare allows you to buy one share of stock and have the actual certificate (or replica certificate) framed as a gift. Your share is electronically registered as well - so you're a real share holder. Check out GiveAShare here >>

You can also simply give stock through your normal brokerage firm. Maybe you already have an investment account at Fidelity, Charles Schwab, or Vanguard? If so, transferring a gift of stock is actually pretty easy - especially if the child already has a UGMA account setup at the same firm.

If they don't, it's actually pretty easy to set one up. If you want to look at all your options, check out our list of the best custodial investment accounts to open for kids.

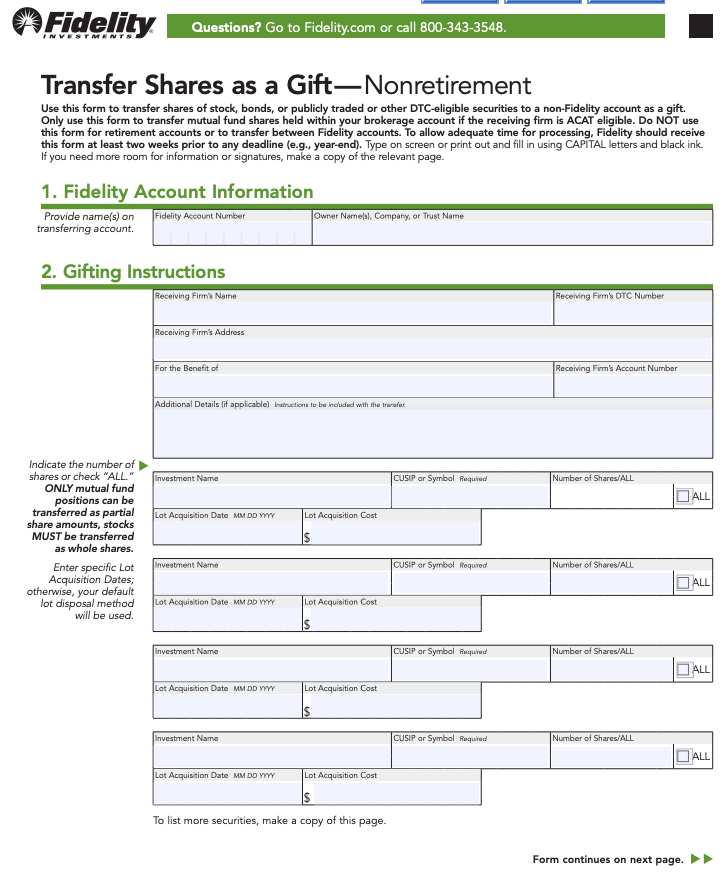

One you do that, all you need to do is fill out the firms "Transfer Shares As A Gift" form. Here's an example from Fidelity:

Set Up A DRiP Plan

Another way to buy a share of stock for a kid is to buy a Dividend Reinvestment Plan (DRiP) directly from a company.

To set up a DRiP, you have to buy a share of the company stock, and then sign up for automatic reinvestments of dividends. Plenty of kid-friendly companies like Hershey’s and Hasbro offer no-fee DRiP plans for shareholders.

Furthermore, most of our favorite free places to invest, such as Charles Schwab, offer free dividend reinvestment within your account.

Don't Forget The Teaching Opportunities

Giving a share of stock is a good way to help a kid get on solid financial footing, but the lessons that come with it are even more important. When you give a special child a share of stock, consider giving them tools for financial literacy too.

If you feel comfortable with it, you could teach them how to evaluate a stock on Yahoo Finance, or you could give them a book that would teach them age appropriate lessons.

These are our top financial books by age range:

Age 0-4 Money A to Z by Scott Alan Turner

Age 5-8 A Chair For My Mother by Vera Williams

Age 9-11 The Secret Millionaires Club by Andy and Amy Heward

Age 12-14 The Young Entrepreneur's Guide to Starting and Running a Business by Steve Mariotti

Age 15-17 The Money Savvy Student by Adam Carroll

Age 18+ I Will Teach you To Be Rich by Ramit Sethi

Are you planning (or have you in the past) given the gift of stock to your kids?

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Claire Tak